Welcome to another Logistics News Update.

As we enter October, with just 85 days left until Christmas, there’s good news—fuel prices are dropping again. However, we must stay vigilant for potential disruptions during Golden Week in China (October 1st–7th), as business activity will slow significantly, possibly causing delays in communication and operations. Locally, there’s another warning of snow, but this time, we are better prepared.

East and Gulf Coast Dockworkers Strike Hits U.S. Economy: – Dockworkers at 36 ports along the East and Gulf Coasts went on strike today (Tuesday), marking the first strike since 1977. This follows a breakdown in contract negotiations between the International Longshoremen’s Association (ILA) and the U.S. Maritime Alliance (USMX). The strike, over wage hikes and protection against port automation, is expected to cost the U.S. economy up to $4.5 billion per day. Despite USMX’s offer of a 50% wage increase and enhanced retirement benefits, the ILA rejected the proposal. The strike will disrupt the import and export of critical goods like cars, agricultural products, and machinery, affecting half of all U.S. imports. Although The President is involved, he has not yet invoked the Taft-Hartley Act, which could temporarily halt the strike. Source Supplied by Richard Rattray FOX Business’ Daniel Hillsdon contributed to this report.

ALERT & BE WARNED: This will lead to significant delays for shipping operations in the coming weeks and may have an effect on the rates out of the USA, additionally, rising freight rates and supply chain challenges persist globally, fuelled by the Suez Canal crisis and ongoing geopolitical conflicts in the Middle East.

Here’s a quick snapshot of what’s happening and happened.

- Blank Sailings Increase as Lines Apply Rate Correction: Shipping lines have increased blank sailings by 13% to adjust freight rates and balance supply with demand.

- Another Fuel Price Drop – 5th in a Row: South African fuel prices will decrease for the fifth consecutive month in October due to lower oil prices and a stronger rand.

- Jitters Grip US and Logistics Industry Ahead of Port Strike: The U.S. logistics industry is concerned about potential delays and disruptions from an impending port strike, affecting essential goods supply.

- Port vs Port – A Balanced View of Durban and Maputo: Businesses are increasingly comparing Durban and Maputo ports, with Maputo emerging as a cost-effective alternative due to operational challenges in Durban.

- Foreign investments in agriculture: Increased foreign interest in South African agriculture, particularly in land and water resources, is driving growth in the sector.

- The African Continental Free Trade Area: The African Continental Free Trade Area (AfCFTA) is expected to boost intra-African trade and economic growth, but challenges remain in implementation.

- Scrutiny of D&D charges by the FMC: The Federal Maritime Commission (FMC) is investigating allegations of unfair practices related to detention and demurrage (D&D) charges imposed by shipping lines.

- The IMO is urged to fine-tune its just-energy transition away from GHG: Maritime organisations are calling on the International Maritime Organization (IMO) to refine its strategy for transitioning to a low-carbon shipping industry.

- Wallenius Wilhelmsen is upsizing the capacity of its Shaper Class vessels: Wallenius Wilhelmsen, a leading shipping company, is increasing the capacity of its Shaper Class vessels to meet growing demand for vehicle transportation. Source: FreighNews

NEWS

Port Strike Begins, Disrupting Operations from Maine to Texas

1st October 2024 – By TOM KRISHER and TASSANEE VEJPONGSA

A tugboat passes shipping containers

The International Longshoremen’s Association (ILA) has initiated a strike at major ports from Maine to Texas, disrupting operations and raising concerns about potential disruptions to the economy. The strike is cantered on issues related to wages and automation.

The union representing the workers has been in negotiations with the shipping industry for months, but they have been unable to reach an agreement. The strike is expected to have a significant impact on the supply chain, as it could lead to shortages of goods and higher prices for consumers.

