Welcome to another Logistics News Update.

As we reflect on the first month of the new year, there’s much to take in within the logistics world.

Locally, several noteworthy developments stand out:

- Port operations have significantly improved, with minimal delays in Durban, while Cape Town has experienced some windbound weather (Mon/Tues) —a much-welcomed change!

- Note SACO report different stats for the ports below, we have placed them in for reference.

- However, the booking system remains a persistent challenge, flying under the radar. Let’s continue to exercise patience with the service providers as they navigate these hurdles.

- Fuel issues at OR Tambo Internation – see our on the ground report back.

On another uplifting note, interest rates are expected to drop again soon, a development we’re all eagerly awaiting. At the recent World Economic Forum, global businesses emphasised the urgent need to adapt supply chains rapidly in response to rising protectionism and evolving geopolitical alliances—a critical shift that resonates across industries. Closer to home, Cape Town International Airport has announced plans to install additional generators to avoid future disruptions. This commitment follows last week’s challenges when flights were cancelled due to a lack of power for refuelling planes, highlighting the importance of resilience in our infrastructure.

This Week’s Learning Spotlight:

Sometimes, we assume we know it all—but even experienced importers can overlook the basics. Here’s a quick refresher to ensure your importing process runs smoothly:

- Clear Documentation: Always ensure your commercial invoice, bill of lading, and packing list are accurate and complete.

- Customs Compliance: Double-check that your Harmonised System (HS) codes match your product descriptions.

- Incoterms: Be clear about who is responsible for each step of the shipment to avoid unexpected costs.

- Insurance Cover: Never underestimate the value of comprehensive cargo insurance—peace of mind is priceless.

Final Note:

The logistics industry is evolving faster than ever and staying informed is the key to staying ahead. Thank you for trusting us to keep you updated every step of the way.

Let’s Learn

Importing goods into South Africa involves several crucial steps to ensure compliance and smooth operations:

- Register as an Importer

Local importers must register with SARS by completing the DA 185 and DA 185.4A1 forms, specifying their intention to import. Submit these forms, along with proof of business address and a certified copy of your ID, to your nearest SARS office.

Foreign importers must register as a “foreign principal” and appoint a South African “registered agent” to manage local import activities. - Understand Tariffs, Costs, and Regulations

Every imported item has a unique tariff code that determines the duties and taxes payable. In addition to the cost of goods, account for shipping, insurance, customs duties, and other fees. The South African Customs Tariff is a helpful resource to estimate these costs. - Ensure Compliance with Documentation and Permits

Accurate documentation, including bills of lading, invoices, and packing lists, is essential. You may also need specific permits depending on the goods being imported. Engaging a customs broker can help navigate these requirements with ease. - Communicate Clearly with Suppliers

Use Incoterms to define responsibilities and avoid misunderstandings during the shipping process. Select secure payment methods such as letters of credit or open account terms to ensure flexibility and safety. - Clear Customs

When goods arrive, customs clearance requires accurate documentation and payment of duties, taxes, and fees. Partnering with a customs broker can streamline this process and ensure timely delivery.

Would you like the full checklist? Reply to this email, and we’ll gladly send you a detailed checklist to simplify your importing process further

NEWS

South Africa’s Citrus Supply Chains Require Urgent Improvement

20th January 2025 – Mike Knowles

Citrus being loaded at the Port of Cape Town Source: EUROFRUIT

Citrus Growers Urge Action to Strengthen Supply Chains

The Citrus Growers’ Association (CGA) has emphasised the urgent need for improvements in South Africa’s citrus supply chains to handle the significant increase in export volumes expected in the coming years. In its “State of Logistics Report,” CGA logistics development manager Mitchell Brooke highlights inefficiencies in the rail network, the poor state of roads, and operational bottlenecks at ports as critical challenges driving up costs and causing delays.

Compounding these issues are unpredictable weather patterns and geopolitical risks, which threaten supply chain stability and product quality. Adverse climate conditions delay harvests and logistics schedules, while shifting global trade policies and political instability add further uncertainty.

Despite these challenges, there is optimism. Investments in cold storage facilities and rail upgrades are set to improve logistics operations. These enhancements will be crucial as new citrus orchards mature across Southern Africa, boosting export volumes. A reliable supply chain is essential to maintain South Africa’s global competitiveness and ensure the long-term success of this vital industry…

– Adapted from Source: Fruit Net – EUROFRUIT

Improvements at Cape Town Container Terminal

20th January 2025 – Fred Meintjes

Efficiency Boost at Cape Town Container Terminal Benefits Exporters

Cape Town’s Container Terminal (CTCT) has reported notable improvements in productivity, offering relief to stonefruit growers, exporters, and logistics providers. A significant reduction in windbound hours—from 130 in early January last year to just 46 this year—has enabled an additional 72 operational hours over the festive season. Gross crane moves per hour (GCH) have also increased, averaging 15 GCH in week 2 compared to 12 GCH in the same period last year.

