Welcome to another Logistics News Update.

This week’s Logistics News Summary:

- Port Delays and Challenges:

- Significant delays reported across South African ports, with Durban’s Pier 2 experiencing the worst delays (up to 21 days).

- Global Reefer Update:- Positive outlook for the reefer sector in 2024 due to strong Southern Hemisphere crop yields, particularly in South Africa’s citrus exports.

- Reefer freight rates are declining after pandemic surges, except for a brief rise in Q1 2024 due to Middle East tensions.

- Reefer sector expected to see a more than 1% increase in global volumes for 2024.

- In addition to these key updates, you’ll also find: A valuable Forex Tip of the Week to help you navigate those things you just don’t understand.

We all escaped a day or two of disruptions by the transport strike being called off at the 11th hour. Petrol prices in South Africa have jumped over R3 per litre since the beginning of 2024, driven by a combination of factors. While diesel prices have seen some recent relief, rising oil prices due to production cuts and global tensions have significantly impacted the cost of petrol. However, there are signs of potential relief in the coming month as the rand strengthens, and oil prices stabilise. This is what you can expect on the first Wednesday of the month, Petrol 93: decrease of 63 cents per litre | Petrol 95: decrease of 61 cents per litre | Diesel 0.05% (wholesale): decrease of 74 cents per litre | Diesel 0.005% (wholesale): decrease of 77 cents per litre remain stable.

Attention Importers and Exporters: Navigating the Challenges in African Shipping

The African shipping landscape is facing some headwinds. Here’s what you need to know: Limited Availability: Blank sailings and equipment shortages are making it harder to secure space for your cargo. Be proactive and book your shipments 3-4 weeks in advance. Rising Costs: Shipping lines are implementing General Rate Increases (GRIs) and pushing for higher rates overall. Expect further increases on Far East routes starting June 1st. We understand these challenges can disrupt your business. Stay tuned for more information on navigating this market and ensuring your shipments arrive on time and within budget. – see definition of Blank Sailing at the end of the newsletter

Forex Tip of the week

What is a CCN & Why do you need it?

CNN is a Customs Client Number

It is a number, or code, that you receive when you register at customs as an importer, exporter, or both. It is also referred to as a customs code or CNN number. It allows an individual or business to clear goods through customs and to make international payments for imported and exported goods.

A CCN is an 8-digit Customs Client Number.

Importers & Exports need to apply for a CCN from SARS Customs and Excise.

With older CCN’s, the number might only be 5 digits in length. When this occurs, simply add zeros at the beginning of the number to make up the 8-digits required.

Source: RMB & FNB

On The Ground Logistics Update:

- Air Cargo Delays Hamper Urgent Shipments

The logistics industry continues to face challenges, with air cargo experiencing significant delays. These delays are impacting the timely delivery of urgent shipments, particularly at OR Tambo International Airport, which has been struggling with operational issues.

- Port Inefficiencies Create Backlogs

Adding to the woes, South African ports are facing inefficiencies that are causing further disruptions. Vessels are arriving, offloading only a limited number of containers (around 30), and then departing again. This inefficient use of resources contributes to port congestion. Equipment breakdowns are also a major hurdle, further slowing down operations.

- Far East Woes Ripple Through Supply Chain

The source of some of these issues appears to be originating in the Far East. Blank sailings (cancelled voyages), limited space availability, and equipment shortages are creating bottlenecks. China, in particular, is experiencing a critical shortage of containers, adding to the challenges of moving goods efficiently.

In short, both air and sea freight are facing significant delays due to a combination of factors. Urgent cargo is particularly at risk, and bottlenecks in the Far East are contributing to the overall problem.

Disclaimer: Please note: All information presented in this post is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed.

NEWS

Reefer sector begins the year on a positive note

17 May 2024 – by Staff reporter

Source: ETEnergyworld

The reefer sector is set for encouraging growth this year, thanks to healthy Southern Hemisphere crops, according to Drewry’s latest ‘Reefer Shipping Forecaster’.

This comes after what the consultancy has called “a tumultuous year in 2023”.

“Good growing seasons have supported improved deciduous exports so far this year, and South Africa’s citrus season is likely to deliver further growth, with new orchards coming into production, and good growing conditions expected to benefit orange, lemon and grapefruit exports.

“Similarly, in New Zealand, although a slow start for kiwis this year, it is expected to develop into a good crop later, with export volumes substantially up from last year’s disappointing performance. The major seaborne reefer commodity trade of meat and bananas also started the year with positive momentum, posting single-digit growth year-on-year (y-o-y).”

The healthy growth is predicted to continue for the rest of the year.

There’s also good news regarding freight rates as carriers continue to adjust prices down after pandemic-era disruptions.

