Welcome to another Logistics News Update.

It is important to note that if you are importing from China, please note that China will observe Golden Week from 1 to 7 October. During this period, most factories, and offices close, which normally creates a rush to get goods shipped both before and after the holiday. Please plan to avoid delays and ensure your cargo is booked in time.

This week, we see a lot of talk of improvement in the logistics industry, and we need to embrace this even though we know there are many challenges that we need to still overcome.

The recent US tariffs are already hurting South Africa’s citrus sector. The Citrus Growers Association estimates exports to the US have dropped by as much as 40% since last year. This is not only about fruit. Entire communities are feeling the impact. Orchards planted for American consumers may be cut down and hundreds of seasonal workers may lose much-needed jobs. The reason Importers of South African citrus in the United States are already scaling back volumes is because of the 30% tariff increases imposed on local fruit.

This week in our Let’s Learn section, we look at import documents, what they are, why they matter, and how the right paperwork keeps your cargo moving without costly delays.

What is the news?

- Reforms ease bottlenecks at Port of Cape Town: Terry Gale from Exporters Western Cape reported that recent reforms at the Port of Cape Town have eased congestion at key terminals. These changes come after new decision-makers were appointed who understand logistics and export industry needs. While progress is being made, stakeholders say that cutting more red tape would further improve operations and competitiveness.

- Fresh Produce Exporters’ Forum names Piet de Jager as CEO, replacing Anton Kruger. After 14 years of leadership under Anton Kruger, South Africa’s Fresh Produce Exporters’ Forum welcomes a new chief executive with a strong background in agricultural strategy and commercial development. South Africa’s Fresh Produce Exporters’ Forum (FPEF) has appointed Piet de Jager as its new chief executive officer. He takes over from Anton Kruger, who has held the position for the past 14 years.

- Room for collaboration between SA and Australian Agri sectors: There’s a growing opportunity for collaboration between South Africa and Australia in agriculture. Although both countries produce similar goods and may compete in export markets, they can benefit more by working together. Australia could help supply products that South Africa doesn’t produce much of, like rice and provide high-quality wheat. Beyond trade, big gains lie in research, seed breeding, plant health, livestock biosecurity, and academic partnerships. Australia’s models for research funding and biosecurity surveillance are areas South Africa could adapt, while ensuring small-scale farmers here are not left out.

- US imports drop in August as expected, but they’re still very high: US imports in August dropped 4% compared to July, according to Descartes, while the National Retail Federation put the decline at about 3%. Despite that drop, imports are still high — August was the second‐busiest month of the year after July. Imports from China fell more sharply: 6% month-on-month and 11% year-on-year. Even so, China’s share remains large at about 34.5% of all US imports. Forecasts for September-December imports have been raised by about 6%, though volumes are expected to be down compared to the same period in 2024. The trade environment remains uncertain mainly due to tariff pressures and how future trade policy and court rulings may affect import demand.

- Trade talks underpin turning point for SA’s cargo industry – Saaff: Saaff (South African Association of Freight Forwarders) has launched a landmark trade talks initiative that brings government, regulatory bodies, and private sector players together in a formal consultative forum. Agencies like SARS, ITAC, the Border Management Authority, and others are involved, along with freight forwarders and clearing agents. The aim is to smooth out friction points in the supply chain, improve logistics efficiency, strengthen compliance, and reduce the high cost of trade in South Africa. Saaff calls this a turning point a chance to restore trade flow with purpose, urgency, and collaboration. Source: Various

Let’s Learn: Key Shipping Documents Explained

Smooth international trade depends on the right paperwork. Missing or incorrect documents can delay cargo, add costs, or even prevent goods from clearing customs. Here are some of the most common document exporters and importers should know:

- Commercial Invoice: A detailed bill issued by the seller to the buyer, listing goods, value, and terms of sale. Customs relies on it to assess duties and taxes.

- Packing List: Lists every item in a shipment, including weight, dimensions, and packaging details. It helps carriers, warehouses, and customs check cargo quickly.

- Bill of Lading (BOL): The carrier’s receipt confirming cargo has been loaded. It also serves as a contract of carriage and a document of title.

- Certificate of Origin (COO): Confirms where the goods were manufactured. This is vital for applying trade agreements or duty preferences.

- Letter of Credit (LC): A bank’s guarantee of payment to the exporter, provided they present the required shipping documents.

- Import/Export Permits: Some goods need special permits (chemicals, medical products, agricultural items). Without them, cargo can be seized at borders.

Key Point: Shipping documents are more than just admin. They protect buyers and sellers, ensure compliance and most importantly, keep your cargo moving without unnecessary holdups.

