Welcome to another Logistics News Update.

Before we get into the News, we would like to wish all our readers a blessed and safe Easter. If you are travelling, please remember to check the latest updates for your route to ensure a smooth and safe journey.

As you may be aware, Donald Trump has paused the reciprocal duties on all countries, except China. But this does not mean we can rest on our laurels. A 10% blanket tariff remains in effect, and uncertainty is still in the air. Now is the time to plan. The 90-day window is ticking, and it’s crucial to start thinking about how your business will respond. Whatever you do, don’t wait, and see. Be ready. Although there has been a pause, the 10% that has been imposed was from a 0%. Government has been engaging with the USA representatives.

BUSA published their weekly report late last week and hence there was no BUSA report. Our On The Ground report below shows what they highlighted. Port volumes dropped last week by 12% and airfreight volumes rose by 12%. We also see that rates out of China have come down and this is a welcomed as we see the rand trading at it’s highest levels. Not great for importers, but exporters must be loving it.

On The Ground

- Potential Strike at SA Ports Could Halt Container Movement: UNTU has declared a deadlock in wage talks with Transnet, paving the way for a strike that could halt port operations and cost the economy billions, after rejecting a 6% wage offer over concerns about job security and retrenchments.

- Transnet’s Port Elizabeth container terminal gears up with arrival of new STS crane: Transnet Port Terminals (TPT) in Port Elizabeth officially unveiled a state-of-the-art Ship-to-Shore (STS) crane, signalling a renewed momentum in South Africa’s port infrastructure investment and operational efficiency strategy.

Key Highlights from Last Week’s Discussions: Source: BUSA

- US Tariffs: Broad Economic Implications: The United States has implemented a sweeping 10% tariff on all imports—its most protectionist measure since the Great Depression—raising the average tariff rate to approximately 20%, and over 36% for containerised goods.

b. Although a 90-day pause was announced last night, the move has already prompted retaliatory measures (notably from China), heightened fears of global stagflation, and injected considerable uncertainty into global supply chains. Shipping routes and sourcing strategies are now undergoing widespread reassessment. - Potential Impacts of US Tariffs on South Africa: Select South African exports now face a 30% US tariff—three times the standard rate—posing a particular threat to key sectors such as automotive, agro-processing, and industrial goods. While around 40% of exports remain unaffected, the remaining 60% includes many high-value, labour-intensive products.

The US accounts for 8% of South Africa’s exports, and these tariffs could undermine competitiveness—especially in sensitive sectors like citrus and automotive components, were even marginal cost increases risk market share erosion.

While the immediate GDP impact is estimated at a modest 1.3%, the broader strategic implications are more serious. A balanced response is advised, including the preservation of diplomatic ties, fast-tracking export diversification, and offering targeted support to impacted firms. - Container Shipping: Capacity Surge and Rate Volatility: a. Container freight rates have dropped more sharply than expected following Chinese New Year, due to aggressive pricing tactics and significant year-on-year capacity expansions: a 27% increase on Asia–Europe routes and 14% on Asia–North America West Coast.

Let’s Learn:

What is a Trade Agreement?

With all the talk about tariffs, let’s look at something that can help mitigate their impact — trade agreements. These are formal arrangements between two or more countries that outline the rules of trade between them, often reducing or eliminating tariffs on certain goods.

Why are trade agreements important?

• They help exporters access new markets with fewer barriers

• They reduce or eliminate tariffs, making your products more competitive

• They create a more predictable trade environment

What South African exporters should know:

- AGOA (African Growth and Opportunity Act) currently allows many SA products duty-free access to the US — but it’s under review.

- EU and SADC trade deals provide preferential access for agricultural and industrial products.

- Rules of origin apply — meaning products must meet specific criteria to qualify for duty-free access.

💡 Tip: Not all trade agreements apply automatically. Speak to your clearing agent or trade advisor to make sure your product qualifies before shipping.

In a world of rising protectionism, understanding which trade agreements South Africa is part of could be the competitive edge your business needs.

NEWS

South African manufacturers change tack as US tariff war rages

14th April 2025 – By Adelaide Changole, Bloomberg

Trump on April 2 announced reciprocal tariffs on trading partners, including a 30% tax on South Africa, before pausing them for 90-days while keeping 10% duties on most countries. South African manufacturers are adapting their strategies in response to the escalating U.S. tariff war initiated by President Donald Trump. The imposition of an original 25% import tariff on cars has significantly impacted the automotive sector, prompting companies to reassess their reliance on the U.S. market.

In response, the South African government is considering expanding its Automotive Production and Development Programme to mitigate the adverse effects of these tariffs. This initiative aims to bolster investment, innovation, and job creation within the industry, offering customs rebates and production-based incentives to manufacturers.

The National Association of Automobile Manufacturers of South Africa (NAAMSA) has expressed concerns that the tariffs will lead to increased costs for American consumers and limit access to South African-made vehicles. Major automakers with manufacturing plants in South Africa, including BMW, Ford, Isuzu, Mercedes-Benz, Nissan, and Toyota, are expected to be significantly affected by these developments.

