Good afternoon,

Welcome to another Logistics News Update.

I love it when they say it is a perfect storm. No storm is perfect and Saaff spells it out in the first story “South Africa’s Logistics Sector on a Precipice” draining the fiscus.

It seems that every bit of news is about the ports and Transnet, as much as some are positive, like the port is not increasing some of its rates, it’s mostly not so positive.

What does that mean for anyone importing or exporting? It means that planning is essential, and you need to make sure that you are on top of your game when it comes to booking your cargo, internationally as well as locally.

Big question – are the ports getting back to normal? A simple answer is that it is better than it was but nowhere near what it should be.

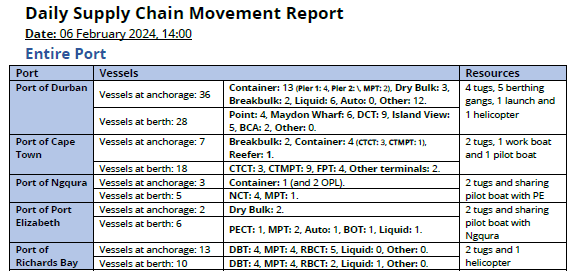

Have a look at the Saaff supply chain movement report below. This will give you a good indication of where we are at. However, having said that, getting the container out of the port is a challenge, bookings are far apart, and the backlog has not been cleared.

NEWS

South Africa’s logistics sector on a precipice – Saaff 01 Feb 2024 – by Staff reporter

‘Freight rail crisis may have peaked’Exporters hope the slump in deliveries has hit rock bottom and they are on the way up 2024

Juanita Maree, CEO of the South African Association of Freight Forwarders.

The South African Association of Freight Forwarders (Saaff) has described the domestic logistics crisis as a “perfect storm” strangling the private sector and trade, draining the fiscus and causing massive knock-on damage to the economy. This situation that the government now recognises as an ‘Achilles heel’ to the national economy is receiving corrective focus through public/private sector collaboration, which is showing progress, but this needs to intensify, Saaff CEO Juanita Maree has said. “The road is long and arduous. We are off to a late but reasonable start.” According to Saaff, imports and exports represented 56.22% of South Africa’s total GDP in 2023, down by 8,7% from 2022, in a boom year for mineral resources. “The drop obliterated robust trade growth posted in 2022 – a recovery year after the impacts of the Covid-19 catastrophe.” Maree said in the context of such losses, and taking into consideration the serious knock-on impact this has on business across all sectors, it is time for expanded targets in the reconstruction of the logistics network.” “South Africa’s freight demand is high, at nearly 500 billion tonne-kilometres. “We need a multi-modal approach to satisfy our freight demand. And, at the worst of times recently, the inefficiencies in rail cost us R1 billion a day while the inefficiencies at the ports amount to a loss of R200 million a day.” Maree said since Saaff’s call to the government for urgent reforms to confront the logistics crisis in February last year, developments had been “encouraging” and were “poised to pick up pace” in 2024.

Source: Freight News

Transnet freight locomotives.- Image: Freight news

Miners and other exporters hope Transnet’s recovery plan will quickly boost its freight rail capacity after coal volumes hit a 30-year low and companies put a ceiling on production due to logistics pains. At the Southern African Coal Conference in Cape Town under the shadow of the rail and ports crisis delegates called on Transnet to expedite its turnaround plan and appoint permanent leadership. Speaking on the sidelines of the conference, Richards Bay Coal Terminal (RBCT) CEO Alan Waller said the terminal has moved severely low volumes of goods as a result of the logistics constraints, but he hoped the crisis has already peaked. “I think it’s already a serious problem. We are 30%-35% down in volume. Even at current levels, you are starting to see an impact on the mining industry. We also can’t run mines when they can’t extract products and get them to the export market. “I would like to believe that we can’t go down any lower than we are. I believe that with the initiatives that are in place now with Transnet, we have hopefully reached the bottom and we should turn the corner now,” he said. Logistics problems have placed an outsize burden on the road network and other infrastructure and the economy cannot afford to have subdued rail capacity for much longer.“I can’t speak on behalf of the mines, but I think the bottom line is the road infrastructure is saturated. The only opportunity is for rail to go up. If rail doesn’t go up and it goes down further, it is an inevitable solution that there has to be curtailment of production. Even with the best endeavours of the mines, that comes with the consequence of downscaling,” he said.

Source: Sunday Time

Cape Town port needs “urgent reform” – 02 Feb 2024 – Staff Reporter

The City of Cape Town has urged President Cyril Ramaphosa to announce plans for urgent reform to improve cargo handling efficiency at the Port of Cape Town.

“The city and country’s economy is dependent on the port for the efficient importing and exporting of goods,” said Mayoral committee member for economic growth, James Vos, ahead of the President’s State of the Nation address next Thursday.

