Welcome to another Logistics News Update.

For those using diesel, as most of our trucks do, brace yourselves for an increase of at least 38c/l next month. On the bright side, petrol prices are expected to decrease slightly, by around 5c/l. The weather has been less than cooperative lately. While conditions in KZN began to settle towards the end of last week, afternoon thundershowers have continued to cause minor delays, particularly in traffic across major centres. The ports also experienced intermittent disruptions. Fortunately, we avoided prolonged disruptions from striking truck drivers, as blockages were quickly cleared, allowing for smooth operations last week and so far, this week. Meanwhile, Mozambique remains on edge. For the world’s poorest country, the ongoing unrest does not bode well for its economy, nor does it help South African businesses trading with our neighbour. While the border briefly reopened last week, protests led to its closure again shortly thereafter.

GOOD NEWS: South African Cherry Exporters Remain Optimistic Despite Frost: South Africa’s cherry industry is demonstrating resilience amid recent challenges. Despite early-season frosts that adversely affected some varieties, producers remain optimistic about the overall quality and market opportunities for this year’s harvest. Later-maturing cherry varieties were largely spared from frost damage, contributing to a positive outlook for the remainder of the season. The industry is also experiencing strong demand from both local retailers and international markets, with prices approximately 25% higher than the previous year. This optimism is further bolstered by the South African Cherry Association’s report of a 54% growth in cherry orchards from 2020 to 2023, indicating a robust expansion within the sector. South Africa’s cherry harvest is progressing, with exporters focusing on international markets. Despite recent frost events, the industry remains optimistic about the season’s prospects. Source: Fresh Fruit Portal

On The Ground Report:

Operators getting caught out as TPT pulls a vessel in even though they are reporting vessel only in later this week, so some operators do not have equipment to collect and by the 19th, the three free days are over, couple this with bookings and you have a quick little cash cow.

TIP OF THE WEEK

You can’t avoid SAPS, Border or Custom Stops but you can minimise delays by ensuring your cargo is cleared at least five days before the vessel is due to berth. Make sure all your paperwork is 100% accurate and up to date. If you’re importing products, have the data sheets ready in advance. This ensures you can provide any requested information immediately, avoiding costly delays caused by waiting on your supplier. Preparation is key, as inspections often require details about how the goods are manufactured and their contents. Additionally, you have rights when your container is stopped. For example, you can nominate the unpack depot if required, so ensure your agent has strong relationships with inspection depots. This allows your cargo to be attended to promptly, saving both time and money.

Increased Container Inspections by SAPS and Customs Impact Importers

Last week, we reported on the SAPS Container Stops on imported cargo, we went back to March, and this is what happened. As there has been a significant rise in import container inspections by the South African Police Service (SAPS) and Customs authorities. This surge is attributed to intensified efforts to combat contraband, drugs, and counterfeit goods entering through South African ports, particularly Durban. The Southern African Association of Freight Forwarders (SAAFF) has engaged with SAPS to address the resulting delays and costs faced by legitimate importers. SAAFF’s data indicates that all containers detained by SAPS have been released without findings, highlighting the need for a more targeted risk profiling approach. (Archives)

INTERNATIONAL NEWS:

CMA CGM changes course on plan to re-route service through Red Sea: CMA CGM, a leading French shipping company, has reversed its decision to reroute its INDAMEX service (connecting the Indian Subcontinent to the US East Coast) through the Suez Canal. Initially, the company planned to avoid the longer route around the Cape of Good Hope by transiting the Red Sea. However, due to ongoing threats from Houthi attacks in the region, cargo insurers have been reluctant to provide coverage for this route. This has led to customer pressure, prompting CMA CGM to revert to the original routing via the Cape of Good Hope. Source: The Loadstar

Weather and Operational Delays Impact South African Ports

- South African ports continue to grapple with operational challenges, including equipment shortages, adverse weather conditions, and congestion. At Durban Port, Pier 1 is currently experiencing delays of up to 12 days, while Pier 2 faces more severe delays of up to 24 days. These delays are primarily due to equipment shortages and breakdowns, compounded by recent adverse weather conditions. Source: GoComet

- In Cape Town, the Container Terminal (CTCT) is experiencing delays of up to 2 days, with strong winds impacting operations. The Multi-Purpose Terminal (MPT) is facing minor delays of up to 1 day. Port Elizabeth and Ngqura ports are currently operating without significant delays, as no strong winds are forecasted for the coming days. Source: GoComet

These ongoing delays are likely to impact supply chains and may lead to increased costs for businesses relying on these ports for imports and exports. Stakeholders are advised to monitor the situation closely and consider alternative logistics arrangements where feasible.

