Welcome to another Logistics News Update.

This week’s newsletter is packed with critical updates that could impact your operations.

We’ve got the latest on:

- Potential National Truck Driver Shutdown: Be prepared for disruptions as the All-Truck Drivers Forum and Allied South Africa (ATDF-ASA) plan a nationwide shutdown on May 20, 2024.

- Fuel Price Impact Analysis: Discover how rising fuel costs are affecting sales, logistics, and manufacturing output.

- Freight Rate Increases & Reasons: Get insights from our agent’s report on the factors driving up freight rates.

- Ongoing Port Delays: Stay informed about current delays at South African ports, with a focus on the critical congestion at Durban’s Pier 2 (up to 21 days).

- In Summary by BUSA-SAAFF: “With freight rates projected to increase to upwards of $5 000 per 40ft container soon, our manufacturing, Agri, and indeed all sectors will not be able to absorb further costs… ‘’

In addition to these key updates, you’ll also find: A valuable Forex Tip of the Week to help you navigate those things you just don’t understand.

BREAKING NEWS – There is a proposed nationwide shutdown on the roads, as the All-Truck Drivers Forum and Allied South Africa (ATDF-ASA) has reportedly called for this. NATIONAL: PLANNED NATIONAL SHUTDOWN BY ATDF-ASA –According to information received, members of the All-Truck Drivers Forum and Allied South Africa (ATDF-ASA) are planning a national shutdown on May 20, 2024. Please be aware of this potential disruption.

The on-the-ground logistics update will provide you with the latest insights on what’s happening at the ports. This past week saw a setback in productivity due to equipment issues. Looking back at last week’s port activity, the situation remains challenging, with significant delays and schedule changes reported across South Africa’s major ports.

Forex Tip of the week

What are Advanced Import Payments or AIPs?

Advanced Import Payments (AIPs) allow importers to pre-pay their overseas suppliers before receiving the goods. However, this approach comes with a structured compliance framework. Importers need a valid import license and must participate in the South African Revenue Service’s (SARS) Advance Payment Notification (APN) system, which applies to transactions exceeding R50,000.

To whom must an Advance Payment Notification be made?

An APN must be made to SARS, speak to your Forex specialist to find out more.

On The Ground Logistics Update:

It seems that Portnet is chasing its tale, equipment is a real problem, and they are moving vessels between different berthing’s to be able to accommodate the volume, however knowing for sure if a container is going to be release has become a guessing game. Clearing Agents have been reporting that they are all facing difficulties pertaining to our import shipments out of the Far East, they gave a synopsis of what has led to this crisis they are facing and why they are facing the current rate increases, space limitations and equipment shortages from all shipping lines.

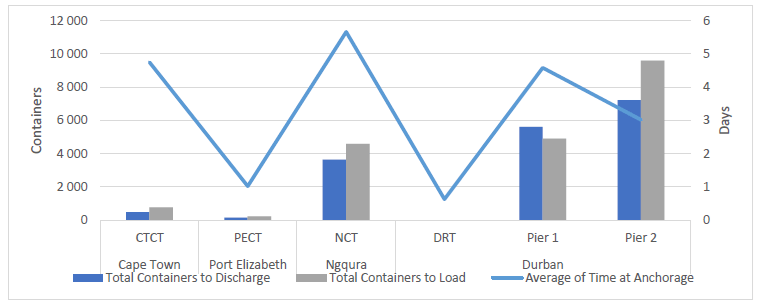

Durban faces the most severe congestion, with Pier 2 experiencing staggering delays of up to 21 days, while Pier 1 expects 5–6-day delays. Cape Town’s terminals are navigating moderate delays of around 5 days. Port Elizabeth seems to be faring better, with minimal 3-day delays at both PECT and NCT terminals. Overall, Durban’s Pier 2 emerges as the most congested, while Port Elizabeth’s terminals currently have the least delays compared to Durban and Cape Town.

Durban Port Congestion:

Backlogs outside the port of Durban reached a crisis point between the 23rd and 30th November 2023 when an estimated 79 vessels and more than 61 000 containers for forced to remain at outer anchorage due to operation challenges, equipment failures and bad weather. This continued through the months and currently as of week 18 – we are still facing port delays of up to 21 days.

