Welcome to another Logistics News Update.

It’s not often we get to share positive news about our ports, but this week, there’s a glimmer of hope.

Durban is set to boost its operations with five new tugboats. While this might seem like a small detail, it’s a crucial step in the right direction. Remember those dire reports about our ports, especially Cape Town holding the unfortunate title of world’s worst? Well, it seems Transnet is starting to turn things around. There’s a renewed focus on efficiency and investment in equipment. This is great news for all of us in the industry. Let’s keep our fingers crossed for continued improvement.

Let’s talk numbers. – We’re seeing a serious pinch on our wallets with shipping costs skyrocketing. It’s becoming increasingly difficult to predict what we’ll be charged next. Every quote is a gamble. Last week brought a small victory for the transport industry. The port authority is finally listening to the chaos around the booking system. It’s a step in the right direction, but we’ve got a long way to go. And let’s not forget the container hunt. It’s like searching for a needle in a digital haystack. Looking ahead, China’s Golden Week is looming large. This means another potential headache with shipping space. We need to be extra vigilant in the coming weeks to ensure smooth operations.

South Africa is locked in a bitter trade dispute with the European Union over citrus fruit exports. The EU has imposed strict regulations on South African citrus due to concerns about citrus black spot and false coddling moth, pests that affect the fruit. South Africa argues these regulations are unjustified, discriminatory, and harm the country’s citrus industry, a major economic driver. The dispute has escalated to the World Trade Organization, with both sides determined to protect their interests. The outcome of this trade battle will have significant implications for South African farmers and the broader economy.

This week on let’s learn, we are speaking about the why are Customs/SARS are asking for your importers freight costs when you use the incoterm CIF or CFR?

Let’s Learn

Why do I have to supply a freight invoice when importing using the incoterm CIF or CFR?

When determining the Customs value of imported goods, certain costs related to international shipping can be deducted:Costs like transportation, loading, unloading, handling, insurance, and other related expenses incurred to ship the goods from the exporting country to South Africa can be subtracted from the price paid for the goods.However, only the actual costs paid to the shipping company or freight forwarder are allowed as deductions.If the supplier estimates freight charges on the invoice, but the actual cost is lower, only the actual cost can be deducted. Any difference is considered part of the product’s price.In essence, the Customs value is based on the true cost of the goods, plus the actual expenses incurred to transport them internationally.NOTE: Customs require the freight invoice to make sure you are paying the right duty and VAT – this came into effect on the 11 January 2022 and enforced 2024

Here is what clause G ii) B says, “When payment is made by the supplier to the international carrier or freight forwarder only 7% of the FOB value is paid to the service provider.”

On The Ground Report

It has been a challenging week, operators feel like they are playing battle ships when it comes to finding containers, the shipping lines and the port and not on the same page, there has been a vessel outside the port for 20 days already in deep anchor and the operators cant get news on when it is coming in, the port is working hard to get the import containers in by doing split berths, meaning they come in, drop a few and then go back out and then come back again, exporters are all holding their breath. Haulier are still battling with the booking system but this also is being addressed.

Citrus export season update

The annual citrus export season is reaching its peak at all four container handling ports. The current forecast is for a drop in annual export volumes from a pre-season estimate of 181,7 million 15kg cartons to around 162,4 million, a drop of ↓10,6% (y/y) and around 3 million less than in 2023. Various reasons are given for this drop in exports, ranging from adverse weather conditions in production areas, particularly in the northern region and the Western Cape, plus a substantial increase in juicing due to a fall in Brazilian production of orange juice and consequent increase in prices. – Source: BUSA

Disclaimer: The information presented in this newsletter is based on reputable sources and has been referenced accordingly. This Logistic News is provided obligation-free. If you wish to be removed from the mailing list, please reply to this email with a request for removal. Please note that all news content is either adapted or specifically quoted from its original sources.

This Weeks Key News Takeaways

Here are the main takeaways:

- Rising shipping insurance pressures due to increased risks, highlighted by recent fires on vessels from MSC and Maersk.

- Disruptions in Copperbelt cross-border cargo movement, with conflicting reports from Zambia and the DRC.

- A significant economic impact on South Africa’s citrus industry from an EU trade dispute.

- Launch of an investigation into AI manipulation claims by TPT.

- An upcoming conference on the SA Navy’s fleet plans addressing global maritime risks.

NEWS

Harbour carrier changes to speed up cargo movement

15 August 2024 – by Eugene Goddard

Container movement alterations at DCT Pier 2 will hopefully bring about smoother operations for transporters. Source: Port Strategy

Public and private stakeholders have collaborated to introduce changes aimed at alleviating the persistent congestion and delays plaguing the landside dispatch of containers at the Port of Durban. These changes, which include modifications to Transnet’s truck-slot booking system, are a direct response to the numerous complaints from transporters regarding system failures, corruption, and financial losses.

A two-week trial period commencing on August 16 will see the implementation of batch-releasing containers, extending booking periods, and establishing daily meetings between port authorities and carriers to address emerging issues. While industry players cautiously welcome these initiatives, concerns persist regarding equipment availability and potential manipulation of the new system.