Port Update

1. Durban

- Wind Conditions: Winds have subsided; no strong winds are forecasted for today or tomorrow.

- Pier 1: Current delays of up to 12 days.

- Pier 2: Severe delays remain, now reported at up to 24 days.

- Durban Point (MPT): No specific update provided, but equipment issues and congestion remain a concern.

2. Cape Town

- Wind Conditions: Strong winds still impacting operations; forecast indicates winds will subside by tomorrow morning.

- CTCT: Delays reduced to up to 1 day for SRX services and up to 2 days for SAS services.

- MPT: No specific update provided; likely minimal delays based on previous trends.

3. Port Elizabeth/Ngqura

- Wind Conditions: Good weather reported for today and tomorrow, with no strong winds expected this week.

- PECT: Delays are not specifically mentioned, suggesting minimal disruptions.

- NCT: Delays reduced to up to 1 day.

Summary:

Delays have worsened significantly at Durban Pier 2 (from 9–14 days to up to 24 days), while Pier 1 delays remain substantial.

Cape Town has seen improvements, with CTCT delays reduced and strong winds expected to subside soon.

Port Elizabeth has stable conditions, with NCT delays reduced significantly.

NEWS

COMESA Introduces Electronic Certificates of Origin to Enhance Trade Facilitation

19 Nov 2024 – by Staff Reporter

The Common Market for Eastern and Southern Africa (COMESA) has initiated a pilot program for Electronic Certificates of Origin (e-CO), with Eswatini leading the implementation. This digital certification aims to streamline customs procedures, reduce processing times, and lower costs for businesses and customs authorities within the COMESA Free Trade Area. The e-CO system is part of the COMESA Trade Facilitation Programme, funded by the 11th European Development Fund.

By transitioning to electronic certificates, COMESA seeks to enhance efficiency and transparency in trade operations. The e-CO system offers real-time tracking and monitoring, bolstered security through digital signatures, and improved compliance with legal requirements. These advancements are expected to increase government revenue by reducing certificate forgery and boosting trade volumes.

Following Eswatini’s lead, Malawi and Zambia are prepared to pilot the e-CO system. COMESA plans to officially launch the regional e-CO during the upcoming Council of Ministers’ meeting on November 28 in Lusaka, Zambia. COMESA Secretary-General Chileshe Kapwepwe has called upon other member states to adopt the e-CO system promptly to realize a region where trade and investment flow freely, efficiently, and securely…

–Adapted from Source: Freight News

Premier Alliance Agreement under the microscope

19 Nov 2024 – by Staff Reporter

Source: Lloyd’s List

The Federal Maritime Commission (FMC) has initiated a 15-day public comment period for the newly filed Premier Alliance Agreement between Ocean Network Express (ONE), Hyundai Merchant Marine (HMM), and Yang Ming Marine Transportation. This agreement allows the three carriers, who are already part of THE Alliance, to collaborate on vessel sharing, chartering, and operational activities, aiming to enhance efficiency and service delivery. The agreement is available for review in the FMC’s online Agreement Library.

FMC assures confidentiality for all comments submitted, safeguarding public input from disclosure. If no objections are raised or actions taken, the agreement will automatically go into effect on December 12. Stakeholders are encouraged to share their perspectives during this window to ensure transparency and accountability in maritime collaborations.

The FMC is thoroughly reviewing the Premier Alliance Agreement to determine its impact on competition. Its primary concern is to assess whether the agreement could reduce transportation services, raise costs, or substantially lessen competition in related markets. This oversight underscores the Commission’s commitment to protecting fair competition and maintaining reasonable transportation costs.

–Source: FreighNews

Weekly Snapshot

- Transporter Counts Cost of Truck Destroyed in Mozambican Protests: A transporter has reported significant losses after one of its trucks was destroyed during post-election protests in Mozambique. The unrest has disrupted logistics and raised concerns about the safety of transport operations in the region.

- Citrus Export Figures Dip Slightly: South Africa’s citrus export volumes have experienced a slight decline. Despite this, growers have maintained strong performance amid challenges, including increased local demand and logistical hurdles.