It remains to be seen how long the strike will last and what the ultimate outcome will be. However, it is clear that the strike

will have a ripple effect on the economy, affecting businesses and consumers alike – Adapted from Source: AP News Read the full story here

US ports shut down as dockworkers strike27

1st October 2024 – by Natalie Sherman Business reporter, BBC News

Lars Jensen, founder and CEO of Vespucci Maritime. Source: Shipping Watch

Tens of thousands of dockworkers from the International Longshoremen’s Association (ILA) have gone on strike at 14 major East and Gulf Coast ports in the US, halting container traffic from Maine to Texas. This marks the first major shutdown in almost 50 years and could cause significant trade disruptions, particularly during the holiday season.

The union demands higher wages and protection against automation, while port employers have offered substantial pay raises and better benefits. The strike could impact imports of essential goods like food, cars, and clothing, with the US economy projected to lose up to $4.5 billion each week. The President has the power to pause the strike but has chosen not to intervene at this time.

The economic impact of the US dockworkers strike could be severe, potentially affecting over one-third of exports and imports, with losses of at least $4.5 billion each week. Additionally, over 100,000 people may face temporary unemployment as the strike’s effects ripple through the economy. Experts warn that this event could push up shipping costs, particularly impacting businesses and consumers relying on “just-in-time” supply chains, creating further disruptions in the coming months.

This could significantly affect the shipping industry and supply chains in the coming weeks. Adapted from Source: Freight News – Read more here

PORTS

SSource: MAERSK

Port Operations: The Port of Durban faced heavy congestion with 30 vessels at anchorage and 39 vessels at berth. Delays were primarily due to strong winds, and equipment issues contributed to operational inefficiencies. Cape Town, Ngqura, and Port Elizabeth also experienced delays, with Cape Town suffering from high swells, and both Ngqura and Port Elizabeth affected by strong winds.

- Equipment Availability: Various ports faced equipment challenges, with some cranes and tugs out of service. Durban’s Pier 2 operated with limited crane availability, and the Richards Bay pilot boat remained out of commission, expected to return by October 7.

- Rail and Trucking: Rail operations were affected by long dwell times, with Durban’s Pier 2 reporting a significant backlog in container handling. Truck turnaround times ranged between 58 to 147 minutes across different terminals.

- Bulk Operations: Richards Bay reported the export of 251,600 ktons of coal, while other bulk terminals across various ports showed lower volumes due to vessel delays or lack of reports.

- Durban: Strong winds caused delays in vessel movements and operations, affecting both waterside and landside activities. Five vessel movements were delayed due to the weather.

- Cape Town: High swells delayed berthing operations over the past 24 hours.

- Ngqura and Port Elizabeth: Both ports experienced significant operational disruptions due to strong winds, halting waterside operations for 24 hours.

- Maydon Wharf (Durban): Rain and strong winds contributed to operational delays over the weekend.

This report highlights the significant operational delays across South African ports, driven by adverse weather and equipment challenges, which continue to impact supply chain efficiency.