Operational efficiency has been bolstered by the deployment of eight out of nine ship-to-shore cranes and 23 out of 24 rubber-tyre gantry cranes. Spare parts for the remaining ship-to-shore crane are expected in week 3, while CTCT is set to receive the first of nine new rubber-tyre gantry cranes by the end of February, with full operation planned by June 2025. Despite a 5% year-on-year decrease in cartons inspected for export, exports have risen by an impressive 39%, reaching 24.5 million cartons.

While the national crop estimate remains steady at 76.4 million cartons, middle-to-late varieties are ripening faster than expected, potentially causing bottlenecks as volumes peak in the coming weeks. Currently, 81% of exports are destined for the EU and UK markets, with 10% heading to North America. These operational gains at CTCT are a welcome development, ensuring better efficiency as the export season progresses…

– Adapted from Source: FreighNews

On The Ground Report

Transnet Releasing Container – Shipping Lines Charging Demurrage

- Transnet Port Authority (TPA) Hare releasing containers out of block C1 and C2, but the shipping line are charging demurrage as they are deemed to be out the report when Transnet moves it from. Source: TSI Operations

Weekly News Snapshot

- Illegal Mining’s Economic Impact: In 2024, South Africa’s economy suffered a loss of approximately R60 billion due to illegal mining activities. Mineral Resources and Energy Minister Gwede Mantashe emphasized the need for mining companies to take responsibility for rehabilitating mines to combat this issue.

- Anticipated Interest Rate Reduction: Economists forecast that the South African Reserve Bank will lower the repo rate in the upcoming week, despite expectations of rising inflation.

- Afreximbank Fosters US-Africa Trade: The African Export-Import Bank (Afreximbank) has signed a Memorandum of Understanding to promote US-Africa trade, focusing on expanding the utilization of the African Growth and Opportunity Act (Agoa) and other shared objectives.

- Transnet’s Private-Sector Engagement: Transnet has unveiled plans to attract private-sector investment, aiming to raise R70 billion over the next five years to modernize and enhance the country’s rail network infrastructure.

- Cape Town International Airport Enhancements: Airports Company South Africa (ACSA) plans to install additional generators at Cape Town International Airport to prevent operational disruptions caused by electrical issues.

- Groblers Bridge Closure: The Groblers Bridge border post remains closed following assessments of flood damage to infrastructure. Engineers are evaluating the necessary repairs to resume operations.

- Air Cargo Outlook: The air cargo sector continues to play a crucial role in maintaining global supply chains. However, experts note that US trade policies, particularly anticipated tariffs under President Trump’s administration, could introduce uncertainties affecting the industry’s growth.

- Wine Export Challenges: South Africa’s wine export industry faces challenges as per capita wine consumption in the US, the world’s largest wine market by value, has been declining since 2017.

- Supply Chain Adaptations: Businesses worldwide are rapidly adapting their supply chains in response to increasing protectionism and shifting geopolitical alliances, as discussed at the World Economic Forum. Source: FreightNews

Port Operations Summary: – Port Update:

Durban :The port experienced low wind speeds during the week, but delays persist across terminals:

- Pier 1: 3–5 days delay

- Pier 2: 7–10 days delay

- Durban Point: 3 days delay

Key Issues: Appointment slots remain constrained due to the high volume of containers moving through Durban terminals. Increased delays in the collection of containers are being caused by limitations in the transport booking system.

Cape Town: The port has experienced windy weather during the week, impacting terminal operations:

- CTCT (Cape Town Container Terminal): 4–7 days delay

- MPT (Multi-Purpose Terminal): 1–3 days delay

Port Elizabeth (Gqeberha): The port has been affected by strong wind speeds during the week:

- PECT (Port Elizabeth Container Terminal): 0–1 day delay

- NCT (Ngqura Container Terminal): 1–3 days delay

BUSA Cargo Movement Update – 26 January 2025

Port and Air Cargo Performance

South Africa’s logistics sector continues to experience challenges, with container volumes at ports declining by 16% week-on-week. An average of 10,368 TEUs was handled daily, down from the previous 12,304 TEUs. Durban’s rail cargo saw a 19% decline, processing 2,467 containers. However, air cargo volumes have surged, with air freight tonnages increasing by 25%, reflecting strong recovery from earlier lulls.

Key Disruptions & Challenges

- Port Congestion & Weather: Strong winds in Cape Town led to over 30 hours of lost operations, while Durban struggled with equipment breakdowns. The Eastern Cape ports also faced delays due to high swells and vacant berths.

- Border Delays: Cross-border transit times increased by 0.5 hours week-on-week, with South African border crossings averaging 7.9 hours, up by 21%.

