Good afternoon, welcome to another Logistics News Update.

This week, we’re going to dig deep so that by the time you finish reading, you’ll have more clarity on tariffs and shipping between South Africa and the U.S.A.

Last week, we looked at what would happen if we couldn’t reach an agreement or, as President Donald Trump likes to say, “do a deal.” Now we find ourselves in a new week, licking our wounds and strategizing on what’s next. To add to the uncertainty, the market reacted sharply to Maersk’s announcement that it will no longer run its direct service between the U.S. and South Africa.

It’s hard to know where to turn right now. Tariffs dominate the headlines, and in a market where we should be shining, it’s frustrating and disheartening. Maersk’s withdrawal has only added to the uncertainty, leaving many unsure of what it means for their business. Let’s cut through the confusion and clarify what’s happening.

South Africa’s shipping landscape is undergoing a major shake-up with Maersk’s decision to end its direct South Africa to the U.S. service from 1 October. This move forces exporters to route goods through European ports, adding two to three weeks to transit times and increasing freight costs by an estimated 20-40%. For industries like citrus and wine, which rely on fast, reliable delivery, these delays and added costs could significantly impact margins and contract fulfilment. With the U.S. already imposing a 30% tariff on South African goods, the combined effect of political tension and reduced shipping options puts exporters under even greater strain.

South African exporters and importers do not need to stress, as the route will still be covered by MSC, which has committed to maintaining its weekly direct service to the U.S. East Coast and is adding extra vessels to ensure reliability. While this is a lifeline, it also creates a single point of failure any disruption to MSC’s service could halt the only direct link between the two markets. Exporters are being urged to plan shipments well in advance, diversify markets, and consider alternative transport modes for urgent cargo. The situation is a stark reminder that resilience in African trade depends on multiple carrier options, stable trade agreements, and proactive risk management.

Navigating the SA/U.S. Shipping Changes

With Maersk ending its direct service to the U.S. from 1 October, all direct sailings will now be handled by MSC. The good news is that MSC is fully committed to this route, adding extra vessels to keep cargo moving on schedule. While there’s no need to stress, there are steps you can take to stay ahead.

- Book early – Secure space 4 to 6 weeks in advance to avoid rollovers.

- Plan for longer lead times – Build in 2–3 extra weeks for shipments.

- Use alternative options for urgent goods – Airfreight or regional sea–air routes can keep critical cargo on time.

- Review pricing – Share any cost increases with your buyers to protect margins.

- Diversify markets – Reduce reliance on one lane by exploring new trade opportunities.

We are monitoring the situation daily and will keep you updated so your cargo moves smoothly, no matter the changes.

What’s happening with tariffs on South Africa

- A 30% US tariff on most SA exports is in effect from 7 August 2025. The government confirmed it failed to secure a deal before the deadline. FreightNews reports the tariff as a unilateral 30% duty effective 7 August, with ministers outlining mitigation steps.

- There are category differences/exemptions: earlier we covered and noted PGMs, gold, chrome and coal are excluded, while most other goods face 30%, cars 25%, and steel/aluminium 50%.

Government Steps Up Response to U.S. Tariffs

- The 30% U.S. tariff on most South African exports came into effect on 7 August, after efforts to secure a last-minute trade deal fell short. The government had tabled a comprehensive framework aimed at boosting investment and removing trade barriers, but the proposal was rejected by Washington.

- In response, Pretoria is moving quickly to soften the blow. An export support desk has been set up to connect businesses with overseas buyers and embassies, while new financial packages will help companies with working capital and equipment needs. The Competition Commission has granted a block exemption to allow competitors to collaborate on logistics and share data to reduce costs, and the UIF is being tapped to assist sectors facing job losses. At the same time, there’s a clear push to diversify markets, with increased focus on Africa, Asia, and the Middle East to reduce reliance on the U.S.

- Officials warn that as many as 30,000 jobs could be at risk, particularly in the automotive and agricultural sectors, but the Reserve Bank sees the broader economic impact as modest. For exporters, the key message is to act early—review your contracts, adjust pricing strategies, and explore new trade opportunities now. The market is challenging, but with the right planning, businesses can adapt and keep cargo moving.