Research from the South African Association of Freight Forwarders indicated that South Africa’s economy was losing R98 million a day due to challenges at the country’s ports, Vos said.

“Clothing retailers and manufacturers are unable to bring in products and raw materials to meet customer needs. Retailers have gone so far as to send containers to Walvis Bay, Namibia, and transport goods via truck to ensure they have the necessary inputs to do business,” he said.

In recent months, fruit exporters have been especially hard hit with Hortgro, the fruit industry representative body, reporting that some fruit exports through the port were down by as much as 62% in November and December 2023 compared to the same time in 2022.

“South African consumers are further hurt because the prices of various foodstuffs, such as cooking oil and canned goods, electronics like smartphones and laptops, as well as medications, are negatively impacted by the delays in the port. These delays knock local retailers who inevitably pass on the increase in cost to their customers,” Vos said.

“I am once again urging the National Government to give a clear and decisive deadline as to when private sector partners can be brought in at our port, and importantly, they must detail what measures will be put in place to avoid misuse or maladministration,” he said.

Port Regulator halts tariff hikes amid economic strain

In a significant decision aimed at easing financial burdens on customers in the face of challenging economic circumstances, the Ports Regulator of South Africa (PRSA) has rejected Transnet National Ports Authority’s (TNPA) proposed 4.98% tariff hike, opting instead for a 0.00% increase for the 2024/25 financial year.

Johanna Mulaudzi, PRSA CEO, said the decision was made after much internal deliberation and consultation with the industry at large, considering the economic conditions locally and internationally.

“We have considered the diminished income of port users and their ability to trade through our ports with the focus on delivering sustainability, affordability and accessibility in the port sector.

“The Regulator has therefore concluded that an appropriate increase in the overall affected weighted average tariff for the financial year 2024/2025 is determined to be 0.00%.”

According to Mulaudzi, the TNPA tariff increase application of 4.98% included an amount of R1 267 million retained in the Excessive Tariff Increase Margin Credit (ETIMC).

“The Regulator deems it necessary to remind the ports sector that the purpose of the ETIMC is not to subsidise inefficiencies or profits for the TNPA.”

Mulaudzi acknowledged that the ports’ operational efficiencies were declining, which was a concern for the regulator and port users.

PORTS

Summary of port operations

The following sections provide a more detailed picture of the operational performance of our commercial ports over the last seven days.

Weather and other delays

- The Port of Cape Town went windbound for more than 22 hours towards the end of the week.

- Equipment breakdowns and network challenges proved to be the main operational constraints in Durban.

- Fog and strong winds disrupted operations at our Eastern Cape ports this week.

- Some minor weather-related delays were reported from the Port of Richards Bay.

Cape Town

On Wednesday, CTCT recorded three vessels at berth and four at anchor, as vessel ranging disrupted operations for approximately two hours. In the preceding 24 hours, stack occupancy for GP containers was recorded at 31%, reefers at 66%, and empties at 46%. In this period, the terminal moved 1 368 containers across the quay, while operating with eight STS cranes and 25 RTGs. Towards the end of the week, the terminal operated with seven STS cranes, as LC6 and LC9 were out of service. On the landside, despite being windbound for more than 22 hours in mid-week, 323 trucks were serviced, while 40 rail units were handled. Because of the delays, all export reefer stacks were placed on hold as Transnet urgently called on the industry to switch to reefer evacuation to create additional capacity. Lastly, the shore tensioner units have finally been cleared through customs and loaded out from the container. The commissioning date should be confirmed next week.

Durban

Pier 1 on Thursday recorded two vessels at berth, operated by five gangs, and zero vessels at anchor. Stack occupancy was 62% for GP containers and remained undisclosed for reefers. During the same period, the terminal recorded 1 097 gate moves on the landside, with an undisclosed number of cancelled slots and 125 wasted. The truck turnaround time was recorded at ~98 minutes, with an average staging time of ~59 minutes. At the beginning of this week, the terminal had 1 689 imports on hand, with 234 having road stops and 157 being unassigned. High traffic volumes at the terminal continued this week as appointments were held back on several occasions on Wednesday. In contrast, appointments at blocks B2 and C1 were ramped up on Friday due to free storage ending.

Pier 2 had four vessels at berth and six at anchorage on Friday. In the preceding 24 hours, stack occupancy was 54% for GP containers and undisclosed for reefers. The terminal operated with 11 gangs while moving 2 817 TEUs across the quay. During the same period, there were 1 860 gate moves on the landside with a truck turnaround time of ~139 minutes and a staging time of ~140 minutes. Additionally, 257 rail import containers were on hand, with 326 moved by rail. The situation regarding the straddle carriers improved somewhat during this period, as the terminal had about 61 straddles in operation. This brings the straddle carrier availability figure in the terminal to about 64%. That is currently approximately ↓20% below the number of machines that would be the minimum to satisfy industry demand; however, these are at least positive developments.

