Welcome to another Logistics News Update.

Durban Port in Turmoil: Delays, Privatisation, and Union Jubilation:

Durban’s port operations were brought to a standstill yesterday due to high winds (90 kms/h), further exacerbating existing delays for importers, exporters, and transporters. The recent court decision halting the Philippine company ICTSI’s takeover of the port has sparked a debate about the potential benefits and drawbacks of privatisation. While Transnet insists that the contract remains unaffected, the legal setback raises questions about the process and its implications for South Africans. The unions’ enthusiastic response to the court interdict is puzzling, particularly given their apparent absence from the negotiation process. This raises concerns about their motivations and the potential impact on workers. As we await a swift resolution to this matter, the industry remains grappling with the consequences of the ongoing disruptions.

Here is one reason we need privatisation – South Africa looks back on a difficult citrus export season:

South Africa’s citrus export season faced significant challenges due to shipping delays, equipment failures, and difficult climate conditions. The Citrus Growers’ Association highlighted issues at key ports, including the Durban and Eastern Cape terminals, which experienced equipment breakdowns and weather disruptions that delayed shipments. However, specialised reefer shipping to major markets like Japan, China, and the USA remained stable. Despite lower export volumes, the citrus industry adapted, and there were positive outcomes in certain regions like the Port of Maputo. These disruptions underscore the need for infrastructure improvements.

– Source FreightNews – 10 Oct 2024 – by Staff reporter

LET’S LEARn – Why DO I NEED A “LC” (Letter of Credit)

Reducing Risk in International Trade: The Letter of Credit

International trade often involves transactions between parties located in different countries, introducing unique risks for both exporters and importers. Exporters face the risk of non-payment, where buyers fail to fulfil their financial obligations after receiving the goods. Conversely, importers worry about non-delivery, where suppliers do not deliver the agreed-upon products or services despite receiving payment.

To mitigate these risks and establish a secure framework for international trade, a letter of credit (LC) can be employed. An LC is a document issued by a bank on behalf of an importer, guaranteeing payment to the exporter provided that specific conditions are met.

Here’s how an LC works:

- Application: The importer applies to their bank to open an LC in favour of the exporter.

- Issuance: The bank, after verifying the importer’s creditworthiness, issues the LC.

- Presentation: The exporter presents the LC to their bank, along with shipping documents and other required documentation.

- Verification: The exporter’s bank verifies that the shipping documents comply with the terms of the LC.

- Payment: If the documents are in order, the exporter’s bank pays them. The bank then seeks reimbursement from the importer’s bank.

By utilising a letter of credit, both exporters and importers can benefit from increased security and confidence in their international trade transactions. It provides a reliable mechanism for ensuring payment and delivery, reducing the risk of financial loss and disputes.

NEWS

Delays at Durban Port Highlight Need for Private Sector Involvement Compilation

FreightNews

Durban Port

The ongoing legal challenges surrounding the Durban Container Terminal (DCT) Pier 2 tender process have sparked industry-wide discussions on the future of South Africa’s port operations. The recent High Court interdict, halting Transnet’s contract with International Container Terminal Services Inc. (ICTSI), has drawn strong reactions from key stakeholders in the logistics sector. These delays not only prolong inefficiencies at the port but also stall much-needed reforms to the country’s logistics infrastructure.

The Road Freight Association (RFA) expressed its frustration with the waiting game that has characterised the privatisation process. Gavin Kelly, CEO of the RFA, emphasised that South Africa’s neighbours, like Mozambique and Namibia, are making significant strides in port efficiency, attracting more shipping lines. He warned that continued delays in improving Durban’s operations could lead to a shrinking logistics supply chain, shifting business to alternative ports in the region. The RFA advocates for the immediate introduction of private players to bring the innovation and efficiency needed to save South African ports from further decline.

On the other hand, the South African Association of Freight Forwarders (Saaff) sees private sector participation as crucial to reviving the country’s ports. Dr Jacob van Rensburg from Saaff highlighted the urgent need for strategic investments and operational expertise from private partners. Saaff also stressed the importance of introducing competitive frameworks within and between ports to drive operational improvements. By fostering competition, South Africa could improve turnaround times, alleviate congestion, and enhance its global competitiveness in trade.

– Adapted from Source: FreightNews

Unions hail Durban port decision Court halts Transnet’s plan to grant R11bn tender to Philippines firm –

13th October 2024 – by Dineo Faku

Durban Container Terminal Pier 2 is at the centre of a battle over Transnet’s plan to outsource its management and operations to a Philippines-based company. Picture: File Image: MARIANNE SCHWANKHART

In a significant victory for South Africa’s labour unions, the Durban High Court has halted Transnet’s plans to privatize the operations of the Durban Container Terminal (DCT) Pier 2. The decision to stop outsourcing the management of the terminal to the Philippines-based company, International Container Terminal Services Inc. (ICTSI), has been hailed by two of the country’s largest transport unions: the United National Transport Union (UNTU) and the South African Transport and Allied Workers Union (SATAWU).

