Welcome to another Logistics News Update.

Rising Logistics Costs Threaten Efficiency, this week’s article dives into a pressing issue for South African businesses: the rising cost and slowing pace of logistics. While reports show improvement in port activity, new regulations and cost increases are squeezing transporters and impacting delivery times.

Key Logistic Challenges:

- Cancelled “dual bookings” force transporters to make separate trips for import and export containers, doubling their time and raising costs.

- Fuel price hikes add further pressure on already strained budgets.

- Looming statutory increases on April 1st threaten to push client acceptance to the limit.

Port Activity: A Mixed Bag – Recap “from the horse mouth”

We’ll also explore the situation on the ground at key ports,

- Durban: A lack of transparency with “no anchorage reports” and a complex “shipping Tetris” approach to offloading raise concerns.

- Appointment slots: are constrained due to high volume of containers moving through Durban terminals.

- Transnet: Transnet have stopped duel drop off and collections, yesterday they sent out a notice to say it would be more efficient to drop a export container, leave the port and book again for the collection of an import. I think this is a nightmare for transporters, besides the extra time and cost, we doing nothing to help our environment, its been the hottest ever in two million years, climate change is real.

- Increased levels of congestion noted at the terminals in Durban. The port reported windy weather during the week.

- Pier 1 : 3-5 days

- Pier 2 : 24-28 days

- Durban Point : 3 days

Source: SACO CFR

- Cape Town: Earns praise for innovative solutions like using the fruit terminal for vessel discharge.

Port berthing delays remain stable with no improvement noted. The port has reported windy weather during the week.

- CTCT : Up to 7 days

- MPT : Up to 5 days

Improved turn around for equipment upliftment experienced as weather conditions have improved. CFS has normal volumes of traffic and operations continue as per normal.

Source: SACO CFR

- Port Elizabeth: Continues to impress with consistent efficiency.

The port has reported strong winds during the week resulting in increased berthing delays experienced.

- PECT : 2-4 days

- NCT : 1-3 days

Source: SACO CFR

Disclaimer 1: Please note: All information presented in this article is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed.

NEWS

Also read : Earlier end forecast for South Africa’s table grape harvest here

Transport cost rises inevitable

07 Mar 2024 – by Staff reporter

Transporters are implementing multiple measures to reduce the impact of rising fuel prices but will soon be forced to pass on the higher cost of doing business to customers, leading to retailers’ hiking the prices of basic goods from groceries to clothing.

Road Freight Association CEO, Gavin Kelly, raised this concern after the latest fuel price hike took effect on Wednesday, 6 March, saying that while diesel prices had not yet hit the all-time high of R25,74 per litre, any gains from the price decreases seen in 2023 were being eroded. The price of diesel increased R1,05 for 500ppm and R1,18 for 50ppm, while the price of petrol (93 and 95 octane) rose by R1,21 per litre.

“We have all become used to the age-old song by The Central Energy Fund (CEF) that this is due to the dollar price of oil on the world market, the value of the rand versus the dollar and the internal ‘under or over recovery’ within the country itself,” Kelly said.

Source: Freight News

Logistics utility steps up tempo towards ports progress

05 Mar 2024 – by Staff reporter

Transnet National Ports Authority (TNPA) is accelerating the execution of port infrastructure development projects to reduce congestion and increase capacity at the ports of Durban and Richards Bay.

During the conclusion of its business-to-business stakeholder engagement roadshow in Durban, TNPA highlighted the progress it had made under its R89-billion megaprojects portfolio, the KwaZulu-Natal Logistics Hub (KZN LH), and other operational projects to ease congestion at the ports.

The KZN Logistics Hub portfolio aims to reposition the ports of Durban and Richards Bay to increase the capacity of handling container, automotive, dry bulk and liquid bulk commodities.

“For effective execution of these projects, we as TNPA rely on collaboration between ourselves and customers to find best solutions to improve port efficiencies,” TNPA managing executive for the eastern region ports, Moshe Motlohi, said.

Source: Freight News

Industry call to action: navigating disruption at Transnet together

01 Mar 2024 – by Staff reporter

In the wake of ongoing disruptions at Transnet, which have significantly impacted South Africa’s cargo transport systems, Freight News is launching a crucial survey to gauge the effects on the import and export sector.

Titled “Assessing the Impact of Transnet Disruptions on Importers and Exporters,” this initiative seeks to compile first-hand accounts from businesses navigating these challenging times.

The disruptions at Transnet, affecting both port and rail operations, have thrown a spotlight on the vulnerabilities within our supply chains and the urgent need for resilient solutions.

The import and export community is the backbone of the economy, and its insights are invaluable in understanding the full scope of these challenges and advocating for meaningful improvements.

