Welcome to another Logistics News Update.

Last week, we provided an on-the-ground report about Transnet being taken to court by AP Moller. Stay tuned, as the outcome could impact you either positively or negatively.

KZN’s weather hasn’t been great, with slight winds yesterday and rain today. This weather is causing disruptions with vessels and collections outside the ports. South Africa’s biggest challenge seems to be the ports, with delays in Port Elizabeth and Coega, where loading times can now take up to 10 hours. Cape Town has the most vessels outside the port—picturesque but damaging to the economy. Watch for possible weather disruptions in Cape Town from Thursday. Durban’s berthing schedules are constantly shifting between DCT and Point, so if you’re not vigilant, your cargo could end up costing more than expected. Anchorage times vary between 5 to 20 days, causing frustration for importers, exporters, and shipping lines.

Here are the highlighted stories from the past week and what is happening now that I think are important to note.

Port Development: Maputo’s grain terminal and rail infrastructure are set for a $5 million upgrade, enhancing trade flow.

Rail Updates: Transnet Freight Rail has resumed operations on the Cape Mainline following flood-related repairs.

Aviation: South Africa faces a looming pilot shortage due to increased outflow, threatening airline growth.

Maritime Safety: SAMSA is investigating a recent medical cargo spill that washed ashore.

Did You Know: Direct Sailing vs Transhipment

What is it?

A direct sailing means your cargo is shipped directly from the origin to the destination port without stopping at other ports. This option is faster but may have limited routes and schedules.On the other hand, a transshipment involves transferring cargo at an intermediate port before reaching its final destination. While this can extend delivery time, it offers more route flexibility and can sometimes be more cost-effective.

Benefits of Direct Sailing:

Faster Transit: No stops at intermediate ports mean quicker delivery times.

Reduced Handling: Less chance for damage or loss since cargo isn’t transferred between vessels.

Predictability: More reliable schedules and fewer delays.

Benefits of Transshipment:

Cost Efficiency: Often more affordable due to shared shipping routes.

Increased Flexibility: Offers more route options and can reach ports not serviced by direct routes.

Better Capacity Management: Can handle a larger variety of cargo due to flexible routing.

HELP CHANGES EVERYTHING

On The Ground Report

Port Operations Overview (17 September 2024)

- Durban: Experienced operational delays due to adverse weather and equipment challenges. Pier 1 recorded a 3% decrease in container flows, while Pier 2 saw a 1% decrease. Ongoing port congestion resulted in significant delays, with an estimated 41,000 TEU waiting offshore.

- Cape Town: Operations were constrained by strong winds and the presence of a distressed vessel. Container flows dropped by 25%. The distressed vessel is expected to vacate by 16 September, which may improve port performance.

- Port Elizabeth (Eastern Cape): Strong winds and high swells affected operations. Ngqura Terminal saw a 17% increase in container flows, while Gqeberha Terminal experienced a 20% drop.

Global Logistics Trends

- MSC and Premier Alliance have announced nine new Asia-Europe services starting in February 2025, increasing competition in the global shipping industry.

- Container Rates: The global container index dropped by 7.5%, now at $4,168 per 40-ft container.

- Port Congestion: 2.5 million TEU (8.2% of the global fleet) remains stuck in ports, with South Africa’s Durban port contributing significantly to the backlog.

Air Cargo

- International Air Cargo: OR Tambo saw a 20% increase in cargo volume compared to last year. Global air cargo spot rates rose to a new high, driven by increased tonnage from Asia Pacific origins.

- Domestic Air Cargo: Steady growth in volumes, with figures significantly up from previous years.

Road Freight and Border Updates

- Border crossing times improved, with South African border delays decreasing by 18%, while SADC region delays dropped by 30%.

- The Beira Corridor saw the longest delays, averaging 15.8 hours, while other corridors showed more stable transit times.

This week, the logistics sector continues to face challenges due to adverse weather, equipment breakdowns, and global congestion, but there are positive developments in air cargo and cross-border road freight. Source: BUSA

This Weeks Key News Takeaways

- Alliances are being formed for East-West container services.

