Good afternoon,

Welcome to another Logistics News Update.

Although Maersk will discontinue its direct service to the USA, exporters can be assured that MSC will maintain direct sailings from South Africa, ensuring continued access to the US market.

Important developments: South Africa will send a high-level delegation to the White House to address the 30% tariffs imposed on local exports to the US. The talks will focus on safeguarding the automotive sector and broader trade flows, with the government stressing the importance of protecting jobs and supply chains.

At the same time, local ports have shown encouraging progress. Container throughput averaged 13,121 TEUs per day last week, almost 15% higher than the previous week. Gqeberha led with a 118% gain, while Durban and Ngqura also recorded solid growth. Despite weather and equipment challenges, the trend reflects improved resilience and efficiency across the network.

However, exporters of pome fruit, such as apples and pears, have raised concerns about the Port of Cape Town’s ongoing delays and inefficiencies. They warn that the port’s performance could damage South Africa’s reputation in international markets, particularly as the fruit season ramps up and exporters face tight delivery windows.

Something to watch out for: SARS’s modality-based structure splits customs processing by transport mode, which may suit their operations but creates unnecessary complexity for traders. This siloed approach slows down clearance and adds friction to multimodal logistics.

Quarterly Review: SA Logistics Recovery: South Africa’s logistics sector is showing some progress, although serious challenges remain. Business Leadership SA’s latest Quarterly Review points to reforms such as the 2023 Freight Logistics Roadmap and Operation Vulindlela gaining ground, but crime, equipment failures and port inefficiencies are still restricting export volumes and holding back growth.

A key highlight is the restructuring of Transnet’s rail operations. The split between the Rail Infrastructure Manager (TRIM) and the Freight Rail Operating Company (TFROC) is now in place, supported by a R47 billion guarantee from National Treasury. This has opened the freight rail network to private operators, with TRIM already making 209 million tonnes of capacity available and receiving 98 slot applications.

Other positive steps include the Government’s Network Statement published in December, which sets the terms for private rail access, and the Department of Transport’s work on public-private partnerships in corridors such as Gauteng-Durban, Richards Bay, and the Northern Cape. Source: FreightNews

Let’s Learn: What is a Reciprocal Tariff?

A reciprocal tariff is when one country responds to another country’s trade measures with its tariff. For example, if the U.S. places a 30% tariff on South African cars, South Africa could impose a similar tariff on U.S. goods in return.

Reciprocal tariffs are meant to create balance in trade, but they can also escalate tensions and lead to what’s known as a “trade war”. For exporters and importers, this means higher risks, increased costs, and the need to diversify markets to avoid being overexposed to one trade route.

Bottom line: Reciprocal tariffs are both a defensive tool and a risk factor and understanding them is key for businesses planning in today’s uncertain trade environment.

NEWS

Automotive Sector Calls for Higher Import Duties

Source: FreightNews 11 August 2025

South Africa’s automotive sector is urging the government to raise import duties on new cars and bakkies to 25-30% in order to protect the local industry. Industry leaders argue that the current system allows imports, now making up 64% of new vehicle sales, to dominate the market. Chinese brands are growing fastest, supported by heavy subsidies that make their vehicles up to 30% cheaper than global competitors.

At present, the Automotive Production and Development Programme (APDP) allows local manufacturers to earn import duty credits based on production volumes. Many use these credits to cancel out duties entirely, and some sell surplus credits on the open market to independent importers. Manufacturers now want APDP rules changed so excess credits can be used to strengthen local operations and cut ad valorem taxes, which make up more than 40% of a vehicle’s price.

The call for reform comes as warning signs mount. Mercedes-Benz SA has cut production, Nissan’s future in the country is uncertain, and the industry is operating at less than 75% capacity. At the same time, two-thirds of local output is exported, mostly internal combustion vehicles, while global markets increasingly demand electric models. Adding to the pressure, the U.S. has imposed 30% tariffs on South African vehicle exports.

Business leaders, including BMW SA CEO Peter van Binsbergen and Toyota SA Motors CEO Andrew Kirby, have cautioned that without decisive policy action, the local motor industry risks long-term decline. The sector contributes 22.6% of national manufacturing output yet is unlikely to reach even 600 000 units of production this year, well below the 1.2 million targets for 2035.

– Source: Adapted from FreightNews

WEEKLY NEWS SNAPSHOT

- Isuzu aims to make SA its African manufacturing hub: Isuzu South Africa is planning to centralise truck manufacturing locally and scale up exports to West Africa. The company targets a jump to 45 percent production localisation, up from around 22-23 percent, amid domestic automotive challenges and steep drop-offs in US exports due to new tariffs.

- South Africa unveils revised US tariff offer: On 12 August, government ministers outlined a five-point trade plan as a base for negotiations with the US, addressing sanitary protocols and seeking better access for poultry, pork and blueberries. Objectives include export diversification and industry support.

- FEU rates hold firm despite volatility: Despite ongoing market volatility, forty-foot Equivalent Unit (FEU) shipping rates have remained stable even though volumes are down 56 percent compared to last year.

