Welcome to another Logistics News Update.

To make the logistics news easy to digest, we have summarised under the heading NEWS SUMMARY.

NEWS SUMMARY:

There’s Good news and bad news for South Africa’s transport sector this week!

We start with positive developments at the ports. Local ports are gearing up for a busy citrus fruit export season, with increased capacity and dedicated lanes for refrigerated containers. There’s also been an improvement in box throughput, suggesting that ports might be overcoming some of the recent challenges. However, cargo crime remains a major concern, a shockingly high number of incidents were reported in the past year, making South Africa a global leader in cargo theft rates. You can read the stories below.

Port Delays in South Africa

- There are still delays in South African ports, though there has been a slight improvement.

- Durban port is experiencing the worst delays, with container ships waiting an average of 21-25 days at Pier 2.

- Cape Town port delays are much shorter at 2-5 days.

- Recovery at Durban is expected to take several months due to equipment problems.

Causes of Delays

- Crane breakdowns: This is a major issue at Durban ports, especially Pier 2.

- Limited trucks: There are not enough trucks available to move containers.

- Bad weather: Strong winds have caused delays at all ports recently.

Good News

- The average number of containers handled per day at South African ports has increased recently.

- Transnet, the state-owned port operator, is taking steps to improve efficiency, such as adding staff and equipment.

- The citrus fruit export season is expected to go smoothly, with dedicated lanes for refrigerated containers and additional capacity at terminals.

Other News

- Cargo crime is a major problem in South Africa, with over 40,000 incidents reported last year.

- The recent small decrease in diesel prices is unlikely to have a significant impact on fleet owners.

- Global container freight rates have fallen slightly after a brief spike due to a bridge incident in the US.

- Despite the challenges, South Africa’s trade and transport sectors are showing signs of resilience.

On The Ground Update:

Cape Town:

- Waiting time: 2-5 days (increased due to strong winds)

- Productivity: Mostly near target, except for some mobile crane breakdowns.

- Recovery: Full recovery expected in 2 weeks (weather permitting).

Port Elizabeth:

- Waiting time: Varies between terminals (0-4 days) with some wind delays expected.

- Productivity: Mostly meeting targets.

- Recovery: Full recovery impacted by wind delays.

Durban:

- Waiting time: Still high (21-25 days at Pier 2, 4-5 days at Pier 1).

- Productivity: Well below target at both piers due to crane issues and limited trucks.

- Recovery: Long-term (3-5 months) due to equipment problems. Pier 1 recovery expected in 3-4 weeks.

Overall:

Port delays in South Africa have improved somewhat, but Durban ports remain congested with long waiting times. Full recovery for Durban is expected to take several months as reported from Maersk.

Source: Maersk

Disclaimer 1: Please note: All information presented in this post is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed.

NEWS

Also read : APM Terminals put a potential spanner in the works for Durban ICTSI’s Takeover

Local ports are ready for fruit exports – Transnet

05 Apr 2024 – by Staff reporter

Transnet Port Terminals (TPT) has assured the citrus fruit industry of its commitment to contributing to a successful export season as harvest forecasts reflect a 15% increase in volumes in 2024.

TPT general manager of commercial and planning, Michelle van Buren Schele, said all container terminals across KwaZulu-Natal (KZN) would have dedicated lanes for refrigerated containers at the gates to cater for the higher volume of traffic.

“We will also increase the number of truck appointment slots based on demand and capacity during this season across KZN and the Eastern Cape,” she said.

TPT has urged port users to place orange stickers on steri-protocol refrigerated containers to ensure two-hourly monitoring in line with the port operator’s commitment.

The recruitment and training of over 200 additional cargo coordinators and port workers for the next seven months is also currently under way.

Some terminals are receiving new equipment including haulers, trailers, reach stackers and empty container handlers to enhance landside operations. Additional capacity has also been created at each terminal to improve the turnaround of empty containers, stacking up to six containers high. The evacuation of import containers via rail to back-of-port facilities will continue to enable fluidity on the landside.

Source: Freight News

Box throughput improves, but delays still endemic at South African ports

By Charlotte Goldstone

Crane breakdowns and adverse weather are exacerbating delays at South Africa’s ports, despite a recent improvement in container throughput at its main gateways.

The South African logistics crisis has been escalating for years, and a lack of government investment into supply chain infrastructure has left the country’s ports, railways and roads extremely susceptible to disruption.

However, for the week ending 15 March, the South African Association of Freight Forwarders (SAAFF) reported that ports had handled an average of 8,838 containers a day, up significantly on the 7,755 handled the week before.