The unions had been vocal in their opposition to the plan, citing concerns over potential job losses and the deterioration of working conditions if a private operator took control of the terminal. The unions argued that while efficiency and modernization of South Africa’s logistics infrastructure are crucial, these goals should not come at the expense of workers’ livelihoods. They view the court’s ruling as a safeguard for workers’ job security and an opportunity to reassess the privatization approach.

This legal decision also underscores the growing debate in South Africa about the balance between privatisation and public control in key industries. While the need for efficiency in logistics and shipping is widely acknowledged, unions are calling for solutions that involve all stakeholders, including the workforce. For now, the ruling has provided a much-needed reprieve for workers, with the unions pledging to continue advocating for fair employment practices as the review process unfolds.

Adapted from Source: The Sunday Times Business

On The Ground Report

The Durban port opened its gates this morning after over 90km/h wind gusts, however they are not taking any booking this morning. They sent out a notification advising transporters not to send trucks to the port as they will not be helped. The notice stated “Pier1 Waterside & Landside RESUMED operations at 06h20 on 15/10/2024 and has since been on standby for wind from 07h10 on 15/10/2024.” It went on to say “ New/unutilized appointment slots will not be available until Landside resumes Operations. Do not dispatch trucks to the Terminal without appointments, as they will not be processed. Wind speed was recorded at gusts of above 90 km/h”

Cape Town appears to be on track (Transnet Report)

Weekly Snapshot

- Port Volumes: Container volumes increased by 14%, with a total of 58,774 containers handled (24,514 imports and 34,260 exports).

- Air Cargo: Volumes decreased by 8%, handling a total of 6,750 tons.

- Rail Cargo: Rail out of Durban dropped by 15%, with 2,666 containers handled.

- Cross-border Delays: Average border crossing time at South African borders increased to 10.9 hours (up 9%) and to 4.3 hours in the SADC region (up 48%).

Key Observations

- Container Rates: Container shipping rates continued their decline, down 4%, trading at $3,349 per 40-ft container.

- Air Cargo Growth: Global air cargo yields grew by 12% year-on-year in August, marking the highest increase in two years.

Port Operations Summary

- Cape Town: Strong winds and dense fog caused operational constraints, though the terminal managed to handle approximately 6,018 containers.

- Durban: Adverse weather and equipment breakdowns impacted performance. Pier 1 recorded 5,769 gate moves, while Pier 2 saw 11,890 gate moves and handled 11,196 containers. Crane outages continued to cause delays.

- Richards Bay: 33 hours of operational time was lost due to equipment issues and adverse weather.

Global Shipping Industry Impact

- US East Coast Strike: The three-day strike caused vessel backlogs, resulting in up to 40% capacity loss on Asia-US East Coast routes.

- Container Market: The global container ship orderbook is at a record high, with 431 ships on order, representing 5.9 million TEU.

Air Cargo Performance

- ORTIA: International air cargo volumes at ORTIA averaged 964,347 kg per day, down 8% from the previous week.

- Global Trends: International air cargo saw a significant year-on-year growth of 41%.

Road Freight and Regional Updates

- Cross-Border Delays: Border times increased slightly in South Africa and the SADC region, with delays primarily due to the introduction of a new biometric identification system at several border posts.

Summary

The logistics network showed improvement, with port volumes rising despite ongoing operational challenges. However, weather and equipment issues at key South African ports, along with global disruptions like the US port strike, continue to strain logistics flows. – Source: BUSA

Weekly Roundup: Key Developments and Insights from the Industry Local & International

- Westfalia Exports Avocados to China – South Africa’s Westfalia Fruit has successfully exported its first batch of avocados to China, marking a significant milestone for South African agricultural exports to this growing market.

- Oil Transit Through Red Sea Drops by 50% – Due to security concerns from Houthi militia attacks, oil shipments through the Bab el-Mandeb Strait have decreased by 50%, forcing vessels to reroute, increasing costs and delays.

- Sea Intel Collaboration to Improve Scheduling – A new collaboration between Sea Intel and eeSea aims to enhance shippers’ scheduling by providing detailed port-to-port transit time data, improving supply chain efficiency.

- Jet Fuel Crisis Warning – South Africa’s aviation sector faces a potential jet fuel shortage due to delays in the licensing of import storage facilities, threatening disruptions at major airports like OR Tambo and King Shaka.