- Red Sea Impact: Yemen’s Houthi rebels announced they would stop targeting non-Israeli vessels, leading to potential relief in global shipping congestion. However, major carriers remain cautious before resuming Suez Canal routes.

Global Freight Market Trends

- Container Rates Drop: Global container spot rates fell by 10.6% to $3,445 per 40-ft container, with further declines expected due to excess capacity and market uncertainties.

- Air Freight Rebound: International air cargo tonnages increased by 8% in mid-January, though spot rates have slightly declined. South African air cargo volumes at OR Tambo Airport are up by 16% year-on-year.

- US Trade Policy Impact: The re-election of US President Donald Trump has introduced uncertainty in global trade, prompting companies to expedite shipments to avoid potential tariff hikes.

Urgent Need for Logistics Reform

Despite some improvements, South Africa’s logistics sector remains under strain. The report underscores the urgent need for private sector investment in ports and rail to address inefficiencies and improve trade facilitation. As neighbouring countries invest in infrastructure projects, South Africa risks falling behind unless decisive action is taken to unlock the full potential of its trade and logistics network.

This update highlights the critical role of logistics in sustaining the economy, emphasising that inefficiencies are more than just delays—they threaten essential supply chains, from food security to industrial production. The time for reform is now. – Source: BUSA

Summary of Global Shipping Industry

- The global container industry experienced significant supply and demand changes in Q4 2024. A total of 1.5 million TEU of new container ship capacity was ordered, with 107 new vessels added, making it the third-highest quarter in history for ship orders. By January 2025, the global orderbook reached a record 780 vessels (8.5 million TEU), marking a 10.7% increase in capacity and 5.1% growth in vessel numbers compared to the previous quarter.

- In 2024, vessel demolitions were unusually low, with only 56 ships (80,950 TEU) scrapped half of 2023 of 2023’s total. This decline was due to strong freight and charter markets, which incentivised shipowners to retain older vessels despite favourable demolition prices and regulatory pressures. Increased TEU-mile demand, spurred by vessels rerouting around the Cape of Good Hope to avoid the Suez Canal, absorbed much of the new capacity, while charter rates nearly doubled from 2023 levels, reaching their highest since the 2021-2022 post-COVID boom.

- Global congestion remained steady at 2.65 million TEU, representing 8.5% of the global fleet. Locally, Durban port has made strides in reducing congestion, with 13,450 TEU waiting outside anchorage and a queue-to-berth ratio of 0.22. These improvements earned Durban a spot on Linerlytica’s “Port Congestion Watch” in 2024. However, challenges remain, particularly in recovering lost connectivity and capacity. Lastly, Drewry’s “Cancelled Sailings Tracker” reported a relatively high cancellation rate of 15%, reflecting ongoing adjustments in global shipping. Source: BUSA

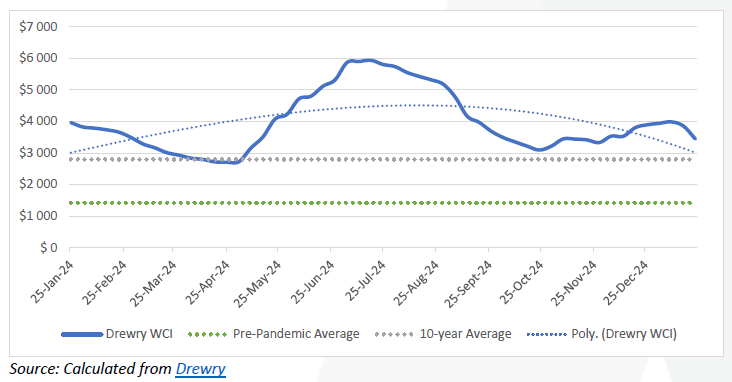

Global Container Freight Rates

Global container spot rates have gone in the opposite direction compared to this time last year, as rates plummeted by ↓10,6% this week to $3 445 per 40-ft container20, according to Drewry’s “World Container Index”. There are currently two major drivers impacting the decrease, namely the (1) upcoming Chinese Lunar New Year celebrations21 and, as mentioned above, (2) the ceasefire in the Red Sea and the potential return to using the Suez Canal.22 Consequently, analysts are predicting a further reduction in spot rates (not to mention a significant agenda item added to contract discussions) in the immediate future, as excess capacity

Spot rates have declined by 13% compared to last year but remain 143% higher than pre-pandemic levels. Rates dropped across all major routes, with further decreases expected due to the Chinese Lunar New Year slowdown. Meanwhile, charter rates remain stable but elevated, with the Harpex Index up 105% year-on-year. Maersk is expanding its charter fleet for the upcoming Gemini Cooperation’s intra-Asia services launching next month.

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”