And state-owned port operator Transnet (TNPA) reported, in its February figures, that 23% more containers were handled than in January and 26% year on year.

“The increasing quantities of cargo handled – in conjunction with the monthly reported volumes from TNPA – for our container industry are starting to indicate that we may have turned a corner, as far as port operations go,” said SAAFF.

However, it warned: “It is probably too early to take this as a firm trend. Some caution must be expressed, as several indicators have again turned for the worse.”

SAAFF highlighted areas of concern such as the number of vessels at anchor off Durban, the queue-to-berth ratio of containers and the ongoing equipment shortages and breakdowns.

delays across its terminals, largely due to high winds.

Source: Loadstar

Cargo crime weighs heavily on transport sector

04 Apr 2024 – by Staff reporter

South Africa has witnessed over 40 000 crimes impacting supply chains in the past year alone, research by the Transported Asset Protection Association (Tapa) has found, based on data received from the SA Police Service.

According to the Chartered Institute for Logistics and Transport (Ciltsa): “These incidents encompass a spectrum of offences, ranging from high-profile truck hijackings and cash-in-transit robberies to common robbery, burglaries and stock theft.”

Most worrying of all recent crime figures is that of the 41 120 transport crime incidents reported last year, 99% occurred in South Africa, Tapa’s research reveals.

Moreover, South Africa ranks fourth globally in cargo theft rates, Tapa’s Cargo Crime Monitor shows.

Items of significant value, such as phones, electronic goods, and food and drink, consistently feature in the top five list of stolen goods.

“Safety and security are critical components of logistics, transport, and supply chain management, yet recent statistics reveal a concerning reality,” says Ciltsa.

Source: Freight News

Marginal diesel price drop ‘not enough’ for fleet owners -Road Freight Association

05 Apr 2024 – by Staff reporter

The scene in the US where important logistical infrastructure has been destroyed when a container vessel struck a main supporting pillar of a long-span truss bridge in Baltimore. Source: NPR

The recent marginal decline in the price of some grades of diesel will do little to quell the pressure fleet owners and consumers are facing, Gavin Kelly, CEO of the Road Freight Association says.

This comes as motorists driving petrol vehicles are expected to feel the pinch even further this month after the price of petrol (93 ULP and LRP) increased by 65 cents inland and 58 cents at the coast on Wednesday, while the price of petrol (95 ULP and LRP) rose 67 cents inland and 60 cents at the coast.

The price of diesel (0.05% sulphur) rose by three cents inland and dropped by three cents at the coast, while the price of diesel (0.005% sulphur) declined by one cent inland and eight cents at the coast.

Kelly said the RFA remained concerned that the trend relating to fuel costs remained on an upward trajectory.

“Unfortunately, large sectors of the economy are reliant on fossil fuel energy and related petrochemical products. While a debate can be held around alternative fuel (energy) sources, the reality remains that fossil fuels drive the logistics chains – and will drive these – for some time to come,” Kelly said.

Source: Freight News.

PORTS

April 2024

Weather and other delays:

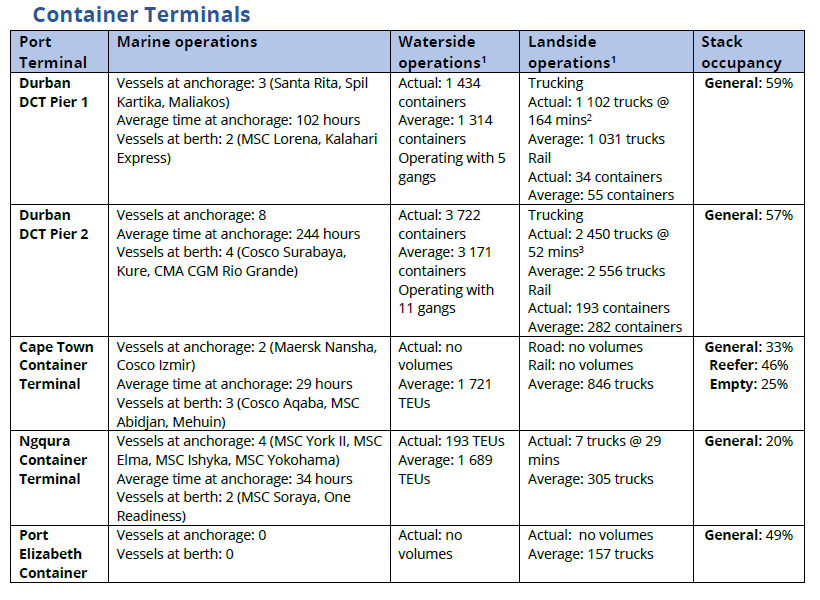

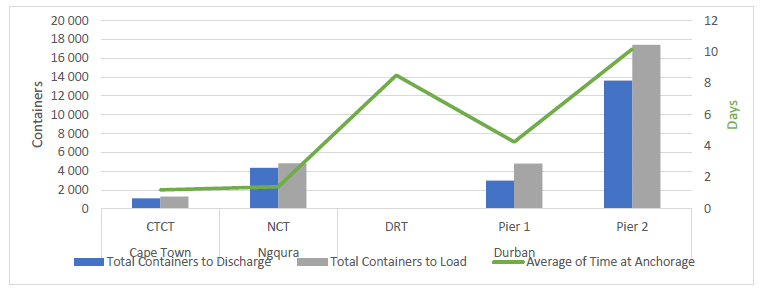

- Average time at anchorage for container vessels as of 06:00 this morning: Durban: 202 hours (Point: 204 hours, Pier1: 102 hours, Pier 2: 244 hours), Cape Town: 29 hours, Ngqura: 34 hours. The figure below shows the current situation at our ports from a container vessel perspective (please note that these figures where necessary have been estimated to the best of our knowledge and abilities). The line indicates the average number of days vessels have been waiting at anchorage (in days), and the bar graphs represent the total volume of containers to be loaded and discharged for the vessels at anchorage at 06:00 this morning).

- Both CTCT and CTMPT have been windbound since Friday, causing extensive delays at the Port. CTCT was operational for 2-3 hours on Saturday, while CTMPT managed to operate for about 17 hours. Additionally, weather predictions for the rest of the week do not look favourable as the strong winds are only expected to abate around 13 April.

- NCT was windbound for about 18 of the preceding 24 hours and also experienced vessel ranging. The Port of PE also experienced strong winds, coupled by high swells.

- Four vessel movements were delayed in Durban due to occupied tugs, while seven vessels deviated from their respective schedules due to agents requesting time changes and unavailable berths.

- The Maydon Wharf terminal experienced some delays due to rainy weather conditions.

Equipment Availability:

- Average time at anchorage for container vessels as of 06:00 this morning: Durban: 202 hours (Point: 204 hours, Pier1: 102 hours, Pier 2: 244 hours), Cape Town: 29 hours, Ngqura: 34 hours. The figure below shows the current situation at our ports from a container vessel perspective (please note that these figures where necessary have been estimated to the best of our knowledge and abilities). The line indicates the average number of days vessels have been waiting at anchorage (in days), and the bar graphs represent the total volume of containers to be loaded and discharged for the vessels at anchorage at 06:00 this morning).

- Both CTCT and CTMPT have been windbound since Friday, causing extensive delays at the Port. CTCT was operational for 2-3 hours on Saturday, while CTMPT managed to operate for about 17 hours. Additionally, weather predictions for the rest of the week do not look favourable as the strong winds are only expected to abate around 13 April.

- NCT was windbound for about 18 of the preceding 24 hours and also experienced vessel ranging. The Port of PE also experienced strong winds, coupled by high swells.

- Four vessel movements were delayed in Durban due to occupied tugs, while seven vessels deviated from their respective schedules due to agents requesting time changes and unavailable berths.

- The Maydon Wharf terminal experienced some delays due to rainy weather conditions.

Ports Update

Cape Town

On Thursday, CTCT recorded three vessels at berth and one at anchor as the terminal focused on recovery from the adverse weather conditions experienced earlier the week. The terminal went windbound around 18:00 on Tuesday and only resumed waterside operations around 09:00 on Wednesday morning and landside operations at 13:00 the afternoon. In the 24 hours between Wednesday and Thursday, stack occupancy for GP containers was recorded at 36%, reefers at 43%, and empties at 25%. During this period, the terminal operated with seven STS cranes, 23 RTGs, and 44 hauliers. Crane LC1 remained out of service this week with the technical team awaiting spares for the crane’s repairs. Adverse weather conditions extensively hampered operations towards the end of the week and were expected to continue through the weekend

The multi-purpose terminal recorded one vessel at anchor and two at berth on Wednesday. In the 24 hours leading to Thursday, the terminal managed to service 199 external trucks at an undisclosed truck turnaround time on the landside. During the same period, CTMPT managed to move 429 TEUs across the quay on the waterside. Stack occupancy was recorded at 52% for GP containers, 62% for reefers, and a very high 100% for empties. Between Tuesday and Wednesday, the terminal lost about six-and-a-half operational hours due to strong winds.

