Welcome to another Logistics News Update.

Weather Disruptions and Supply Chain Pressures: This week, weather has significantly impacted operations in KwaZulu-Natal, with intermittent disruptions at the port. On a local front, members of the All-Truck Drivers Forum and Allied South Africa (ATDF ASA) have announced intentions to begin a nationwide strike, which could exacerbate pressures on our already strained supply chain. On Monday morning, an attempted blockade of the N3 was swiftly addressed, with the obstructing truck removed and the driver arrested.

In Mozambique, borders and operations have reopened following unrest, but some South African businesses have chosen to remain closed as a precaution. The country’s volatile situation has also led many holidaymakers to reconsider their plans for December, highlighting ongoing regional instability, however, Heightened Security Measures Have Been Implemented on Maputo Corridor Amid Anticipated Protests.

On The Ground Report: SAPS are stopping a lot of containers, once documents are submitted, at least 50% of the goods are “paper released” and the others are sent for inspection. – Please be aware of this. Transporters are still battling to get bookings, there has been no resolution on the booking system.

What Could a Trump Presidency Mean for South African Logistics? –There is concern about the potential challenges South Africa might face under a Trump presidency. However, during his previous term, Trump introduced the “Africa Strategy,” which supported cooperation and mutual interests between the U.S. and African nations. With an ex-South African (Elon Musk) serving as an advisor, it is likely that this collaborative approach will continue. From a trade perspective, Trump may prioritise mutual benefits in his dealings with South Africa, ensuring that economic ties remain strong. The African Growth and Opportunity Act (AGOA), which grants South Africa preferential access to the U.S. market, is expected to remain a cornerstone of this relationship, offering continued support to South Africa’s logistics and trade sectors. We will watch this space and hope that it will be to advantage.

Shipping expert Lars Jensen gives his opinion of Trump and Imports into the USA: – From a shipping perspective, the US-China trade war and potential new tariffs are expected to trigger a short-term surge in US import demand as shippers stockpile non-time-sensitive goods. Over the long term, supply chain patterns will likely shift, such as increased rerouting of Chinese goods via Mexico. US exports may face negative impacts due to retaliatory tariffs, exacerbating container flow imbalances. The potential January 15th US East Coast port strike adds uncertainty, depending on whether the Trump administration invokes Taft-Hartley or brokers an agreement. Meanwhile, ongoing port strikes in Canada are disrupting trade flows in the northern US. Delays at Asian ports like Shanghai and Ningbo are also mounting due to typhoon Kong-Rey. Globally, the Red Sea crisis continues, with reports suggesting Houthi rebels monetize it at $180M/month, though this claim lacks independent verification. US policy under Trump, focused on “America-first,” could influence both the Red Sea crisis and shipping policies, potentially favouring US-flagged vessels. Overall, the international shipping landscape faces heightened uncertainty and disruption in the short and long term. – Adapted from Lars Jensen – Leading expert in the container shipping industry

Weather and Operational Delays Impact South African Ports

South African ports continue to face significant challenges due to adverse weather conditions and operational delays. As of this morning, container vessels at Durban port are experiencing average anchorage times of 67 hours, with Pier 1 at 25 hours and Pier 2 at a concerning 110 hours. Ngqura port is slightly better off with an average anchorage time of 37 hours. Additional delays were reported at Richards Bay due to adverse weather, while NCT and PECT faced setbacks from strong winds, power outages, and equipment breakdowns. Durban port saw disruptions to vessel movements caused by weather conditions and tug shortages. These ongoing delays are likely to impact supply chains and lead to increased costs for businesses.- Source: BUSA

Port Update

- Durban:

- Wind Delays: Ongoing windy weather causing significant disruptions, weather is good today.

- Pier 1: Delays of 3–5 days.

- Pier 2: Severe delays of 9–14 days.

- Durban Point: Delays of 3 days.

Cape Town:

- Wind Delays: Adverse weather impacting operations.

- CTCT: Delays of 4–6 days.

- MPT: Minor delays of 0–2 days.

Port Elizabeth:

- Wind Delays: Weather is good today but wind is expected.

- PECT: Delays of 1–3 days.

- NCT: Delays of 3–5 days.

Summary:

Windy weather across South African ports continues to disrupt operations, with Durban bearing the brunt, especially at Pier 2, facing delays of up to two weeks. Cape Town and Port Elizabeth have been less severely affected, but delays are still notable. Traders and shippers should plan accordingly to mitigate disruptions.