NEWS

Trade talks underpin turning point for SA’s cargo industry – SAAFF

BusinessTech 2 September 2025 – Luke Frazer

Trade Talks Signal a Turning Point for South Africa’s Cargo Industry

The South African Association of Freight Forwarders (Saaff) has taken a bold step by bringing government and industry together in structured talks aimed at fixing the country’s logistics challenges. For the first time, a broad platform has been created where regulators, customs, and trade agencies sit at the same table with freight forwarders and clearing agents.

These discussions are not just another round of meetings. They are focused on clearing the blockages that add cost and delay to every shipment. Bodies such as SARS, ITAC, the Border Management Authority, the National Regulator of Compulsory Specifications, and the SA Health Products Regulatory Authority are part of the process. This level of collaboration is unprecedented and is being described as a real turning point for trade.

The goal is clear: create a more reliable and cost-effective trading environment. By tackling inefficiencies head-on, the initiative aims to lower logistics costs, speed up cargo movements, and make South Africa more competitive on the global stage. Already, the talks are clearing up misunderstandings and producing practical ideas from both government and industry sides.

For businesses that rely on imports and exports, this momentum could mark a shift toward a system that is not only compliant but also supportive of growth and job creation. If successful, South Africa’s cargo industry will become leaner, faster, and better placed to compete internationally.

– Source: Adapted from BusinessTech and Reuters.

WEEKLY NEWS SNAPSHOT

1. Transnet FY2025 Results – Progress but Risks Remain

- Revenue rose by +7,8% to R82,7bn, while EBITDA climbed +39% to R30,6bn. The annual loss narrowed sharply to R1,9bn, down from R7,3bn last year.

- Operationally, volumes improved across rail (160,1 Mt, +5,5%) and automotive (+3,9%), although container throughput (-1,4%) and pipeline flows (-12%) fell short of targets.

- Debt remains high at R144,8bn, with covenant waivers required to avoid default. Irregular expenditure (R3,2bn) and ongoing litigation also weigh heavily.

- Capital investment jumped +44% to R24bn, focused on port equipment and infrastructure renewal – a positive sign for long-term competitiveness

2. Port Operations – Record Throughput but Disruptions Persist

- Container terminals processed 103 086 TEUs, averaging a record 14 727 TEUs/day, up 6% week on week.

- Durban (-6% Pier 2, -5% Pier 1) faced wind delays, equipment failures, and a taxi strike that disrupted Maydon Wharf and Island View.

- Cape Town (+16%), Ngqura (+16%), and Port Elizabeth (+84%) delivered strong gains despite weather and equipment constraints.

- Rail cargo out of Durban dropped -17% to 2 756 containers, reflecting cable theft and diesel hauling issues

3. Air Cargo – Slight Growth Amid ACSA Concerns

- OR Tambo handled ~623 000 kg inbound (+5%) and ~356 000 kg outbound (-4%), totalling 6,85m kg (+2%) for the week.

- Levels remain ~4% above last year and ~5% above 2019.

- Stakeholders remain frustrated with ACSA’s stalled upgrades, including the cargo precinct and midfield terminal

4. Regional & Cross-Border – Border Delays and Costs

- Lebombo truck flows fell -10% to 1,521/day; queue times rose to 4,9 hours (+17%). Processing times also climbed to 4,1 hours (+12%).

- SA border median crossing times eased to ~10,3 hours (-11%), while the wider SADC region worsened to ~5,7 hours (+4%).

- Estimated cross-border delays cost the transport industry ~$10,5m (R184m) for the week

5. Global Trade & Shipping – Buoyant Volumes, Rates Under Pressure

- Global container throughput (July) rose +3% m/m and +5,1% y/y to 16,6m TEUs, just shy of record highs.

- SSA imports increased +3,8%, exports +1,9%, while North America logged a fourth straight monthly export decline (-3,0%).

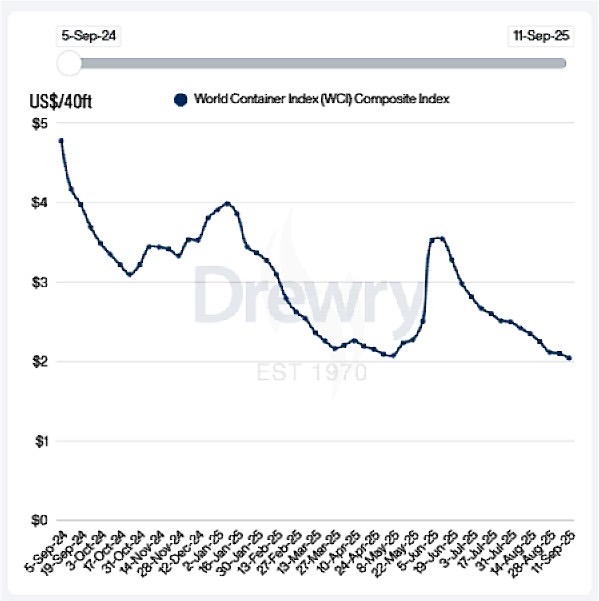

- Spot freight rates fell further, down -0,7% to $2 104/FEU, now -56% y/y, while charter rates (Harpex) stayed firm.