During the week of 25 to 31 March 2024, the FPT terminal serviced four vessels comprising two multi-purpose vessels, one dry bulk vessel, and one layby vessel. Berth occupancy during this period was recorded at 36%. During the week, 449 TEUs were handled at ~10.11 containers per hour and 47 tons of general breakbulk cargo at ~40 tons per hour. Additionally, 9 951 tons of dry bulk were handled at ~242 tons per hour, while a further 3 539 pallets of fruit were handled at ~34 pallets per hour. FPT planned to handle six vessels between 01 and 07 April, with another seven planned between 08 and 14 April. The late arrival of transporters, coupled with inclement weather conditions, constituted the majority of the delays encountered at the terminal this week.

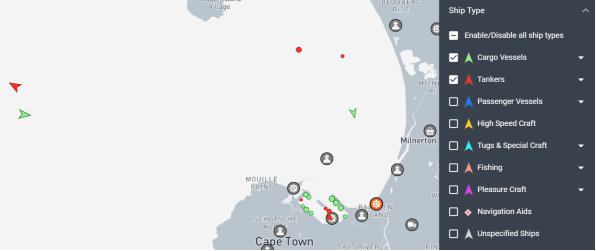

At midday on Friday, five vessels were waiting outside at anchorage in Cape Town, with the following snapshot of the port and vessels waiting to berth:

Durban

The port helicopter went out of service towards the end of the week with no ETR available just yet, while the floating crane made a welcome return to service. During the same period, berth 108 at South Quay returned to only one available crane after crane 523 experienced a breakdown.

Pier 1 on Thursday recorded two vessels at berth, operated by five gangs, and three vessels at anchor. Stack occupancy was 46% for GP containers and remained undisclosed for reefers. Between Monday and Wednesday, the terminal managed to execute 3 452 gate moves on the landside at an average truck turnaround time of ~80 minutes, with an average staging time of ~26 minutes. Additionally, towards the end of the week, the terminal had 1 752 imports on hand, with 120 of these units having road stops and 84 being unassigned.

Pier 2 had four vessels on berth and ten at anchorage on Thursday, as several vessels were delayed due to equipment breakdowns. In the preceding 24 hours, stack occupancy was 48% for GP containers and 16% for reefer ground slots. The terminal operated with 11 gangs while moving 3 072 containers across the quay. During the same period, there were 2 199 gate moves on the landside, of which 1 015 were for imports and 1 184 were for exports. The average truck turnaround time for the week was recorded at ~73 minutes, with an average staging time of ~31 minutes. Additionally, 400 rail containers were on hand with 332 units moved by rail. The terminal had a reported 58 straddles (↓~2, w/w) in operation, translating to an availability figure of approximately 59%, which is around ↓24% below the minimum number required to meet industry demand and achieve acceptable terminal performance.

Durban’s MPT terminal recorded three vessels at berth on Wednesday and three vessels at outer anchorage. On the waterside, 381 containers and 3 042 tons of break-bulk were moved across the quay, while 214 container road slots and ten breakbulk RMTs carrying 300 tons were serviced on the landside. Stack occupancy for breakbulk was recorded at 20% and 65% for containers. During the same period, four cranes, five reach stackers, one empty handler, seven forklifts, and 16 ERFs were in operation. The fourth crane made its long-awaited return to service this week shortly after completing its load testing.

On Thursday, the Maydon Wharf MPT had one vessel on berth and none at outer anchorage while handling 6 526 tons of cargo on the waterside. On the landside, 65 trucks conveying 2 252 tons were serviced. On Tuesday, the last vessel for the week at the Agri-bulk facility was completed after handling 5 812 tons of cargo. No volumes were handled on the landside, with the next vessel expected to arrive on 14 April.

Richards Bay

On Thursday, Richards Bay recorded 11 vessels at anchor, while 12 vessels were berthed, consisting of five at DBT, five at MPT, one at RBCT, and one at the liquid-bulk terminal. Two tugs, one pilot boat, and one helicopter were in operation for marine resources. On Wednesday, the coal terminal had three vessels at anchor and two at berth while handling 116 668 tons on the waterside. On the landside, 14 trains were serviced.

Eastern Cape ports

On Wednesday, NCT recorded two vessels on the berth and one vessel at the outer anchorage, with three vessels drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading to Thursday. Stack occupancy was 28% for GP containers, 30% for reefers, and 53% for reefer ground slots, as a total of 2 564 TEUs were processed on the waterside. Additionally, 369 trucks were serviced on the landside at a truck turnaround time of ~38 minutes.