Despite scepticism from some quarters, the introduction of a group import release (GIR) system is seen as a potential game-changer. By allowing large carriers to bypass the booking system and collect containers in batches, it is hoped that more slots will become available for smaller operators. However, challenges related to container weight variations and the possibility of slot hoarding could hinder the system’s effectiveness…

Adapted from Source: Freight News

India’s ports face indefinite strike over long-standing disagreements

15 August 2024 – by Staff Reporter

SIndia’s V.O. Chidambaranar Port, where labour negotiations have broken down. Source: ITLN

Dockworkers at India’s twelve largest ports have announced an indefinite strike commencing on August 28th, in response to a prolonged deadlock in wage negotiations. Despite multiple attempts at resolving the issue through a bipartite wage negotiation committee, no agreement has been reached since the previous wage agreement expired in December 2021. The workers’ demands encompass wage revisions, fitment benefits, pension enhancements, and the fulfilment of previous agreements. The strike is expected to significantly disrupt port operations nationwide, particularly during the upcoming festival season.

The root of the problem lies in what the union describes as “illogical and unlawful guidelines” imposed by the government, which have hindered negotiations. The dockworkers’ frustration has been exacerbated by the Ministry of Shipping’s perceived lethargy in addressing port-related matters, marking a stark contrast to previous engagement practices. As the strike looms, dockworkers remain resolute in their demands, emphasising the urgency of a fair and timely resolution to their grievances. The potential impact on India’s economy and trade is significant, placing immense pressure on both parties to reach a compromise…

Adapted from Source: Freight News

PORTS

South African Port Delays Summary (as of August 19, 2024)

SA Port Updates

South African ports faced significant operational delays this week due to adverse weather conditions, specifically strong winds and vessel ranging. Cape Town experienced vessel movement alongside berths, leading to operational halts. Both Durban and Eastern Cape ports were impacted by inclement weather, with equipment breakdowns also contributing to delays in Durban.

- Durban: Wind is forecasted for Tuesday, causing delays.

- DELAYS

- Pier 1 – 10 days and

- Pier 2 – 25 days

- DELAYS

- Cape Town: No major delays are anticipated for the week.

- DELAYS

- CTCT – 3 days.

- DELAYS

- Port Elizabeth / Ngqura:

- DELAYS

- NCT and PECT are facing delays of up to 2 days.

- DELAYS

NOTE: We recommend factoring these potential delays into your shipment planning to avoid disruptions.

Red Sea Crisis Update: Impact on Gas Carriers

The Red Sea crisis continues to disrupt global shipping, with gas carriers being particularly hard hit. Since the conflict escalated, the number of LNG and LPG vessels passing through the Suez Canal has plummeted from 30-40 per week to less than ten. This significant reduction has far-reaching implications for the energy and shipping industries.

Global Container Shipping Update

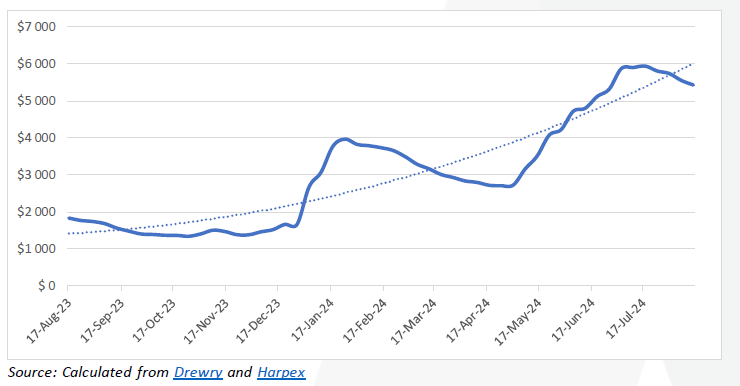

Charter Rates: Charter rates have remained relatively stable, with a slight decrease this week but significant year-over-year growth.

Terminal Operators: The seven largest global terminal operators continue to dominate the industry, with throughput exceeding 40 million TEU in 2023. While smaller operators aim to expand, the gap between them and the leaders remains significant.

Freight Rates: Container freight rates have declined slightly but remain significantly higher than the 10-year average. Contract negotiations are ongoing, with shippers questioning their value due to market conditions and carrier dominance.

BUSA-SAAFF Summary – Summary

South African Logistics & International Trade Summary

The South African logistics network experienced operational challenges last week due to adverse weather, vessel ranging, and equipment breakdowns. Container handling volumes were slightly lower than the previous week. Despite these setbacks, there have been positive developments, such as the implementation of a new booking system in Durban and infrastructure upgrades at various ports.

Internationally, the shipping industry continues to be affected by the Red Sea crisis, with reduced Suez Canal crossings for gas carriers and tankers. Major port operators like PSA International and MSC have shown growth in container throughput, while other developments include a new study on shipping fuel’s impact on climate change and a box ship explosion. In South Africa, air cargo volumes have reached record highs, both domestically and internationally. This is a significant boost for the industry after a slight decline in total cargo volume in July.

This report details the current state of South African logistics and international trade.

Transnet’s Challenges:

- Reduced throughput: Many sub-sectors of Transnet have seen a significant decline in throughput, as illustrated in Figure 1.

- Financial struggles: Despite optimism, Transnet’s current financial performance is not promising.

- Infrastructure vulnerabilities: Theft, vandalism, and other issues are impacting rail volumes and causing disruptions.

Recommendations for Improvement:

- Enhance rail volumes: Increase rail traffic to boost profitability.

- Address infrastructure issues: Resolve problems like theft and vandalism to minimize disruptions.

- Implement recovery plan: Expedite the implementation of Transnet’s rail and port recovery plan, including opening network access to private operators and establishing a leasing company.

- Invest in equipment: Sustained investment in critical equipment and signalling is essential.

- Secure long-term funding: Seek long-term funding commitments from stakeholders to reduce reliance on borrowing.

- Restructure debt: Reduce the monthly interest burden to stabilize the financial outlook.

The coming months will be crucial for Transnet’s future and the overall health of the South African logistics industry. – Source::BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape.

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”