Welcome to another Logistics News Update.

Spring has arrived, bringing longer days and fresh energy.

Please be aware: The National Ports Authority has applied for an average tariff increase of 9.61% for 2026/27. The proposed hikes range from 8.6% on containers and automotive cargo to 11.2% on marine services. The Ports Regulator will host public consultation roadshows before final approval, with the increases expected to take effect in April 2026. As these are fixed costs, businesses should budget accordingly for the 2026/27 financial year.

Diesel has dropped by 54c, giving transporters some much-needed relief. Port operations are also holding up well this week. Cape Town faced some wind-related delays, which is expected at this time of year, but overall performance remains solid. Adding to the good news, South African citrus exports to Russia are showing strong growth, according to FreightNews.

At the same time, our top story looks at a more challenging development: new US tariffs now in effect, which exporters warn could threaten tens of thousands of jobs in the Western Cape.

Let’s Learn: Understanding Incoterms – Who Carries the Risk?

In global trade, misunderstandings often come down to one thing: Incoterms. These three-letter trade terms define exactly who is responsible for costs, insurance, and risk at each stage of the shipment. If not used correctly, they can expose your business to unexpected charges and disputes.

Why it matters:

If you’re an importer, using the wrong Incoterm can leave you paying for insurance or transport you assumed the exporter was covering. For exporters, unclear terms can mean you carry liability longer than you intended.

Examples:

- FOB (Free on Board): The seller covers costs until the goods are loaded on the ship. After that, the buyer carries the risk.

- CIF (Cost, Insurance and Freight): The seller pays for transport and insurance to the destination port, but once the goods arrive, risk shifts to the buyer.

- DAP (Delivered at Place): The seller takes responsibility until the goods arrive at the buyer’s premises.

The takeaway:

Make sure your sales and procurement teams know the difference. Choosing the right Incoterm protects your business from surprise costs and disputes.

NEWS

Effect of Trump tariffs ‘understated’

Khulekani Magubane – Sunday Times 31st August 2025

Citrus farmers in the Addo area. From left, Edward Noketshe, Buyiswa Ndyenga and Thando Mto.

Exporters fear as many as 100,000 people – many in the citrus exporting sector – could lose their jobs due to US tariffs.

File photo. Image: Judy de Vega

Tariffs Threaten Western Cape Jobs

Exporters in the Western Cape are warning that the full impact of US tariffs on South African products has been underestimated. While government estimates suggest 30,000 jobs are at risk, Terry Gale, chairperson of Exporters Western Cape, believes the number could be closer to 100,000. He points to towns like Citrusdal, where citrus exports rely heavily on the US market, and wine producers are now preparing for export season. “The South African economy cannot afford to lose one job,” Gale said, stressing that the consequences could be devastating if the tariffs are not resolved quickly.

The 30% tariffs, announced by President Donald Trump in April and suspended for 90 days, officially came into effect this month after South Africa failed to secure a trade deal framework. While the US is not South Africa’s largest trade partner, certain categories of citrus, wine, and manufactured goods are highly exposed. Exporters say replacing the US market is not simple. The EU is close to saturation, and while China and Japan offer opportunities, long transit times and heavy congestion at transhipment hubs like Singapore make those markets far more difficult to service.

Exporters have found limited relief by diversifying. For example, Western Cape producers have managed to redirect apple exports to the Philippines. However, Gale cautioned that these alternative arrangements cannot fully offset the US’s advantages of direct routes and shorter transit times. With global trade fragmentation adding pressure on major ports worldwide, many exporters now face delays of up to 60 days on routes that would previously have taken less than three weeks.

The government continues to engage Washington to ease the impasse. International relations minister Ronald Lamola confirmed ongoing discussions with US officials and the planned visit of a congressional delegation. Meanwhile, some industries are better prepared. The Rooibos Council, for instance, says its decade-long push into 30 global markets, led by Europe and Japan, has reduced reliance on the US. For sectors like citrus and wine, however, the reality is that the tariffs pose an immediate and significant threat to jobs and growth in South Africa’s export economy. Adapted from The Sunday Times. Read the full story here

Importers seek continuation of duty-free US chicken

Source: FreightNews 29 August 2025

The Battle Over US Chicken Imports

There is a renewed fight over whether American chicken should continue entering South Africa at dumped prices. A long-standing quota allows 72,000 tonnes of US chicken into the country each year without anti-dumping duties. South African poultry producers argue this damages the local industry, while importers and US producers insist the quota should remain. The issue has resurfaced as part of broader trade talks with the Trump administration.

