Welcome to another Logistics News Update.

While February is the ‘month of love,’ the logistics sector is showing some signs of slowing down—ports are however, doing well, but this past weekend seemed to be a bit of a problem as Durban Port suspended all bookings due to breakdowns. Container bookings are still a huge problem, transporters continue to voice frustrations over persistent inefficiencies in the booking process.

Shifting focus to global trade, the buzzword of the moment is TARIFF. Exporters, take note: the newly elected US president has floated tariffs tied to geopolitical tensions—a move that could ripple far beyond traditional trade disputes. Businesses reliant on US-bound shipments should brace for potential turbulence, this may also create opportunities for South Africa. We will cover the purpose and reason for tariff codes and why duty is applied to them next week in let’s learn.

On the domestic front, interest rates have dipped, offering some relief to borrowers. But this silver lining comes with a cloud: the rand has weakened sharply, with the dollar surging past R19 this week. For logistics players, this creates a delicate balancing act—cheaper borrowing costs versus pricier imports and volatile export margins.

Let’s Learn

This Week’s Learning Spotlight: Sometimes, we assume we know it all—but even experienced importers and exporters can overlook the basics. Here’s a quick refresher to ensure your importing process runs smoothly:

Requirements to Clear Customs When Importing Goods into South Africa

| 1. Essential Documentation Commercial Invoice: Must include a detailed description of goods, value, buyer/seller details, and Incoterms (e.g., FOB, CIF). Bill of Lading (Sea Freight) or Airway Bill (Air Freight): Original shipping document required to release goods. Packing List: Specifies quantities, weights, and packaging type for each item. Import Permit/Licence: Needed for restricted goods (e.g., pharmaceuticals, firearms, agricultural products). SARS Customs Client Code: Mandatory registration with the South African Revenue Service (SARS). SAD 500 Form: Customs declaration submitted electronically via SARS’ system. 2. Duties and Taxes Customs Duties: Calculated using the Harmonised System (HS) code and the value of goods (including freight and insurance). Value-Added Tax (VAT): 15% levied on the total value (goods + duties + insurance). Some items, like basic foodstuffs, are exempt. Proof of Payment: Duties and VAT must be settled before goods are released. | 3. Compliance Requirements HS Code Classification: Correct classification is critical to avoid penalties or delays. Certificates of Origin: Required for preferential tariffs under agreements like SADC or AGOA. Product-Specific Certifications: NRCS Approval: For electronics, automotive parts, or appliances. Health/Phytosanitary Certificates: For food, plants, or animal products. SABS Certification: For compliance with South African Bureau of Standards regulations. 4. Additional ConsiderationsProhibited Goods: Counterfeit items, hazardous waste, and certain second-hand goods (e.g., used clothing) are banned. Storage Costs: Delays may incur demurrage fees at ports or airports. Pre-Clearance: Submit documents in advance to expedite clearance. Key Tips for Smooth Clearance Double-Check HS Codes: Use the SARS Customs Tariff or consult a broker to avoid misclassification. Avoid Under-Invoicing: SARS imposes strict penalties for undervalued goods. |

NEWS

Port productivity continues positive trend

31st January 2025 – Staff Reporter

FreightNews

The much-improved operational environment at South Africa’s ports reported earlier this month appears to be continuing, with minimal waiting time, low terminal and yard density, plenty of depot capacity and an improving equipment position, according to Danish shipping major Maersk Line. “The southeaster, largely absent through summer, made an unwelcome appearance in Cape Town this week, but overall, it’s a positive operational picture,” according to a statement.

Despite concerns, the return to business after the festive break has put limited pressure on port and landside infrastructure.

While political tension in Mozambique resulted in significant delays in Beira and Maputo, an easing of the situation appears to be improving waiting times – although high waiting times are still being experienced, according to the statement.

Port Louis is also recovering from the low productivity and the delays of Q4 last year and waiting time has reduced…

– Adapted from Source: FreightNews

Fruit exporters set sights on market diversification

31st January 2025 – Staff Reporter

South African fresh fruit exporters are gearing up to showcase their produce at the Fruit Logistica Berlin exhibition, set to take place from 5-7 February 2025. This initiative, led by the Fresh Produce Exporters’ Forum (FPEF) and supported by the Department of Trade, Industry and Competition, aims to strengthen relationships with existing markets while seeking new opportunities for growth. Over 160 local exporters will be featured under the South African National Pavilion, highlighting the country’s diverse and world-class fruit exports.

While Europe has long been a key market, shifting consumer demand and declining consumption have prompted local exporters to explore new regions. The focus is now shifting towards the Far East and Asia, where growing demand for fresh produce presents exciting new opportunities. Market diversification is crucial to ensuring long-term industry stability, reducing reliance on traditional markets, and positioning South Africa as a globally competitive supplier.

Fruit Logistica Berlin is one of the most significant events in the fresh produce industry, attracting over 60,000 visitors and exhibitors from more than 140 countries. The event offers a prime platform for networking, forging trade deals, and gaining insights into global market trends. For South African exporters, participation in this exhibition is a strategic move to expand their footprint, establish new trade relationships, and showcase the country’s agricultural excellence on the world stage...