- The South African Maritime Safety Authority is looking for the ship that lost medical cargo that washed ashore.

- A new airport planned north of Cape Town is expected to boost airfreight.

- ITAC responded to criticism over how they handle import duties.

- There is a lot of traffic congestion from trucks in the Durban Port area.

- China is investing in improvements to the Tanzania-Zambia railway.

Source: Freight news

NEWS

Transnet sticks with choice of port bidder

15 September 2024 – by Sunday Times – Dineo Faku

AP Moller Terminals heads to court after International Container Terminal Service named preferred bidder to manage and upgrade Durban Container Terminal

Transnet says the financial and operational failures at the Durban port is ‘umbilically linked to the wellbeing of the economy’ as it defends its decision to name International Container Terminal Services International to upgrade Durban Container Terminal 2.

Transnet awarded a tender to upgrade Durban Container Terminal (DCT) to International Container Terminal Services (ICTSI) , a company from Philippines. This decision is being challenged by AP Moller Terminals (APMT) in court this week.

Here are the reasons why APMT is challenging the decision:

- APMT believes that ICTSI was not qualified because it did not meet the solvency criteria.

- The tender process was not transparent because there were private communications between Transnet and ICTSI.

Here are the reasons why Transnet awarded the tender to ICTSI:

- ICTSI offered a higher bid than APMT. (2 Billion Higher)

- The partnership with ICTSI is expected to improve the capacity of DCT and benefit both parties.

AP Moller Terminals (APMT) is challenging Transnet’s decision to award the Durban Container Terminal 2 (DCT2) tender to International Container Terminal Services Inc. (ICTSI). If APMT wins, the project could be delayed. However, if Transnet wins, ICTSI will proceed with its R9.4 billion upgrade plan. Transnet believes that the privatization of the port is necessary and urgent. – Adapted from Source: The Sunday Times read the full story here

Exporters Western Cape Endorses New Cape Winelands Airport

13 September 2024 – by Jeanne van der Merwe

Source: Food & Wine

Exporters Western Cape (EWC) has expressed its support for the development of the Cape Winelands Airport, a new facility north of Cape Town. The airport is expected to significantly boost airfreight in and out of the city, providing much-needed capacity as Cape Town International Airport reaches its limits.

EWC Chairman Terry Gale highlighted the airport’s potential to enhance Cape Town’s market share in the airfreight sector. While the airport initially focused on airfreight, there has been growing interest from passenger carriers as well. Gale emphasized the positive impact this development would have on EWC members and the broader export industry.

The environmental impact assessment process for the airport is currently underway, with the goal of commencing operations by 2027. EWC’s endorsement comes as the organisation elected its new committee at its annual general meeting. The committee will continue to prioritize close collaboration with the management of the Port of Cape Town to address challenges and ensure the port’s sustainability.

In addition to its support for the airport, EWC celebrated its 45th anniversary and acknowledged the dedication of its members and committee. The organization remains committed to its role as the independent voice of the export industry, advocating for the growth and competitiveness of the Western Cape economy..

Adapted from Source: Freight News – read the full article here

PORTS

Container Vessel Congestion:

- Durban: Average anchorage times remain high at 98 hours.

- Cape Town: The situation has improved slightly, with an average anchorage time of 83 hours.

- Ngqura and Port Elizabeth: Both ports continue to experience significant delays, with average anchorage times of 113 and 118 hours, respectively.

Distressed Vessel Updates:

- A distressed vessel at Cape Town Container Terminal is expected to depart this evening, pending SAMSA approval.

- The CMA CGM Belem has returned to berth at NCT and still has 684 container moves to complete.

Overall, South African ports have experienced significant disruptions due to adverse weather conditions. This has led to delays, congestion, and reduced productivity.

Durban:

- Pier 1: 9 days delay

- Pier 2: 10-16 days delay

- Durban Point: 3 days delay

Cape Town: (Windy weather expected this week)

- CTCT: 3-4 days delay

- MPT: 1-2 days delay

Port Elizabeth: (Strong winds expected this week)

- PECT: 3-5 days delay

- NCT: 7-11 days delay

NOTE: We recommend factoring these potential delays into your shipment planning to avoid disruptions.