FairPlay, a local advocacy group, notes that the quota was originally forced on South Africa in 2015 as a condition of keeping benefits under the African Growth and Opportunity Act (AGOA). Those benefits have since been lost, following new US tariffs on South African exports. Poultry producers argue this should have automatically ended the quota. However, US negotiators are pushing to keep it in place, regardless of AGOA, and to secure further relief on poultry tariffs.

At the heart of the dispute is whether the quota amounts to dumping. South Africa’s International Trade Administration Commission (ITAC) has maintained anti-dumping duties on US chicken since 2000, repeatedly finding that low-priced imports harm the domestic industry and threaten jobs. In its most recent review in 2024, ITAC concluded that lifting these protections would almost certainly see dumping return, with serious consequences for local producers.

US poultry companies dispute this, arguing that the 72 000-tonne quota is not dumping but rather a way to meet consumer demand in South Africa. Critics, however, say the quota effectively licenses dumping, since it allows imports at prices below fair market value without penalties. With trade negotiations ongoing, this issue is set to become a test of how South Africa balances protecting local industries with securing favourable terms in its wider trade relationship with the United States.. Source: Adapted from FreightNews

WEEKLY NEWS SNAPSHOT

- Ford may cut about 9% of jobs at two South African plants: Ford plans to cut more than 470 jobs at two plants in South Africa, just as imports of cars from India and China jump.

- Private operators gain access to freight rail network: South Africa will allow 11 private Train Operating Companies to use Transnet’s freight rail network across 41 routes. They’ll move bulk goods, including coal and chrome, adding up to 20 million tonnes annually from 2026/27 to help reach the 250 million‑ton target by 2029.

- Grindrod among first private rail operators: Grindrod confirmed it’s one of the companies granted third-party access. These roles mark a pivotal shift in the rail sector from monopoly to shared participation paving the way for logistics innovation.

- TNPA and NERSA ink 10-year energy MoU: The Transnet National Ports Authority signed a 10-year agreement with NERSA to coordinate licensing and operations for energy infrastructure (petroleum, LNG, electricity) at ports—boosting energy readiness at terminals.

- Trans‑Kalahari Railway gains momentum: Botswana and Namibia reaffirmed their commitment to advancing the Trans‑Kalahari Railway—a 1,500 km corridor aimed at offering an alternative to congested South African routes. It could lower costs for landlocked neighbours.

- New Mahindra assembly plant opens in Durban: Mahindra launched a new vehicle assembly plant within the Dube TradePort SEZ. This will support local jobs, promote exports, and reinforce logistics activity in the Durban corridor.

- US imposes sweeping 30 % tariffs on SA exports: Starting 7 August, the US applied a 30 % tariff across South African goods. The government is negotiating relief while supporting exporters facing headwinds across agriculture and manufacturing.

- Stats SA briefing on transport & storage sector survey: Statistics South Africa scheduled a virtual briefing on 27 August for the 2023 Transport and Storage Industry Survey. The survey provides insights on income, employment, services, and expenditure in the transport sector. Source: Various

Key Highlights from Last Week’s Discussions – 24th August 2025

Source: BUSA, SAAFF, and global logistics data

1. Rail reform: new operators confirmed

- The government approved 11 new Train Operating Companies across 41 routes.

- The move could add 20 million tonnes annually from 2026/27, a critical step towards the target of 250 million tonnes by 2029.

- This marks the most significant progress yet in South Africa’s rail liberalisation drive.

2. Port operations: volumes slip under pressure

- National port volumes averaged 13,888 TEUs/day, slightly lower than last week.

- Durban Pier 2 (+2%) and Cape Town (+7%) showed resilience, but Ngqura (-23%) and Port Elizabeth (-60%) declined sharply.

- The coming week is projected to fall further, to around 12,105 TEUs/day.

- Rail cargo out of Durban fell 47% w/w to just 2,954 containers, reflecting cable theft and diesel hauling constraints.

