Welcome to another Logistics News Update.

Reform seems to be moving in the right direction. Transnet says the wheels are rolling more smoothly; their biggest challenge is still security. We are seeing an improvement in the flow at the port, but the transporters’ booking system remains a challenge, which is hindering the transporters. Transporters are urging the relevant parties to resolve this issue. While neighbouring corridors are taking advantage, as Maputo and Beira attract cargo that used to move through Durban and Richards Bay. We will continue to guide you on the best routes for reliability and cost.

Citrus growers are under pressure. Egypt’s longer harvest has oversupplied key markets in the Middle East and Asia. Prices have dropped to unsustainable levels, and smaller producers feel the impact the most. There are bright spots. The rand has firmed to a nine-month high, and some input costs are easing. That gives importers and exporters a little more breathing room while we navigate tariff risk.

Let’s Learn: Common Logistics Acronyms – Sea and Air Freight

Shipping documents, schedules, and updates often use short acronyms that can be confusing at first glance. Learning a few of the most common terms helps avoid costly delays and makes communication with carriers and agents much easier.

Sea Freight Acronyms:

- BOL (Bill of Lading): A key contract between shipper and carrier, proving receipt of cargo and its destination.

- TEU (Twenty-foot Equivalent Unit): The standard measure for container capacity.

- LCL (Less than Container Load): Cargo from multiple shippers consolidated in one container.

- FCL (Full Container Load): One shipper’s goods occupy the entire container.

- DEM (Demurrage): Fees charged when a container stays too long in port after free time expires.

Air Freight Acronyms:

- AWB (Air Waybill): Proof of contract for goods shipped by air, issued by the airline.

- ULD (Unit Load Device): A container or pallet used to load freight on aircraft.

- ETA (Estimated Time of Arrival): The planned arrival time of the flight.

- ETD (Estimated Time of Departure): The scheduled departure time.

- DIM Weight (Dimensional Weight): A pricing method based on cargo size as well as weight.

The takeaway: Sea and air freight rely on their own language of acronyms. Understanding these basics gives your business a stronger handle on communication, costs, and timelines. Share these with your teams to cut out confusion and keep cargo moving.

NEWS

US tariffs are bleeding South African companies

BusinessTech 2 September 2025 – Luke Frazer

South African businesses are under growing pressure from the latest round of US tariffs. In August, Washington imposed a 30 percent duty on a wide range of imports as part of its claim of a trade imbalance. The move dashed hopes of a negotiated deal and created fresh uncertainty in global markets. Early signs already show that exporters are struggling, with order books beginning to shrink as buyers respond cautiously to higher costs.

The effects are already evident in company forecasts. Bell Equipment, a Johannesburg-listed manufacturer, has warned that earnings could fall by as much as a third. Management has identified weaker global demand, combined with the shock of new tariffs, as the primary drivers. While the first half of the year performed better than many expected, the company has cautioned that the second half of the year looks far more challenging.

The automotive sector has emerged as one of the hardest hit. Jendamark Automation in Gqeberha has reported that contracts worth about R750 million are now at risk. The business, which builds assembly lines for major brands such as BMW and Mercedes Benz, is urgently trying to diversify its markets. Saudi Arabia has been identified as a possible alternative, although building those new relationships will take time.

Overall, these tariffs are beginning to erode South African exporters’ revenue and market share. Manufacturing orders are slowing, investment confidence is weakening, and companies across multiple sectors are preparing for a period of tighter margins. Unless trade talks regain momentum, the outlook for exporters remains uncertain. Source: Adapted from BusinessTech and Reuters

Disaster for South Africa as major companies buckle

South Africa is facing a crisis as several major companies reel under mounting pressures. Ford, Glencore and ArcelorMittal SA this week announced plans to cut thousands of jobs in the country’s struggling industrial sector. The economy continues to bear the weight of an unreliable and expensive electricity supply alongside growing competition from Asian manufacturers. These factors, combined with steep new US tariffs, are driving local firms to scale down operations.