By participating, you will be contributing to a collective effort to strengthen our industry’s resilience and adaptability.

Source: Freight News

Chikunga welcomes private sector input on freight problems

08 Mar 2024 – by Staff reporter

South Africa’s transport minister, Sindisiwe Chikunga. Source: Jacaranda FM

South Africa’s Department of Transport has welcomed the opportunity to work with the private sector to confront the challenges facing the country’s roads and logistics networks to meet the demands of the economy.

Transport Minister Sindisiwe Chikunga told delegates at the inaugural Truck Driver Safety and Wellness Symposium in Johannesburg this week, which was attended by government and business leaders, that the government valued the input of the logistics industry to help it confront the challenges facing the sector.

The event, held in collaboration with the SaferStops Association (SSA), focused on enhancing the safety and wellness of truck drivers across South Africa, which is experiencing growth in the number of heavy vehicles on the road.

Source: Freight News

PORTS

Weather and other delays:

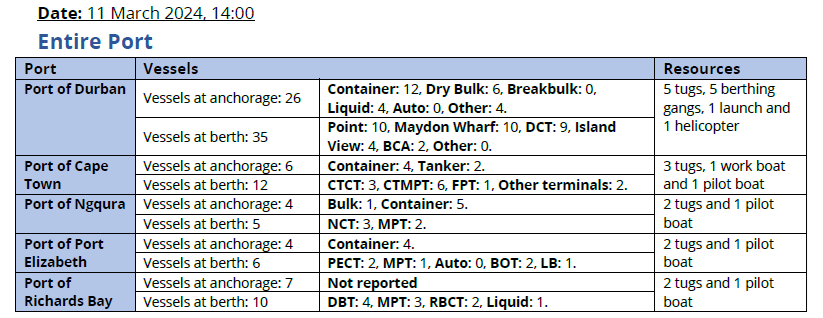

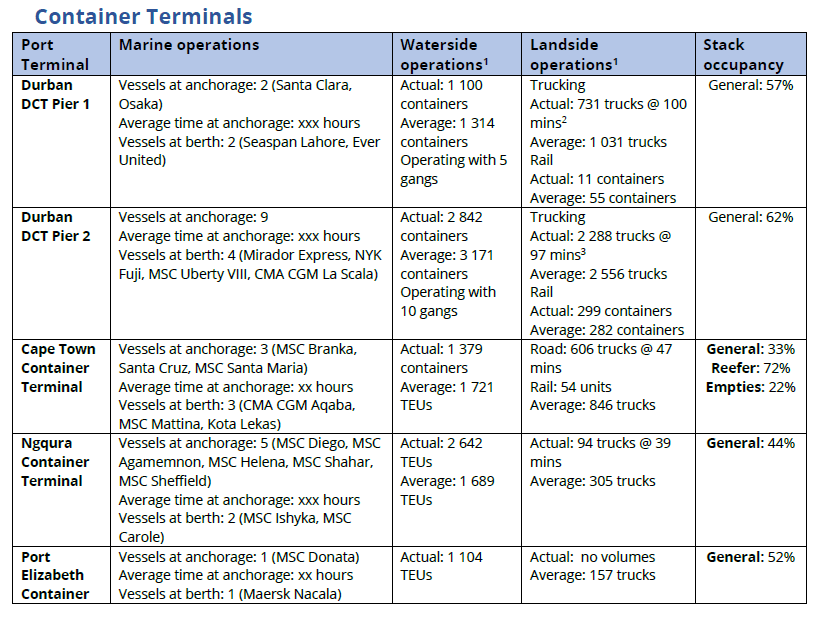

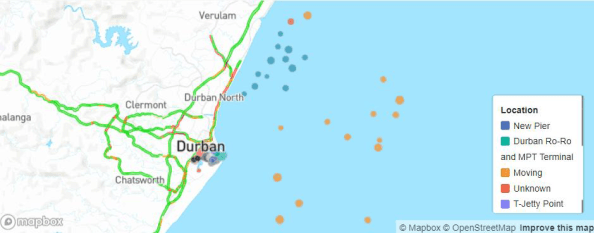

Average time at anchorage for container vessels as of 06:00 this morning: Durban: 146 hours (Point: 71 hours, Pier 1: 20 hours, Pier 2: 182 hours), Cape Town: 60 hours (CTCT: 64 hours, CTMPT: 43 hours), Ngqura: 250 hours, Port Elizabeth: 7 hours. The figure below shows the current situation at our ports from a container vessel perspective (please note that these figures where necessary have been estimated to the best of our knowledge and abilities). The line indicates the average number of days vessels have been waiting at anchorage (in days), and the bar graphs represent the total volume of containers to be loaded and discharged for the vessels at anchorage at 06:00 this morning).