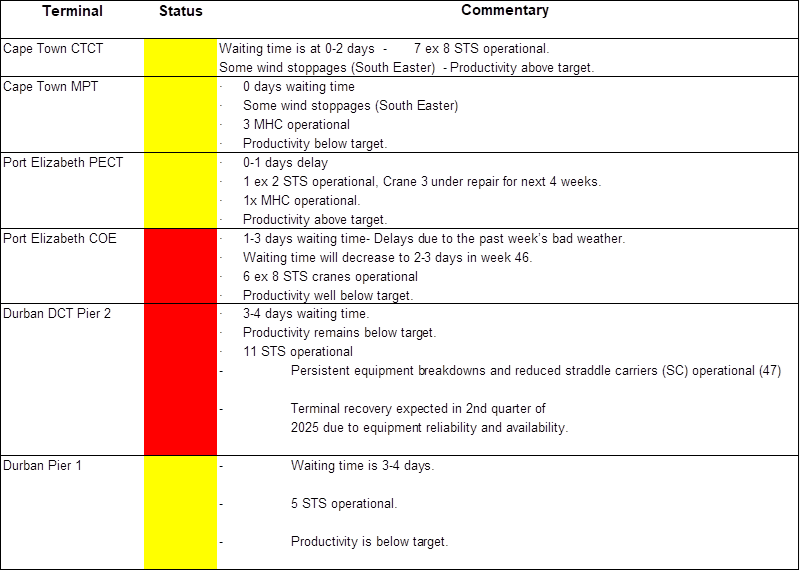

South Africa Terminal and Service Update – Week 46 – By Maersk

Terminal Performance and Challenges: South Africa’s terminal performance continues to face significant hurdles, with equipment downtime severely impacting productivity and leading to extended port congestion. The Durban Container Terminal (DCT) is experiencing the most delays, with waiting times of 3–4 days due to reduced operational capacity and ongoing equipment breakdowns. Cape Town, despite wind stoppages, reports improved productivity with minimal delays, while Port Elizabeth and other terminals are making slow progress in addressing operational setbacks.

Equipment and Logistics Updates: Dry equipment supply remains tight in Cape Town and Johannesburg, but all export bookings have reopened without restrictions. Rail services between Durban and Johannesburg remain fully operational, providing some relief for inland logistics. Meanwhile, civil unrest in Mozambique has disrupted operations, with the N4 Lebombo border crossing closed, and long truck queues reported at South African borders.

Service and Rate Adjustments: Maersk has announced the removal of the Congestion Surcharge Fee (USD 200/400) for Far East Asia to Durban and Cape Town routes, effective 8th November. Despite delays and constraints, export bookings remain fully open across all services, while import bookings face selective restrictions. Customers are encouraged to leverage staging and transport solutions to mitigate disruptions and consider discounted free-time extension products for managing import delays.

Port Update

Source: Maersk

NEWS

Transnet is responsible for business closures – CT harbour carriers

01 Nov 2024 – by Eugene Goddard

The All-Truck Drivers’ Forum Allied South Africa (ATDF-SA) suspended its planned national shutdown. Picture Archive: Timothy Bernard

The All-Truck Drivers Forum and Allied South Africa (ATDF ASA) has announced plans for a nationwide strike (this week 11-15 November ‘24), escalating tensions within the freight and logistics industry. At the heart of the dispute are concerns over the hiring of foreign nationals, which drivers argue undermines their job security and creates unfair competition. Additionally, many drivers allege that employers are failing to adhere to minimum wage policies and overtime regulations, leading to financial hardship.

The strike comes amid a backdrop of ongoing disputes between truck drivers and employers. Previous protests, including road blockades and acts of vandalism, have caused significant disruptions to supply chains and the broader economy. Drivers feel their grievances have been largely ignored by bargaining councils and industry leaders.

To avert a potential crisis, stakeholders in the freight and logistics industry must address the underlying issues promptly. This includes ensuring compliance with labour laws, establishing fair hiring practices, and improving communication channels between employers and drivers. Failure to do so could result in further protests and severe disruptions to the nation’s supply chain..

–Adapted from Source: SABC News

Local Steel Gets a Boost: New Scaw Mill to Replace R4 Billion in Imports

11 Nov 2024 – by Staff Reporter

Great news for South African manufacturing! Scaw Metals, a leading steel producer, has invested over R5 billion in a new steel mill located in Johannesburg. This exciting development is poised to significantly reduce the country’s reliance on imported steel from China.

The new facility is designed to manufacture flat steel products, a category currently dominated by imports, particularly from China. Scaw’s production is expected to replace an estimated R4 billion worth of imported steel, catering to the local demand that existing South African producers haven’t been able to fully meet.

This investment marks a significant step towards self-sufficiency in steel production for South Africa. The increased domestic production will not only benefit the construction and manufacturing sectors but also create new job opportunities within the country.

Exporters of scrap metal will now have to offer local steel producers their goods first before getting permission to export our scrap

–Source: FreighNews Read the full story here

Weekly Snapshot

- Port Congestion and Delays: The Port of Durban continues to face severe congestion, with vessel berthing delays extending up to a month. Simphiwe Mpanza, corporate affairs manager for Durban Terminals, acknowledged the challenges, stating, “The terminal always aims to do better.”

- Security Concerns: There has been a notable increase in criminal activities targeting couriers, prompting logistics providers to heighten vigilance to safeguard their operations.

