Welcome to another Logistics News Update.

It’s great news. The USA & China are speaking and that means we see the markets start to rebound.

The headlines are already showing this “US and China reach agreement to cut tariffs, US treasury secretary says”.

The United States and China have agreed to a 90-day pause in their trade war, easing tensions between the two economic giants. As part of the deal, the US will reduce tariffs on Chinese goods from 145% to 30%, while China will cut its tariffs on American imports from 125% to 10%. The agreement, reached in Geneva, is expected to bring some stability to global markets.” –This is a developing story, and we will keep our ears close to the ground. The market has responded by Stocks; dollar is all up on the news of US-China trade promise.

So, what does that mean for South Africa? It means that a lot of the larger vessels will be taken off other routes and be put back onto China – USA route. This means that freight will definitely go up, be prepared or book now before it does.

It seems we are starting the second week with good news, so let’s go find it in the local market. Freight News reports that “The South African Association of Freight Forwarders (Saaff) has welcomed the decision by Trade, Industry and Competition Minister Parks Tau to Gazette the “block exemption for ports, rail and key feeder road corridors” Saaff CEO Juanita Maree described the May 8 announcement as “excellent news.” And the news gets better, “SA wine industry predicts exceptional grape harvest” South Africa’s wine industry is expecting a strong 2025 grape harvest, with an 11% increase from last year, thanks to ideal ripening conditions. This comes alongside solid gains in other agricultural sectors like grains, soybeans, and horticulture, boosting overall export potential. With higher volumes and quality, industry leaders are prioritising export market growth, especially to China, despite facing tariff barriers compared to competitors like Australia.

On the Ground

Durban port has received new equipment; this is a positive move to keep up the good work.

Let’s Learn: What Is a Certificate of Origin and When Do You Need One?

Following last week’s topic on rules of origin, let’s focus on a critical document that proves your goods qualify for preferential trade, the Certificate of Origin.

What is it?

A Certificate of Origin (CO) is an official document that certifies the country in which your goods were manufactured. It’s issued by authorised bodies such as your local chamber of commerce and is essential when exporting under trade agreements like AGOA, SADC, or the EU–SA Trade Agreement.

Why is it important?

• It’s often a mandatory requirement for duty-free or reduced-tariff entry.

• Customs authorities in the destination country use it to verify eligibility under a trade agreement.

• Without it, your shipment could face delays, extra charges, or even rejection.

Types of Certificates of Origin

- Preferential CO – Used when trading under a trade agreement (e.g. AGOA, SADC, EPA).

- Non-preferential CO – Used when no agreement applies, but proof of origin is still required.

Tip for South African Exporters

Make sure your paperwork is accurate and complete. Even small mistakes can lead to rejections or penalties at customs.

💡 Tip: Create a checklist for every export that includes origin declarations, supporting invoices, and compliance documentation and ensure your clearing agent signs off before dispatch. A properly issued Certificate of Origin is your passport to smoother, more cost-effective international trade.

NEWS

Proposed cabotage rules in line with 91 other countries

09 May 2025 – by Ed Richardson

The South African government is advancing plans to implement cabotage regulations through the Merchant Shipping Bill of 2023. This legislation, which was open for public comment until April 2025, stipulates that only South African-owned vessels will be permitted to transport goods between domestic ports. The objective is to bolster the local maritime industry and enhance national control over coastal shipping activities.

By adopting these measures, South Africa would align itself with 91 other nations that have similar cabotage laws restricting foreign-owned vessels from engaging in domestic maritime trade. Such regulations are commonly employed to protect national shipping industries, promote employment within the sector, and safeguard economic sovereignty.

While the proposed cabotage rules aim to strengthen South Africa’s maritime capabilities, they may also lead to increased reliance on road and rail transport for domestic cargo movement. This shift could have implications for logistics costs and infrastructure demands. Stakeholders in the freight and logistics sectors are closely monitoring the potential impacts of these regulations on operational efficiency and competitiveness.

– Source: FreightNews – See full story here

WEEKLY NEWS SNAPSHOT

- Durban Port Enhances Capacity with New Cranes: Durban’s container terminal has invested approximately R1.5 billion over the past 18 months in new equipment, including the recent acquisition of ship-to-shore cranes. This investment is part of efforts to modernize port operations and improve cargo handling efficiency.

- Sugar Tariff Reduction Announced: The South African Revenue Service (SARS) has announced a reduction in the variable tariff formula rate of customs duty on sugar, effective May 9, 2025. This adjustment aims to balance domestic industry protection with consumer price considerations.

- Price Preference System Discount on Ferrous Scrap: The International Trade Administration Commission of South Africa (ITAC) has published a “Price Preference System” discount on ferrous scrap, effective May 8, 2025. This measure is intended to support local steel producers by ensuring access to affordable raw materials.

- OR Tambo Airfreight Volumes Increase Amid Challenges: Airfreight volumes at OR Tambo International Airport have risen 13% year-on-year, with imports and exports showing significant growth. However, the aviation sector faces challenges, including skills shortages and outdated air traffic procedures, leading to delays and cancellations. Transport Minister Barbara Creecy has initiated an urgent action plan to address these issues.