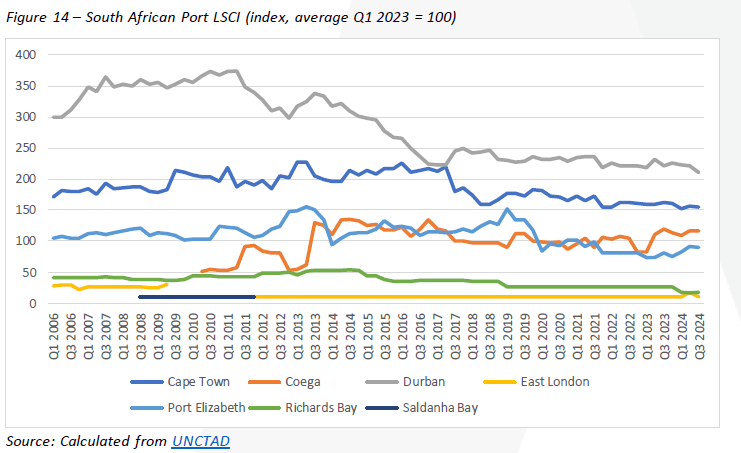

Summary of Global Shipping Industry

UNCTAD released its latest “Liner Shipping Connectivity Index” (LSCI12) for Q3 2024, making reading for South African ports uncomfortable. For the quarter, all ports experienced decreased connectivity (around ↓1-5%) except for Richards Bay (↑2%). Versus this time ten years ago (Q3 2014), the reality is even bleaker, as Cape Town is down by ↓28%, Coega by ↓14%, Durban by ↓32%, Port Elizabeth by ↓21%, and Richards Bay by ↓66%. During this period, only East London increased – by a marginal ↑2% – and based on a small sample. The following figure displays the movement of our respective ports since the inception of the index in 2006:

Global Container Freight Rates and US Strike Surcharges

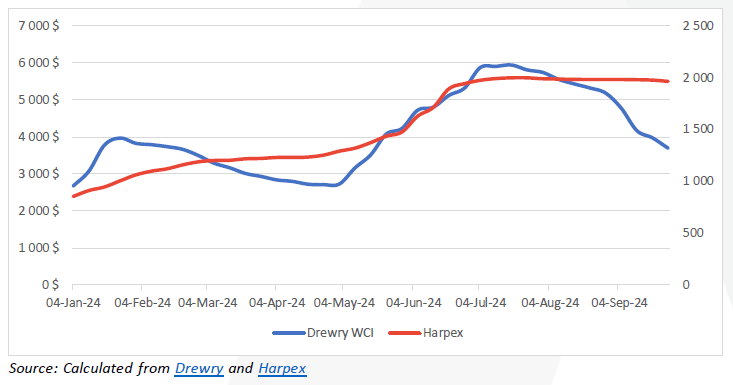

Drewry’s “World Container Index” recorded another significant drop this week, as the composite index is down by ↓7% (or $279), trading at $3 691 per 40-ft container.19 Meanwhile, charter rates have finally started to follow suit, as the Harper Petersen Index (Harpex) traded around 1 963 points on Friday. The following combined illustration shows their relationship since the start of the year: The latest spot-rate composite index is ↓64% below the pandemic peak ($10 377) but still ↑160% more than September 2023. Drewry said a continued decline in rates for Asia-to-Europe routes was expected due to weaker demand. However, they noted that rates for transatlantic and transpacific head haul trade routes are expected to rise, driven by potential labour strikes and the impact of China’s Golden Week holiday.

Elsewhere, Alphaliner has posted collective H1 2024 carrier earnings per TEU. A recent earnings review of containerised shipping reveals a significant shift in carrier rankings over the past six months. Alphaliner’s study of operating profit per TEU (EBIT – earnings before interest and tax) for the first half of 2024 highlights HMM and ZIM leading the field, surpassing Matson Inc., which held the top position in 2023. HMM and ZIM reported operating profits of $390 and $364 per TEU, respectively, compared to $150 and a loss of $99 per TEU during the same period in 2023:

Source: BUSA

BUSA-SAAFF Summary – Summary

Container handling at South African ports saw a slight increase last week, but operations faced challenges due to adverse weather, equipment issues, and congestion. The UNCTAD’s Liner Shipping Connectivity Index (LSCI) revealed a concerning decline in port connectivity for South Africa, except for Richards Bay. Cape Town and Durban have experienced significant declines in connectivity over the past decade, impacting the country’s trade competitiveness.

The global shipping industry is facing several challenges, including excessive new building, declining demand, and growing dissatisfaction among shippers. These factors are straining the capacity-demand balance and raising concerns about overcapacity in the near future. The Container Shipping Performance Indicators (CSPI) initiative aims to address these issues by providing shippers with greater transparency and information.

The weakening of port performance exacerbates South Africa’s logistical challenges and could hinder its ability to facilitate trade and stimulate economic growth. To address these issues, South Africa must modernize its port infrastructure, improve service levels, and actively participate in international efforts to optimize shipping capacity and enhance trade route visibility. By taking these steps, South Africa can ensure its competitiveness in an increasingly volatile global shipping market. Source::BUSA

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”