Red Sea Crisis:

The Red Sea crisis began on the 19th of October 2023, which have obstructed the usual flow of maritime traffic. These disruptions have necessitated all carriers, to adjust their routing. Consequently, they are now navigating around the Cape of Good Hope, which has resulted in increased bunker consumption and an average extension of transit times by 10 days on average.

Operations along the Far East lines are particularly affected, as these routes typically utilise the Red Sea canal. Due to the rerouting around the Cape of Good Hope, many shipping lines had no choice but to announce blank sailings, as the vessels’ turnaround to the Far East is considerably delayed. South African port challenges are also compounding to the disruptions and delays which affect vessel turn around.

Disclaimer: Please note: All information presented in this newsletter is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed.

NEWS

Also read: Container Line Reliability Improves

Learn more about the air cargo boom and the port challenges in this week’s story here Air cargo sector continues to soar.

High prices choke fuel sales, impact logistics

10 May 2024 – by Jeanne van der Merwe

Source: ETEnergyworld

High fuel prices are taking a toll on fuel sales for the KAL Group, with sales down to 307.4 million litres in the six months to March compared to the same period a year before.

In addition, says Sean Walsh, CEO of KAL Group, the company has noticed a significant drop in petrol sales from its own fuel business, The Fuel Company (TFC), and an increase in diesel sales as the freight sector started taking more market share and private vehicle use decreased.

“As soon as the (petrol) price went beyond R16 per litre, we saw the general public’s travel patterns reducing. In our group we’ve seen petrol sales down 5-6% and diesel sales up around 3-4%.”

In the half-year to March 2022, diesel sales made up 54% of TFC’s fuel sales, rising to 55.3% in the same period a year later, and ending on 56.5% at the end of March this year.

The KAL Group sold 2% less fuel during the reporting period, but industry talk puts competitors’ sales losses between high single-digit and low double-digit percentages.

Walsh said the group’s biggest logistical challenge was the expense of transporting grains by road instead of rail, due to the deteriorating service quality of Transnet Freight Rail.

“The cost per ton differential between road and rail is between R300 and R400 per ton. At nearly 20 million tons of grain that has to be transported every year, if we could get 80% of grain transport back onto rail, we could save the country and everyone in it a fortune.”

Source: Freight News

Manufacturing production output dips

10 May 2024 – by Staff reporter

Manufacturing production plummeted in March and came in much weaker than expected, according to the latest data released by Statistics South Africa.

Bureau for Economic Research economists noted in their Weekly Review that the latest official data showed that manufacturing output had decreased by 2.2% month-on-month and was down by 6.4% compared to March 2023, marking the biggest annual decline in almost two years.

“While monthly fluctuations are noteworthy, examining quarterly trends offers a clearer understanding of the sector’s dynamics and gives a good idea of the sector’s contribution to GDP growth,” the BER noted.

During the first quarter of 2024, output was 1% lower than in the fourth quarter of 2023.

“Notably, two of the largest divisions made positive contributions to quarterly growth: food and beverages (2.7% q-o-q) and petrochemicals (2.6% q-o-q). This was outweighed by steep declines in vehicle manufacturing (-14.9%) and steel and machinery (-3.1%),” the economists said.

“Fortunately, following a poor start to the year, the recent more upbeat Absa PMI suggests a potential improvement in production in April.”

April’s electricity production is also expected to be better than it was in the first quarter due to the absence of load-shedding. More load-shedding in 2024Q1 relative to 2023Q4 meant that electricity output was down 1% q-o-q.

Source: Freight News

PORTS

Weather and other delays:

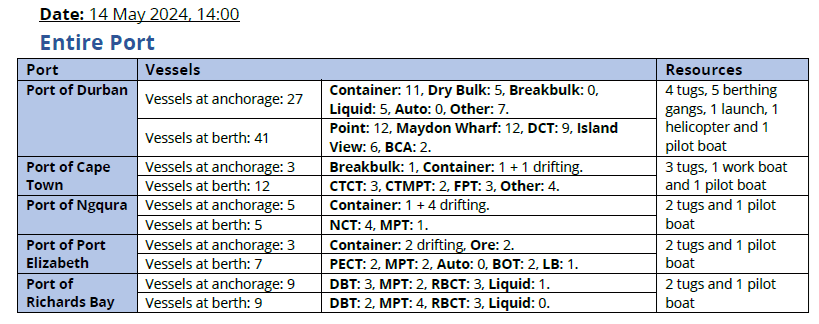

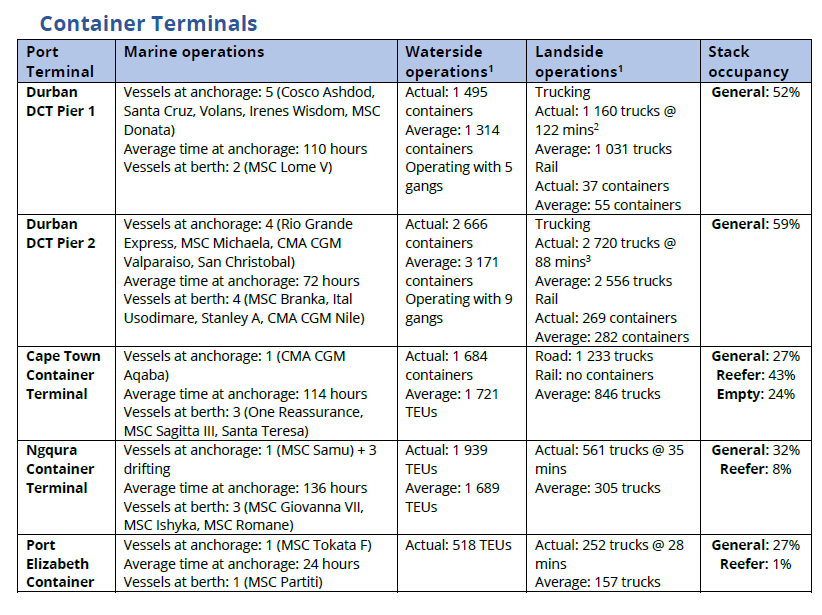

- Average time at anchorage for container vessels as of 06:00 this morning: Durban: 85 hours (Points: 15 hours, Pier1: 110 hours, Pier 2: 72 hours), Cape Town: 114 hours, Ngqura: 136 hours, Port Elizabeth: 24 hours. The figure below shows the current situation at our ports from a container vessel perspective (please note that these figures where necessary have been estimated to the best of our knowledge and abilities). The line indicates the average number of days vessels have been waiting at anchorage (in days), and the bar graphs represent the total volume of containers to be loaded and discharged for the vessels at anchorage at 06:00 this morning).

- Three vessel movements were delayed in Durban due to occupied tugs.

- Berth 203 at DCT is expected to be out of commission between 15 and 16 May due to dredging operations.

- After the rainy weather experienced at the Port of Richards Bay yesterday, no strong winds or adverse weather conditions are expected today.

- A vessel at NCT experienced some delays yesterday due to a change over at one of the berths.

Equipment Availability:

- Available resources at the Port of Durban include: Four tugs, one pilot boat, one helicopter, and one floating crane.

- Durban MPT reported equipment availability as follows: three cranes, nine reach stackers, one empty handler, seven forklifts, and 16 ERFs. The fourth crane is still anticipated to return to service by the end of the month.

- DCT Pier 2 reported having only 49 straddle carriers available this morning. Additionally, Pier 1 reported having 11 RTGs available, awaiting two more RTGs to return to service as the day progresses.

- Crane 3 at NCT has a faulty cable and will be taken out of commission later today. Additionally, crane 7 is also still out of service for planned maintenance which subsequently renders crane 8 as inaccessible.

- At the time of reporting, CTCT was operating with seven STS cranes, 25 RTG’s and 42 haulers, while CTMPT had two operational cranes.

- The helicopter at the Port of Richards Bay is still out of commission and should return to service during the course of next week.

Ports Update

Summary of port operations

- Vessel ranging and adverse weather represented the main operational constraints in Cape Town.

- Equipment breakdowns and shortages prevented optimal performance in Durban.

- Strong winds, dense fog, and RTG breakdowns constrained our Eastern Cape Ports operations.

- No delays were reported at the Port of Richards Bay this week.