– Adapted from Source: FreighNews

On The Ground Report

O.R. Tambo International – Fuel Shortage

ACSA is managing a jet fuel shortage at O.R. Tambo International Airport due to a 4 January 2025 fire at the NATREF refinery, which damaged its Crude Distillation Unit. Repairs are expected until 21 February 2025. To mitigate the issue, ACSA, FIASA, and NATREF are securing fuel via rail and pipeline from Durban and Matola, Mozambique, and sourcing supplies from other airports.

Weekly News Snapshot

- Jet Fuel Supply Challenges: Following a fire-induced shutdown at Natref on January 4, which supplies 72% of OR Tambo International Airport’s jet fuel, logistical hurdles have emerged in transporting imported fuel from Durban to Johannesburg. As of January 28, the airport had 29.7 million litters of fuel, sufficient for approximately 11.7 days.

- Global Traders Adapt Supply Chains: In response to a fragmented global landscape, traders are implementing innovative supply chain strategies to mitigate risks and maintain operational efficiency.

- Fruit Exporters Seek Market Diversification: South African fruit exporters are actively pursuing new international markets to reduce reliance on traditional destinations and enhance trade resilience.

- Shift Towards External Training: There’s a growing trend of freight companies investing in external training programs to address skill gaps and improve workforce competence.

- South African Airways Expands Fleet: The airline has added two A320 aircraft, coinciding with the launch of new routes and increased flight frequencies, aiming to boost cargo capacity.

- Improved Port Productivity in Mozambique: Easing political tensions in Mozambique have led to reduced waiting times at the country’s ports, enhancing logistics efficiency.

- Interest Rate Reduction Welcomed: Both Cosatu and economists have expressed approval of the recent interest rate cut, though caution about potential inflation risks that could limit further reductions.

Port Operations Summary: – Port Update:

Durban : The port has experienced low wind speeds during the week.

- Pier 1 : Significant improvement going into 2025. No waiting time: productivity target met.

- Pier 2 : Significant improvement going into 2025. Max 0-2 days waiting time; productivity close to target.

- Durban Point : 3 days delay

Cape Town: The port has experienced strong winds during the week.

- CTCT : 0-1 day waiting time, limited wind delays, services on schedule.

- MPT : No waiting time, limited wind delays, services on schedule.

Port Elizabeth (Gqeberha): The port has experienced windy weather during the week.

PECT : No waiting time, some wind delays. Terminal maintenance planned.

NCT : No Waiting time, some wind delays, services on schedule. Source: SACO

BUSA Cargo Movement Update – 26 January 2025

South Africa’s Logistics & Trade Update

Ports & Shipping:

South African container terminals saw an increase in daily TEU volumes, but operations were disrupted by bad weather and ongoing equipment failures. Cape Town lost 50 operational hours due to strong winds, dense fog, and breakdowns, while Durban and the Eastern Cape ports faced similar challenges. The Maersk Vilnius 502N had to leave Cape Town early to meet a dry dock deadline in Shanghai, and the Kalahari Express was delayed after taking shelter in Europe. A derailment on the ConCor line caused service disruptions, though one track has been restored, with the second expected back in operation soon.

Global Trade & Freight Rates:

The US will introduce new tariffs on imports from Canada, Mexico, and China in February 2025, which will further strain container trade. Global shipping schedule reliability remained unstable, dropping to 53.8% in December. Freight rates declined by 2.4% this week, but the Shanghai-Durban route remains expensive due to blank sailings. The widening gap between spot and contract rates highlights the need for well-planned shipping agreements.

Air Cargo Growth:

Air cargo volumes at OR Tambo International Airport (ORTIA) rose sharply, with inbound and outbound freight increasing by 14% week-on-week. While international cargo volumes for December declined by 15% month-on-month, annual figures have exceeded 2023 levels. IATA reported a 6.1% year-on-year increase in global cargo volumes, marking the 17th consecutive month of growth. In the UK, the government has approved the Heathrow third runway and Lower Thames Crossing projects, which could boost trade efficiency.

Border & Rail Operations:

Truck volumes at the Lebombo Border Post and the N4 Corridor have stabilised, while rail freight to Maputo has increased. However, a derailment in Mozambique caused a three-day delay. Border crossing times across SADC worsened, with South African borders averaging 10.7 hours per crossing—up 44% from last week. Beitbridge, Kasumbalesa, and Katima/Mulilo remain the most congested border posts. Other key developments include Botswana lifting its grain import ban and Zimbabwe increasing its lithium tax.

Infrastructure & Policy Outlook:

As the State of the Nation Address (SONA) approaches on 6 February 2025, the logistics sector is awaiting urgent action on port and rail reform. While Transnet has received a R47 billion state guarantee, long-term efficiency will only come with structural change—particularly through an open-access model that allows private sector investment. The industry calls for a move from policy discussions to implementation, with clear funding commitments, improved freight corridors, and better-managed concessions to drive real progress.