On Thursday, GCT had one vessel on berth and two at anchor. In the preceding 24 hours, the terminal had two tugs, one pilot boat, two pilots, and one berthing gang in operation. On the landside, 296 trucks were processed at a truck turnaround time of ~44 minutes, while 419 TEUs were handled across the quay on the waterside. Between Tuesday and Wednesday, the Ro-Ro terminal had one vessel at berth and zero vessels at anchor. The terminal handled 657 units on the waterside, contributing to an improved stack occupancy figure of 50%.

No reports were received for the Port of East London this week.

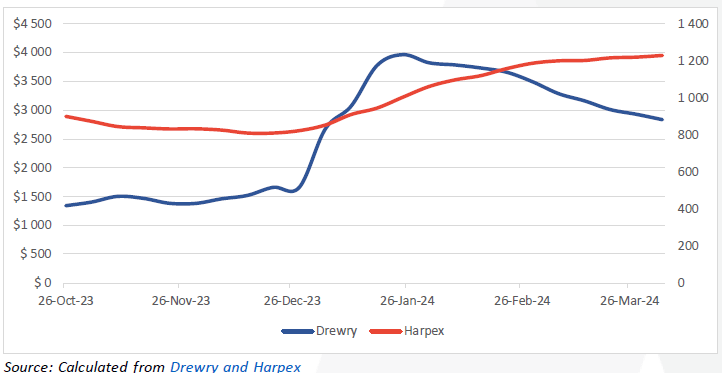

Global container freight rates and carrier profits

The Baltimore bridge incident failed to lift freight rates, with Transpacific rates still sliding after initial fears of disruptions to the US supply chains receded17. The brief spike in both import and export spot rates from the US East Coast was quickly reversed as the Transpacific rate weakness pulled down average rates last week despite encouraging hikes on the Asia-Europe, Middle East and Latin America rates. For the industry, the “World Container Index” is down by ↓3,2% (or $93) to $2 836 per 40-ft container.18 All major routes fell between ↓1-5%, with the most significant drop on the Shanghai – Genoa route. The composite index remains up by ↑66% compared to the same week last year and ↑100% higher than the average 2019 pre-pandemic rates of $1 420. Moreover, the average composite index for the year-to-date is $3 372 per 40ft container, which is $666 higher than the 10-year average rate of $2 706 (which was inflated by the exceptional 2020-22 pandemic period). In the charter market, the rate increases have stabilised, as the Harper Petersen Index (Harpex) is currently trending at 1 229 points, up by ↑0,7% (w/w) and up by ↑11% (y/y) versus this time last year19.

The Baltimore bridge incident failed to lift freight rates, with Transpacific rates still sliding after initial fears of disruptions to the US supply chains receded17. The brief spike in both import and export spot rates from the US East Coast was quickly reversed as the Transpacific rate weakness pulled down average rates last week despite encouraging hikes on the Asia-Europe, Middle East and Latin America rates. For the industry, the “World Container Index” is down by ↓3,2% (or $93) to $2 836 per 40-ft container.18 All major routes fell between ↓1-5%, with the most significant drop on the Shanghai – Genoa route. The composite index remains up by ↑66% compared to the same week last year and ↑100% higher than the average 2019 pre-pandemic rates of $1 420. Moreover, the average composite index for the year-to-date is $3 372 per 40ft container, which is $666 higher than the 10-year average rate of $2 706 (which was inflated by the exceptional 2020-22 pandemic period). In the charter market, the rate increases have stabilised, as the Harper Petersen Index (Harpex) is currently trending at 1 229 points, up by ↑0,7% (w/w) and up by ↑11% (y/y) versus this time last year19. The following figure shows the movement of both indices since the start of this year, illustrating the contrasting trajectories of these two indices:

BUSA-SAAFF Summary

In summary, South Africa’s trade, transport, and logistics sectors have recently demonstrated resilience, evidenced by a minor increase in port and air cargo volumes. This suggests a positive trend. However, substantial obstacles still need to be addressed, necessitating continuous industry-wide collaboration. The complexity of global supply chains requires an unwavering dedication to tackle infrastructure limitations, improve operational efficiency, and promote innovative solutions to adapt to changing market needs. By cultivating a collaborative and innovative environment, we can manage future uncertainties and guarantee the continuous expansion and competitiveness of our trade and transport networks.

Source: BUSA – SAAFF

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape