Welcome to another Logistics News Update.

As we mentioned last week, volumes remain low, and the market is beginning to take note of the work being done in the sector. At the same time, winter has officially arrived, the construction of Durban’s Bayhead Road has begun and started on the 3rd of June and is expected to continue until mid-December 2025. Delays in deliveries and collections are likely if transporters do not stick to their booked time slots. Weather is also playing a role, with strong winds continuing to affect loading and offloading at the container terminal. Shipping lines have started applying peak season surcharges, so please check with your carrier and plan for the extra costs this may bring.

We notice that the word of the day is “SURCHARGE”.

Asia-US freight costs surge as carriers impose back-to-back peak season surcharges and tighten capacity. Is this the carrier capitalising on the situation, or is it something that they can’t avoid? Or could it be that Q1 margins for top shipping lines averaged 18.1, the lowest in a year?

On The Ground

- From 1 July 2025, Maersk will apply a Peak Season Surcharge of USD 500 (20ft) and USD 1,000 (40ft/40HC) on cargo from the Far East to Southern Africa, please factor this into your landed cost estimates and payment planning for Q3.

- South African Routes Under Strain: Rates remain low for Durban and Cape Town, but shipping lines are reducing capacity on these routes in favour of more profitable ones. This could lead to fewer sailings and tighter space availability.

- Eastern & Western Africa Facing Port Delays: Heavy congestion in ports like Mombasa, Dar es Salaam, and Tema is causing major vessel return delays. Strong demand and fewer vessel options have pushed freight rates up sharply. We recommend booking shipments early to avoid delays and potential rate hikes. More vessel reallocation is expected if Southern Africa trade doesn’t respond with stronger demand.

- Port of Durban’s Bayhead Road upgrade gets underway: Transnet National Ports Authority (TNPA) started its critical six-month rehabilitation work on Bayhead Road in the Port of Durban this week. The project aims to reduce congestion, improve road safety, and support seamless cargo movement at the port.

Let’s Learn: The Role of the Bill of Lading

The Bill of Lading (B/L) is one of the most important documents in international trade but also one of the most misunderstood. It’s not just paperwork. It’s proof of ownership, a receipt for cargo, and a contract all rolled into one.

What is it?:

At its core, the B/L is issued by the shipping line or carrier once they’ve received your goods for transport. It confirms:

– The goods were loaded

– On which vessel

– From where to where

– And who is responsible

Why is it important?

1. Title to the Goods

The original Bill of Lading acts like a key – whoever holds it, owns the cargo. That’s why banks, especially in trade finance deals, often insist on holding the original until payment is made.

2. Proof of Shipment

Your evidence that cargo was handed to the carrier is vital for customs clearance and resolving claims.

3. Contract of Carriage

It outlines the terms between the shipper and carrier – delivery terms, conditions, and liabilities.

Types of Bills of Lading:

– Original: A physical document is needed to release cargo. Risky if delayed.

– Seaway Bill: Electronic. Faster, but no title transfer – only for trusted trade partners.

– Express Release: Like a Seaway but confirms cargo can be released without presenting the original.

NEWS

Trump and Xi talk trade for more than an hour

Source: Various

President Donald Trump and Chinese President Xi Jinping held a roughly 90-minute phone call earlier this week, initiated by Trump. Both sides described it as “very positive,” with the focus on ongoing trade disputes, especially tariffs and critical issues such as rare earth element exports.

A key outcome was both leaders agreeing to resume face-to-face trade delegation talks soon. This follows the recently agreed 90-day pause on additional tariffs — a move aimed at de-escalating tensions between the world’s two largest economies.

Although the White House has yet to issue an official press release, confirmation came via Chinese officials and Trump’s own social media. Reuters, CNN, and CNBC also corroborated the timing, tone, and key contents of the conversation.

Overall, this exchange is being viewed as a meaningful step towards resolving the long-running trade conflict, offering fresh hope for future stability, though much will depend on the follow-through from upcoming delegation meetings.

– Source: FreightNews

WEEKLY NEWS SNAPSHOT

- Exporters challenge cabotage proposal: Exporters Western Cape raised serious concerns in Parliament about the transport minister’s plan to allow local shipping under cabotage rules. They warned it could lead to a state-owned shipping line, increase port handling costs, and raise inland transport charges.

- Airlines project strong profits, but air cargo slows: IATA expects global airline profits to reach US$36 billion in 2025. This is mainly due to lower fuel prices and record passenger numbers. However, air cargo volumes are likely to drop by nearly 5 percent, affected by weak GDP growth and unstable trade flows.

- KZN cargo theft rises as digital services improve: KwaZulu-Natal has been named one of the top cargo theft hotspots in Africa, with organised crime targeting both rail and road freight. At the same time, the Road Traffic Management Corporation reported over four million online transactions, showing more public trust in digital services.

- Fire at sea and border delays in Zimbabwe: A car carrier transporting electric and petrol vehicles caught fire near Alaska, raising fresh concerns over shipping mixed loads. In southern Africa, Zimbabwe’s anti-smuggling checks are causing major delays for legitimate freight, leading to higher costs and longer transit times.

- Zimbabwe’s anti-smuggling checks slow freight: Random inspections by the Zimbabwe Republic Police, despite clearance from ZIMRA’s ConDep are causing serious delays at Beitbridge. One transporter warned these unnecessary stops can cost US $480 a day. Source: FreightNews

Key Highlights from Last Week’s Discussions

Source: BUSA, SAAFF, and global logistics data

Week in Review – 5 June 2025

1. Merchant Shipping Bill Faces Industry Pushback

- On 3 June, public hearings on the proposed Merchant Shipping Bill raised serious concerns.

