This is not a scare tactic to say beware. The transport industry has been screaming from the rooftops to get better policing on the N3, and now it’s the everyday person travelling by car to and from KZN. This is a warning. Please do not travel at night between Heidelberg and Villiers.

In the headlines below, you may think we have repeated three stories, but we haven’t, what we have done is shown three views on the same problem.

Cape Town port is in crisis.

NEWS

Transnet’s turnaround plan needs R122bn

That’s just for the next five years – and it also needs more rolling stock and security teams to tackle vandalism and theft.

Transnet needs R122 billion over the next five years to turn around its waning fortunes, according to a Freight Logistics Roadmap issued in October by the Department of Transport. Of this, 19% will need to be spent on expansion and the rest on sustaining existing operations.

This is no trifling matter. Transnet’s dismal performance will likely cost the country 5% in lost GDP in 2023, translating to about R1 billion a day. Transnet is an “uncompetitively positioned, ineffectively equipped, operationally inefficient railway that has lost its ability to both dominate local logistics and mobility markets and to support global exports” according to the National Rail Policy White Paper. . Source: The Money Web

‘Port chaos puts fruit exports at risk’

Major overseas markets look elsewhere as delays hit the quality of produce

Transnet’s turnaround plan needs R122bn

The dysfunctional state of Cape Town’s port is trashing South Africa’s hard-won reputation as a reliable supplier of high-quality fruit and endangering its lucrative overseas markets, says Fhumulani Ratshitanga, CEO of Fruit South Africa, which represents the country’s fresh fruit producers and exporters.

“We were in the UK and Germany in late September and in all the meetings we had with different retailers logistics came up as the major issue of concern to the markets. Every single person we spoke to raised this as their most serious concern.

Source: The Sunday Times

he Western Cape is heading for an export crisis at the end of the year.

Warns Western Cape Finance and Economic Opportunities Minister Mireille Wenger.

“With the good rains we have experienced, our agricultural goods for export are anticipated to increase by 25%. “This is a wonderful opportunity…to bring in more revenue.”

In direct contrast to this opportunity, however, there has been a “significant deterioration” at the Port of Cape Town, particularly when it comes to critical equipment, such as rubber-tyred gantries, warns Wenger. “South Africa cannot wait any longer. It is high time that the private sector is brought in to boost the efficiency of the Port of Cape Town so we can work together to achieve the kind of breakout economic growth we need to create thousands of new jobs in the province, and in South Africa.” Source: Engineering News

Carrier (shipping Lines) profits plummet as market normalise

What goes up must come down – and that’s the reality facing the shipping industry which is seeing profits plummet as the market begins to normalise.

French shipping major CMA CGM is the latest carrier to announce underwhelming third quarter results – reporting revenue of $11.4 billion, with a gradual rebalancing of contributions from the Group’s maritime shipping and logistics businesses.

Ebitda was recorded at $2.0bn, 78.2% lower than the third quarter of 2022. The Ebitda margin came in at 17.5%, down 28.5 points, while the Group’s net income amounted to $388 million. The debt net of financial resources totalled $1bn at September 30.

That’s just for the next five years – and it also needs more rolling stock and security teams to tackle vandalism and theft.

Transnet needs R122 billion over the next five years to turn around its waning fortunes, according to a Freight Logistics Roadmap issued in October by the Department of Transport. Of this, 19% will need to be spent on expansion and the rest on sustaining existing operations.

This is no trifling matter. Transnet’s dismal performance will likely cost the country 5% in lost GDP in 2023, translating to about R1 billion a day. Transnet is an “uncompetitively positioned, ineffectively equipped, operationally inefficient railway that has lost its ability to both dominate local logistics and mobility markets and to support global exports” according to the National Rail Policy White Paper. . Source: The Money Web

Fruit industry collaborates with Port of Cape Town ahead of busy season

Fruit industry exporters and Transnet are engaging at a strategic and operational level to improve efficiencies, specifically at the Port of Cape Town (PoCT), as the deciduous fruit export season ramps up.

Transnet announced in a joint statement with industry bodies, including Hortgro, the Fresh Produce Exporters’ Forum and the South African Table Grape Industry, that it was holding weekly meetings to exchange information on expected fruit flows and the status of port operations, specifically during the peak of the stone fruit, table grape and early pear seasons.