ArcelorMittal has already begun shutting steel operations that employ around 3 500 people after nearly two years of talks with the government failed to resolve complaints about high costs and cheap imports. Ford is set to lay off 470 workers at plants around Pretoria and Gqeberha. Glencore, too, plans to initiate talks with workers about job cuts at its ferrochrome facilities, which it closed earlier this year. These announcements follow retrenchments by Goodyear and Mercedes-Benz in 2024.

The government’s industrial decline is drawing sharp criticism from unions and economists. South Africa once relied on heavy industries powered by cheap labour and robust transport networks. Those advantages are now fading. Industry’s share of national output has dropped from 23.5 percent in 1994 to just 13 percent today. Eskom’s electricity tariffs have soared 600 percent since 2006 and rail and port inefficiencies continue to hinder exports.

The consequences are serious. Unemployment sits at a record-high near 33 percent. Analysts warn that without decisive action the collapse of South Africa’s remaining industrial base will hollow out communities. Since 2000 some 70 000 companies have entered liquidation, costing 2.8 million jobs. Political and labour leaders call it a crisis, urging the government to act or risk further erosion of the nation’s economic foundations.

– Source: Adapted from BusinessTech and Reuters.

WEEKLY NEWS SNAPSHOT

- Transnet trims annual loss: Transnet cut its full-year loss to R1.9 billion for the year ending March 2025, down from R7.3 billion previously. Revenue rose nearly 8 percent to R82.7 billion, supported by tariff increases and higher rail volumes.

- Manufacturing confidence weakens: The latest PMI slipped to 49.5 in August, indicating contraction. New sales orders dropped as tariffs slowed exports and demand softened.

- ArcelorMittal job cuts: ArcelorMittal South Africa may cut up to 4,000 jobs. Rising energy costs, weak demand, import pressure and logistics challenges are driving the retrenchments.

- Private rail operators approved: The Government approved 11 private operators to run trains across 41 freight routes. The aim is to raise rail capacity toward 250 million tonnes a year by 2029.

- Rail theft remains critical risk: Transnet says theft of copper cables and rail infrastructure is costing 4.5 million tonnes of lost cargo each year. Security spending has risen to nearly R4 billion annually.

- Cape Town terminal exceeds targets: Cape Town Container Terminal handled almost 20,000 TEUs in a single week, more than 60 percent above its target. Infrastructure improvements and operational changes are driving results.

- New trade links with West Africa: A Department of Trade mission to Nigeria and Ghana promoted South African products and explored opportunities for joint manufacturing and industrial cooperation.

- Transnet outlook cautious: While financial results improved, Transnet warned that maintenance backlogs and equipment shortages still constrain reliable freight and port performance. Source: various

Key Highlights from Last Week’s Discussions – 31st August 2025

Source: BUSA, SAAFF, and global logistics data

- Port operations: elevated container throughput sustained

• South Africa’s container terminals processed nearly 97,000 TEUs for the week, the fourth consecutive week above 90 000.

• Daily averages held at ~13,842 TEUs, with Durban (+6%) and Ngqura (+20%) supporting volumes, while Cape Town (-21%) and Port Elizabeth (-60%) slipped.

• Rail cargo out of Durban rose 13% w/w to 3,324 containers, but delays of 4–6 hours continue on the Pretoria–Durban line due to diesel hauling from cable theft. - Air cargo: consolidation at OR Tambo

• August closed with air cargo up +15% m/m and +12% y/y.

• Weekly flows softened slightly, averaging 961,000 kg per day, but remain ~11% above last year and 13% above 2019 levels.

• OR Tambo is undergoing scheduled power outages (1–5 September). Backup systems are in place, but risk of disruption remains. - Trade balance: surplus extended

• SARS reported a R20,3 billion trade surplus in July, with exports up 8,5% m/m and imports down 10,2%.