Cape Town

On Thursday, CTCT recorded three vessels at berth and two at anchor as adverse weather conditions impacted operations at the terminal. Between Monday and Thursday, the terminal handled 6 545 container moves on the waterside, translating to an average of 1 636 daily moves. On the landside, during the same period, the terminal managed to service 4 651 trucks, translating to an average of 1 163 trucks per day while handling 151 rail units. By the end of the week, stack occupancy for GP containers was recorded at 32%, reefers at 49%, and empties at 22%. At the start of the week, the terminal operated with seven STS cranes, 26 RTGs, 42 hauliers, and three straddles. The terminal lost at least 22 operational hours this week due to vessel ranging.

The multi-purpose terminal recorded one vessel at anchor and one at berth on Thursday. In the preceding 24 hours, the terminal managed to service 77 external trucks at an undisclosed truck turnaround time on the landside. During the same period, CTMPT managed to move 2 098 tons of bulk across the quay on the waterside. Stack occupancy was recorded low at 20% for GP containers, 76% for reefers, and 2% for empties. The terminal lost around ten operational hours throughout the week due to inclement weather conditions. Throughout the week, the terminal managed to move 2 497 TEUs, exceeding the 2 088 TEUs target at a GCH of ~14 and SWH of ~14.

During the week of 29 April to 05 May 2024, the FPT terminal serviced nine vessels comprising five multi-purpose vessels, one vessel containing fruit, and three container vessels. Berth occupancy during this period was recorded at 62%. During the week, 2 602 TEUs were handled, while 1 000 tons of general cargo was handled. Additionally, 3 785 pallets of fruit and 3 301 tons of dry bulk were handled. FPT planned to handle seven vessels between 06 and 12 May, with another seven planned between 13 and 19 May. Adverse weather and crane breakdowns accounted for most of the delays at the terminal this week.

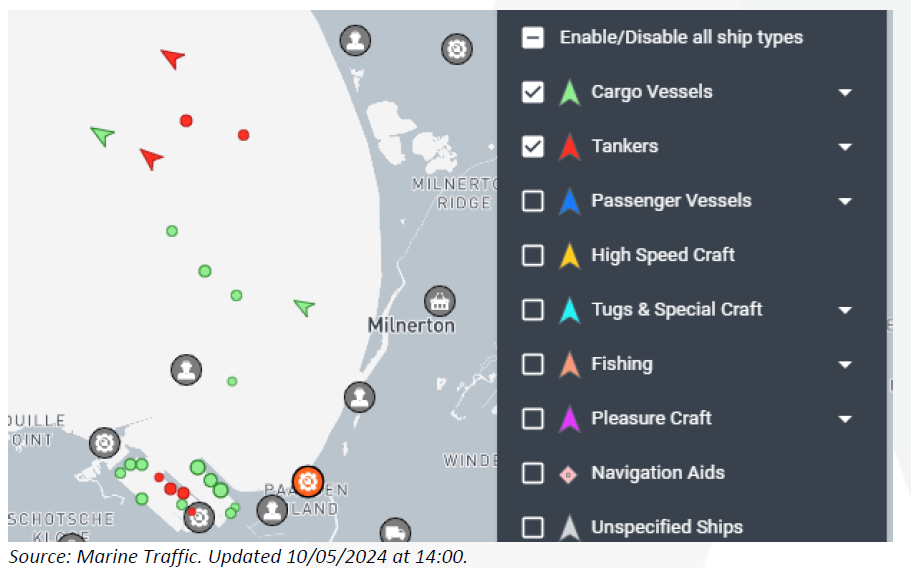

At midday on Friday, ten vessels were waiting outside at anchorage in Cape Town, with the following snapshot of the port and vessels waiting to berth:

Figure 8 – Cape Town vessel view (per vessel group)