“While the deciduous fruit industry is concerned about the physical flow of product through the PoCT in the coming season, at the most recent engagement Transnet management committed to better planning, sourcing additional equipment, on-site maintenance capacity and increasing availability of spares,” Transnet said.

Source: FTW

Repairs in Richards Bay expected to improve rail loads – Transnet

10 Nov 2023 – by Eugene Goddard

Transnet Port Terminals (TPT) has confirmed that a damaged conveyor belt used for moving bulk freight at the Port of Richards Bay should be back in operation by December, raising hopes of faster throughput at one of the world’s busiest coal export terminals.

TPT said: “The managing executive of Richards Bay Terminals, Thulasizwe Dlamini, has recently conducted an inspection to ascertain the progress being made at a workshop of the service provider where the infrastructure of the belt is being assembled.”

Source: FTW

Port congestion leads to surcharge

Congestion at South African ports is having a severe impact on the shipping industry with two major companies now taking action in a bid to recover losses.

Shipping company Mediterranean Shipping Company (MSC) recently announced that it was imposing a congestion surcharge for cargo from any destination, except east and west Africa, to all South African ports.

MSC said the congestion in South African ports was generating difficult conditions to operate and therefore the surcharge was to be applied from December.

“As from December 3, 2023 (bill of lading date) onwards, the CGS (congestion surcharge) will be charged (at) $210/TEU (about R3 900) for dry cargoes only.”

Key Notes

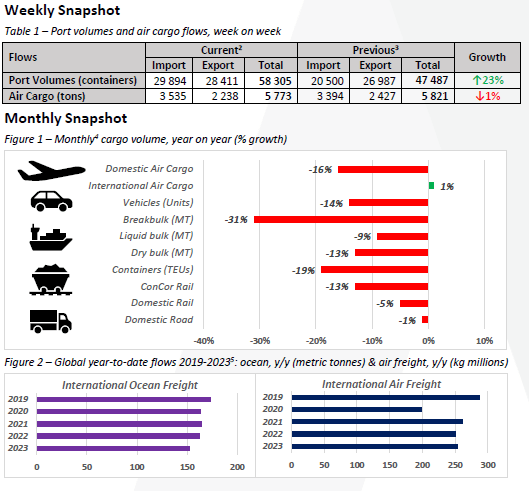

• An average of ~8 329 containers was handled per day, with ~8 120 containers projected for next week.

• Rail cargo handled out of Durban amounted to 2 636 containers for the week, ↑13% (w/w).

• Cross-border queue times were unchanged (w/w), with transit times ↑2,0 hours (w/w); SA borders

decreased by ~3,7 hours, averaging ~9,7 hours (↓28%); Other SADC borders averaged ~5,8 hours (↓28%).

• CTS container volume in September (dry & reefer) is down by ↓0,9% (m/m) but up by ↑12,8% (y/y).

• Global freight rates are up by another substantial ↑7% (or $98) to $1 504 per 40-ft container this week.

• Global air cargo is up by ↑1,9% (y/y) but and remained down versus the pre-pandemic era (↓1,3%).

SUMMARY

Commercial ports handled an average of 8 329 containers per day, significantly up from the 6 710 reported last week. Port operations in the last week were characterised by improved throughput levels, but productivity concerns still remain and are exacerbated by the ongoing congestion, poor weather conditions, and equipment breakdowns and shortages. Vessel ranging and strong winds were the primary sources of operational delays in Cape Town. Durban’s port congestion remains a concern, with more than 70 000 TEUs at berth, potentially causing significant delays in containerised cargo processing. CMA CGM has followed the Maersk and MSC by becoming the next shipping line to implement a “Port Congestion Surcharge” on all dry and reefer cargo shipments en route to South Africa. Several incidents of equipment challenges further persisted at Pier 2 as the terminal had 53 straddle carriers in operation towards the end of the week. Fortunately, on the rail front, the last seven days were positive, as minimal delays and incidents of cable theft and vandalism were reported on our rail network.

