Welcome to another Logistics News Update.

It’s Tuesday but it feels a bit like a Friday 😊, with Heritage Day breaking up the week.

South Africa is a country built on diverse cultures, ideas and traditions, and this holiday is a reminder of why that matters. Heritage is not only about where we come from, it’s also about the values and connections that guide where we’re going. So, while you take the time to celebrate with family, friends, or colleagues, let’s also recognise the strength of what we’ve built together, a country and an economy shaped by resilience, creativity, and community – HAPPY HERITAGE DAY!

A reminder that Golden Week is coming up from 1 to 7 October 2025 in China. Make sure you place your shipping orders in advance. Looking outward, global freight markets remain under pressure. Container rates on key trade lanes have dropped for a 14th straight week, with Transpacific and Asia–Europe lanes both sliding sharply. At home, Transnet has moved to strengthen port capacity with a major Liebherr crane deal and the introduction of new gantries in Cape Town. These investments are already showing results, with higher throughput and more stable operations, even as weather and infrastructure constraints continue to weigh on Durban and Eastern Cape terminals.

The picture is one of contrast: global shipping costs falling while South African ports push through much-needed upgrades. Together, these developments will shape the competitive position of exporters in the months ahead.

What is the news?

Strong reaction expected from ocean carriers as rates tumble: Shanghai Containerised Freight Index (SCFI) spot rates collapsed on Pacific trade routes with a sharp decline of 31% to the US West Coast and 23% to the East Coast.- TPT strikes equipment deal with Swiss OEM: Transnet has signed a 10-year agreement for Liebherr to supply and service a range of cranes across key South African ports.

- Creecy orders renewal of Island View leases: The Central Energy Fund (CEF) has been granted access to Durban’s Island View terminal in a move aimed at boosting broad-based black economic empowerment (B-BBEE).

- Transnet and police arrest 17 theft suspects: The alleged criminals were arrested over two days and charged under multiple laws for theft and tampering with rail and port infrastructure.

- Cape Town’s new ‘red ladies’ transform container handling at port: The new RTG cranes are part of Transnet’s R3.4 billion capital investment plan to modernise container handling.

- Peninsula launches bunkering services in South Africa: The global supplier has expanded into South Africa, providing bunkering solutions that strengthen the region’s marine fuel supply chain.

Let’s Learn: Why Clearing Instructions Matter

A clearing instruction is the written authority your clearing agent needs before they can submit a customs declaration on your behalf. Without it, your cargo cannot legally be cleared, and delays or penalties are almost certain.

Why it’s important:

- Legal Requirement: SARS will not accept a clearance without the importer/exporter’s written authority.

- Accuracy: The instruction ensures the agent uses the correct details (values, HS codes, permits). Any mismatch can cause queries or penalties.

- Accountability: It confirms who is responsible for the shipment and under what terms.

- Speed: If instructions are delayed, the container sits at port and charges for storage or demurrage can quickly escalate.

- Audit Trail: Clearing instructions form part of the official records SARS can request in an audit.

Key Point: Completing a clearing instruction is not red tape; it’s the step that keeps your cargo compliant, accountable, and moving on time.

NEWS

Cape Town’s new ‘red ladies’ transform container handling at port

Source: FreightNews.co.za Liesel Venter

Trade Talks Signal a Turning Point for South Africa’s Cargo Industry

Cape Town’s container handling has been given a major boost with the arrival of nine new rubber-tyred gantries at the Cape Town Container Terminal. Known as the “red ladies,” the cranes are the first phase of a planned fleet of 28. They are part of a R3.4 billion investment plan that also includes forklifts, hauliers and trailers to modernise the terminal.

Transnet leadership has said the investment is designed to improve efficiency and strengthen economic recovery. The impact is already visible, with refrigerated container volumes up by 32% year on year and overall export volumes increasing by about 24% at the terminal as of August. The new cranes are built with advanced technology that allows safer operations in stronger winds. They also have anti-sway systems that make cargo movements more precise. To maximise the use of the new equipment, a fourth shift has been introduced at the terminal, which means operations can continue around the clock.

This upgrade is viewed as the first step in a longer journey. Further improvements are expected through infrastructure expansion, stronger private sector partnerships and new policy support. The combined effort is aimed at creating a more competitive port that supports higher export volumes, greater job creation and long-term growth for Cape Town and the province. Source: Adapted from FreightNews.co.za

– Source: Adapted from FreightNews.co.za

WEEKLY NEWS SNAPSHOT

- Transnet & Liebherr ink major port-equipment deal : Transnet Port Terminals has signed a 10-year partnership with Liebherr to supply new cranes and associated services. The deal includes 48 rubber-tyred gantry cranes (RTGs) for Durban and Cape Town, plus ship-to-shore cranes for Durban. There’s also a 20-year asset management programme to ensure maintenance, repairs, and spare parts are handled under a lifecycle support plan.

- Long-term leases granted at Island View in Durban fuel hub: Major oil companies like BP, Vitol, and Engen have been granted long leases (around 25 years) at Durban’s Island View Precinct. The move stabilises fuel import infrastructure and is expected to attract investment. Transport Minister Barbara Creecy invoked special powers to reach the decision.

- Logistics sector shows signs of turning the corner: Recent reports and the Cargo Movement Update indicate improved throughput in ports, rail freight, pipelines, and automotive exports. Key metrics like port and rail volumes have shown growth. However, Transnet still has major gaps to close around reliability, maintenance, and meeting targets.

- More RTGs to enter service at Cape Town Container Terminal: The Port of Cape Town is expanding its fleet of rubber-tyred gantry cranes. The enhancements are intended to reduce delays and increase handling capacity, especially for export traffic. Source: various

Key Highlights from Last Week’s Discussions – 14th September 2025

Source: BUSA, SAAFF, and global logistics data

1. Port Operations – Equipment Gains but Weather Disruptions

• Cape Town commissioned nine new RTGs, marking a significant capacity upgrade to support productivity.