- Key industry bodies, including Agbiz and SAAFF, warned the Bill lacks trade volume justification and could misdirect already stretched resources.

- The call is for urgent referral to Nedlac and a stronger focus on fixing SA’s port and maritime systems before launching a national carrier.

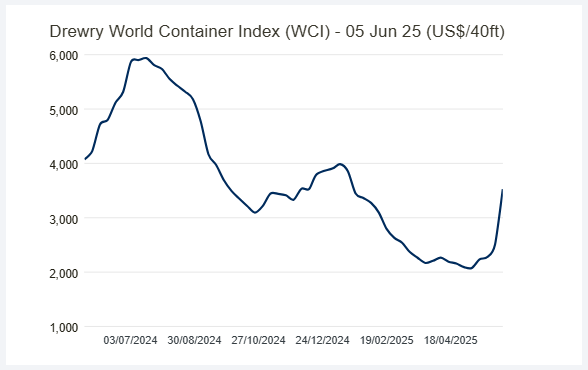

2. Global Freight Rates Spike – But Doubts Remain

- Transpacific rates shot up as carriers reinstated suspended services following temporary US tariff relief.

- Drewry’s World Container Index jumped 10% to $2,508/40ft, while SCFI posted its second-biggest gain ever.

- However, with 25% more vessel capacity entering the market in June, rate stability is uncertain.

3. Carrier Margins Under Pressure Despite Rate Gains

- Q1 margins for top shipping lines averaged 18.1%, the lowest in a year.

- Evergreen outperformed with a 26.7% margin, but others like ONE dropped to 5.2%, hit by rising costs and soft demand.

- Carriers face a double squeeze: higher operating expenses and uncertain demand recovery.

4. Port Volumes Recover, But Delays Persist

- National container throughput rose 17% to 84,043 TEUs last week.

- Ngqura and Cape Town saw double-digit growth, but operational challenges remain.

- Durban Pier 2 continues to struggle with equipment breakdowns, while Cape Town faced weather-related disruptions.

5. Air Cargo Holds Steady – Africa Returns to Growth

- Global air cargo demand rose 5.8% y/y in April, with African carriers posting a 4.8% increase.

- Rates remain stable at $2.40/kg, driven by strong flows from Asia Pacific and recovering transatlantic trade.

- ORTIA handled 6,895 tons, a 3% rise w/w and 17% y/y increase.

6. Border Delays Cost SA Economy R168 Million

- Average SADC queue time rose to 5.5 hours; border crossing times held at 5.3 hours.

- Groblersbrug delays worsened, with tankers waiting over 48 hours.

- Combined delays cost transporters an estimated R168 million last week, up 6.4% from the week before.

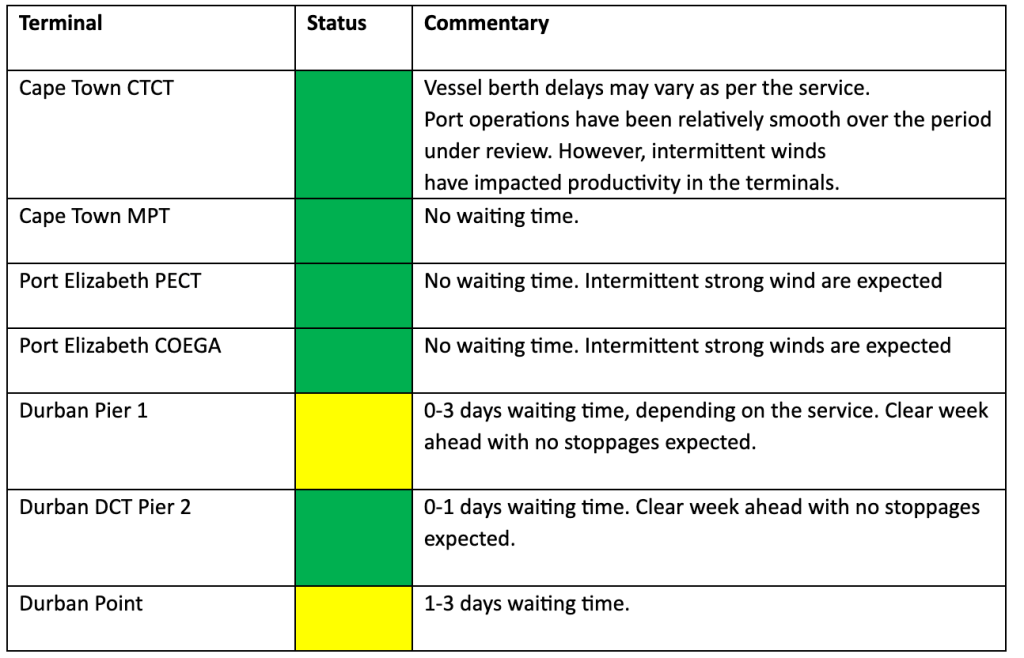

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS

Global Freight Rates

World Container Index –29th May 2025

Drewry’s World Container Index rose by 41% this week, reaching $3,527 for a 40ft container. This marks a 70% jump in the past month, driven by the return of US-bound shipping traffic following President Donald Trump’s temporary “pause” on import tariffs.

- Shanghai to Los Angeles rates surged 57% in the past week to $5,876 and are up 117% since 8 May.

- Shanghai to New York spot rates climbed 39% this week, up 96% over four weeks.

- Shanghai to Rotterdam and Genoa saw increases of 32% and 38%, respectively.

This spike has temporarily reversed the downward trend that started in January. However, Drewry expects the supply-demand balance to weaken again in the second half of the year, which could bring rates back down. Future rate movements will depend on how legal challenges to US tariffs unfold and whether the penalties on Chinese vessels are enforced or delayed.

– Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”