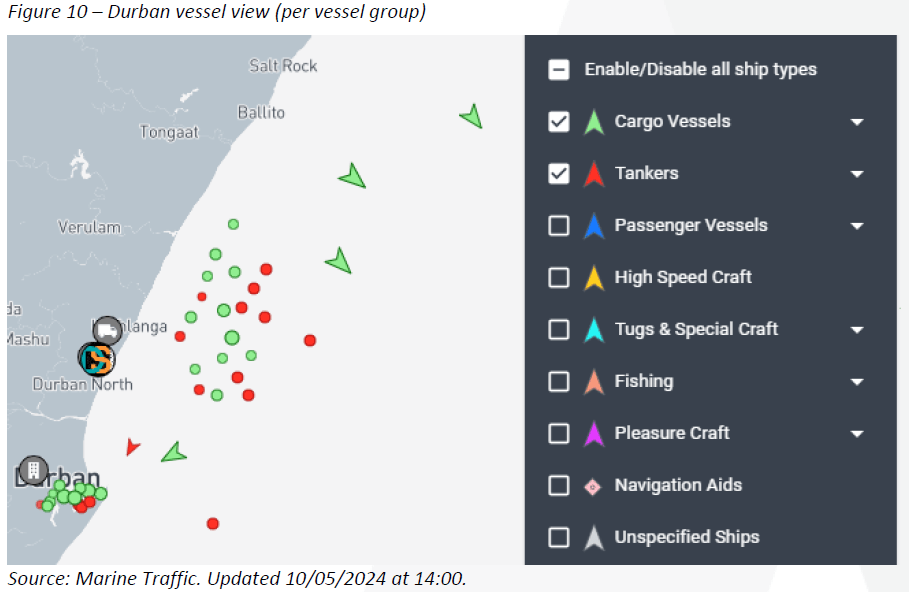

Durban

Durban

On Thursday, Pier 1 recorded two vessels at berth, operated by five gangs, and three vessels at anchor. Stack occupancy was 64% for GP containers and remained undisclosed for reefers. Between Monday and Thursday, the terminal executed 4 287 gate moves on the landside at an average truck turnaround time of ~109 minutes and an average staging time of ~83 minutes. Additionally, the terminal moved 5 739 TEUs across the quay on the waterside throughout the week.

Pier 2 had four vessels on berth and four at anchorage on Thursday as equipment breakdowns and shortages impacted the terminal throughout the week. In the 24 hours before Thursday, stack occupancy was 55% for GP containers and remained undisclosed for reefer ground slots. The terminal operated with 11 gangs while moving 11 400 containers across the quay throughout the week. Between Monday and Thursday, there were 9 611 gate moves on the landside at an average truck turnaround time of ~136 minutes and an average staging time of ~165 minutes. Additionally, 967 units were moved by rail in the same period. The number of available straddle carriers was not reported this week.

Durban’s MPT terminal recorded one vessel at berth on Thursday and zero vessels at outer anchorage. On the waterside, 215 containers were moved across the quay, while 182 container road slots and 15 breakbulk RMTs were serviced on the landside. Stack occupancy for breakbulk at C-square was recorded at 17% and 10 53% for containers. During the same period, two cranes, eight reach stackers, one empty handler, and 18 ERFs were in operation. The third crane was utilised for training purposes, while the fourth crane is anticipated to return to service by the end of the month.

On Thursday, the Maydon Wharf MPT had one vessel on berth and zero at outer anchorage, as 968 volumes were handled on the waterside. Nine trucks were serviced on the landside. During the same period, the Agri-bulk facility had no vessels

Richards Bay

On Thursday, Richards Bay recorded 14 vessels at anchor, while 13 vessels were berthed, consisting of five at DBT, five at MPT, two at RBCT, and one at the liquid-bulk terminal. Two tugs, one pilot boat, and one helicopter were in operation for marine resources. During the same period, the coal terminal had six vessels at anchor and two at berth while handling 177 101 tons on the waterside. On the landside, 26 trains were serviced, exceeding the target of 22.

Eastern Cape ports

On Wednesday, NCT recorded three vessels on the berth and one at the outer anchorage, with four drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading to Thursday. Stack occupancy was 36% for GP containers and 31% for reefers., as a total of 1 689 TEUs were processed on the waterside. Additionally, 563 trucks were serviced on the landside at a truck turnaround time of ~41 minutes.

On Wednesday, GCT recorded one vessel at berth and one at outer anchorage. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading to Thursday. On the waterside, 556 TEUs were handled across the quay, while 302 trucks were processed at a truck turnaround time of ~44 minutes. Stack occupancy figures were recorded at 42% for GP containers and 34% for reefers.

This week, no reports were received for the Ports of Port Elizabeth and East London.