Container throughput for September decreased at a more negative rate than expected. Despite this monthly reduction, annual throughput increased by a substantial ↑12,8% compared to September 2022. The global fleet of cellular vessels aged 20 years or more, comprising about 1 200 ships with a total capacity of around 2,9 million TEUs, presents an opportunity for scrapping to address industry overcapacity. In September 2023, global schedule reliability increased by ↑1,2% to 64,4%, with Maersk and Hamburg Süd leading in reliability among the top 14 carriers. In the bulk industry, El Niño events are anticipated to impact crop yields on at least a quarter of global croplands, leading to significant changes in seaborne gas and oil trading patterns. The droughts are already affecting the Panama Canal crossings, as the queue has increased by ↑13% from Thursday to Friday. Other developments affecting the international market include (1) HHLA directors recommending MSC’s offer to shareholders and (2) ONE consolidating its port terminal network.

In the air freight market, international air cargo to and from South Africa continues to perform well, with volumes up to levels similar to those registered last year. Inbound cargo this week was up by ↑4%; however, outbound has dropped this week and is down by ↓8%. Internationally, IATA shows that global air cargo tonne-kilometres were slightly up in September, as air cargo capacity surged by ↑12,1% (y/y), driven by robust international belly cargo capacity in the Asia Pacific, Latin America, and the Middle East. Despite the decreased trade trend (↓3,8% in August), airlines in the Asia Pacific, Latin America, Middle East, and North America regions reported annual growth in international cargo. However, African figures showed a slight reduction in CTKs (↓0,1%) and a more modest increase in capacity (↑2,7%).

In summary, the numbers reported recently continue to trend below long-term averages, with very few green shoots evident. The struggles are akin to the current global reality of weak demand in the merchandise trade space; however, South Africa’s shortfall is more pronounced compared to other countries. Furthermore, Transnet’s operational shortcomings have been well-documented weekly, as the extended logistics network has not come anywhere close to its demonstrated capacity. Furthermore, Transnet’s financial crisis has been well-document in the public space, with the Public Investment Corporation (PIC) announcing it has rolled over R4,4 billion of its exposure to the Transnet (TN23) bond that matured on 6 November 2023 into a new short-term commercial paper, maturing in March 2024, and received the balance of more than R250 million6. Therefore, the PIC gave Transnet only four months’ grace as the repayment falls due again on 8 March, indicating that it is wary of bailing out failing state-owned enterprises. On that basis, the focus must be on improving the operational performance of the SOE, which is urgently needed.

PORT NEWS

‘Weather and other delays

Vessel ranging and strong winds were the core sources of operational delays in Cape Town. A minimum of ten vessels deviated from their schedules in Durban. Minimal operational delays were reported in Richards Bay this week.

Cape Town

On Thursday, CTCT recorded three vessels at berth and three at anchor, as productivity at the port still leaves a lot to be desired. In the preceding 24 hours, stack occupancy for GP containers was recorded at 50%, reefers at 24%, and empties at 62%. In this period, despite being windbound for seven hours and the APL Houston ranging for three hours, the terminal handled 1 238 TEUs across the quay while 893 trucks were serviced on the landside. Additionally, equipment challenges at the terminal continued this week as Cranes LC1 and LC4 remained out of commission, with LC3 and LC9 giving the technical team some problems. Dredging at berths 601 and 604 was completed at the start of the week, with dredging on berths 602 and 603 to commence soon. The terminal operated with between 15 and 17 RTGs throughout the week as it eagerly awaits the “like new” seven much-required additional RTGs from LA around early December. The multi-purpose terminal recorded zero vessels at anchor and two at berth on Wednesday. In the 24 hours leading to Thursday, the terminal managed to service 234 external trucks at an undisclosed truck turnaround time on the landside. During the same period, 502 TEUs and 9 450 tons of general cargo were handled across the quay on the waterside. Stack occupancy was recorded at 32% for GP containers, 25% for reefers, and 44% for empties during the same period.

Durban

Pier 1 on Wednesday recorded two vessels at berth, operated by four gangs, and four vessels at anchor. Stack occupancy was 48% for GP containers and remained undisclosed for reefers. During the same period, 800 imports were on hand, with 59 units having road stops and 33 unassigned. The terminal recorded 1 757 gate moves on the landside, with an undisclosed number of cancelled slots and 156 wasted. The truck turnaround time was recorded at ~98 minutes, with an average staging time of ~92 minutes. During the same period, the terminal had 14 RTGs in operation, and an additional two machines returned to service.