Earlier this week, TPT announced that the import-free storage days at DCT Pier 2 will be extended to 4,25 days from 1 February until 31 March 2023 for vessels with a discharge volume greater than 2,000 containers. The announcement further stated that this interim dispensation excludes IMDGs, which remain unchanged as published in the TPT Tariff book. Export stack date rules remain the same, and the terminal will continue to engage with shipping lines on a case-by-case basis for impacted vessels.

Richards Bay

On Friday, Richards Bay recorded ten vessels at anchor, while 13 vessels were recorded on the berth, consisting of four at DBT, six at MPT, three at RBCT, and none at the liquid bulk terminal. Two tugs and one helicopter were in operation for marine resources, while the pilot boat remained out of service. During the same period, the coal terminal had three vessels at anchor and three at berth while handling 218 207 tons on the waterside. On the landside, six trains were serviced. Furthermore, traffic authorities are issuing heavy fines to tipper trucks, causing congestion en route to the port, while Reload Logistics acquired a 50 000 square meter bulk sulphur terminal at the port.

Eastern Cape ports

On Thursday, NCT recorded two vessels on the berth and one vessel at the outer anchorage, with three vessels drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading up to Friday. The port’s original pilot boat remains out of service; however, an outsourced pilot boat is being used in the interim to service waterside activities. Stack occupancy was 33% for GP containers and 66% for reefer ground slots, as a total of 2 323 TEUs were processed on the waterside. Additionally, 433 trucks were serviced on the landside at a truck turnaround time of ~44 minutes. No trains were serviced on the landside.

GCT on Friday recorded zero vessels at the outer anchorage with one vessel on the berth. Available waterside resources were two tugs, a pilot boat, two pilots, and one berthing gang in the preceding 24 hours. Stack occupancy was recorded at 80% for GP containers, 100% for reefers, and 69% for reefer ground slots. The next vessel to arrive is anticipated to bring some relief to the congested reefer stack. On the waterside, 538 TEUs were handled across the quay. Additionally, 199 trucks were serviced on the landside at a truck turnaround time of ~15 minutes. Strong winds and dense fog challenged the terminal throughout the week.

International Freight Rates (Shipping)

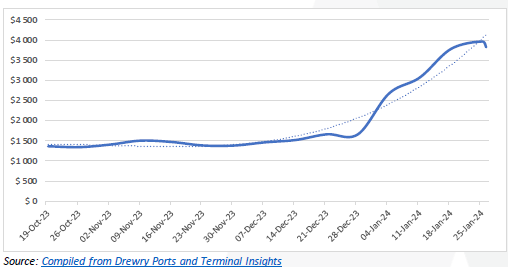

The figure is curious for two main reasons, notably that (1) disruptions in any of the major trade lanes influence the entire market, and (2) the typically delayed onset of disruptions (approximately 60 days – or the typical service length from East to West calling at ten significant ports). All-in-all, the composite index remains up by ↑88% higher compared to the same week last year and ↑169% higher than the average 2019 pre-pandemic rates of $1 420. Drewry expects rates to continue plateauing as China’s factories gear down in February. Charter rates continue to rapidly catch up, as the Harper Petersen Index (Harpex) is currently trending at 1 061 points, up by ↑5,7% (w/w) and even surpassing 2023 levels (↓6,2%)21.

Summary

In concluding this week’s report, the increased port throughput is encouraging, although still falling slightly short of our best-case projections. Hopefully, with the continued efforts of the recovery plan, the backlog will be cleared at all ports by the end of February as the continued efforts to turn the massive ship around slowly begin to bear some fruit. Despite many positive developments in recent weeks (including the work of the NLCC, the Freight Logistics Roadmap approved by Cabinet, and the ongoing Transnet recovery plan (see the overview provided by Prof Havenga6), other developments such as allegations around corruption and mismanagement involving yet another senior Transnet executive7 curtails optimism. Collaborative efforts between South Africa’s public and private sectors are making strides in addressing the logistics crisis, but they must be intensified8. Although progress has been made, the journey ahead is challenging and time-consuming, and the problems will not disappear overnight. South Africa possesses the capability to rectify logistical problems and blockages, enhance its infrastructure, and leverage this situation to reinforce its leadership role regionally, continentally, and globally in supply chain management. The demand for efficient alternative routes and trade partners due to geopolitical and climate-induced congestion underscores the urgency for proactive measures in the development of partnerships between the public and private sectors.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

Enjoy the rest of your week.