Welcome to another Logistics News Update.

We’re dedicated to keeping you informed about the latest happenings in the local and international freight industry. If you have colleagues or companies who might benefit from these updates, please share their details, and we’ll gladly add them to our distribution list. If you enjoy the learning section and want to explore specific topics from Forex or Logistics, let us know.

Now, onto this week’s news.

Here are the highlighted stories from the past week and what is happening now that I think are important to note.

MSC’s Detour to Eastern Cape Ports Raises Concerns: Mediterranean Shipping Company (MSC) has been bypassing Cape Town and Durban, opting to offload containers at Coega and Port Elizabeth. This unexpected move has led to significant challenges for importers and exporters. Containers have been stranded at these ports for over a month, incurring substantial storage fees, change-of-destination charges, and other costs that can exceed R60,000. The process of retrieving containers is complex and time-consuming, with potential delays of several weeks.

South Africa’s trade relations with China are flourishing, thanks to recent trade agreements. These agreements have expanded the Chinese market for South African products, boosting exports in agriculture, manufacturing, and other sectors. Additionally, they foster cooperation in energy, science, and technology. The goal is to increase South Africa’s exports to China and reduce the trade imbalance.

Meanwhile, the Port of East London has received a significant investment of R1 billion to modernize its infrastructure. Two new advanced tugboats have been added, enhancing vessel navigation, pilotage, and pollution management. This investment is a crucial step towards improving port efficiency and supporting economic growth in the Eastern Cape.

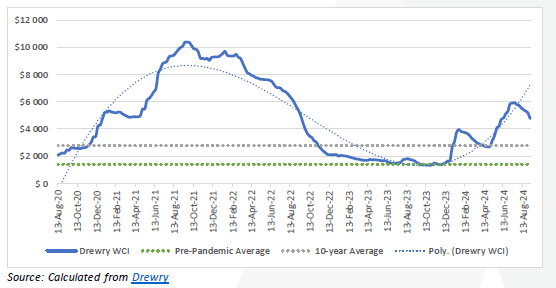

Container Spot Rates Take a Dive: Recent disruptions in the Red Sea and Suez Canal, along with congestion at major ports, have caused a significant drop in container spot rates between Asia and Europe. Rates for trades like Shanghai to Rotterdam and Genoa have seen decreases of up to 8%, while the Transpacific route has experienced a more modest decline. However, the Transatlantic route has seen a notable increase in rates.

Did you know?

Did You Know: Vessel Bypassing Can Delay Your Shipment

What is it?

Vessel bypassing happens when a port is too congested or experiencing bad weather, forcing a ship to skip it and head to the next port. This can delay your shipment.

What can you do?

1. Re-routing Cargo

2. Arrange for Transshipment

3. Storage at a Different Port

4. Negotiate with the Shipping Line

Contact your agent: They can help you find alternative ways to get your shipment where it needs to go, such as putting it on a different ship or bringing it back to the bypassed port later.

Remember: There’s no quick fix once a ship bypasses the port. Be patient and work with your agent to find a solution.

Contact Kevin Pillay on Kevin.Pillay@fnb.co.za for more information

HELP CHANGES EVERYTHING

On The Ground Report

Maersk take Transnet to Court: The transformation of South Africa’s supply chains may face further delays due to a legal dispute initiated by AP Moller-Mærsk’s APM Terminals. The company is challenging Transnet’s decision to grant a 25-year concession of a Durban container terminal to Filipino operator International Container Terminal Services Inc. (ICTSI). This legal bid could impact the progress of reforms aimed at improving port and rail operations under Transnet’s management. For more details, visit the original story here.

Weather is still playing a big role in the delays at the ports, client that have had shipments bypass feel stranded and the only quick fix is “pay up” the shipping lines are happy to help if you pay your part.

This Weeks Key News Takeaways

Efficient logistics: Crucial for South Africa’s economic growth.

Source: Freight news

South Africa-China trade: New agreements boost exports from South Africa to China.

Panama Canal: Sets a new record for the largest ship passing through.

Transnet: Facing challenges and calls for better data on logistics.

SA fruit traders: Making inroads in East Africa.

Ship fire proliferation: Call for concerted effort to address the issue.