Eastern Cape ports

On Tuesday, NCT recorded two vessels on the berth and one at the outer anchorage, with two drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation 24 hours before Wednesday. Stack occupancy was 31% for GP containers, 47% for reefers, and 82% for reefer ground slots, as a total of 1 185 TEUs were processed on the waterside. Additionally, 254 trucks were serviced on the landside at a truck turnaround time of ~37 minutes. Towards the end of the week, the terminal experienced delays of up to six hours due to strong winds.

No reports were received for either the Ports of Port Elizabeth or East London this week

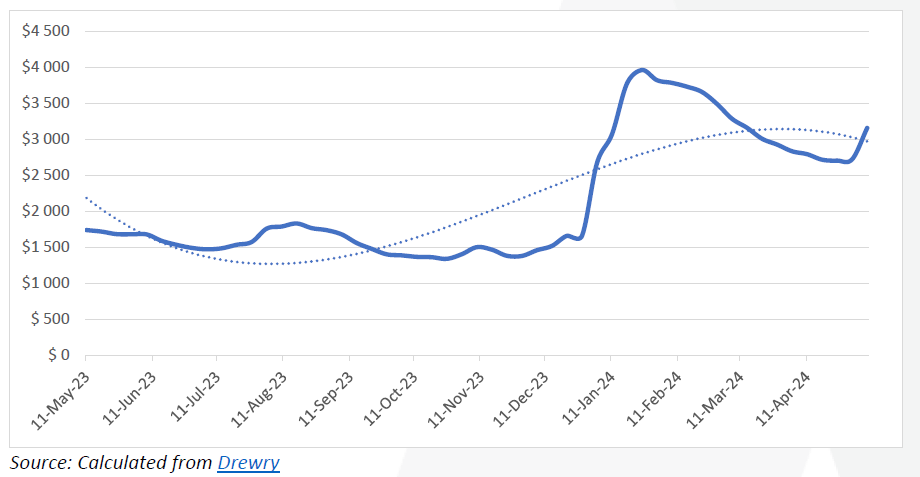

Global Container Freight Rates

Global container capacity and freight rates

Robust activity in the container freight and charter markets continues this week, with ongoing rate increases and strong demand for ships13. Over-capacity concerns are currently sidelined due to diversions of containerships to the Cape route, removing over ~7% of the total fleet. Global congestion continues to subside, as is the case in South Africa, as congestion keeps improving steadily in Durban in particular, although the port remains on the first page of Linerlytica’s “Port Congestion Watch” at a queue-to-berth ratio of 0,5114. Furthermore, there is almost no capacity sitting idle (only ~0,3% of the total fleet – with several Mediterranean hubs facing a transhipment blockage15), as the “Cancelled Sailings Tracker” remains low but slightly increased this week to 5%16.

Also, there’s a noticeable shift in tonnage requirements towards Mexico and the Middle East/Indian subcontinent, highlighted by the launch of three new services to Mexico by COSCO, CMA CGM, and MSC, and MSC’s rerouting of service to cater to the Mexico and Caribbean market. In the context of freight futures, there was a significant rally during a holiday-shortened trading week. The collapse of peace talks in the Middle East has heightened expectations for further rate hikes over the next two months on the North Europe route, where capacity utilisation has reached a three-year high. The overall market absorption trends are evident in the analysis by Sea Intelligence this week, evidently indicating a ‘carrier-controlled’ market, as some analysts have put it17:

Source: BUSA-SAAFF

BUSA-SAAFF Summary

In summary, the recent successes achieved by the energy sector – especially the collaboration between the government and the private sector – are a blueprint for the logistics sector. Private sector participation must be accelerated – else South Africa will continue to fall short of meeting its high freight demand. In the ports sector, it is clear that Transnet needs a revamp – especially with accelerating equipment procurement and modernising port processes. The fact that the global containerised industry continues to accelerate more rapidly than our own recovery sends alarm bells ringing. Indeed, the increased demand on Far East, European, and North American trade lanes should further drive impetus for South Africa to get its own house in order. With freight rates projected to increase to upwards of $5 000 per 40ft container soon, our manufacturing, agri, and indeed all sectors will not be able to absorb further costs – which is added to the supply chain delays already experienced since October last year.

Source: BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape.