Welcome to another Logistics News Update.

In this week’s news, we explore how the logistics landscape is evolving with significant developments at two major ports. Discussions about Saldanha Bay’s potential to surpass Cape Town signal shifting priorities, while Ngqura (Coega) is emerging as a game-changer, reducing transit times, and streamlining cargo operations. See the detailed stories below. Fortunately, weather conditions at all ports have improved this week, allowing the focus to shift entirely to operations. While some ports have seen progress, others continue to frustrate importers and exporters. Vessels often arrive, discharge a limited number of containers, and depart, while delays at slower berths, hindered by equipment issues, extend discharge times. Adding to the challenges, transporters are stuck in queues, battling for “slots” to collect and deliver cargo, through the container booking system. We offer a great tip of the week below, understanding global trade and some of the pitfalls, tips, and tricks that can help you. Let’s jump straight into this week’s news.

On The Ground Report:

Truckers continue to face challenges with the booking system, which remains a source of frustration. It seems that only when media attention is drawn to the issue does any communication or action take place. Despite these difficulties, transporters are showing more collaboration and mutual support, marking a noticeable shift. In the truckers’ WhatsApp group, there are instances where booking slots are swapped, and occasionally, some attempt to sell slots. This highlights the pressing need for TPT to urgently address the ongoing issues with the booking system. MAERSK have reported The Removal of Congestion Fee – from the World to South Africa (excluding Europe) didn’t know, Europe wasn’t part of the world.

TIP OF THE WEEK : Demystifying the language of global trade:

Incoterms provide a shared language between buyers and sellers, simplifying agreements by setting expectations, reducing confusion, and fostering trust. When venturing into international trade, businesses often face complex rules and confusing terminology. Among the most essential—and misunderstood—are Incoterms, short for International Commercial Terms. These guidelines, established by the International Chamber of Commerce (ICC) in 1936 and updated every decade, clarify the roles and responsibilities of buyers and sellers, making trade more efficient and transparent.

What Are Incoterms? : Incoterms define who handles transport, pays for insurance, clears customs, and bears the risk during transit. They prevent disputes and streamline global trade by ensuring all parties understand their roles. For instance, a South African importer buying electronics from China needs clarity on who ships the goods, pays for damages, or handles customs. Incoterms provide a shared language that answers these questions, fostering trust and reducing confusion.

| Key Objectives:Define Responsibilities: Clarify who manages transport, insurance, and customs tasks.Transfer Risk: Specify when risk shifts from seller to buyer.Allocate Costs: Outline who pays for freight, packaging, and other expenses. | Important Considerations:Not a Contract: Incoterms complement, not replace, trade contracts.Limited Scope: They cover transport responsibilities but not payment terms or ownership transfer.Local Laws Apply: National regulations, like South African customs rules, remain in effect. |

Why It Matters: Understanding Incoterms offers businesses a strategic edge. They simplify negotiations, reduce risks, and strengthen relationships with trade partners. While they may seem daunting at first, Incoterms are tools to create clarity and confidence in global trade. Mastering Incoterms is more than a skill; it’s a pathway to smoother transactions, fewer misunderstandings, and successful international partnerships. Please see bottom of Newsletter for Common Incoterms. Adapted from : Herman Bezuidenhout – The Sunday Time Business.

Next Week we discuss If an importer bases their forex pricing on the spot rate and defers payment, does it expose them?

INTERNATIONAL NEWS:

As of November 26, 2024, CMA CGM has maintained its decision to route the INDAMEX service around the Cape of Good Hope, despite initial plans to revert to the Suez Canal route. This decision was influenced by customer concerns and cargo insurers’ reluctance to cover the Red Sea route due to ongoing security threats from Houthi attacks. Source: MFAME. The INDAMEX service, connecting the Indian Subcontinent to the US East Coast, continues to operate with 11 vessels, each with capacities ranging from 8,500 to 9,950 TEUs. The first vessel on the revised route, CMA CGM Pelleas, commenced its voyage in mid-November. Source: MyKN

This strategic routing decision underscores CMA CGM’s commitment to balancing operational efficiency with customer and insurance requirements in a complex maritime environment.

Port Update: Week of November 18–26, 2024

1. Durban Port:

- Pier 1: Delays have improved, now averaging 8–10 days, down from the previous 12 days.

- Pier 2: Severe delays continue, though slightly reduced to approximately 20 days, compared to the earlier 24 days.- Equipment problems, using waterside e

- Durban Point (MPT): Operations remain affected by equipment issues and congestion, with delays averaging 5–7 days.

Cape Town Port:

- CTCT: Delays have further decreased, now at up to 1 day for SRX services and up to 1.5 days for SAS services.