NEWS

China Opens Markets Wider for Africa

6 September 2024 – by Staff Reporter

In a major announcement, China has pledged to significantly increase economic cooperation with Africa. This includes:

- Tariff-free access for all African least developed countries to China’s market.

- Increased access for African agricultural products.

- Infrastructure development projects across Africa.

- Investment in clean energy, healthcare, and education.

This move is expected to create significant opportunities for African businesses and economies.

Adapted from Source: Freight News read the full story here

WTO trade barometer signals volume growth

30 August 2024 – by Eugene Goddard

Source: Redmond Magazine

The World Trade Organization’s (WTO) latest Goods Trade Barometer shows positive signs for global trade growth, with a reading of 99.1 in Q2 2023, indicating a modest upturn in merchandise trade after two previous quarters of decline. This improvement has been driven primarily by strong performance in automotive production and sales. However, the future outlook remains uncertain, as weak export orders and global economic pressures, such as high food and energy prices linked to the war in Ukraine, continue to weigh on growth prospects.

Despite these challenges, automotive exports have provided a boost to economies like Japan and China. While trade volume is expected to grow by 1.7% in 2023, this target may only be met if stronger growth materializes in the second half of the year.

For more detailed insights, you can visit the original article here.

Adapted from Source: Freight News

PORTS

South African Ports Face Disruptions Due to Adverse Weather

Key Challenges:

- Significant Delays: Average anchorage times for container vessels remain high, particularly at Durban and Port Elizabeth.

- Weather-Related Disruptions: Both Cape Town and Ngqura have experienced operational delays due to strong winds and rain.

- Operational Challenges: Tug shortages and adverse weather conditions have impacted vessel movements in Durban.

Port-Specific Updates:

- Durban: Multiple vessels are currently at anchor due to equipment issues and weather.

- Cape Town: Operations have been disrupted by strong winds and rain.

- Ngqura: The port has faced delays due to adverse weather conditions.

Overall, South African ports have experienced significant disruptions due to adverse weather conditions. This has led to delays, congestion, and reduced productivity.

Durban:

- Pier 1: 8-9 days

- Pier 2: 9-16 days

- Durban Point: 3 days

Cape Town:

- CTCT: 2-3 days

- MPT: 1-2 days

Port Elizabeth:

- PECT: 4-6 days

- NCT: 6-10 days

NOTE: We recommend factoring these potential delays into your shipment planning to avoid disruptions.

Summary of Global Shipping Industry

Container Throughput and Trade:

- Global: Container volume declined slightly in July but remains up year-over-year.

- Regional: Australasia and Oceania experienced a notable decline, while other regions remained relatively stable.

- Sub-Saharan Africa: Both exports and imports decreased slightly in July.

Price Index:

- Increase: The global price index for dry and reefer containers rose significantly.

Summary of Global Container Freight Rates

Key Developments:

- Rate Decline: Container spot freight rates between Asia and Europe have decreased significantly due to weakening demand.

- Capacity Reduction: Carriers are reducing capacity through blank sailings to mitigate the impact of declining demand.

- Shipping Line Profits: Container shipping companies recorded strong profits in the second quarter due to record volumes and rising rates.

- Weather Disruptions: Super Typhoon Yagi is expected to impact China, potentially causing disruptions to air and sea operations.

- MSC Acquisition: MSC has received approval to acquire a stake in HHLA.

Overall, the global container shipping industry is experiencing a period of adjustment. While freight rates have declined, shipping lines continue to benefit from strong profits. However, weather disruptions and ongoing industry developments pose challenges for the sector.

BUSA-SAAFF Summary – Summary

Transnet’s Financial Results Highlight Challenges and Opportunities

Key Developments:

- Financial Performance: Transnet reported increased revenue and capital investment but faced declining EBITDA and a significant loss due to litigation and increased finance costs.

- Operational Challenges: Actual throughput fell short of budgeted targets in all sub-sectors.

- Financial Concerns: The restatements of prior financials and auditors’ concerns raise questions about Transnet’s financial sustainability.

Looking Ahead:

Despite these difficulties, collaboration between business, industry, and Transnet is crucial for ensuring its recovery. By working together, we can address challenges and leverage growth opportunities. Transnet’s strategic investments and recovery plan demonstrate the potential for a turnaround. Perseverance and collective action are essential to rebuilding and strengthening South Africa’s logistics infrastructure for the future. Source::BUSA

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”