Let’s Learn:What is a Tariff Exemption?

A tariff exemption is when a government decides that certain products from a specific country will not be subject to the usual import duty. For example, the U.S. recently chose not to impose a 50% tariff on orange juice from Brazil. This means Brazilian exporters can continue selling to the U.S. without that extra cost, keeping their products competitive.

Exemptions are often granted for economic, political, or supply reasons, such as avoiding price spikes for consumers or maintaining a steady supply of seasonal goods. For South Africa, a similar exemption on fresh citrus would mean avoiding the new 30% tariff, helping local growers keep their place in the U.S. market and protecting rural jobs.

Bottom line: Exemptions can be just as powerful as trade deals in keeping products competitive internationally – and right now, they’re top of mind for South African exporters.

NEWS

Export protection essential for South African citrus – CGA

Citrus Industry Sees Glimmer of Hope in U.S. Tariff Exemption

Source: FreightNews 11 August 2025

South Africa’s citrus growers are cautiously optimistic after the U.S. exempted Brazilian orange juice from a planned 50% tariff hike. The Citrus Growers’ Association (CGA) hopes this sets a precedent for seasonal fresh produce, potentially sparing local citrus from the recently implemented 30% U.S. tariff on South African exports. CGA CEO Dr Boitshoko Ntshabele emphasised that South African citrus plays a vital role in supplying the U.S. market when local growers are out of season, helping to keep prices stable for consumers.

The CGA welcomed government’s announced industry support measures, stressing the need for swift action to protect rural jobs. It also endorsed market diversification as a key strategy, noting that South Africa already exports to over 100 destinations and aims to reach 260 million 15 kg cartons by 2032. Ntshabele called for closer private–public partnerships to unlock underutilised markets affected by high tariffs and urged the government to use forums like the G20 to deepen market access while continuing efforts to secure a U.S. exemption for fresh produce. Source: Adapted from FreightNews

WEEKLY NEWS SNAPSHOT

- SA fails to secure U.S. tariff relief: After presenting its Framework Deal, South Africa didn’t swing a deal—starting 7 August, most exports face a 30% U.S. tariff, with no softened outcome on the table.

- Ramaphosa: time to adapt to turbulent trade conditions: The president urges businesses to brace for tougher global headwinds, citing the U.S. tariff escalation and reaffirming the push for market diversification.

- MSC confirms SA–US direct sailings will continue: Despite tariff concerns, MSC is sticking with the 16–18-day direct service and even adding four more vessels, bringing their fleet to eight.

- Millions lost to fuel waste in logistics: Wasteful fuel use is draining profits across the sector, even as carriers wrestle with rising cost pressures and operational inefficiencies.

- South Africa denies Russian naval vessel docking: The Cape Times-linked story says the refusal to allow the Russian Navy’s training vessel into Cape Town was tied to delicate timing amid U.S. tariff negotiations.

- SA exporters need plan B for Cape Town congestion: With ever-tightening space at the Port of Cape Town, fruit exporters are urged to use alternate ports like Walvis Bay to avoid delays.

- South32 JV secures manganese rail capacity: A joint venture between two Kalahari mines, Wessels and Mamatwan, has secured rail capacity with Transnet, promising smoother flow for mineral exports. Source: FreightNews

Key Highlights from Last Week’s Discussions – 3rd August 2025

Source: BUSA, SAAFF, and global logistics data

1. SA Ports: Throughput Falls After Strong Run

South African container volumes dropped sharply to an average of 11 438 TEUs/day (↓19% w/w) after several weeks of high performance.

- Next week forecast: Throughput expected to rise 10% to 12,581 TEUs/day.

- Causes: Inclement weather, vacant berths, equipment breakdowns, and staff engagements hit performance in Cape Town, Durban, and Eastern Cape ports.

- Rail: Durban corridor rail volumes rose 24% to 3,134 containers despite a derailment near Thornwood late in the week.