CTCT went windbound from 20:00 to midnight last night.

The late arrival of cargo was the main source of delay at the Maydon Wharf terminal. The terminal is planning to put asphalt on two of the roads tomorrow which may impact landside operations.

Equipment Availability:

- At the time of reporting CTCT had nine STS cranes and 25 RTGs available.

- At the time of reporting this morning, Durban MPT had three cranes, nine reach stackers, one empty handler, six forklifts, and 20 ERFs in service. Additionally, the third crane was utilised for training once more from 06:00 this morning to 14:00 this afternoon.

- DCT Pier 2 had 53 straddle carriers in service at the start of the morning shift while equipment challenges persisted over the latest 24 hours.

- Cranes 6, 7, and 8 at NCT all remain out of commission. The revised ETR for crane 6 is scheduled for 20 March, crane 7 is still scheduled for 22 March, while crane 8 is scheduled for 18 March.

- At the time of reporting, everything was ready and in place for the pilot boat in Durban to be certified by SAMSA. The craft should thus return to service sometime today if all goes according to plan.

Cape Town

On Thursday, CTCT recorded two vessels at berth and two at anchor as strong winds and dense fog continued to disrupt operations at the terminal. In the preceding 24 hours, stack occupancy for GP containers was recorded at 22%, reefers at 47%, and empties at 18%. In this period, the terminal managed to move 1 370 containers across the quay. On the landside, 920 trucks were serviced, while 91 rail units were handled. At the start of the week, the terminal went windbound for more than seven hours. Towards the end of the week, the terminal operated with eight STS cranes, 25 RTGs, and 42 hauliers. Crane LC9 remained out of commission after experiencing a trolley fault, which contributed to some extensive berthing and sailing delays. Furthermore, the new shift system at the terminal started this week.

The multi-purpose terminal recorded zero vessels at anchor and one at berth on Wednesday. In the 24 hours leading to Thursday, the terminal managed to service 74 external trucks at an undisclosed truck turnaround time on the landside. During the same period, CTMPT managed to execute 275 moves (383 TEUs) across the quay on the waterside. Stack occupancy was 42% for GP containers, a very low 8% for reefers, and 2% for empties during the same period. The terminal is anticipating the citrus season to kick off in April.

Durban

On Thursday, the Port of Durban started the morning with four operational tugs but swiftly returned to a complement of five available craft. Unfortunately, the challenges on the helicopters persisted this week, as five operational hours were lost on Wednesday due to intermittent breakdowns. The pilot boat certification is set to be done by SAMSA on Monday which should see the craft return to operations shortly after that. The certification process is anticipated to take about four hours. Furthermore, the technical team discovered some engine problems on the floating crane while doing steelwork. No ETR is available yet. The crane is more than 50 years old, and TNPA will seek a replacement in the next financial year.

MSC has launched its pioneering R350 million cold storage facility globally. Strategically located less than 10 km from the Port of Durban at 8 121005 Street, Chesterville, near Harry Gwala Road, the facility boasts 10 000 pallet spaces and caters to the burgeoning cold logistics sector, safeguarding the quality of temperature-sensitive goods during transit.

Pier 1 on Thursday recorded two vessels at berth, operated by five gangs, and one vessel at anchor. Stack occupancy was 43% for GP containers and remained undisclosed for reefers. During the same period, the terminal recorded 1 480 gate moves on the landside, with 236 cancelled slots and the wasted slots remaining undisclosed. On Wednesday, truck turnaround time was recorded at ~101 minutes, with an average staging time of ~116 minutes. Additionally, the terminal had 1 120 imports on hand, with 75 of these units having road stops and 58 units being unassigned. Towards the end of the week, the terminal made all imports available for collection and slightly ramped up both import and export slots to facilitate collection and discharge operations. During this time, the terminal had 12 RTGs available with the 13th crane returning on Thursday.

Pier 2 had three vessels on berth and six at anchorage on Wednesday. In the preceding 24 hours, stack occupancy was 61% for GP containers and undisclosed for reefers. The terminal operated with 11 gangs while moving 2 707 containers across the quay. During the same period, there were 2 589 gate moves on the landside with a truck turnaround time of ~97 minutes and a staging time of ~90 minutes. Additionally, 446 rail containers were on hand, with 354 moved by rail. The terminal had a reported 49 straddles in operation. The current availability of straddle carriers in the terminal stands at approximately ~52%, which is around ↓36% below the minimum number required to meet industry demand and achieve acceptable terminal performance. Additionally, South Quay returned to two operational cranes after crane 522 returned to service. Furthermore, the latest reports suggest that Transnet’s board has approved the finalisation of the contract to run the terminal, which will be awarded to the preferred bidder, Philippine terminal operator ICTSI. In terms of the deal, ICTSI will partner with TPT in a 25-year joint venture to develop and upgrade the terminal.

