Welcome to our final Logistics News Update for 2024.

Wishing you and your family a joyous festive season and look we forward to a successful and prosperous 2025.

FUN FACT: If our logistics news weekly mailer were a TV series, this would be our 46th episode of the year! We hope the insights and updates we’ve shared have been helpful and informative.

As we prepare to welcome the new year, we’re excited to continue bringing you the latest industry news and meaningful on-the-ground updates. Thank you for your support and engagement throughout 2024.

If we had a crystal ball, what should 2025 look like from a logistics perspective?

South Africa’s logistics sector is poised for significant growth in 2025, driven by several key trends:

- E-commerce Expansion: The rapid growth of e-commerce is increasing demand for efficient last-mile delivery services and quality warehousing. The number of e-commerce users is expected to reach 37 million by 2027, up from 27 million in 2022.

- Infrastructure Investments: The National Infrastructure Plan 2050 aims to enhance logistics capabilities, attracting foreign investment and fostering a more efficient supply chain.

- Technological Advancements: Adoption of automation, blockchain, and data analytics is transforming logistics operations, leading to more efficient and transparent supply chains.

- Regional Trade Integration: The African Continental Free Trade Agreement (AfCFTA) is expected to increase intra-African trade, positioning South Africa as a key logistics hub on the continent.

- Private Sector Participation: Increased private sector involvement, particularly in port operations, is anticipated to improve efficiency and capacity in the logistics sector.

ON THE GROUND REPORT

The battle continues, truckers are complaining daily about the booking system, and it feels like a struggling system when truckers can’t get bookings, some transporters are waiting up to 12 hours at Pier 1 in Durban. Also, post-poll violence continues in Mozambique, if you are traveling there for a break, please be extra cautious as these border posts can be violent.

New Port Tariff

The South African Ports Regulator has approved an average tariff increase of 4.4% for services provided by the Transnet National Ports Authority (TNPA) for the 2025/26 period. This decision follows TNPA’s initial request for a 7.9% increase.

The approved adjustments are as follows:

- Marine services and related tariffs: Increase of 6.15%.

- Cargo dues: General increase of 3.4%, with specific adjustments:

- Dry bulk imports and exports: Increase of 4%.

- Empty containers (deep sea and transshipment): Tariffs equalised to coastwise rates.

Additionally, existing commercial South African-flagged vessels, as well as those registered since 2019/20, will continue to receive a 30% discount on marine tariffs. All license fees for port activities will also maintain a 30% discount, payable in equal annual instalments over the license period. The Regulator’s decision considered stakeholder feedback, updated inflation data from the National Treasury’s Medium-Term Budget Policy Statement, and its tariff methodology and strategy. To mitigate the transition to a low-inflation environment, R225 million from the Excessive Tariff Increase Margin Credit (ETIMC) will be utilized to smooth tariffs for the 2025/26 period. The approved tariff adjustment results in revenue of R15.318 billion for TNPA, slightly less than the R15.663 billion initially requested. The Regulator emphasized the need for TNPA to control operational costs, disallowing R185 million in over-expenditure and noting R12 million in fruitless and wasteful expenditure. This tariff adjustment aims to balance the financial requirements of TNPA with the economic realities faced by port users, ensuring the sustainability and efficiency of South Africa’s port operations.

On The Ground Report:

Always sound like ground hog day on this section but this week, operators complaining that between the TPT and the shipping lines you get different information, even the sites that offer detail on the arrival of the vessels are wrong, they all need to get their act together. If you have cargo coming in over the festive period, please remember to speak to your operators to either store your cargo or speak to the shipping line on getting extended time on the storage.

TIP OF THE WEEK: Let’s Learn: The Importance of Proper Shipping Documentation in International Trade:

Incomplete or inaccurate shipping documentation can lead to costly delays, fines, or even seizure of goods at customs. Here’s why ensuring proper documentation is critical:

| Key Documentation to Prepare:Commercial Invoice: This is the contract between the buyer and seller, detailing the goods, their value, and payment terms.Bill of Lading (B/L): Serves as proof of shipment, receipt of goods, and a title of ownership.Packing List: Provides detailed information about the shipment contents for easy customs clearance.Certificate of Origin: Specifies where the goods were manufactured, which may affect tariffs and trade agreements.Insurance Certificate: Protects against potential losses during transit.Import/Export Licenses: Ensures compliance with government regulations | Benefits of Proper Documentation:Faster Customs Clearance: Accurate documentation minimizes inspection delays.Reduced Costs: Avoids penalties and storage fees due to non-compliance.Enhanced Credibility: Builds trust with clients and partners by demonstrating professionalism.Legal Protection: Provides clarity in case of disputes or claims. | Common Pitfalls to Avoid:Missing or incomplete forms.Errors in product descriptions or tariff codes.Delayed submissions leading to additional charges.Overlooking country-specific requirements. |

Pro Tip: Work with logistics experts or trade finance advisors to ensure your documentation is accurate and complete. Investing time upfront saves you money and avoids headaches later. Proper documentation is the cornerstone of smooth international trade!

INTERNATIONAL NEWS:

As of December 9, 2024, the maritime industry continues to navigate significant challenges due to security threats in the Red Sea region, particularly from Houthi rebel activities. These developments have influenced shipping routes and operational decisions for major carriers, including CMA CGM’s INDAMEX service.

INDAMEX Service Routing:

- CMA CGM’s Decision: Initially, CMA CGM planned to revert the INDAMEX service to the Suez Canal route. However, due to customer concerns and cargo insurers’ reluctance to cover the Red Sea route amid ongoing security threats, the company has maintained the Cape of Good Hope routing.

- Operational Impact: This strategic decision underscores CMA CGM’s commitment to balancing operational efficiency with customer and insurance requirements in a complex maritime environment. The INDAMEX service, connecting the Indian Subcontinent to the U.S. East Coast, continues to operate with vessels ranging from 8,000 to 9,950 TEUs.

Regional Security Concerns:

- Houthi Attacks: The Red Sea has experienced increased disruptions due to Houthi rebel attacks on commercial vessels. These attacks have compelled numerous ships to avoid the Suez Canal, opting instead for the longer route around the Cape of Good Hope, which adds approximately two weeks to transit times.

- International Response: The U.S. Navy has actively engaged in intercepting missiles and drones launched by Houthi forces targeting American ships in the Gulf of Aden, highlighting the ongoing security challenges in the region.

Industry Implications:

- Operational Adjustments: Shipping companies are continually assessing and adjusting their routes to ensure the safety of their vessels and cargo. The decision to bypass the Suez Canal in favour of the Cape of Good Hope reflects a strategic response to mitigate risks associated with the Red Sea corridor.

- Economic Impact: Rerouting vessels increases transit times and operational costs, which can affect global supply chains and freight rates. The industry remains vigilant, monitoring the situation closely to adapt to evolving security dynamics.

In summary, the maritime sector is navigating a complex landscape marked by security threats and operational challenges. CMA CGM’s routing decisions for the INDAMEX service exemplify the industry’s efforts to balance efficiency with safety and customer assurance.

Port Update: Week of Dec4th – 9th, 2024

As of December 9, 2024, South African ports have experienced notable operational changes:

1. Durban Port:

- Pier 1: Delays have decreased to approximately 7–8 days, down from the previous 9-day average.

- Pier 2: Delays remain around 9 days. The arrival of the first four of twenty new diesel-electric straddle carriers is expected to enhance operational efficiency.

- Durban Point (MPT): Operations continue to face challenges due to equipment issues and congestion, with delays averaging 5–6 days.

2. Cape Town Port:

- CTCT: Delays have increased, with vessels waiting between 6–11 days, up from the previous 5–10 days. Severe wind conditions continue to impact operations.

- MPT: Operations are running smoothly, with minimal delays reported.

3. Port Elizabeth/Ngqura:

- PECT: Operations remain stable, with no significant delays reported.

- NCT: Delays have been minimized, now averaging less than 1 day.

Additional Developments:

- Beira Port (Mozambique): Congestion has led to shipping lines imposing surcharges, with delays of up to 10 days reported.