- SAA Expands Network and Frequencies – South African Airways has announced an expansion of its flight routes and increased frequencies to key African destinations, reinforcing its position in the regional aviation market.

- South Africa’s Challenging Citrus Export Season – The 2024 citrus export season faced delays due to weather conditions, logistical bottlenecks, and equipment failures, affecting output and causing widespread industry challenges.

Summary of Global Shipping Industry

The recent US East Coast port strike ended after three days and temporarily impacted shipping capacity. Although the strike concluded with a tentative agreement (a ↑61,5% wage hike over six years, far more than the ↑32% increase the ILWU secured for their 2022-2028 US West Coast master contract), vessels are still queuing, leading to potential capacity loss. If the backlog clears in three days, capacity from Asia to the US East Coast could drop by ↓17%, while a week-long delay may result in a ↓40% loss.10 Similar reductions are expected for North Europe and the Mediterranean routes. Shipping lines are unlikely to speed up vessels to compensate for the shortfall, and exporters, particularly in Asia, North Europe, and the Mediterranean, should prepare for a short-term capacity crunch.

Elsewhere, labour tensions at the Port of Montreal are escalating as the longshoremen’s union initiates an indefinite overtime strike, adding pressure on negotiations that have already lasted over a year.11 Simultaneously, carriers on the transatlantic route are imposing surcharge hikes, further impacting trade amid the ongoing disruptions.

ii. Container market summary and current orderbook

Global congestion remains around 2,8 million TEU, accounting for 9% of the global fleet.12 In South Africa, port congestion at the Port of Durban increased again this week, with some 35 500 TEU currently outside anchorage. As such, the queue-to-berth ratio at Durban was 0,8513. The number of cancelled services has also increased this week, as Drewry’s “Cancelled Sailings Tracker” increased to a 10% cancellation rate.14

The global container ship orderbook has reached unprecedented levels, driven by both the need for fleet renewal and the desire to enhance efficiency and reduce CO₂ emissions.15 The top 10 ocean carriers have 431 ships on order, representing a total capacity of 5,9 million TEU. Analysts highlight that nearly half of these new builds are necessary for replacing ageing fleets, with 683 vessels (2,6 million TEU) over 20 years old still in service:

Global Container Freight Rates

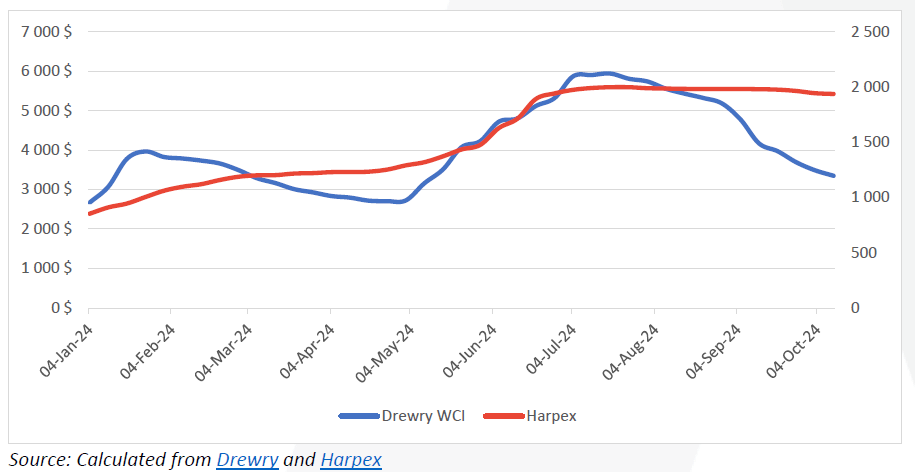

Drewry’s “World Container Index” recorded another similar drop this week. The composite index is down by ↓4,0% (or $140), trading at $3 349 per 40-ft container.16 Six of the major eight trades saw reductions this week, except for the New York – Rotterdam (and mirror) route. Meanwhile, charter rates also saw a commensurate drop this week, as the Harper Petersen Index (Harpex) traded around 1 936 points (↓1%, w/w) on Friday. The following combined illustration shows their relationship since the start of the year:. Source: BUSA↓66%. During this period, only East London increased – by a marginal ↑2% – and based on a small sample. The following figure displays the movement of our respective ports since the inception of the index in 2006:

BUSA-SAAFF Summary – Summary

The National Logistics Command Centre’s efforts to stabilise and modernise South Africa’s logistics network are showing positive results. Recent challenges present opportunities for further reforms to attract private sector investment and enhance port operations. By fostering competition and implementing advanced technologies, the country can transform its ports into world-class hubs, driving economic growth and job creation. The future outlook for South Africa’s logistics sector is promising, with the potential to significantly improve the country’s global competitiveness. Source:BUSA

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”