Durban’s MPT terminal recorded one container vessel at berth on Wednesday and three container vessels at outer anchorage while handling 399 TEUs on the waterside. Despite no volumes during this period, stack occupancy for breakbulk was recorded at 20% and 40% for containers. The terminal handled 534 container road slots, while 56 breakbulk road visits containing 1 484 tons were facilitated on the landside. During the same period, three cranes, five reach stackers, one empty handler, seven forklifts, and 19 ERFs were in operation. The third crane was used to facilitate training operations throughout the week during the 06:00 – 14:00 shift. Additionally, the revised ETR for the fourth crane is 22 March.

Richards Bay

On Tuesday, Richards Bay recorded nine vessels at anchor, comprising two break bulk vessels, two MPT coal carriers, two dry bulk vessels, and three RBCT coal vessels. A further seven vessels were recorded on the berth, consisting of four at DBT, and three at MPT. Two tugs, one pilot boat, and one helicopter were in operation for marine resources. On Wednesday, the coal terminal had three vessels at anchor and four at berth while handling 130 466 tons on the waterside. On the landside, 19 trains were serviced. Additionally, operations at the port were delayed between Tuesday and Wednesday for at least five hours due to adverse weather. The latest reports suggest that TNPA is accelerating the execution of port infrastructure development projects to reduce congestion and increase capacity at the ports of Durban and Richards Bay.

Eastern Cape ports

On Thursday, NCT recorded two vessels on the berth and zero vessels at the outer anchorage, with five vessels drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the preceding 24 hours. Stack occupancy was 29% for GP containers, 12% for reefers, and 26% for reefer ground slots, as a total of 2 488 TEUs were processed on the waterside. Additionally, 443 trucks were serviced on the landside at a truck turnaround time of ~40 minutes. Cranes 6, 7, and 8 at the terminal all remain out of commission. The ETR for crane 6 is scheduled for 15 March, while the other two cranes are anticipated to return around 22 March. Between Tuesday and Wednesday, the terminal was windbound for the entire 24-hour period.

Global container summary

Global port congestion is stable and currently affecting ~4,8% of the total fleet, with Durban the only South African port featuring on the first page of the “Port Congestion Watch” with a queue-to-berth ratio of 0,5714 (slightly less than last week and continuing its downward trajectory, which is positive). The idle capacity stands at ~0,3% of the total fleet, with that number set to drop even lower as some 300 000 TEU is scheduled for delivery in March (after new ship deliveries fell to just 194 000 TEU in February due to the holidays in the Far East). Lastly, the “Cancelled Sailings Tracker” is stable and is currently trending at around 8%15.

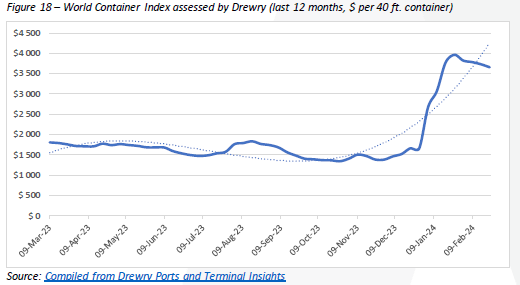

Global container freight rates and carrier profits

Global container rates continued their precipitous fall, as the “World Container Index” is down by another ↓5,9% (or $206) to $3 287 per 40-ft container16. Despite the weekly change, the composite index remains up by ↑82% compared to the same week last year and ↑131% higher than the average 2019 pre-pandemic rates of $1 420. All eight major East-West trades declined this week, with the most significant change occurring on the Shanghai – Rotterdam

BUSA-SAAFF Summary

In summary, the developments in the first two months of the year have given rise to some minor wins in our industry, which must be celebrated. For example, Durban’s vessel dwell time has notably improved to approximately five days, signifying enhanced efficiency and the likelihood of clearance of the long-standing backlog. In Cape Town, the port has implemented a fourth shift on Fridays, potentially mitigating congestion and delays. The presence of port equipment OEMs onsite has expedited repair times, bolstering operational reliability. Capital expenditure initiatives are underway to acquire new straddle carriers, hauliers, and reach stackers, essential components for port functionality. Private security measures are now deployed to police main rail lines, enhancing security and averting disruptions. Discussions regarding rail concessions are ongoing, with potential benefits contingent upon Transnet’s maintenance of line integrity. These developments collectively reflect positive strides within South Africa’s cargo movement landscape, promising improved efficiency and reliability.

Source: BUSA – SAAFF

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”