- Cape of Good Hope: Increased maritime traffic due to Red Sea tensions has led to higher shipment costs and extended transit times.

Overall, while some South African ports show improvements, challenges persist due to equipment issues and adverse weather conditions. Continuous monitoring is recommended for the most current information.

NEWS

KZN expands macadamia exports

29 Nov 2024 – by Lyse Comins

Kwazulu-Natal (KZN) South Coast macadamia nut producers have doubled volumes over the past four years, capitalising on the growing global demand for the popular nuts.

South Africa is one of the world’s leading macadamia nut producers, and while Mpumalanga tops the list for trading, KZN posted a positive macadamia nut trade balance of more than R50 million in 2023, according to Trade and Investment KwaZulu-Natal (TIKZN).

The KZN South Coast has established itself as a leading producer of premium macadamia nuts, with exporters like Mayo Macs, Mac Eden, and Coastal Macadamia at the forefront of high-quality production.

CEO of macadamia processing, marketing, and distribution company Mayo Macs, Cobus Venter, said the coast was one of the best-growing regions for macadamia worldwide.

“Mayo Macs have doubled their volumes in the last four years and again expect to double in the next four years, according to the current intake figures,” Venter said.

– Adapted from Source: Freight News

Private sector calls for overhaul of Durban Container Terminal Pier 2 plan

06 Dec 2024 – by Juanita Maree

Dr Juanita Maree is the chief executive officer of the Southern Africa Association of Freight Forwarders (Saaff). Source: SAAFF

Here are the highlights of the full article:

- Freight Logistics Roadmap: Implemented to overhaul South Africa’s logistics, focusing on moving from monopolistic structures to efficient, competitive supply chains.

- Durban Container Terminal Pier 2: Africa’s largest container hub under a delayed 25-year concession by ICTSI due to a legal dispute from APM Terminals. Court ruling expected in March 2025.

- Public-Private Partnerships (PPP): Dr. Juanita Maree advocates for PPP models to address logistics challenges and reduce costs, which currently account for 57% of total product costs.

- Opportunity for Review: The delay provides a chance to reassess the Pier 2 concession framework to ensure alignment with South Africa’s needs.

- IRERC Report: Expected in December 2024, it will offer critical insights for optimizing South Africa’s logistics sector and reducing inefficiencies.

- Economic Competitiveness: The focus remains on creating streamlined, cost-effective logistics to support both domestic and international supply chains.

–Source: FreightNews go see the full story

Weekly Snapshot

Weekly Snapshot

As of December 9, 2024, the South African freight and logistics sector has experienced several significant developments:

- Port Operations: Durban Port Enhancements: Transnet has refurbished Alkantstrand beach to combat soil erosion, aiming to improve port infrastructure and environmental sustainability.

- National Road Traffic Amendment Bill: President Cyril Ramaphosa has signed this bill into law, aiming to improve road safety and traffic management systems across the country.

- Aviation Sector: SAA Cargo Operations: South African Airways Cargo has implemented contingency plans to maintain operations on certain routes amid a pilot strike, ensuring continuity in cargo movement.

- Border and Trade Facilitation: Botswana Border Congestion: Rigid cargo clearing procedures continue to cause significant delays at Botswana borders, with efforts underway to address these bottlenecks and improve trade flow.

- Industry Innovations: Electric Truck Deployment: Bakers SA, a South African logistics firm, has integrated electric trucks into its fleet, marking a significant step towards sustainable transportation within the logistics industry.

- Economic Indicators: GDP Decline: South Africa’s GDP contracted by 0.3% in the third quarter, with notable decreases in agriculture, transport, trade, and government services sectors.

- International Relations: SA-Nigeria Trade Relations: South Africa strengthened bilateral ties, leveraging the African Continental Free Trade Area to unlock further trade opportunities. – Source: FreighNews

Key Observations:

- Container Shipping Rates: Current Rates: The average global freight rate for a 40-foot container stands at approximately $3,349, reflecting a stabilisation in prices.

