Welcome to another Logistics News Update.

The citrus export season has closed on a strong note, finishing with a 19% year-on-year increase in volumes, according to Transnet Port Terminals.

Durban’s multi-Purpose Terminal recorded the most significant improvement, up 131.6% compared to last year. Ngqura Container Terminal increased volumes by 35%, while Cape Town Container Terminal and Durban Pier 2 rose by 27.4% and 28.8%, respectively.

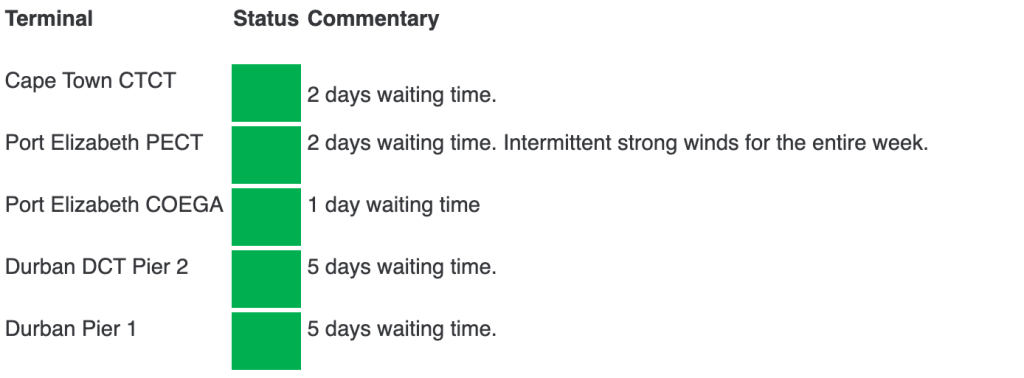

Locally, while port performance is improving, peak season pressure is being felt. Durban is currently experiencing vessel waiting times of around five days, and transporters are reporting extended delays to load or offload cargo. In Cape Town, trucking delays of up to five hours are being reported, even with prior booking.

At the same time, global pressures continue to shape our operating environment. From 14 October, vessels owned or operated by Chinese entities will face new port-entry fees in the United States. Charges will begin at $50 per net ton, rising to $140 by 2028. US Customs has warned that non-compliant vessels may be denied cargo operations or departure clearance a development that could impact freight rates and routing decisions worldwide.

Regionally, South Africa has received one of the first commercial shipments under the African Continental Free Trade Area (AfCFTA), dispatched from Ethiopia. The cargo included meat, fruit, pulses, and horticultural products, all moved under preferential trade terms — a positive signal for intra-African trade growth.

Trade

- TRADE ADVISORY: The United Arab Emirates (UAE) requires, from 1st Feb 2026, a 12-digit HS Code on the house bill of lading.

- Trade deal “imminent”: South Africa’s trade minister, Parks Tau, stated in mid-October 2025 that the two countries are very close to finalising a trade agreement. He described the ongoing dialogue with the U.S. as tough but progressive. Source ~ Click Here

- AGOA has lapsed: A significant driver of these urgent talks is the fact that the African Growth and Opportunity Act (AGOA) expired on September 30, 2025. This has eliminated duty-free access for many South African goods, leading to severe tariffs that threaten key export sectors.

- Disruptive tariffs: The expiration of AGOA followed the Trump administration’s decision in August 2025 to impose 30% tariffs on South African exports, heavily impacting the automotive and agriculture industries.

What is the news

- Minister Creecy says vessel congestion has eased and weekly TEU targets are now being met at major ports.

- A fire at the Kazungula border involving hazardous chemicals exposed serious gaps in dangerous goods handling and border safety protocols.

- Transnet and ICTSI celebrated the Durban Terminal Pier 2 concession verdict after the court dismissed Maersk’s legal challenge.

- Port operations are showing strong gains: Transnet Port Terminals has averaged over 90,000 TEUs weekly since June, up from ~65,000 last year, supported by new equipment and maintenance efforts.

- Port Elizabeth’s container terminal has boosted capacity with a new Ship‑to‑Shore crane to support more efficient handling.

- Port of Gauteng project gains support: Industry leaders say the R50 billion dry port plan could relieve Durban congestion and resolve systemic inefficiencies along the Durban-Gauteng corridor.

Let’s Learn: What Is Overcapacity in Shipping?

Freight rates are falling again, and the term “overcapacity” keeps coming up. But what does it really mean, and why does it matter to your business?

What Is Overcapacity?

Overcapacity happens when there are more ships (or containers) available than there is demand for cargo. In short, there’s too much space chasing too little freight.

Why Does It Happen?

• Shipping lines order new vessels based on past demand

• When the economy slows or demand drops, the new capacity still arrives

• Major events like COVID, trade wars, or rising interest rates can suddenly shift volumes

What Are the Impacts?

• Rates drop – Carriers fight for cargo, and prices fall

• Blank sailings rise – To manage the excess, carriers cancel sailings

• Reliability suffers – Schedule changes become more common as carriers shuffle capacity

• Consolidation risk – Some weaker carriers may exit routes or collapse

What Should You Watch?

• If rates seem “too good to be true”, check the service levels

• Plan for instability – low rates often mean less schedule certainty

• Lean on partners with multi-carrier access and route flexibility

Key Point:

Overcapacity is good for your freight bill in the short term, but it comes with risk. Stability, routing options, and proper planning are more important than chasing the cheapest rate..

NEWS

South Africa’s port performance is improving – Creecy

Source: FreightNews – Lyse Comins

South Africa’s Port Performance Is Finally Improving

Creecy: TEU Targets Met, Queues Cleared, and Rail Volumes Rising

Transport Minister Barbara Creecy says South Africa’s ports are showing real signs of recovery. Addressing the National Press Club, she confirmed that weekly container targets are now being met or exceeded and terminal queues have been eliminated. This follows a difficult period of chronic underperformance across the logistics system.

