Welcome to another Logistics News Update.

This week, the trucking industry is grappling with significant challenges, as local transporters continue to struggle with the truck booking system at the port. This system is placing considerable pressure on both transporters and importers, leading to disruptions across the supply chain. In a recent article, “AI and Chaos at Durban Port,” allegations have surfaced regarding AI manipulation within the Durban Container Terminal’s truck booking system. While the port authority is investigating these claims and proposing changes to reduce congestion, many truckers remain sceptical due to ongoing system failures and perceived biases. This situation is not only affecting the logistics sector but also causing financial strain for many businesses.

On the export front, South Africa’s citrus industry faces new hurdles as Botswana and other neighbouring countries impose restrictions on oranges and other fruits and vegetables. As the world’s second-largest exporter of citrus, these restrictions pose a significant challenge for South African exporters. We also delve into the ongoing EU dispute on citrus exports and its implications for our market.

Finally, a recent explosion in China highlights the critical importance of accurate goods declaration in shipping. The incident, triggered by undeclared refrigerated organic peroxides, serves as a stark reminder of the severe financial and safety risks associated with incorrect declarations.

USA NEWS

US Port Strike Looms

Adapted from JOC.COM – Credit Richard Rattray – Concordia International Forwarding

Shippers relying on U.S. East and Gulf Coast ports are facing a perfect storm. A potential strike by longshore workers in September could cripple operations, adding to the already dire situation caused by severe port congestion. With limited options and rising costs, importers and exporters are racing against time to find alternative routes or expedite shipments before the looming deadline. Diversions to Canadian ports have been hampered by labour issues, while Mexican routes are struggling to handle increased traffic. This perfect storm of challenges threatens to disrupt supply chains and drive up consumer costs.

ILA demands massive wage increase

The International Longshoremen’s Association (ILA) is demanding a substantial 80% wage increase over the next six years from maritime employers on the East and Gulf coasts. This aggressive stance comes amid a backdrop of other unions securing significant wage gains. The union has issued a strike warning if a new contract isn’t signed by September 30. The proposed wage hike is significantly higher than previous agreements and other recent union contracts.

Credit Richard Rattray

Let’s Learn

Incoterm FCA – Tip of the week

Understanding Free Carrier (FCA) Shipping TermsWhat Is Free Carrier (FCA)?Free carrier is a trade term dictating that a seller of goods is responsible for the delivery of those goods to a destination specified by the buyer. When used in trade, the word “free” means the seller has an obligation to deliver goods to a named place for transfer to a carrier. The destination is typically an airport, shipping terminal, warehouse, or other location where the carrier operates. It might even be the seller’s business location.Key TakeawaysFree carrier is a trade term requiring the seller of goods to deliver those goods to a named airport, shipping terminal, warehouse, or other carrier location specified by the buyer.The seller includes transportation costs in its price and assumes the risk of loss until the carrier receives the goods.Once the seller delivers the goods to the carrier, the buyer assumes all responsibility for the goods.The International Chamber of Commerce updated Incoterms in 1980 to include the free carrier provision, and the ICC simplified the free carrier term in 1990.As part of the liability transfer, the seller is responsible for delivery to the specified carrier location but isn’t obligated to unload the goods.

On The Ground Report

It has been a challenging week, operators feel like they are playing battle ships when it comes to finding containers, the shipping lines and the port and not on the same page, there has been a vessel outside the port for 20 days already in deep anchor and the operators cant get news on when it is coming in, the port is working hard to get the import containers in by doing split berths, meaning they come in, drop a few and then go back out and then come back again, exporters are all holding their breath. Haulier are still battling with the booking system but this also is being addressed.

Disclaimer: The information presented in this newsletter is based on reputable sources and has been referenced accordingly. This Logistic News is provided obligation-free. If you wish to be removed from the mailing list, please reply to this email with a request for removal. Please note that all news content is either adapted or specifically quoted from its original sources.

This Weeks Key News Takeaways

Here are the main takeaways:

Wage Agreements in the Freight Sector: A new wage agreement has been reached in the road freight industry, with a 5% increase in truck drivers’ minimum wages implemented this year. This agreement also addresses the contentious issue of employing foreign drivers, highlighting the industry’s ongoing efforts to balance economic pressures with fair labour practices (Freight News).

Challenges in the Trucking Industry: The South African trucking industry continues to face multiple challenges, including rising fuel costs, frequent attacks on trucks, and persistent load shedding. The Road Freight Association (RFA) emphasised the need for collaboration between road and rail sectors to address these issues, underscoring that road freight cannot be the sole mode of transport in the country. The RFA is also advocating for improved safety standards and fair wages within the industry (Freight News) (Freight News).

Railway Rehabilitation and Infrastructure: Progress is being made on the rehabilitation of a 614-kilometer railway line that connects Mozambique, Zimbabwe, and Botswana. This project aims to enhance regional connectivity and improve the efficiency of freight movement across these countries (Freight News).

Beira Port Expansion: The Port of Beira in Mozambique is set to experience increased activity with the planned construction of an aluminium smelter plant. This project is expected to boost local employment and significantly increase the volume of goods handled by the port (Freight News).

NEWS

Truck Booking System is Killing Transporters Business

08 August 2024 – by Eugene Goddard

Source: Nautical Elements

South African truckers are facing a severe crisis due to a combination of factors, including congestion at the Durban Container Terminal and a problematic automated truck booking system. The system, implemented at several ports, is accused of failing to effectively manage truck appointments.