- MPT: Operations are running smoothly, with minimal delays reported.

Port Elizabeth/Ngqura:

- PECT: Operations are stable, with no significant delays reported.

- NCT: Delays have been minimized, now averaging less than 1 day.

Summary: Overall, port operations have shown improvement over the past week. Durban’s Pier 1 and Pier 2 have experienced reductions in delays, though challenges persist. Cape Town’s CTCT has seen further improvements, with delays now minimal. Port Elizabeth and Ngqura continue to operate efficiently, maintaining stable conditions.

NEWS

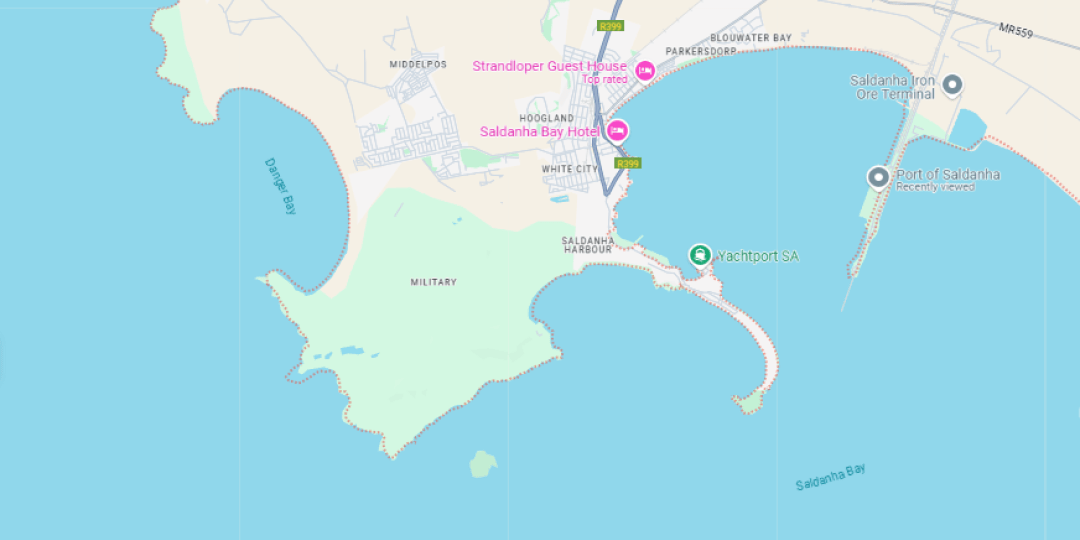

Saldanha Bay’s Potential to Surpass Cape Town as South Africa’s Premier Port

22 Nov 2024 – by Jeanne van der Merwe

Persistent delays at the Port of Cape Town, attributed to adverse weather, equipment failures, and traffic congestion, have sparked discussions about its potential downgrading in favour of expanding the Port of Saldanha Bay. Industry expert Thomas Eskesen has suggested relocating port operations to Saldanha Bay to alleviate Cape Town’s urban congestion and mitigate wind-related challenges.

Saldanha Bay boasts the largest and deepest natural port in the Southern Hemisphere, accommodating vessels with draughts up to 21.5 meters, compared to Cape Town’s 14.5 meters. The port’s multipurpose terminal recorded a 6.2% increase in annual cargo handling volume, indicating its growing capacity.

However, Dr. Jacob van Rensburg of the South African Association of Freight Forwarders emphasizes that the Western Cape cannot afford to upgrade Saldanha at Cape Town’s expense. He advocates for a synchronised development approach, enhancing both ports to meet the region’s high freight demand and support economic growth.

–Adapted from Source: Freight News

Saving time by routing through Ngqura

25 Nov 2024 – by Ed Richardson

Source: Lloyd’s List

The Port of Ngqura, located within the Coega Special Economic Zone (SEZ) in the Eastern Cape, is emerging as a strategic hub for South African importers seeking to expedite cargo delivery. By utilising Ngqura as the first port of call for consolidated shipments from Europe, businesses can significantly reduce transit times. This approach circumvents the congestion and delays often experienced at Durban and Cape Town ports, leading to time savings ranging from 14 to 40 days, depending on the specific route and prevailing conditions.

The operational efficiency at Ngqura is further enhanced by the establishment of a dedicated warehouse within the Coega SEZ. This facility enables the swift deconsolidation of containers arriving from various European countries, including Spain, Italy, the United Kingdom, Belgium, the Netherlands, Germany, and Türkiye. Subsequent road transport ensures prompt delivery to key destinations such as Cape Town, Durban, and Gauteng. For time-sensitive shipments, premium services are available, facilitating delivery within two to three days post-unpacking.