- Foot-and-Mouth Disease Reappears in Mpumalanga and Gauteng: New cases of foot-and-mouth disease have been reported in Mpumalanga and Gauteng, prompting China to suspend imports of cloven-hoofed animals and related products from South Africa. This development poses challenges for the livestock industry and export markets.

- PwC Forecasts Tightrope for 2025 Budget: PwC reports that Finance Minister Enoch Godongwana faces a challenging balance between stimulating economic growth and managing fiscal constraints in the upcoming 2025 budget. State-owned entities like Transnet and Eskom require significant investment, with Transnet needing R90 billion to modernize infrastructure. Despite these challenges, 83% of CEOs in South Africa expect economic growth to improve in 2025. . Source: – FreightNews

Key Highlights from Last Week’s Discussions: Source: BUSA

Cargo and Trade Update – Week Ending 4th 2025

Logistics Snapshot: Key Highlights This Week

1. Port Upgrades Signal Momentum but Delays Continue

- Nationwide rollout of 45 RTGs and new STS cranes is underway, marking meaningful progress for port capacity.

- That said, Durban and Cape Town continue to face delays due to adverse weather, equipment failures, and systemic challenges.

- Rail volumes out of Durban dropped by 32%, and the N3 closure from 9–11 May is expected to add more pressure.

2. Global Trade Lanes Disrupted by US Tariffs

- The impact of new US tariffs is reverberating through global shipping lanes: 8,6% of China–US capacity has been withdrawn, and bookings are down by up to 30%.

- Surplus tonnage is being redeployed to Europe, with freight and charter rates dropping again this week.

- South Africa’s logistics sector must prioritise resilience and agility to remain globally competitive.

3. Air Cargo Shows Mixed Signals

- Globally, air freight demand rose by 4,4% y/y in March, with Asia Pacific and North America leading the recovery.

- African carriers, however, saw volumes plunge by 13,4%, with Africa–Asia routes down 40% y/y.

- The continent’s load factor sits at just 37,1%, underscoring ongoing challenges in regional air cargo markets.

BUSA Report Insights – Week Ending 4 May 2025

- Port volumes dropped marginally by 1% week-on-week, with just over 82 000 TEUs handled.

- Air cargo volumes through ORTIA declined by 10% this week, marking the second consecutive dip.

- Durban’s Pier 2 handled 32 726 TEUs, but ongoing equipment breakdowns and weather continue to disrupt operations.

- A container train derailment near Cato Ridge impacted rail links between Durban and Pietermaritzburg.

- Lebombo border post performance improved, with queue and processing times each dropping by 29%.

- Maersk has adjusted THC rates for Mozambique, with notable increases taking effect from 1 June 2025.

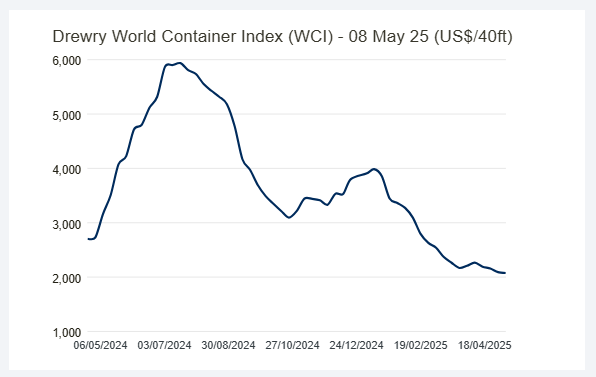

- Global container rates (Drewry WCI) fell by 3,1% to $2 091/40’, while charter rates dipped by 1,3%.

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS

Durban

Pier 1: 0-2 days

- Pier 2: No delays

- Durban Point: 0-2 days delay

Cape Town

CTCT: 0–4 days delay

- MPT: No delay

Port Elizabeth

PECT: no delays

- NCT: 0-1 days

- Coega 4 Days

Source: GoComet

Global Freight Rates

World Container Index –8th May 2025

Drewry’s World Container Index (WCI) has continued its downward trend, falling 1% week-on-week to US$2,076 per 40-foot container. While this represents an 80% drop from the pandemic-era peak of US$10,377 (September 2021), the rate remains 46% higher than the pre-pandemic average of US$1,420 recorded in 2019.

This softening comes amid a general decline in container demand, largely driven by shifting global trade flows following recent U.S. tariff policies, including a 145% tariff on Chinese goods and a 10% blanket import tariff on most other nations. Analysts project that U.S. imports from China could fall by as much as 40%, while imports from alternative sources may rise by 15%. These dynamics are reshaping capacity and pricing trends across major shipping routes.

In response, carriers are actively managing capacity. Between 12 May and 15 June, 58 sailings have already been cancelled across key East–West trade lanes, amounting to an 8% cancellation rate. This signals more volatility ahead in freight pricing and service availability.

📌 What to watch: With fewer vessels in circulation and peak-season demand around the corner, rates may stabilise or rebound unexpectedly. Importers and exporters are advised to plan early and remain agile.

Source: Drewry Supply Chain Advisors – WCI Weekly Update (8 May 2025)

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”