3. Air cargo: steady demand but policy bottlenecks

- OR Tambo handled ~7,1m kg of international cargo last week, with outbound flows rising 15% w/w.

- Volumes remain about 17% above last year and 19% above pre-COVID levels.

- Persistent delays in issuing Foreign Operating Permits continue to hold back the sector, though escalation to the Presidency suggests movement.

4. Regional road freight: border delays increase

- Lebombo border truck flows remained stable at 1 527 per day. Queue times halved to 3,4 hours, but overall SA border crossing times rose to 10,7 hours (+16%).

- SADC borders averaged 5,8 hours (+23%).

- Pressure points include Zimbabwe licensing issues, N3 protest blockages, and discussions on a Beitbridge toll plaza.

5. Global trade and shipping

- The world’s top 30 ports grew 7% y/y in H1 2025, led by Shanghai (27m TEUs), Singapore (21,7m) and Ningbo-Zhoushan (21m).

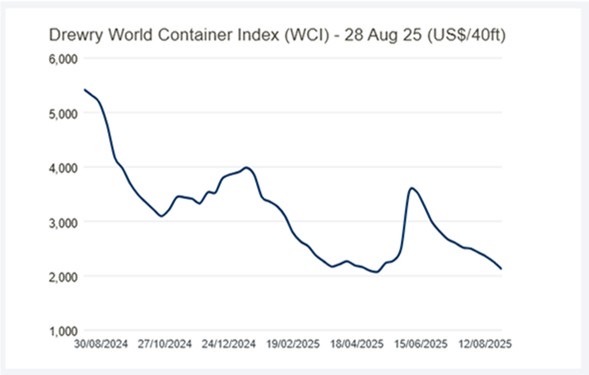

- Drewry’s World Container Index dropped again, now at $2 250/FEU, down 58% y/y.

- In contrast, the Harpex charter index is up 12% y/y, underlining ongoing vessel demand despite weaker spot markets.

- Other global developments: South Korea is accelerating Arctic shipping plans, and the Panama Canal will auction rights to two new ports.

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

DURBAN

Terminal operations at DCT have seen some delays with Tower 203, resulting in slow bookings. As a result of high demand for Reefer, SA has seen larger volume vessels on rotation. Vessel split discharges/loadings at different terminals are being experienced; therefore, it is recommended close attention be paid to terminal changes and earlier berthing times. Berth 200 at DCT has seen some delays due to crane breakdowns; it has been advised that 2 new cranes are expected to be operational in November and 2 in March 2026. Terminal operations are performing as normal, with no extraordinary delays or challenges.

- Pier 1 – 0 days waiting time

- Pier 2 (DCT) – 2 days waiting time

- Point 1 – 2 days waiting time

CAPE TOWN

Vessel berth delays may vary as per the service. Port operations have been relatively smooth over the period under review

- CTCT: 0 day waiting time – carrier service dependent.

PORT ELIZABETH

- PECT: 0 – 1 day waiting time.

- NCT: 0 – 1 day waiting time Source: SACO

Global Freight Rates

Weekly Container Rate Update – 28th August 2025

Market Update: Container Rates Continue to Fall: Drewry’s World Container Index dropped another 6% this week to $2,119 per 40ft container, marking the 11th consecutive weekly decline. Rates have been on a downward trend since mid-July, following the sharp surge earlier this year when U.S. tariffs were first announced. Transpacific trade saw further weakness. Rates from Shanghai to Los Angeles fell 3% to $2,332 per feu, while Shanghai to New York dropped 5% to $3,291 per feu. The early peak season, driven by front-loaded U.S. retailer orders, has ended. With the U.S. economy slowing and tariff costs mounting, procurement is easing, and spot rates are expected to fall further in the coming weeks.

Asia–Europe trade also softened. Shanghai to Rotterdam slid 10% to $2,661 per feu, and Shanghai to Genoa declined 5% to $2,842 per feu. Despite strong demand and some congestion in Europe, surplus vessel capacity is weighing on rates. Drewry expects this downward pressure to continue. Looking ahead, Drewry’s Container Forecaster warns that the supply-demand balance will weaken again in the second half of 2025. The extent of rate volatility will hinge on future U.S. tariff policies and potential restrictions on Chinese shipping capacity, both of which remain uncertain. Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”