Looking ahead, plans are underway to expand these expedited services to include routes from the Far East, notably Singapore, and other ports with direct connections to Ngqura. Additionally, export services currently operating out of Durban and Cape Town are set to be extended to Ngqura, further solidifying its role as a pivotal node in South Africa’s logistics network.

–Source: FreighNews

Weekly Snapshot

- Extreme Weather Disrupts Cape of Good Hope Traffic: Severe weather conditions near the Cape of Good Hope have halted container traffic, affecting global shipping routes and schedules.

- Container Port Congestion Nears Pandemic Levels: Global container port congestion has risen to approximately 9 million TEUs, approaching the peak levels experienced during the COVID-19 pandemic. This surge is attributed to increased trade volumes and logistical challenges.

- Could Saldanha trump Cape Town? An exploration of Saldanha Bay’s potential advantages over Cape Town in the logistics sector.

- New cargo clearing system causes Botswana border backlog Implementation of a new system has led to significant delays at Botswana’s borders, affecting trucks carrying supplies from South Africa to Zambia and the DRC.

- SAA posts first profit in a decade South African Airways reports a profit for the 2022/2023 financial year, marking its first profitable period since exiting business rescue in September 2021.

- South Africa must exploit green energy opportunities Discussions on the urgency for South Africa to capitalize on green energy to avoid being left behind in the global shift towards sustainability.

- German port takes delivery of container handling behemoths A German port has received massive cranes, each standing 80 meters high with jibs spanning 26 container rows, enhancing its cargo handling capabilities.

- Port of Durban tugs berth world’s largest car carrier The Port of Durban successfully berthed the world’s largest car carrier, showcasing its capacity to handle advanced vessels.

- New report examines how AI may shape future of international trade A report highlighting the impact of artificial intelligence on international trade, particularly concerning small and medium-sized enterprises.

- Efficiency demands push digital agenda for ports Insights into how efficiency requirements are driving ports and terminals to adopt new technologies.

- Höegh Aurora super-size roro calls at Gqeberha The world’s largest car carrier, Höegh Aurora, made its first call to Africa at the Port of Gqeberha.

These events underscore the dynamic nature of the freight and logistics industry, highlighting the need for stakeholders to remain adaptable and informed. Source: Container news & FTW

Key Observations:

Container Shipping Rates:

- Update: Container shipping rates have decreased by another 2.5%, now averaging $3,015 per 40-ft container. This reflects sustained downward pressure on freight costs.

- Charter Rates: Remain stable, but continue monitoring for any fluctuations.

This update highlights continued changes in shipping rates and the sustained growth in air cargo demand, reflecting dynamic market conditions and opportunities in the logistics sector.

Global Shipping Update

Delays and Key Updates

- Brazil: Port congestion due to high cargo volumes and limited capacity.

- Far East: Increased demand causing disruptions in shipping schedules and transshipment delays at hubs like Singapore.

- South Africa: Durban Port faces equipment shortages, breakdowns, and weather-related disruptions.

- India: Delays due to blank sailings and port backlogs.

- Singapore: Transshipment delays of 2-3 weeks.

- Mozambique: Protests and strikes causing operational disruptions.

- Airfreight: Delays at Johannesburg (JNB) airport and 48-hour strikes in Brazil affecting GRU Airport.

- Equipment Shortages: 20ft container scarcity reported by shipping lines.

Additional Charges by Carriers

- MSC: Effective 1 January 2025, FuelEU Maritime regulation fees will be introduced (€14/TEU for GP containers and €21/TEU for Reefers).

- CMA CGM:

- PCS surcharge of USD 1,000 per container (effective 1 December 2024) for shipments to Nicaragua and El Salvador.

- PSS of USD 150/TEU (effective 1 January 2025) for exports from Africa to South America West Coast via the Panama Canal.

Summary

Summary for Newsletter: BUSA Cargo Movement Update (25 November 2024)

1. Weekly Snapshot

- Port Volumes: Total container throughput declined by 8% to 77,278 TEUs. Average daily handling was 11,040 TEUs, with a further dip to 10,803 TEUs projected for next week.

- Air Cargo: Increased by 7%, reaching 7,783 tons, with both inbound and outbound volumes growing steadily.

- Rail Cargo: Durban rail handled 3,489 containers, a 3% rise from last week.

- Cross-Border Challenges: Border crossing times at South African checkpoints increased significantly to an average of 17 hours (+33%), while SADC region times rose slightly (+2%).

2. Port Operations

- Cape Town: Weather disruptions caused delays exceeding 35 hours. However, truck and rail service efficiency improved, with 3,580 trucks and 449 rail units serviced.

