Welcome to another Logistics News Update.

Here’s a quick update on the tariffs.

The USA has imposed a 30% tariff on South African exports with effect from 7 August 2025. The White House has confirmed the framework and timing, and the government says it is negotiating to reduce the rate while rolling out support for affected exporters. SA agricultural exports to the US rose 26% year on year in Q2 to $161 million but the new tariff clouds the outlook for citrus, grapes, apples, pears, nuts, and wine. Sources: The White House and DTIC.

On The Ground Report:

Transnet communication has deteriorated. Vessels are arriving on dates different from those previously advised. Exporters should note that stack dates are being changed, and both depots and shipping lines are applying additional charges.

Transnet Progress Update: Transnet’s turnaround is showing early signs of recovery. Rail freight volumes are improving, coal exports are back on track, and new private operators will soon add capacity to the network. A three-year wage deal has averted strikes, while government guarantees of nearly R150 billion are keeping capital projects moving. The path is long, but momentum is finally building.

Transport Minister Barbara Creecy says turning Transnet around will be a long process, with reforms to ports and rail needing private sector support and major infrastructure upgrades. Treasury has already approved R94.8 bn in guarantees to keep the operator afloat as it struggles to operate optimally.

Let’s Learn: Direct vs Indirect Sailings

Direct sailing means your container stays on the same vessel from the country you are importing from to South Africa. No transhipment.

Indirect sailing means your box is offloaded at a hub and connects to a second vessel.

Why it matters:

- Time: Direct is usually faster with fewer touch points. Indirect adds a hub stop that can extend the total transit. Also, there may be a price difference.

- Reliability: Fewer handovers mean fewer chances of rollovers or missed connections.

- Cost: Indirect can look cheaper on the base the ocean rate, yet buffer stock, feeder surcharges, and D&D from slipped connections can erase the savings.

- Risk: Extra handling increases exposure to hub congestion, weather, and labour action. High-value or tariff-sensitive cargo is safer on the most reliable rotation.

How to choose:

- Check the published port rotation and the number of transhipments.

- Compare historical schedule reliability and typical dwell at the hub.

- Confirm free time at the destination and plan a buffer for customs and last mile.

- Align with Incoterms so everyone knows who carries the risk if a connection is missed.

The Bottom line: Pick direct when speed and reliability trump a small rate difference. Use indirect when timelines are flexible, and you have cover for hub risk.

SA logistics complexity demands rapid upskilling

Disruption is now standard in our sector, driven by geopolitics, new tech like AI and IoT, tighter sustainability rules, fast e-commerce growth and shifting trade lanes. With freight forwarding at the heart of 90% of South Africa’s international trade, employers risk credibility if they do not invest in professionalisation and adaptive learning. Priority capabilities include forwarding control, customs broking aligned to SARS and OGAs, trade law, trade finance, data and supply chain analysis, client service, compliant sales, cargo handling and insurance risk control. The takeaway is simple. Build skills and data literacy now to manage volatility better and protect margin.

- Source: freightnews.co.za

NEWS

A sign of things to come for South African trade?

Source: By Fred Meintjes 20 March 2025

SA fruit trade braces for post-AGOA reality

South Africa’s fresh produce industry is preparing for a tougher season as political tension with the US raises the risk of losing AGOA preferences. The Fruitnet piece notes the reported expulsion of South Africa’s ambassador to Washington and says there is little appetite to let the matter drag on because exporters fear immediate trade consequences.

Although AGOA access has been extended to the year-end, the article warns that the US administration could terminate South Africa’s participation at short notice. Automotive and agriculture would take the biggest hit and industry observers say shifting and unpredictable US policy is undermining stable trade planning.

Sector leaders are pushing diversification. The Citrus Growers’ Association argues South Africa must deepen market access in BRICS+ countries and fight for better tariff regimes, while the EU remains challenging due to continued CBS and FCM measures. The call is for different thinking about new markets and opportunities as politics in key destinations harden.

Hortgro’s Anton Rabe says being kicked out of AGOA would carry serious economic fallout, even if the short-term duty impact on deciduous fruit is modest at about R6 million. He urges a pragmatic approach to broker a new trade deal with the US and reminds stakeholders that trade runs both ways, so a balanced agreement would benefit both countries.

– Source: Adapted from Fruitnet

WEEKLY NEWS SNAPSHOT

- Government opens freight rail to private operators: Eleven firms have been cleared to negotiate access on 41 routes across key bulk corridors to add capacity alongside Transnet, with slot terms from 1 to 10 years and safety and port-interface conditions attached.

- ITAC proposes higher duties on selected steel products: The tariff body tabled increases on flat-rolled, bars, rods, wire and some tubes to counter low-priced imports, mainly from China, with rebates where local supply is not available. Public comment is underway.

- TNPA and Nersa sign energy MoU for ports: The agreement aligns licensing and operations for petroleum, LNG and electricity projects at ports, aiming to crowd in investment and speed energy infrastructure at terminals.

- Durban lands first Tata vehicle shipment in six years: A ro-ro call discharged 485 units at the Durban Car Terminal, signalling the OEM’s return and further recovery in automotive flows through the port.

- Beitbridge toll plaza proposal published: The Government gazetted plans for a toll facility on the SA side of the border post. Industry stakeholders warn the extra charge could add cost on an already strained corridor.

- Bayhead Road rehabilitation moves into Phase 2: TNPA reports the key Durban access route upgrade is on schedule, with current works focused on outbound and inbound carriageways to improve resilience and traffic flow.