- Infrastructure Developments: Eskom has secured funding from a French agency to support a new hydroelectric project, aiming to enhance South Africa’s energy infrastructure.

- Trade Relations: Solidarity’s head of international liaison, Jaco Kleynhans, is in the USA engaging with influential figures in the newly elected government to advocate for the retention of the African Growth and Opportunity Act, which is crucial for trade between South Africa and the United States.

- Global Trade Dynamics: China has initiated dispute consultations with the World Trade Organization concerning the European Union’s duties on battery electric vehicles, a move that could have significant implications for international trade.

- Political Impacts on Trade: Analysts are assessing the potential effects of the recent U.S. presidential election on Africa, with concerns that a reduction in Chinese exports to the U.S. could dampen Chinese demand for commodities such as copper, zinc, and iron ore.

- Regional Stability: Political unrest in Mozambique has adversely affected South Africa, with infrastructure at the Ressano Garcia Border Post and the KM4 truck-staging facility suffering severe damage.

- E-commerce Challenges: The potential implementation of de minimis thresholds by the U.S. government under President Trump could impact e-commerce volumes, particularly affecting parcels originating from China.

These events underscore the dynamic nature of the freight and logistics industry, highlighting the need for stakeholders to remain adaptable and informed.

Key Observations

- Container Shipping Rates:

- Update: Container shipping rates have decreased by another 2.5%, now averaging $3,015 per 40-ft container. This reflects sustained downward pressure on freight costs.

- Charter Rates: Remain stable, but continue monitoring for any fluctuations.

- Air Cargo Growth:

- Update: African air cargo sales maintained strong momentum with a 10% growth in October, driven by ongoing demand in e-commerce and high-tech shipments from Asia-Pacific.

- Local Insight (South Africa):

- Domestic rates are relatively steady; however, import/export demand shows slight fluctuations due to global supply chain constraints.

- Weather-related port delays (noted earlier) are impacting the movement of goods, particularly for Durban-bound cargo.

This update highlights continued changes in shipping rates and the sustained growth in air cargo demand, reflecting dynamic market conditions and opportunities in the logistics sector.

Global Shipping Update

- Brazil: Ports are under heavy strain from increasing cargo volumes and limited capacity, causing delays and higher costs for shipping companies and traders.

- Far East: Surging demand has prompted carriers to adjust routes, disrupting direct sailings and transshipments through key hubs like Singapore, where delays are notable.

- South Africa (Durban Port): Equipment shortages, weather disruptions, and maintenance issues are hampering operations, affecting inbound and outbound schedules.

- India: Major ports are experiencing delays due to blank sailings and backlogs.

- Singapore: Transshipment delays average 2–3 weeks, impacting global schedules.

- These challenges highlight widespread disruptions across the shipping industry, affecting trade and logistics worldwide.

Summary

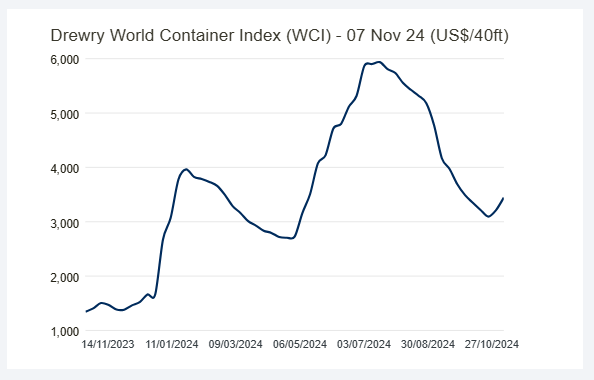

Global Container Freight Rates

Drewry World Container Index (WCI)

Drewry’s World Container Index increased 7% to $3,444 per 40ft container this week.

Market Update: Ocean Freight Rates on the Rise

As of November 7, 2024, Drewry’s World Container Index (WCI) reported a 7% increase, bringing the average cost to $3,444 per 40-foot container. This rate is 67% below the pandemic peak of $10,377 in September 2021 but remains 142% higher than the pre-pandemic average of $1,420 in 2019. The year-to-date average composite index stands at $4,005 per 40-foot container, surpassing the 10-year average of $2,843, which was influenced by the exceptional rates during the COVID-19 period.

Key Rate Movements:

- Shanghai to Genoa: Increased by 21% ($751) to $4,399 per 40-foot container.

- Shanghai to Rotterdam: Rose by 16% ($558) to $3,954 per 40-foot container.

- New York to Rotterdam: Up by 3% ($25) to $785 per 40-foot container.

- Rotterdam to Shanghai: Decreased by 3% ($19) to $524 per 40-foot container.

- Rotterdam to New York: Fell by 2% ($40) to $2,624 per 40-foot container.

- Shanghai to Los Angeles: Slight decline of 1% ($33) to $4,806 per 40-foot container.

- Los Angeles to Shanghai and Shanghai to New York: Rates remained stable.

The uptick in spot rates on the Asia-Europe trade lane has persisted for the second consecutive week, with expectations of continued increases in the coming week.

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”