Summary of Global Shipping Industry

International Trade & Logistics Update

Global Shipping Industry

- US Tariffs & Trade Impact : The United States is set to introduce new tariffs from 4 February 2025, imposing 25% duties on imports from Canada and Mexico, along with an additional 10% tariff on imports from China. These measures are expected to worsen the already imbalanced US container trade, where imports have consistently outpaced exports (2.4:1 in 2024). Despite previous tariffs, China remains the dominant supplier, accounting for 41% of US containerised imports. The new tariffs are unlikely to change this trend significantly, though businesses are advised to remain flexible and strategically plan for potential trade shifts.

- Global Shipping Schedule Reliability: According to Sea-Intelligence’s Global Liner Performance (GLP) report, schedule reliability remained volatile throughout 2024, averaging between 50%-55%. December saw a slight decline to 53.8%, down 3% year-on-year. The average delay for late vessel arrivals improved to 5.28 days, the lowest since July 2024. Among major carriers, Maersk led with 60.4% reliability, while Wan Hai had the lowest at 47.9%. Port congestion eased slightly this week, with 2.83 million TEU still stuck in the system—down from 3.3 million last week. However, congestion persists in China due to the Lunar New Year, while severe weather in the US Atlantic and English Channel continues to disrupt schedules.

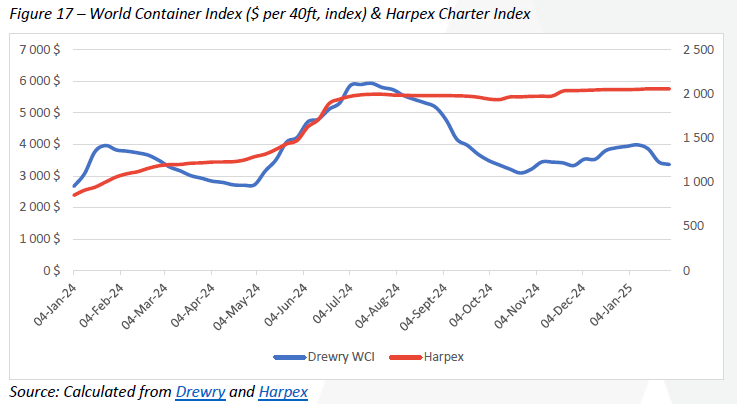

- Freight & Contract Rates: Global container spot rates declined again this week, dropping by 2.4% to $3 364 per 40-ft container. Spot rates are now 12% lower than this time last year but remain 137% above the pre-pandemic average of $1 420 in 2019. Despite the general decline, rates on the Shanghai-Durban route remain high at $6 810 per 40-ft container due to blank sailings and a focus on European trade lanes. South Africa typically experiences market shifts a month or two later, suggesting further adjustments ahead. Meanwhile, charter rates remain stable, with the Harpex Index at 2 057 points—94% higher than a year ago.

- Outlook for Shippers: With ongoing market volatility and trade uncertainty, businesses are advised to adopt a flexible and strategic approach. This includes adjusting product sourcing, rebalancing supply chains, and exploring new markets. Analysts recommend focusing on long-term resilience rather than reactive changes, as the trade environment remains unpredictable.

- Source: BUSA

Global Container Freight Rates

Freight & Contract Rates Update

Global container spot rates declined by 2.4% this week, now averaging $3 364 per 40-ft container, according to Drewry’s World Container Index. While rates are 12% lower than this time last year, they remain 137% higher than the pre-pandemic average of $1 420 in 2019. Despite the overall decline, the Shanghai-Durban route remains elevated at $6 810 per 40-ft container, according to the SCFI. This is due to limited capacity from blank sailings and carriers prioritising European destinations, keeping Asian export rates at a premium. South Africa tends to follow global market trends with a lag of one to two months, so further rate adjustments can be expected.

Meanwhile, charter rates remain stable but still high, with the Harper Petersen Index (Harpex) trading at 2 057 points—a 94% increase year-on-year.

Recent analyses indicate a widening gap between spot and contract rates in both air and ocean freight sectors.15 The robustness of the charter market has played its part. In air cargo, the volatility of spot rates has led forwarders to increasingly favour long-term contracts, with e-commerce giants like Alibaba and Shein securing dedicated freighter capacity to ensure supply chain stability. Conversely, in ocean shipping, the Asia-Europe contract season faces delays as stakeholders await clarity on Red Sea transit conditions, contributing to market uncertainty.16 This divergence underscores the strategic importance for shippers to carefully assess their reliance on spot versus contract rates, balancing flexibility with the need for predictability in their logistics planning. Interestingly, while the Red Sea crisis has contributed to increased shipping costs due to longer routes around the Cape of Good Hope, other factors, such as rising fuel prices, labour shortages, and higher insurance premiums, also play significant roles. Despite the surge in maritime traffic around South Africa, the local shipping industry has not fully capitalised on this opportunity, potentially missing out on increased business.17

Lastly, in related financial news, China United Lines has filed a record $96 million compensation claim against Amazon with the US Federal Maritime Commission (FMC), citing wrongful contract termination and failure to meet minimum quantity commitments.18 This unprecedented case highlights the growing legal and financial stakes in shipper-carrier disputes, reinforcing the importance of regulatory oversight in contractual enforcement. – Source: BUSA

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”