2. Global & SA Economic Outlook

- IMF: Global growth forecast revised up to +3,0% for 2025, driven by front-loaded trade, looser financial conditions, and fiscal expansion.

- South Africa: Growth forecast remains +1,0% for 2025.

- Risks: Tariff-related uncertainty remains high, with potential GDP drag if planned hikes materialise.

3. US Tariffs & Impact on SA

- Tariff structure: A 10% global minimum tariff now applies broadly, with elevated rates of up to 50% on countries with large U.S. trade surpluses.

- SA impact: Most exports now face a 30% duty (previously zero under AGOA), threatening over R80 billion in bilateral trade and putting automotive and metals sectors under severe strain.

- Tip: Exporters are advised to have goods in U.S. customs clearance before 5 October to retain current tariff rates.

4. Air Cargo Update

- Volumes at ORTIA: 594 000 kg inbound (↑1% w/w) and 313 000 kg outbound (↓5% w/w). Levels are ~5% above 2024 and 7% above pre-pandemic averages.

- Operational concern: R5,7 billion midfield cargo terminal project faces ongoing uncertainty; handlers still have no valid leases and limited consultation from ACSA.

- IATA: African carriers’ operating costs are nearly double the global average, driven by high fuel (+63%), non-fuel costs (+112%), and older fleets (~5 years older than global average).

5. Cross-Border & Road Freight

- SA borders: Average crossing time rose slightly to 11,6 hours (↑2%), adding costs of R170 million/week to the transport industry.

- Hotspots: Beitbridge LPG tanker incident caused temporary closure; Ramatlhabama border faced water outages; increase in DRC copper hijackings.

- Lebombo corridor: Truck volumes up 2% to 1 585/day; rail volumes to Maputo rose to 10 trains/day.

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

DURBAN

Terminal operations are performing as normal, with no extraordinary delays or challenges.

- Pier 1 – 0 days waiting time

- Pier 2 (DCT) – 0 – 1 day waiting time

- Point 1 – 2 days waiting time

High winds have impacted port productivity in the past week, as reported.

CAPE TOWN

Vessel berth delays may vary as per the service. Port operations have been relatively smooth over the period under report.

Seasonal, inclement weather and strong winds may impact port operations.

- CTCT: 0 days waiting time – carrier service dependent.

- MPT: 0 days waiting time

PORT ELIZABETH

Both ports are operating smoothly, with no congestion or delays

- PECT: 0 – 2 days waiting time.

- NCT: 0 – 2 days waiting time – carrier service dependent

Source: SACO

Global Freight Rates

Weekly Container Rate Update – 7th August 2025

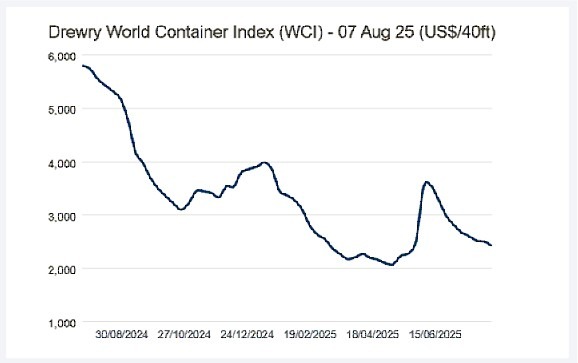

Drewry’s World Container Index fell 3% this week, signalling continued stabilisation after months of volatility sparked by April’s U.S. tariff announcement. Rates surged in May–June, dropped sharply until mid-July, and have since been easing more gradually. Transpacific spot rates declined further, with Shanghai–Los Angeles down 4% to $2,534/FEU and Shanghai to New York down 7% to $3,826/FEU, as the pre-tariff shipping rush has ended.

Looking ahead, Drewry forecasts a weaker supply/demand balance in the second half of 2025, likely pushing spot rates lower. Future rate movements will hinge on the U.S.’s next tariff actions and potential penalties on Chinese ships, both of which remain uncertain. Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”