Summary of Global Shipping Industry

Container Freight Rates Continue to Fall

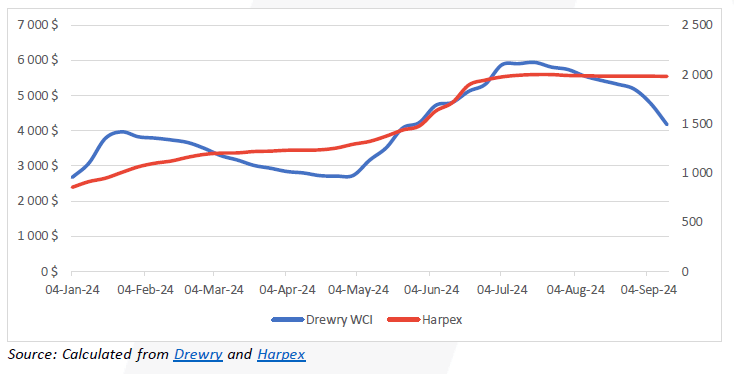

Drewry’s World Container Index has dropped significantly for another week, indicating a continued decline in global container freight rates. The composite index is now at $4,168 per 40-ft container, down 7.5% from the previous week. This marks a substantial decrease of over $1,260 in the past four weeks.

Charter Rates Remain Stable: Despite the falling freight rates, charter rates have remained relatively stable, as measured by the Harper Petersen Index (Harpex). This suggests that shipping lines are still benefiting from previously negotiated contracts. However, based on historical trends, charter rates are expected to decline in the coming weeks.

Impact of Falling Rates:

- Historical Context: The current rate is 60% below the pandemic peak but 193% higher than this time last year.

- Market Volatility: The sharp decline highlights the industry’s post-pandemic volatility.

- Regional Trends: Asia-North Europe and Asia-USEC routes have seen the most significant drops.

- US East Coast Strike: The planned strike has had limited impact on rates due to insufficient demand.

- Shipper and Forwarder Benefits: While shippers and forwarders are welcoming lower rates, shipping lines continue to benefit from higher profits due to frontloaded imports.

Overall, the container freight market continues to experience significant fluctuations, with rates falling sharply while shipping lines maintain profitability.

BUSA-SAAFF Summary – Summary

Operational Challenges and Delays:

- Container Handling: Average daily container handling decreased to 7,940 TEU due to adverse weather, network outages, and equipment breakdowns.

- Port-Specific Issues: Cape Town faced strong winds and a distressed vessel, while Durban experienced adverse weather and equipment challenges.

- Eastern Cape: Strong winds and high swells disrupted operations.

- Richards Bay: Adverse weather and landside congestion caused delays.

- Rail Network: Cable theft and a derailment following the ConCor shutdown impacted rail operations.

Global Shipping and Logistics:

- MSC and Premier Alliance: Announced a partnership for nine new Asia-Europe services starting in February 2025.

- Global Port Congestion: Remains high, with 2.5 million TEU stuck in ports. Durban is experiencing worsening congestion with a queue-to-berth ratio of 1.29.

- Cancelled Sailings: Increased to 13% to maintain high rates.

- Container Rates: Continue to fall, but the industry’s rate volatility persists.

- Shipping Lines: Saw higher profits in Q2 2024 with EBIT margins exceeding 20%.

- Import Trends: Shifted to “just-in-case” logistics.

- Industry Developments: DSV and Deutsche Bahn agreed on a €14.3 billion sale of DB Schenker, and FMC approved Gemini Cooperation.

Air Cargo:

- ORTIA: Handled 560,458 kg inbound and 397,277 kg outbound air cargo daily, showing significant increases compared to previous years.

- Global Air Cargo: Spot rates reached a new 2024 high in the first week of September, driven by increased tonnages from Asia Pacific.

Source::BUSA

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”