- Other developments:

- US Supreme Court to fast-track Trump tariff legality in November, raising risk of tens of billions in refunds.

- 67 containers lost off a ZIM-chartered vessel at Long Beach, disrupting terminal operations

Key Highlights from Last Week’s Discussions – 7th September 2025

Source: BUSA, SAAFF, and global logistics data

- Port operations: elevated container throughput sustained

• South Africa’s container terminals processed nearly 97,000 TEUs for the week, the fourth consecutive week above 90 000.

• Daily averages held at ~13,842 TEUs, with Durban (+6%) and Ngqura (+20%) supporting volumes, while Cape Town (-21%) and Port Elizabeth (-60%) slipped.

• Rail cargo out of Durban rose 13% w/w to 3,324 containers, but delays of 4–6 hours continue on the Pretoria–Durban line due to diesel hauling from cable theft. - Air cargo: consolidation at OR Tambo

• August closed with air cargo up +15% m/m and +12% y/y.

• Weekly flows softened slightly, averaging 961,000 kg per day, but remain ~11% above last year and 13% above 2019 levels.

• OR Tambo is undergoing scheduled power outages (1–5 September). Backup systems are in place, but risk of disruption remains. - Trade balance: surplus extended

• SARS reported a R20,3 billion trade surplus in July, with exports up 8,5% m/m and imports down 10,2%.

• Year-to-date surplus stands at R98,9 billion, broadly in line with 2024.

• Regionally, BELN trade posted an R11,4 billion surplus, driven by stronger exports to neighbours. - Regional road freight: border constraints intensify

• Lebombo border truck volumes rose 9% to 1 674/day, but queue times increased to 4,2 hours (+24%).

• SA border crossings averaged 11,6 hours (+8%), while broader SADC borders eased to 5,5 hours (-5%).

• Added friction points include a Botswana/South Africa network failure, disputes over “mixed load” scanning at Beitbridge, and plans for a SANRAL tollgate at Beitbridge. - Global trade and shipping

• Drewry’s World Container Index fell another 5,8% to $2 119/FEU, now 59% lower y/y.

• The global container orderbook reached 9,95m TEU, on the verge of 10m – a historic high, with most new builds alternative-fuelled.

• Global air cargo demand rose 5,5% y/y in July, led by Asia Pacific (+11%) and Africa (+9,4%). Africa also saw the strongest rate growth (+7% y/y).

• Legal uncertainty continues in the US as the Court of Appeals ruled Trump’s parcel tariffs unlawful but left them in place until October.

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

During the week of September 8th to September 12th, 2025, South African ports experienced moderate operational disruptions, with Durban facing significant challenges due to an ongoing rehabilitation on Bayhead Road, equipment issues, and continued adverse weather conditions. The Cape Town port also suffered operational hours lost to adverse weather, while the Eastern Cape ports contended with equipment challenges and power failures. Richards Bay reported minimal delays.

DURBAN

The 7-day average vessel waiting time is around 2.25 days. On the landside, the Bayhead Road rehabilitation continues in Durban, which can result in some congestion at the port gate. A train derailment has caused a backlog, which is being cleared.

- Pier 1 – 2.25 days waiting time

- Pier 2 (DCT) – 2.25 days waiting time

- Point 1 – 2 days waiting time

CAPE TOWN

Vessel berth delays may vary as per the service.

The 7-day average vessel waiting time is around 5.5 days.

- CTCT: 5.50 days waiting time.

PORT ELIZABETH

- PECT: 0 days waiting time.

- NCT: 0 days waiting time Source: SACO

Global Freight Rates

Weekly Container Rate Update – 11th September 2025

Container Rates Slide Again

Drewry’s World Container Index fell for the 13th consecutive week, down 3% to $2,044 per 40ft container. Transpacific rates bucked the trend, with Shanghai–Los Angeles up 6% and Shanghai–New York up 2% on the back of general rate increases by carriers, though analysts doubt these gains will last beyond China’s Golden Week. Asia-Europe lanes continued to weaken, with Shanghai-Rotterdam down 10% and Shanghai Genoa down 12%, as new vessel capacity meets softening demand. Looking ahead, Drewry expects further downward pressure on rates in the second half of 2025, with volatility shaped by tariff decisions in the US and capacity adjustments tied to restrictions on Chinese carriers. Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”