• Container volumes fell to 93,982 TEUs (↓9% w/w), averaging 13,426 TEUs/day. Durban Pier 2 dropped ↓12%, Cape Town ↓19%, and Ngqura ↓19%, while Pier 1 rose ↑7%.

• Inclement weather, equipment breakdowns, and a Durban power failure weighed on performance, although Richards Bay saw minimal disruption.

• Rail cargo out of Durban improved to 3,097 containers (↑12% w/w), signalling recovery despite ongoing cable theft and diesel locomotive shortages

2. National Throughput – Solid August Benchmark

• TNPA August data showed container throughput ↓6% m/m but ↑7% y/y, with landed containers ↑17% y/y.

• Dry bulk rose ↑10% y/y, vehicles ↑6% y/y, and breakbulk ↑29% y/y, offsetting weaker liquid bulk (↓10% y/y).

• YTD containers are now ↑1,2% after strong July and August, compared with being ↓4,2% just two months ago — a clear turnaround

3. Air Cargo – Mixed Weekly, Strong Monthly Growth

• OR Tambo handled ~644 000 kg inbound (↓10% w/w) and ~431 000 kg outbound (↑10% w/w), totalling 7,52m kg (↓3% w/w).

• Despite the weekly dip, August volumes rose sharply: Johannesburg ↑10% y/y, Cape Town ↑28% y/y, Durban ↑12% y/y.

• ACSA issued a directive tightening ad hoc slot applications to curb misuse and maintain runway capacity

4. Regional & Cross-Border – Rising Delays, Higher Costs

• Lebombo flows held steady at 1,522 trucks/day, but queue times averaged 4,2 hours (↓10% w/w) and processing times also 4,2 hours (↓9%).

• Broader SA border median crossing times worsened to ~12,1 hrs (↑17%), while the wider SADC region averaged ~6,4 hrs (↑12%).

• Total cross-border delays cost the industry ~$12m (R210m) for the week, ↑14% from last week’s ~$10,5m (R184m)

5. Global Trade & Shipping – Rates Slide, Capacity Withdrawals

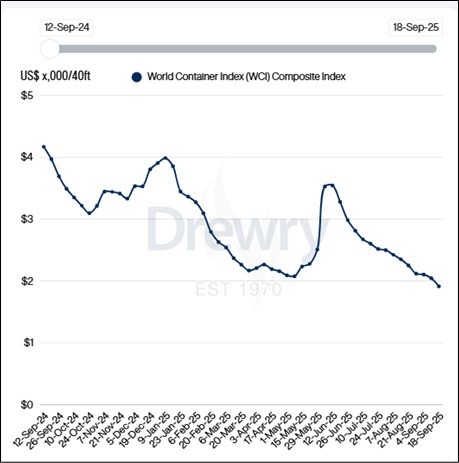

• Drewry’s WCI dropped ↓3% to $2 044/FEU, now ↓51% y/y, while charter rates (Harpex) stayed firm at ~2 215 points (↑12% y/y).

• Carriers, led by Maersk, are enforcing stricter weight declarations after safety incidents, with penalties for shippers.

• Lines announced blank sailings around China’s Golden Week to underpin rate increases, while COSCO faces $1,02bn in upcoming USTR-301 fees.

• Global air cargo markets remain volatile: India–US volumes plunged under new 50% tariffs, while Southeast Asia–US and China–Europe flows expanded

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

During the week of September 8th to September 12th, 2025, South African ports experienced moderate operational disruptions, with Durban facing significant challenges due to an ongoing rehabilitation on Bayhead Road, equipment issues, and continued adverse weather conditions. The Cape Town port also suffered operational hours lost to adverse weather, while the Eastern Cape ports contended with equipment challenges and power failures. Richards Bay reported minimal delays.

DURBAN

Crane replacement work affecting landside clearance. Some vessels being only partially handled and then delayed further. Equipment challenges at

- Pier 2.Pier 1 – 2.7 days waiting time

- Pier 2 (DCT) – 2.25 days waiting time

- Point 1 – 2 days waiting time

CAPE TOWN

Vessel berth delays may vary as per the service.

Moderate to strong winds causing operational stoppages at the terminal..

- CTCT: 3.00 days waiting time.

PORT ELIZABETH

Weather is the main disruptor this week in that region. Operations are slower, but no severe equipment failures have been reported

- PECT: 2 days waiting time.

- NCT: 0 days waiting time Source: SACO

Global Freight Rates

Weekly Container Rate Update – 11th September 2025

Container Rates Slide Again

Drewry’s World Container Index (WCI) fell 6% this week to $1,913 per 40ft container, marking the 14th consecutive weekly decline. Both Transpacific and Asia–Europe routes are now moving downwards, although at different speeds. On the Transpacific, Shanghai–Los Angeles rates dropped 4% to $2,561 per 40ft and Shanghai–New York fell 5% to $3,571 per 40ft. The temporary gains from GRIs and blank sailings have faded, pushing rates back to early-September levels.

Asia–Europe lanes saw steeper declines. Shanghai–Rotterdam fell 11% to $1,910/feu, while Shanghai–Genoa slid 9% to $2,131/feu. Extra vessel capacity entering the market, combined with weaker demand, is driving the pressure. With China’s Golden Week approaching on 1 October, carriers are adding blank sailings, yet rates are still trending downward. Looking ahead, Drewry expects the supply-demand balance to weaken in the second half of 2025. Further declines are likely, with volatility influenced by new US tariffs, capacity shifts, and possible penalties on Chinese shipping lines.. Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”