- Durban: Operations faced challenges from equipment breakdowns and weather. Pier 2 saw mixed performance, while Pier 1 throughput dropped 11%.

- Richards Bay: Operational delays due to marine equipment shortages, though some recovery in coal terminal operations.

- Eastern Cape Ports: Delays from weather and equipment shortages impacted throughput. Port Elizabeth saw a sharp 60% decline in activity.

- Global Perspective: Port congestion slightly eased globally, with Durban’s queue-to-berth ratio improving to 0.83.

3. Air Freight Trends

- International Air Cargo: ORTIA recorded steady growth, with a 13% rise year-on-year. Total inbound and outbound cargo flows reached 7,783 tons.

- Global Growth: Spot rates surged by 10% week-on-week and 23% year-on-year, driven by transatlantic demand and capacity constraints.

4. Road Freight and Border Delays

- Border Times: Crossing times increased across South African borders, averaging 17 hours, while SADC transit times rose slightly to 5 hours.

- Key Challenges: Protests at Lebombo border, system outages at Kopfontein, and miscommunication on vehicle clearance requirements caused disruptions.

- Costs: Weekly cross-border delays cost the transport industry an estimated $9.3 million (R167 million).

5. Global Shipping Industry

- Container Freight Rates: Marginal decline of 1%, with global rates at $3,413 per 40ft container. Charter rates surged 28% week-on-week, reflecting tightening capacity.

- Challenges: Vessel blanking’s rose, and geopolitical factors increased global fragmentation, driving the highest tonne-mile growth since 2010.

6. Insights and Takeaways

- Infrastructure Needs: Adverse weather, aging equipment, and pilot shortages highlight the urgency for operational improvements in South Africa.

- Global Competitiveness: Strategic collaboration and investment in digital integration are essential to maintain trade efficiency and competitiveness amidst global challenges.

Source: Summary from BUSA

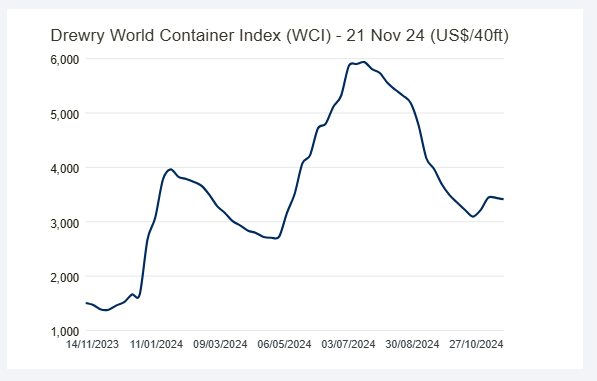

Global Container Freight Rates

As of November 21, 2024, Drewry’s World Container Index (WCI) has decreased by 1% to $3,413 per 40-foot container.

This rate is 67% below the pandemic peak of $10,377 in September 2021 but remains 140% higher than the pre-pandemic average of $1,420 in 2019. The year-to-date average composite index stands at $3,980 per 40-foot container, surpassing the 10-year average of $2,848, which was influenced by the exceptional rates during the COVID-19 period.

Key Rate Movements:

- Shanghai to Genoa: Increased by 3% ($120) to $4,520 per 40-foot container.

- Shanghai to Rotterdam: Rose by 1% to $4,071 per 40-foot container.

- New York to Rotterdam: Up by 1% to $793 per 40-foot container.

- Rotterdam to New York: Increased by 1% to $2,672 per 40-foot container.

- Shanghai to Los Angeles: Decreased by 5% ($212) to $4,488 per 40-foot container.

- Rotterdam to Shanghai: Fell by 1% ($4) to $517 per 40-foot container.

- Los Angeles to Shanghai and Shanghai to New York: Rates remained stable.

Drewry anticipates that spot rates will remain stable in the upcoming week

INCOTERMS

Common Incoterms:

- EXW (Ex Works): Buyer handles all transport from the seller’s premises.

- FOB (Free on Board): Seller loads goods onto the ship, but risk transfers to the buyer afterward.

- CIF (Cost, Insurance, Freight): Seller pays for transport and insurance up to the port, but risk shifts to the buyer once goods are on board.

Practical Examples:

- Under EXW, a South African buyer purchasing machinery from Germany assumes all transport responsibilities.

- With CIF, the seller arranges shipping and insurance but transfers risk at the point of loading.

Important Considerations:

- Not a Contract: Incoterms complement, not replace, trade contracts.

- Limited Scope: They cover transport responsibilities but not payment terms or ownership transfer.

- Local Laws Apply: National regulations, like South African customs rules, remain in effect.

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”