- SA Manufacturers Urged to Engage with the Department of Trade, Industry and Competition (DTIC): Deputy Minister of Trade, Industry and Competition, Andrew Whitfield, has called on South African manufacturers to actively engage with the DTIC, emphasising the government’s appreciation of the sector’s contributions.

- Canada’s Ports Close as Strike Hits: Canadian ports have been shut down as employers lock out workers amid deadlocked negotiations over wages and working conditions, impacting international trade routes.

- SA-Mozambique Border Update: Drivers Hesitant to Proceed to Port of Maputo: Truck drivers have expressed reluctance to continue to the Port of Maputo due to escalating tensions and safety concerns at the South Africa-Mozambique border.

- Eswatini Railway Turns 60: Eswatini Railway celebrates its 60th anniversary, marking six decades since Portuguese colonial authorities proposed a railway from Swaziland in 1902 to boost business.

- Truck Movement Stops as Protestors Take to the Streets in Ressano: Protests in Ressano have brought truck movements to a halt, disrupting trade flows, and highlighting the impact of civil unrest on logistics.

- Lekki’s Liner Collaboration to Enhance Nigeria’s Maritime Sector: A new liner collaboration at Lekki is expected to create opportunities for trade and industry within Nigeria and the broader region, enhancing the country’s maritime sector.

- Roads Agency Unpacks E-Toll Debt: The South African National Roads Agency (SANRAL) has detailed its e-toll debt, revealing an amount of R29.031 billion owed when the government agreed to end e-tolls in April.

- US Navy Repels Houthi Attack: The US Navy successfully repelled an attack by Houthi rebels, who launched missiles and drones targeting two American warships in the Bab al-Mandab Strait.

- Maersk Adjusts Peak Season Surcharge: Danish carrier Maersk has revised its Peak Season Surcharge for shipments from the Far East to Oceania, effective from mid-November 2024, in response to changing market conditions.

These events underscore the dynamic nature of the freight and logistics industry, highlighting the need for stakeholders to remain adaptable and informed. Source: Container news & FTW

Key Observations:

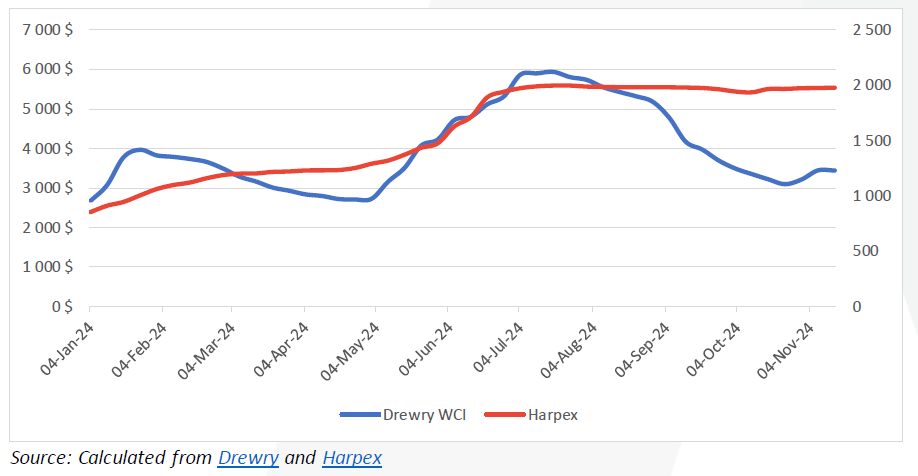

Container Shipping Rates:

- Update: Container shipping rates have decreased by another 2.5%, now averaging $3,015 per 40-ft container. This reflects sustained downward pressure on freight costs.

- Charter Rates: Remain stable, but continue monitoring for any fluctuations.

This update highlights continued changes in shipping rates and the sustained growth in air cargo demand, reflecting dynamic market conditions and opportunities in the logistics sector.

Global Shipping Update

Delays and Key Updates

- Brazil: Port congestion due to high cargo volumes and limited capacity.

- Far East: Increased demand causing disruptions in shipping schedules and transshipment delays at hubs like Singapore.

- South Africa: Durban Port faces equipment shortages, breakdowns, and weather-related disruptions.

- India: Delays due to blank sailings and port backlogs.

- Singapore: Transshipment delays of 2-3 weeks.

- Mozambique: Protests and strikes causing operational disruptions.