- Carriers face capacity glut if Red Sea risk normalises: Liner trade may be facing over‑capacity if the heightened risks in the Red Sea subside. Shipping lines will need time to recalibrate after rerouting decisions.

- Sapo vs Saepa standoff hits breaking point: A six-year stand‑off between Sapo and Saepa is reaching crisis levels. Industry frustration is mounting with no resolution in sight.

- Air rates hold steady amid softening demand: Air freight rates have remained firm despite weakening demand in key markets, presenting a reprieve amid broader pricing pressures. Source: FreightNews

Key Highlights from Last Week’s Discussions – 10TH August 2025

Source: BUSA, SAAFF, and global logistics data

1. SA Ports: Throughput Remains High but Forecast Softens

South African container volumes averaged 13,121 TEUs/day last week (↑15% w/w), maintaining a strong 10-week run above early-year levels.

Next week forecast: Throughput expected to ease 4% to 12,581 TEUs/day.

Causes: Weather disruptions, vacant berths, and equipment breakdowns affected Cape Town, Durban, and Eastern Cape ports.

Rail: Durban corridor volumes fell 12% to 2,745 containers after the Thornwood derailment; the line has now been recommissioned.

2. Global & SA Economic Outlook

• WTO: Global trade growth for 2025 revised up to +0,9% (from –0,2%) on US import front-loading ahead of tariff hikes, but the 2026 outlook was trimmed to +1,8%.

• Sub-Saharan Africa: Imports surged 23,6% y/y; SA’s share of regional imports and exports remains below 2022 highs.

• Risks: Tariffs, shifting supply chains, and volatile freight rates continue to pressure medium-term growth.

3. US Tariffs & Shipping Market Impact

• Transpacific: July volumes hit a record 1,81 m TEU before 7 Aug US tariffs; rates to US West Coast down >60% since June.

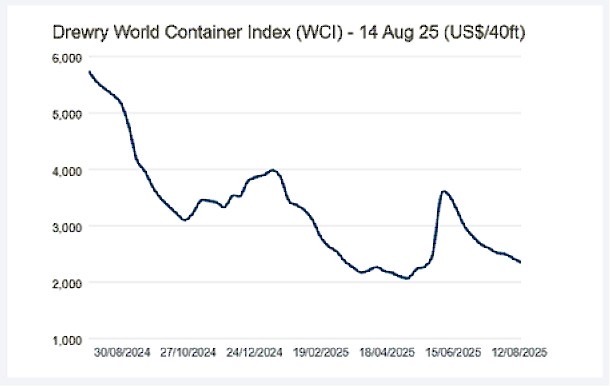

• Global freight rates: Drewry WCI fell for an 8th straight week to $2 424/40ft (↓38% YTD, ↓56% y/y).

• Policy: US rejects IMO Net-Zero Framework; extends reciprocal tariff pause with China to 10 Nov.

4. Air Cargo Update

• Volumes at ORTIA: 585 000 kg inbound (↓1% w/w) and 302 000 kg outbound (↓4% w/w); levels remain ~3% above 2024 and 5% above pre-pandemic.

• July performance: Cape Town ↑15% m/m, Durban ↓3% m/m, Johannesburg ↓2% m/m; domestic cargo up strongly across all three hubs.

• Operational: OR Tambo cargo lease tenders expected in two months; High Court rules race-based licence criteria unlawful.

5. Cross-Border & Road Freight

• SA borders: Median crossing time improved to 10,6 hrs (↓9%); SADC average 4,4 hrs (↓6%), cutting weekly cost impact to R152 million (↓13%).

• Hotspots: SADC certificate stamping delays (SARS JHB), CONDEP Beitbridge staffing shortages, and COMESA e-Certificates rollout in Zimbabwe.

• Lebombo corridor: Truck volumes steady at 1 580/day; queue times ↑14% to 5,8 hrs; rail to Maputo down to 8 trains/day.

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

DURBAN

Terminal operations are performing as normal, with no extraordinary delays or challenges.

- Pier 1 – 2 days waiting time

- Pier 2 (DCT) – 2 day waiting time

- Point 1 – 2 days waiting time

CAPE TOWN

- CTCT: 1 day waiting time – carrier service dependent.

PORT ELIZABETH

- PECT: 0 – 1 day waiting time.

- NCT: 0 – 1 day waiting time Source: JAS

Global Freight Rates

Weekly Container Rate Update – 14th August 2025

Drewry’s World Container Index decreased 3% to $2,350 per 40ft container this week. Drewry’s World Container Index has now declined for nine straight weeks, stabilising after sharp swings triggered by the April U.S. tariff announcement. Rates had spiked in May and June, dropped steeply through mid-July, and are now easing at a slower pace.

This week, transpacific spot rates fell again, with Shanghai–Los Angeles down 2% to $2,494/FEU and Shanghai–New York down 5% to $3,638/FEU. With the pre-tariff cargo rush over, Drewry expects rates to be less volatile in the short term.

Looking ahead, the supply-demand balance is expected to weaken in the second half of 2025, putting further pressure on spot rates. The degree of volatility will hinge on future U.S. tariffs and potential restrictions on Chinese shipping capacity.

– Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”