• Year-to-date surplus stands at R98,9 billion, broadly in line with 2024.

• Regionally, BELN trade posted an R11,4 billion surplus, driven by stronger exports to neighbours. - Regional road freight: border constraints intensify

• Lebombo border truck volumes rose 9% to 1 674/day, but queue times increased to 4,2 hours (+24%).

• SA border crossings averaged 11,6 hours (+8%), while broader SADC borders eased to 5,5 hours (-5%).

• Added friction points include a Botswana/South Africa network failure, disputes over “mixed load” scanning at Beitbridge, and plans for a SANRAL tollgate at Beitbridge. - Global trade and shipping

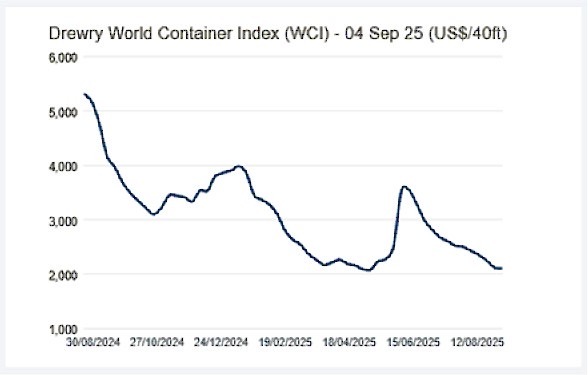

• Drewry’s World Container Index fell another 5,8% to $2 119/FEU, now 59% lower y/y.

• The global container orderbook reached 9,95m TEU, on the verge of 10m – a historic high, with most new builds alternative-fuelled.

• Global air cargo demand rose 5,5% y/y in July, led by Asia Pacific (+11%) and Africa (+9,4%). Africa also saw the strongest rate growth (+7% y/y).

• Legal uncertainty continues in the US as the Court of Appeals ruled Trump’s parcel tariffs unlawful but left them in place until October.

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

Currently, there are no reports of extraordinary delays or dramatic disruptions at the ports, except for the booking system, which continues to trouble transporters. Last week we saw up to 6 days’ delay at the Durban port due to weather, but everything has normalised.

DURBAN

Terminal operations are performing as normal, with no extraordinary delays or challenges. Clear week ahead with no weather stoppages expected. Road rehabilitation along Bayhead Road continues, which may lead to some gate congestion.

- Pier 1 – 1 day waiting time

- Pier 2 (DCT) – 2 day waiting time

- Point 1 – 2 days waiting time

CAPE TOWN

Vessel berth delays may vary as per the service.

Port operations have been relatively smooth over the period under review.

- CTCT: 3 day waiting time – carrier service dependent.

PORT ELIZABETH

- PECT: 0 days waiting time.

- NCT: 0 days waiting time Source: SACO

Global Freight Rates

Weekly Container Rate Update – 4th September 2025

Global Freight Rates Hold Steady

Drewry’s World Container Index dipped just 1% this week to $2,104 per 40ft container, signalling stability after 11 weeks of decline. The balance came from opposite movements on major trade lanes. Transpacific routes saw a sharp rebound, with Shanghai–Los Angeles up 8% to $2,522 per feu and Shanghai–New York up 12% to $3,677 per feu. Carriers introduced general rate increases ahead of China’s Golden Week, though these levels are unlikely to hold unless capacity is cut further. On the other hand, Asia–Europe routes continued to weaken. Shanghai–Rotterdam fell 10% to $2,385 per feu and Shanghai–Genoa dropped 7% to $2,653 per feu, as excess vessel capacity outweighed steady demand and European port delays.

Looking ahead, Drewry warns that the supply-demand balance is set to weaken again in the second half of 2025. Future rate movements will depend heavily on new US tariffs and possible restrictions on Chinese shipping, which add uncertainty to the outlook. Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”