Carriers report significant delays in clearing containers, with some processes taking up to nine times longer than usual. This has resulted in substantial financial losses, forcing some businesses to close down entirely. Truck drivers are enduring long waiting times, often exceeding legal limits, and are being paid less due to reduced productivity. The automated booking system is also criticized for being unreliable and difficult to navigate. Truckers often find themselves engaged in a constant battle to secure slots, with the system frequently crashing or showing inaccurate availability.

These challenges have led to a decline in the quality of life for truckers and their families, as they are forced to dedicate excessive hours to managing the booking process. Despite numerous complaints to port authorities, the situation remains unresolved, with truckers feeling increasingly desperate and frustrated.. read full story here

Adapted from Source: Freight News

EU citrus dispute results in significant costs for local industry

12th August 2024 – by Staff Reporter

Source: SRCC

South Africa has launched a formal dispute against the European Union at the World Trade Organization (WTO) over strict regulations imposed on South African citrus exports. The EU’s rules, aimed at preventing the spread of plant diseases, are deemed unnecessary and costly by South Africa. These measures have a significant impact on the citrus industry, a major employer in the country, with an estimated annual cost of $110 million.

South Africa argues that the EU’s regulations are discriminatory as similar restrictions are not imposed on other countries with comparable plant health conditions. The country contends that these measures are harming its citrus exports, which constitute 33% of the total, and negatively affecting the livelihoods of over 140,000 people directly employed in the industry.

The South African government is seeking to resolve the dispute through the WTO, claiming that the EU’s actions are hindering fair trade and causing undue economic hardship to its citrus industry. The outcome of this case will have significant implications for both countries’ agricultural trade relations…

Adapted from Source: Freight News read full story here

PORTS

South African Port Delays Summary (as of August 12, 2024)

SA Port Updates:

- Durban:

- Wind forecasted for Today.

- Pier 1: Delays of up to 10 days.

- Pier 2: Delays of up to 25 days.

- Cape Town:

- Strong winds expected on Sunday, with no major delays anticipated for the rest of the week.

- CTCT: Delays of up to 3 days.

- Port Elizabeth / Ngqura:

- Strong winds are forecasted for today, tomorrow, and Sunday.

- NCT / PECT: Delays of up to 2 days.

NOTE: We recommend factoring these potential delays into your shipment planning to avoid disruptions.

Global Freight Rates

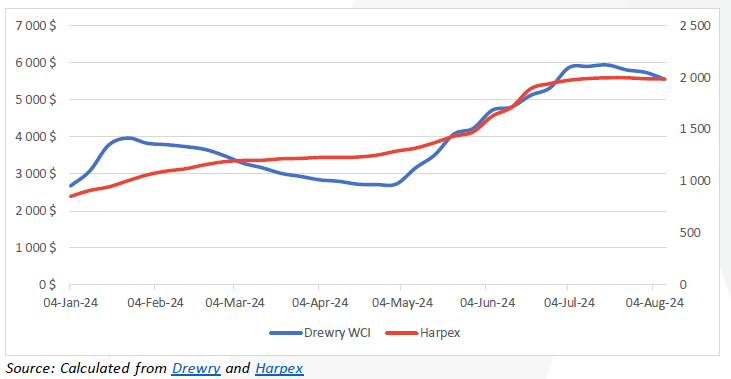

Container freight rates have again subsided this week, as Drewry’s “World Container Index” decreased by ↓3,2% (or $185) and is trading at $5 551 per 40-ft container.14 The average composite index for the year-to-date is $3 996 per 40-ft container, which is $1 204 higher than the 10-year average rate of $2 791. The best current estimates indicate that we will see rates of just North of $4 000 per 40-ft container by the end of the year; however, the recent rates of volatility experienced in the last four years – coupled with the major disruptions to global supply chains – make these estimations almost meaningless with still more than a quarter of the year to go. Charter rates have also continued to decrease, as the Harper Petersen Index (Harpex) is trading around 1 985 points on Friday, down by ↓0,2% (w/w) – but still up by ↑80% compared to this time last year.15 The following figure shows the movement of both of these indices since the start of the year, with expectations of a continuation of the recent reduction:

BUSA-SAAFF Summary – Summary

South African Logistics & International Trade Summary

This report details the current state of South African logistics and international trade.

South African Ports:

- Container handling decreased compared to the previous week due to weather, equipment issues, and system failures.

- Delays occurred at major ports like Cape Town, Durban, Eastern Cape, and Richards Bay.

Global Maritime Industry:

- Container throughput declined in June but remains high year-over-year, reflecting recovering global demand.

- Regional variations exist, with growth in Australasia and Oceania, and declines in the Indian Subcontinent and Middle East.

- Shipping prices have risen significantly, with dry goods experiencing steeper increases.

- Sub-Saharan Africa’s trade saw monthly declines, despite annual export growth. South Africa’s share of regional trade has decreased.

- Concerns about a US recession is impacting global shipping, especially on US West Coast routes.

- Disruptions continue due to Middle Eastern tensions and port congestion (including Durban).

South African Air Cargo:

- ORTIA saw increased inbound cargo but decreased outbound cargo compared to the prior week.

- Overall air cargo volume is up year-over-year but remains below pre-pandemic levels.

- Air cargo growth globally is driven by limitations in maritime shipping and booming e-commerce.

Industry Outlook:

- Despite recent improvements, the logistics sector faces challenges in reaching its full global trade potential.

- Key areas for improvement include infrastructure investments, digitalization, public-private partnerships, and policy/regulatory reforms.

Overall:

While the industry shows some positive signs, addressing these challenges is crucial for sustained growth and competitiveness in global trade.

Source::BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape.

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”