- Africa freight outlook points to steady growth: A new market review sees the continent’s logistics sector expanding through 2033, with South Africa holding about 22.5% of the MEA freight market and remaining the regional anchor. Source: Various

Key Highlights from Last Week’s Discussions – 17th August 2025

Source: BUSA, SAAFF, and global logistics data

1. SA Ports: Container Volumes Surge to Post-COVID Record

- In July, Transnet handled nearly 100 000 more containers than July 2024, with throughput now 0,3% above 2024 levels and only 2,1% below 2019.

- Weekly performance: 14 168 TEUs/day (↑8% w/w), well above projections, despite weather and equipment disruptions.

- Forecast: Volumes expected to ease back to 12 581 TEUs/day in the coming week.

- Bulk cargo: ↓8% m/m, but still ↑3% y/y and ↑5,1% YTD, showing steady improvement in commodity flows.

2. Global Shipping Market

- Orderbook risk: Global containership orderbook hit a record 10,4m TEU (31,7% of fleet), raising fears of structural overcapacity similar to 2004–2009.

- Freight rates: Spot container rates fell for the ninth straight week, now at $2 350/40ft (↓3% w/w, ↓38% y/y).

- Charter market: Defying the downturn, charter demand remains firm, keeping rates high across Asia, Med, Middle East, and Latin America lanes.

3. Trade & Tariff Developments

- Brazil vs US: Brazil launched a WTO dispute over new US tariffs (10–50%), citing WTO violations; the US claims “national security” grounds.

- South Africa: DTIC proposed a five-year block exemption to let exporters coordinate supply chains and marketing as a defensive response to tariff risks.

- These moves highlight the strain on the WTO system and exporters’ need for policy certainty.

4. Air Cargo Update

- Volumes at ORTIA: 627 000 kg inbound (↓3% w/w) and 336 000 kg outbound (↑1% w/w). Despite the dip, levels remain 12% above 2024 and 14% above 2019.

- Operations: Cargo handlers still await clarity on ACSA lease renewals for the midfield terminal, constraining investment decisions.

- Global demand: IATA reports air cargo ↑0,8% y/y in June; Africa saw ↑3,9% y/y, with stronger growth than most regions.

5. Cross-Border & Road Freight

- SA borders: Median crossing time improved to 9,3 hrs (↓12% w/w), while SADC borders worsened slightly to 4,7 hrs (↑7%).

- Lebombo corridor: Truck volumes steady at 1 526/day (↓4% w/w); queues stretched 16 km (640 trucks) due to roadworks, pushing waiting times to 6,8 hrs (↑17%).

- Rail: Flows to Maputo improved to 10 trains/day; sugar trains from Eswatini stable at two/day.

Important to note:

Border flows are mixed: SA-controlled crossings are improving, but wider SADC inefficiencies persist.

South African ports are edging back to pre-pandemic performance, but efficiency gains will stall without long-term infrastructure upgrades.

Overcapacity risks in global shipping could pressure freight rates, though charter rates remain firm in the short term.

Exporters should watch tariff disputes and SA’s new policy proposals, which could change market dynamics.

Air cargo remains above pre-COVID benchmarks, keeping SA competitive in fast-moving sectors.

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

DURBAN

Terminal operations are performing as normal, with no extraordinary delays or challenges.

- Pier 1 – 2 days waiting time

- Pier 2 (DCT) – 2 day waiting time

- Point 1 – 2 days waiting time

CAPE TOWN

- CTCT: 1 day waiting time – carrier service dependent.

PORT ELIZABETH

- PECT: 0 – 1 day waiting time.

- NCT: 0 – 1 day waiting time Source: JAS

Global Freight Rates

Weekly Container Rate Update – 21st August 2025

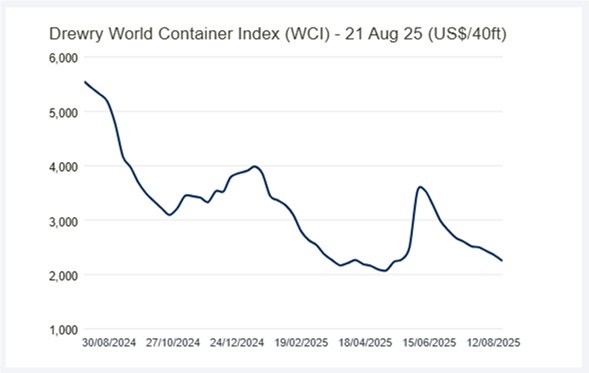

Drewry’s World Container Index fell for the tenth straight week and is settling after a volatile spell. The turbulence started when US tariffs were announced in April, which pushed rates up from May to early June. Prices then slid through mid-July, and the pace of decline has slowed since.

Transpacific: Shanghai–Los Angeles down 3% to $2,412/feu and Shanghai–New York down 5% to $3,463/feu. The early peak season driven by US retailers has ended. With a softer US economy and higher tariff costs, buyers are trimming orders, so Drewry expects less rate volatility in the near term.

Asia-Europe: Shanghai–Rotterdam down 6% to $2,973/feu and Shanghai–Genoa down 3% to $2,978/feu. Demand and port delays in Europe remain steady, but growing vessel capacity is pulling spot rates lower. Drewry expects further easing in the weeks ahead.

Outlook: Drewry’s Container Forecaster sees supply outpacing demand again in 2H25, which points to softer spot rates. The scale and timing will depend on any new US tariff actions under President Trump and on capacity shifts linked to possible US penalties on Chinese ships, which remain uncertain.

– Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”