What You Need to Know:

• TEUs handled at ports increased by 48 000 containers in the past year – a 54% rise.

• Rail freight grew by 9 million tonnes, reaching 161 million tonnes for the year.

• Port targets for crane productivity are being set at 30 gross crane moves per hour.

• Transnet aims to move 250 million tonnes of freight by 2029.

• The Department of Transport will issue Requests for Proposals before December to attract private operators into rail and port terminals.

Sector Snapshot:

• Aviation also showed gains, with 19 million passengers and 489 000 tons of airfreight handled.

• The improvements are part of a broader push to implement the Freight Logistics Roadmap and open key corridors to private investment.

• Creecy highlighted the importance of private sector partnerships to meet South Africa’s trade and infrastructure goals.

What Now?

The signs of improvement are encouraging, but the momentum must be maintained. With international shipping under pressure and exporters still facing delays, the focus must now shift to:

• Sustained investment in port infrastructure and technology

• Fast-tracking private sector participation

• Resolving backlogs on critical rail corridors

This is the first real progress South Africa’s ports have seen in years. Now the challenge is to build on it.

Source: Adapted from FreightNews

Key Highlights from Last Week’s Discussions – 5th October 2025

Source: BUSA, SAAFF, and global logistics data

1. Port Operations – Throughput slows as weather and equipment remain an issue

South African ports handled 81 088 TEUs this week, down 14 percent week on week, averaging 11 584 TEUs per day.

Cape Town increased throughput by 49 percent to 16 436 TEUs despite strong winds and berth congestion.

Durban Pier 2 dropped 5 percent to 31 830 TEUs, while Pier 1 declined 8 percent to 13 293 TEUs.

Ngqura volumes fell sharply by 46 percent to 12 071 TEUs and Port Elizabeth dropped 72 percent.

Richards Bay moved more coal this week, averaging 157 000 tons per day and handling 23 trains, but delays continued due to poor weather.

Rail volumes out of Durban declined by 58 percent to 2 856 containers.

Maersk reported minimal waiting times across major terminals, but CMA CGM Nile skipped Port Louis due to congestion.

2. Air Cargo – Inbound improves, outbound dips

International air cargo at OR Tambo fell slightly to 6,98 million kilograms, a 4 percent drop week on week.

Inbound volumes rose 8 percent to 4,21 million kilograms.

Outbound volumes dropped 18 percent to 2,78 million kilograms.

Despite the dip, current levels remain slightly above last year and pre-pandemic volumes.

September volumes rose 1 percent month on month, although they were 1 percent lower than September last year.

3. Road and Border – Mixed trends across corridors

Truck volumes at Lebombo rose to 1 422 vehicles per day, but queue and processing times jumped to 7,1 hours, up 29 and 34 percent respectively.

Rail into Maputo dropped to 9 trains per day.

Across the SADC region, queue and transit times dropped by around 2 hours on average.

South African border times increased by 18 percent to 11,1 hours.

SADC borders outside SA averaged 5,0 hours, an improvement of 32 percent.

Beitbridge, Groblersbrug, and Kasumbalesa remained high-risk crossings, each taking close to a full day or longer.

4. Global Shipping – Rates fall, margins under pressure

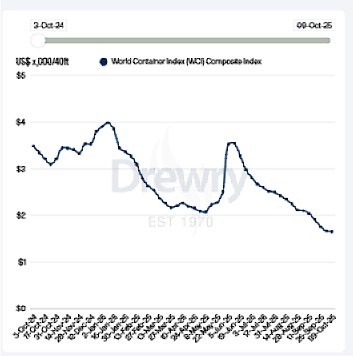

The World Container Index fell 5,2 percent to 1 669 dollars per 40-foot container.

This marks a 52 percent year-on-year drop, with weaker demand and excess capacity weighing on prices.

Major carriers are facing pressure. Margins are now below 10 percent for the first time in 18 months.

Sea-Intelligence warns of a structural overcapacity cycle that may peak in 2027.

The US has confirmed that new port service fees for vessels built in China will come into effect on 14 October. COSCO could face up to 1,5 billion dollars annually in added costs.

5. Global Air Cargo – Africa leads growth

Global air cargo demand rose 4,1 percent year on year in August.

Africa recorded 11 percent growth, its second consecutive month of double-digit gains.

Rates fell slightly, but volumes held firm.

Jet fuel prices dropped 6,4 percent year on year to 87,60 dollars per barrel.

Freighter activity grew by 2,6 percent and belly-hold capacity rose by 7,8 percent.

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

Global Freight Rates

Weekly Container Rate Update – 5th October 2025

Freight Rates Touch 2024 Lows

Drewry’s World Container Index fell another 1 percent this week to $1,651 per 40-foot container, its 17th straight weekly decline and the lowest level recorded since January 2024.

- Spot rates into South Africa are likely under downward pressure, mirroring trends in Asia → Europe / Transpacific.

- High throughput in August/September suggests strong volume demand, which may buffer rate declines locally.

- Infrastructure, congestion, and terminal efficiency will play a larger role than rate volatility in terms of landed cost stability.

The Transpacific trade lane remained steady with little volatility during China’s Golden Week.

• Shanghai to Los Angeles dropped 1 percent to $2,176

• Shanghai to New York stayed flat at $3,189

On the Asia-Europe route, spot rates continued to slide for the ninth week in a row, now nearing levels seen before the Red Sea disruption.

• Shanghai to Rotterdam fell 2 percent to $1,577

• Shanghai to Genoa dropped 1 percent to $1,793

Drewry expects further softening in the coming weeks as demand slows and supply remains elevated. Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”