Welcome to another Logistics News Update.

This week, South African ports are facing significant operational challenges due to weather disruptions, equipment shortages, and congestion. Cape Town and Durban are particularly affected.

As we enter November, a traditionally busy period for logistics, we’re noticing a quieter than usual season. It seems many importers anticipated the peak and brought in their goods earlier this year, especially in August and September.

Port Update:

Durban: The port has been impacted by windy weather conditions this week, leading to delays:

- Pier 1: 3-5 days

- Pier 2: 8-12 days

- Durban Point: 3 days

Cape Town: Strong winds have also affected operations at Cape Town port:

- CTCT: 3-5 days

- MPT: 0-2 days

Port Elizabeth: Windy weather has caused delays at Port Elizabeth:

NCT: 2-3 days

PECT: 0-1 day

NEWS

Transnet’s proposed tariff hikes unjustifiable – RFA

24 Oct 2024 – by Staff reporter

Gavin Kelly, CEO of the Road Freight Association

The Road Freight Association (RFA) has expressed strong opposition to Transnet’s proposed 2025/26 tariff increase, arguing that it will further harm the already struggling Durban port. The RFA CEO, Gavin Kelly, believes the increase is unjustified and will exacerbate existing problems.

Kelly has also criticized the port’s truck booking system, questioning its effectiveness. He argues that the system does not accurately reflect the challenges faced by truck drivers, who often struggle to obtain booking slots and experience significant delays.

The RFA is urging the National Transport Regulator to carefully consider Transnet’s tariff increase application and to address the ongoing issues at the Durban port. The association believes that without significant improvements, the port’s competitiveness and efficiency will continue to decline.- Adapted from Source: FreighNews Read the full Story Here

Port of Cape Town remains a blight on booming apple and pear sector

Ongoing Equipment Shortages at Transnet Causing Port Delays

25 Oct 2024 – by Jeanne van der Merwe

Pink Lady cultivars such as Ruby Matilda have fetched more than R500 per carton in some parts of Europe and the UK.

At a time when Western Cape pear and apple producers should be celebrating the success of their export marketing campaigns, inefficiencies at the Port of Cape Town are costing them just shy of R1 billion annually.

During a recent visit to the facility, Dr Ivan Meyer, Western Cape minister of agriculture, economic development and tourism, expressed concern at “the worryingly slow pace” at which the Port of Cape Town’s turnaround strategy was happening, as it had “direct cost implications for the agricultural sector in the Western Cape”.

“While this figure is deeply worrying, it does not show the full extent of the loss to the agriculture sector because we are not calculating the lost opportunities of growing into new markets. We are not seen as a reliable supplier to the international market because we cannot guarantee delivery,” said Premier Alan Winde. Adapted Source: FreighNews Read the full story here

Weekly Snapshot

- Port Volumes: Container volumes surged by 30%, with 74,836 TEUs handled (34,218 imports and 40,618 exports). Rail cargo out of Durban reached 3,784 containers, a 47% increase from last week.

- Air Cargo: Volumes rose by 4%, with a total of 7,576 tons handled. Outbound cargo from OR Tambo Airport recorded its highest weekly volume since 2019.

- Cross-Border Delays: Average border crossing time at South African borders dropped to 13.6 hours (down 17%), while the SADC region averaged 4 hours (down 25%).

Key Observations

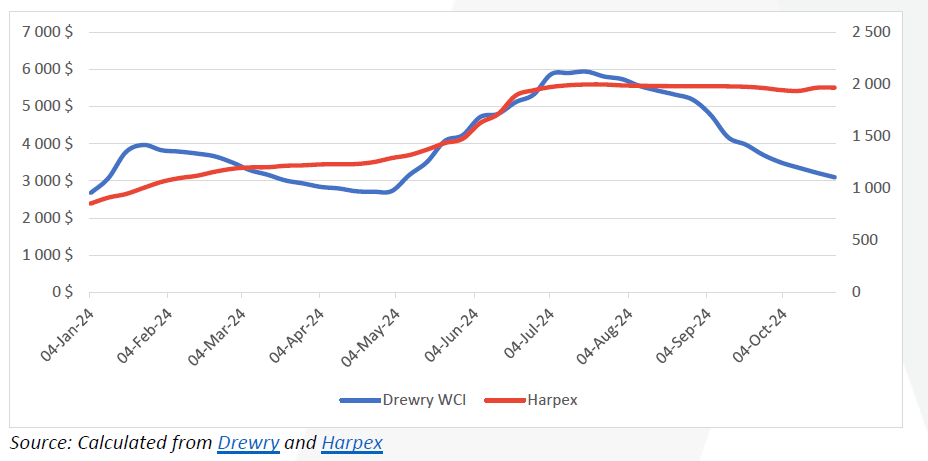

- Container Rates: Container shipping rates fell by 3.8%, now trading at $3,095 per 40-ft container. Meanwhile, charter rates remain stable.(Remember USA is the gauge – check locally for rates)

- Air Cargo Growth: African air cargo sales increased by 9% in September, led by e-commerce demand and high-tech shipments from Asia-Pacific.

Port Operations Summary

- Cape Town: Weather challenges, including strong winds, impacted operations. Despite this, the terminal managed 5,187 trucks and 6,449 container moves across the quay.

- Durban: Equipment shortages and adverse weather affected efficiency. Pier 1 saw 4,980 gate moves, while Pier 2 completed 9,798 gate moves, with straddle carrier availability at only 49%.

- Richards Bay: Heavy rain caused delays, with flooding impacting operations. Marine services, including tugs and pilot boats, resumed service mid-week.

Global Shipping Industry Impact

- Container Fleet Growth: Record deliveries, totalling 2.5 million TEUs year-to-date, are intensifying “vessel bunching” and putting strain on global port operations.

- Freight Rates: While rates on the transatlantic route rose by 28%, rates from Asia to North America saw declines due to overcapacity.

Air Cargo Performance

- ORTIA: Inbound cargo handled at OR Tambo Airport averaged 578,169 kg, while outbound volumes increased by 2%, highlighting strong international demand.

- Global Trends: Despite a rate drop, international air cargo saw robust growth, particularly in the Middle East and Asia-Pacific, with high-tech and e-commerce shipments driving sales.

Road Freight and Regional Updates

- Cross-Border Delays: South African borders saw faster clearance times this week. However, severe delays continued at Groblersbrug, where some transporters waited over six hours to cross.

Summary

South Africa’s logistics network showed improvement in port volumes and air cargo, despite ongoing challenges from weather, equipment issues, and global disruptions. Enhanced efficiencies at borders also provided relief to transporters, though specific border points like Groblersbrug experienced significant delays. Source: BUSA

Summary

The logistics network showed improvement, with port volumes rising despite ongoing operational challenges. However, weather and equipment issues at key South African ports, along with global disruptions like the US port strike, continue to strain logistics flows.. – Source: BUSA

Weekly Roundup: Key Developments and Insights from the Industry Local & International

- Port Operations: Cape Town continues facing logistical challenges impacting agricultural exports, with delays persisting in Durban due to proposed tariff hikes.

- Global Economy: The IMF maintains a steady growth forecast, while President Ramaphosa emphasizes BRICS’s role in supporting the Global South.

- Sector Updates: E-commerce preps for Black Friday; poultry sector seeks VAT-free status to bolster production.

- Freight Rates: Container shipping orders surge, but tariff challenges remain for South African logistics. Source: FreighNews

Global Container Freight Rates

This week, Drewry’s World Container Index (WCI) dropped by 4% to $3,095 per 40-foot container. This rate is about 70% below the pandemic peak of $10,377 seen in September 2021 but remains 118% above the pre-pandemic average of $1,420 from 2019. The year-to-date average for the WCI is $4,036 per container, significantly higher than the 10-year average of $2,836, even when accounting for the pandemic-driven rate surges.

Freight rates on major routes saw a mixed performance. Rates from Shanghai to Rotterdam fell by 7% to $3,132, while Shanghai-New York decreased by 6% to $5,266. Conversely, the transatlantic route from Rotterdam to New York experienced a 28% surge to $2,663 per container, reflecting regional demand variations and ongoing adjustments in global shipping capacity Drewry

Global Freight Rates

The most recent Drewry World Container Index (WCI) update from October 24, 2024, shows a continued decline in container freight rates. The composite index decreased by 4% to $3,095 per 40-foot container, which is significantly lower than the pandemic peak of $10,377 in September 2021. However, it is still 118% higher than the pre-pandemic average rate of $1,420 in 2019. The year-to-date average for 2024 stands at $4,036, a level that remains above the 10-year average of $2,836 due to lingering pandemic-driven inflation in shipping costs.

Route-specific changes were notable as well: Shanghai to Rotterdam dropped by 7% to $3,132, and Shanghai to New York declined by 6% to $5,266. Meanwhile, transatlantic routes saw contrasting trends, with Rotterdam to New York rising by 28% to $2,663 per container, reflecting increased demand on that route. These variations indicate adjustments in global shipping capacity and route demand as the industry stabilizes post-pandemic. For more insights on global shipping trends, you can access Drewry’s comprehensive updates on their World Container Index page.

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”