As the U.S. remains a crucial export market for South African vehicles, with exports valued at approximately 35 billion rand ($1.8 billion) in 2024, the industry is seeking ways to navigate the challenges posed by the tariff war. Diversifying export markets and enhancing domestic incentives are among the strategies being considered to sustain the sector’s growth and stability…

– Source: – MoneyWeb & Reuters

WEEKLY NEWS SNAPSHOT

Clock’s ticking for freight industry to object to cabotage: An urgent appeal has gone out to local shippers, the freight forwarding community and the liner trade serving South Africa’s ports to meet a tight deadline for objecting to the government’s contentious plans for in-shoring cargo movement along the country’s coastline.

South Africa breaks all-time table grape export record: The South African table grape industry broke several records this season. Although South Africa’s table grape hectares have shrunk by 2% this past year, the industry recorded the largest national harvest ever. Of a total of 78.9 million cartons (4.5 kg equivalent), which was 4% more than last season, 77.4 million cartons were exported – 5% more than last season, said Jacques Ferreira, commercial affairs manager for the South African Table Grape Industry (Sati).

Global Trade and Shipping Disruptions :The escalating U.S.-China trade tensions have led to significant disruptions in global shipping. The Port of Shanghai experienced a standstill due to tariff hikes, causing major carriers to cut back on transpacific routes. Smaller shipping lines are facing profitability challenges amid declining demand and spot rates. The World Trade Organization warns that U.S.-China trade could shrink by up to 80%, with global economic repercussions.

South Africa’s Logistics and Trade Developments: South Africa achieved a record in table grape exports, with expectations of further yield increases as vineyards adopt higher-yielding cultivars. However, the country faces challenges in enhancing its role as a sub-Saharan transshipment hub due to infrastructure and regulatory hurdles. The government, in collaboration with Transnet, aims to move at least 250 million tonnes of freight on the Transnet network by 2030, up from 150 million tonnes in the 2023/24 financial year.

Infrastructure Investments and Innovations: Rangel Logistics Solutions invested €6 million in a new 10,000 sqm warehouse near OR Tambo International Airport, enhancing South Africa’s logistics capabilities and creating 160 jobs. The facility will serve as a central hub for cross-border contract logistics, with bonded storage capabilities and cross-docking services. Additionally, the company opened a new office in Nakop, strengthening trade links with neighbouring countries.

Environmental Initiatives and Challenges: The International Maritime Organization approved a global carbon fee for shipping, establishing a net-zero fund to reward low-emission ships and support a just transition. However, a proposed greenhouse levy faced setbacks due to unresolved technical and economic issues. These developments highlight the ongoing efforts and challenges in reducing the environmental impact of global shipping. Source: – FreightNews

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS

Durban

All Durban ports less than 3 days delays

- Pier 1: 0–2 days delay

- Pier 2: No delay

- Durban Point: 2 days delay

Cape Town

The port was impacted by strong winds throughout the week.

- CTCT: 9–19 days delay

- MPT: No delay

Port Elizabeth

The port experienced windy conditions during the week.

- PECT: 0–2 day delay

- NCT: No delay

Source: GoCommet * as reported 16/4/2025

Global Freight Rates

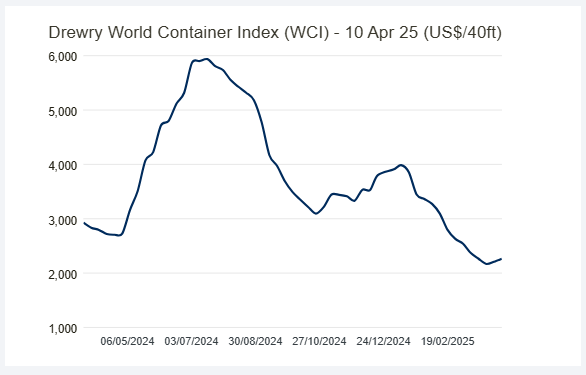

World Container Index – 10 April 2025

Drewry’s World Container Index (WCI) for the week ending 10 April 2025 shows a 3% increase, bringing the composite index to $2,265 per 40-foot container. This marks the second consecutive weekly rise, indicating a potential shift in market dynamics. The index remains 78% below its peak of $10,377 in September 2021 but is 59% higher than the pre-pandemic average of $1,420 in 2019. The year-to-date average for 2025 stands at $2,944 per 40-foot container, which is $55 above the 10-year average of $2,889.

Freight rates on major routes have also seen changes:

- Shanghai to Rotterdam: Increased by 4% to $2,392 per 40-foot container.

- Shanghai to Los Angeles: Rose by 3% to $2,815 per 40-foot container.

- Shanghai to New York: Climbed by 2% to $3,976 per 40-foot container.

- Rotterdam to Shanghai: Increased by 2% to $475 per 40-foot container.

- Shanghai to Genoa: Went up by 1% to $3,071 per 40-foot container.

- Rotterdam to New York: Rose by 1% to $2,153 per 40-foot container.

- New York to Rotterdam: Decreased by 1% to $824 per 40-foot container.

- Los Angeles to Shanghai: Remained stable.

Drewry anticipates that rates may continue to rise in the coming weeks due to tariffs and reduced capacity. – Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”