- Airfreight: Delays at Johannesburg (JNB) airport and 48-hour strikes in Brazil affecting GRU Airport.

- Equipment Shortages: 20ft container scarcity reported by shipping lines.

Additional Charges by Carriers

- MSC: Effective 1 January 2025, FuelEU Maritime regulation fees will be introduced (€14/TEU for GP containers and €21/TEU for Reefers).

- CMA CGM:

- PCS surcharge of USD 1,000 per container (effective 1 December 2024) for shipments to Nicaragua and El Salvador.

- PSS of USD 150/TEU (effective 1 January 2025) for exports from Africa to South America West Coast via the Panama Canal.

Summary

Summary for Newsletter: BUSA Cargo Movement Update (17 November 2024)

1. Weekly Snapshot

- Port Volumes: Significant increase of 18% in total container volume, reaching 84,089 TEUs.

- Air Cargo: Increased by 10%, with total air cargo flows reaching 7,272 tons.

- Rail Cargo: Durban rail handled 3,387 containers, a 3% increase.

- Cross-Border Challenges: South African border crossing times rose by 41%, with SADC transit times up by 40%.

2. Port Operations

- Cape Town: Weather disruptions caused over 30 hours of delays. Improved truck service efficiency with 1,835 trucks handled.

- Durban: Mixed performance; operational delays due to equipment breakdowns and weather. Weekly throughput increased at Pier 2 but declined at Pier 1.

- Richards Bay: Improved coal terminal operations, exceeding rail service targets.

- Eastern Cape: Moderate delays from adverse weather and equipment shortages.

- Global Perspective: Durban port congestion increased, with 28,575 TEUs awaiting offload.

3. Air Freight Trends

- International Air Cargo: ORTIA inbound and outbound cargo flows rose by 11% and 9%, respectively, compared to last week.

- Global Growth: Year-to-date demand for air freight grew by 12.6% from 2023, with Latin America and Europe leading regional growth.

4. Road Freight and Border Delays

- Border Times: Median crossing times at South African borders rose to 12.8 hours, impacting transport costs.

- Protests: Disruptions in Mozambique and ATDFASA protests affected cross-border operations.

- Costs: Weekly cross-border delays cost the transport industry an estimated $10 million (R178 million).

5. Global Shipping Industry

- Container Freight Rates: Stable at $3,440 per 40ft container, with Q3 carrier profits rising to 33%.

- Challenges: Overcapacity and congestion remain major issues, with 2.53 million TEUs globally awaiting offload.

- Investments: Substantial infrastructure projects underway in Southern Africa, including AGL’s commitments in Namibia and Angola.

6. Insights and Takeaways

- Infrastructure Needs: Persistent challenges in aging infrastructure and energy supply highlight the need for improvements to sustain South Africa’s economic growth.

- Global Competitiveness: Effective cost management and network flexibility are crucial as freight industries face rising volatility.

Source: Summary from BUSA

Global Container Freight Rates

Drewry World Container Index (WCI)

Drewry’s World Container Index increased 7% to $3,444 per 40ft container this week.

Market Update: Ocean Freight Rates on the Rise

As of November 7, 2024, Drewry’s World Container Index (WCI) reported a 7% increase, bringing the average cost to $3,444 per 40-foot container. This rate is 67% below the pandemic peak of $10,377 in September 2021 but remains 142% higher than the pre-pandemic average of $1,420 in 2019. The year-to-date average composite index stands at $4,005 per 40-foot container, surpassing the 10-year average of $2,843, which was influenced by the exceptional rates during the COVID-19 period.

Key Rate Movements:

- Shanghai to Genoa: Increased by 21% ($751) to $4,399 per 40-foot container.

- Shanghai to Rotterdam: Rose by 16% ($558) to $3,954 per 40-foot container.

- New York to Rotterdam: Up by 3% ($25) to $785 per 40-foot container.

- Rotterdam to Shanghai: Decreased by 3% ($19) to $524 per 40-foot container.

- Rotterdam to New York: Fell by 2% ($40) to $2,624 per 40-foot container.

- Shanghai to Los Angeles: Slight decline of 1% ($33) to $4,806 per 40-foot container.

- Los Angeles to Shanghai and Shanghai to New York: Rates remained stable.

The uptick in spot rates on the Asia-Europe trade lane has persisted for the second consecutive week, with expectations of continued increases in the coming week.

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”