- Market Dynamics: The container shipping market has shown signs of stabilisation, with rates holding steady in recent weeks. However, industry leaders like Hapag-Lloyd anticipate reduced profitability in the fourth quarter, citing factors such as geopolitical tensions and rerouting challenges.

- Air Cargo Demand: Current Trends: The air cargo sector has experienced a significant surge, with global demand increasing by 10.8% in December 2023 compared to the previous year.

- Regional Performance: Middle Eastern airlines reported an 18.3% increase in demand for both global and international operations in December 2023, indicating robust growth in specific markets.

Summary: The logistics sector is navigating a complex landscape marked by stabilising container shipping rates and a resurgence in air cargo demand. While the container shipping market shows signs of equilibrium, the air cargo industry is experiencing significant growth, particularly in regions like the Middle East. Stakeholders are advised to monitor these trends closely, considering the potential impacts of geopolitical developments and seasonal fluctuations on global supply chains.

Global Shipping Update

Delays and Key Updates

- Brazil: Ports are experiencing significant congestion due to high cargo volumes and limited capacity, leading to extended vessel wait times.

- Far East: Surging demand has disrupted shipping schedules, causing transshipment delays at major hubs like Singapore.

- South Africa: Durban Port faces equipment shortages and weather-related disruptions, resulting in operational delays.

- India: Blank sailings and port backlogs are contributing to shipment delays across the region.

- Singapore: Transshipment delays have extended to 2–3 weeks, impacting global supply chains.

- Mozambique: Protests and strikes are causing operational disruptions at key ports.

Global Container Freight Rates

Global Container Freight Rates Update: December 9, 2024

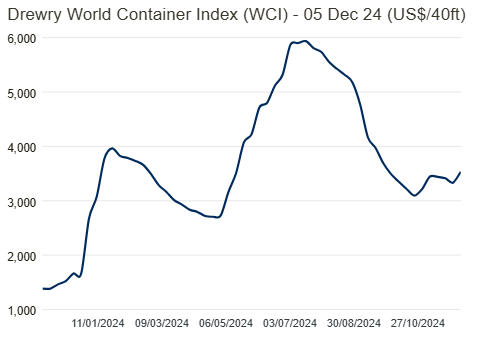

As of December 5, 2024, Drewry’s World Container Index (WCI) increased by 6% to $3,533 per 40-foot container.

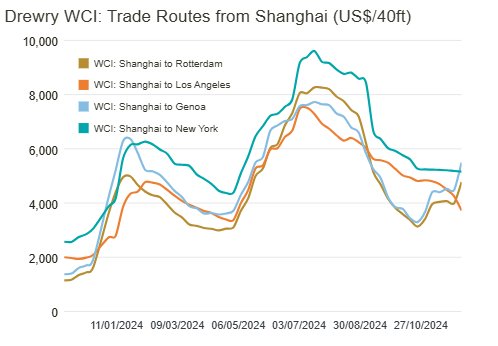

Key Rate Movements:

- Shanghai to Los Angeles: Rates increased by 6% to $4,505 per 40-foot container.

- Shanghai to Rotterdam: Rates rose by 6% to $4,237 per 40-foot container.

- Shanghai to New York: Rates climbed by 5% to $5,441 per 40-foot container.

- Shanghai to Genoa: Rates went up by 4% to $4,670 per 40-foot container.

- Rotterdam to New York: Rates increased by 3% to $2,742 per 40-foot container.

- New York to Rotterdam: Rates rose by 2% to $805 per 40-foot container.

- Rotterdam to Shanghai: Rates remained stable at $524 per 40-foot container.

- Los Angeles to Shanghai: Rates held steady at $710 per 40-foot container.

Year-to-Date and Historical Context:

The year-to-date average composite index stands at $3,980 per 40-foot container, which is $1,132 higher than the 10-year average of $2,848, a figure still influenced by the elevated rates during the COVID-19 pandemic.

Market Outlook: Drewry anticipates that spot rates will remain stable in the coming week. These rate movements reflect ongoing adjustments in the global shipping market as it continues to stabilize post-pandemic. Shippers and logistics providers should remain vigilant and monitor these trends to make informed decisions. Source: Drewry

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”