Pier 2 had four vessels at berth and 15 at anchorage on Thursday. In the prior 24 hours, stack occupancy was 43% for GP containers and undisclosed for reefers. The terminal operated with ten gangs while moving 3 323 TEUs across the quay. During the same period, there were 1 710 gate moves on the landside with a truck turnaround time of ~79 minutes and a staging time of ~54 minutes. Of the landside gate moves, 1 350 (79%) were for imports and 410 (21%) for exports. Additionally, 1 014 rail import containers were on hand, with 300 moved by rail. The terminal experienced a much improved week on the weather front as minimal delays were reported due to weather conditions. However, equipment challenges persisted, as the terminal had 53 straddle carriers in operation towards the end of the week. The terminal currently sits on an availability figure of approximately 46% when it comes to their straddles and is currently approximately 34% below the number of machines that would satisfy industry demand. Additionally, cranes 520 and 521 at South Quay are out of commission with an unknown estimated time of return. Crane 520 is out of commission for trolley repairs, while crane 521 is out of service due to updates needed on its drives.

Durban’s MPT terminal recorded three vessels at berth on Wednesday and four at outer anchorage while handling 322 TEUs and 1 280 breakbulk tons on the waterside. Stack occupancy for breakbulk was recorded at 85% during that time and at 54% for containers. The terminal handled 326 container road slots and 160 breakbulk RMTs containing 4 310 tons on the landside. During the same period, two cranes, eight reach stackers, one empty handler, seven forklifts and 19 ERFs were in operation. According to the latest reports, the recommissioning date of the third crane has been postponed yet again to early next week. This has become an all too familiar trend where the cranes remain out of service way longer than anticipated due to procurement and repair inefficiencies by the technical team.

Richards Bay

On Tuesday, Richards Bay recorded 17 vessels at anchor and 12 vessels on the berth, translating to five at DBT, four at MPT, one at RBCT, and two at the liquid bulk terminal. Two tugs and one helicopter were in operation for marine resources in the 24 hours leading to Wednesday while the pilot boat remained out of commission. During the same period, the coal terminal had no vessels at anchor and one at berth while handling 118 446 tons on the waterside and 17 trains on the landside.

Eastern Cape ports

NCT on Tuesday recorded three vessels on the berth and seven vessels at the outer anchorage. Marine resources of two tugs, a pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading up to Wednesday. In the same period, stack occupancy was undisclosed for both GP containers and reefers, as a total of 2 646 TEUs were processed. Additionally, 422 trucks were serviced on the landside at a truck turnaround time of ~44 minutes.

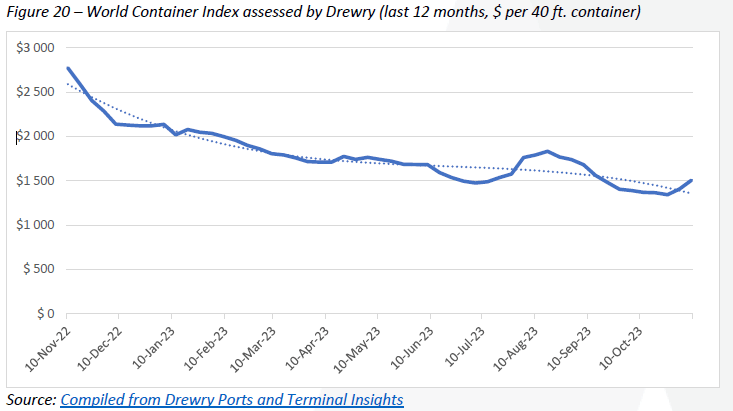

Global container freight rates

This week, the “World Container Index” increased again and is up by another substantial ↑7% (or $98) to $1 504 per 40-ft container

The composite index is now ↓54% lower compared to the same period last year but ↑6% higher than the average 2019 rates, pre-pandemic. The year-to-date average composite index is $1 700 per 40ft container, $976 below the 10-year average rate of $2 676. This figure keeps on dropping week-by-week; however, it is still influenced by the exceptional pandemic period in 2020-22. Shanghai to Rotterdam rates rose most substantially – by ↑21%, while rates on other lanes showed mixed trends. Drewry expects East-West spot rates on non-Asia-to-Europe lanes to remain stable in the coming weeks. The weak spot market has also further dragged down contractual rates in the wake of the start of the Asia-Europe contract negotiating season.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape. Enjoy the rest of your week.