And while the Middle Eastern conflict pushed up rates slightly in the first quarter, Drewry believes they will continue falling as excess capacity in the container segment compensates for any rerouting needed around the Red Sea.

Source: Freight News

Shipping major predicts rates downturn amid capacity uptick

20 May 2024 – by Staff reporter

Announcing its first-quarter results last week – which saw Ebitda down 30% – the CMA CGM Group described its performance as “robust” in the face of the macroeconomic and geopolitical environment that could continue to cause fluctuations in the transport and logistics market.

The French shipping major recorded revenue of $11.8 billion, driven largely by its maritime shipping business.

Ebitda totalled $2.4 billion, 30.3% lower than in the first quarter of 2023. The Ebitda margin came in at 20.2%, down 6.8 points.

Commenting on the results for the period, Rodolphe Saadé, the Group’s chairman and chief executive officer, said against a backdrop of industry normalisation, the shipping division had turned in a solid performance, buoyed by restocking in China and the United States.

“As for our logistics business, the acquisition of Bolloré Logistics gives us the critical mass we need to better withstand cyclical changes. In 2024, a year that remains uncertain due to the crisis in the Red Sea, CMA CGM will continue to meet its customers’ needs as effectively as possible. We will stay on course with our strategic investments, whether in decarbonisation or artificial intelligence.”

He said uncertainties in the macroeconomic and geopolitical environment could continue to cause fluctuations in the market, and weigh on its fluidity and seasonality.

Source: Freight News

PORTS

Weather and other delays:

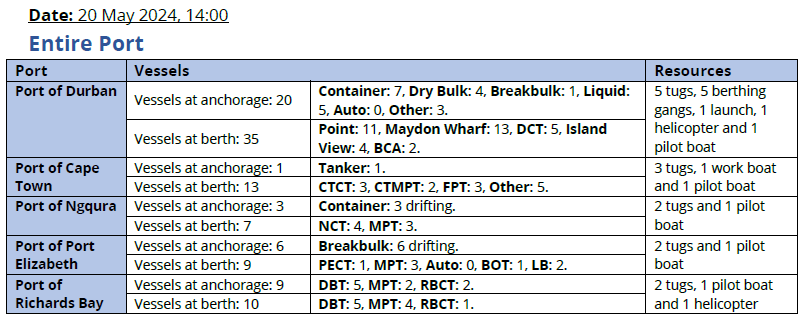

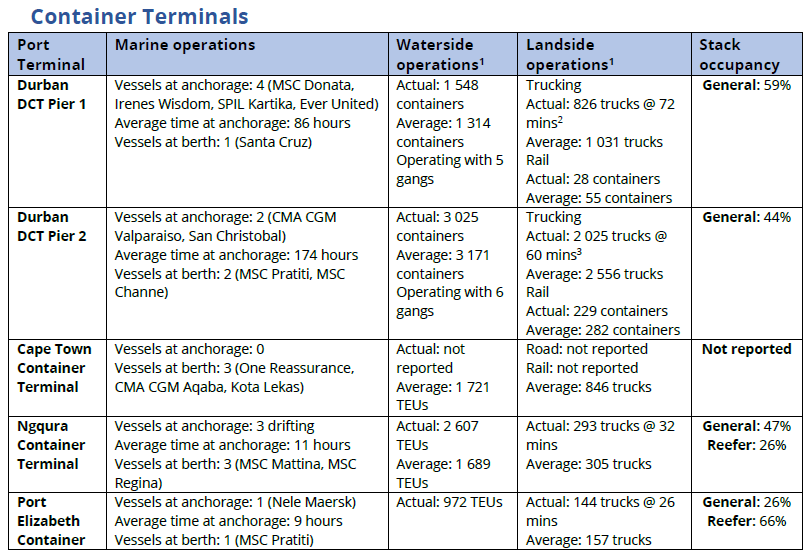

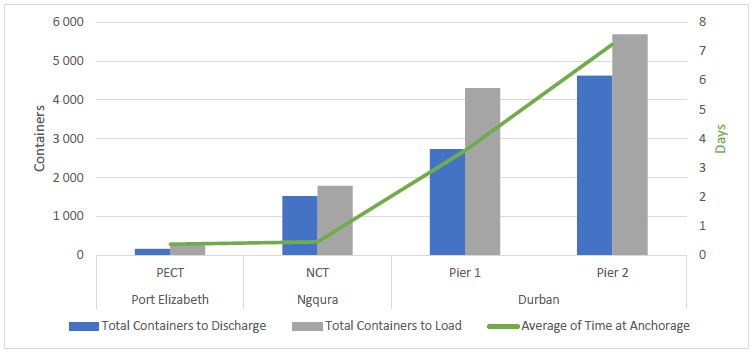

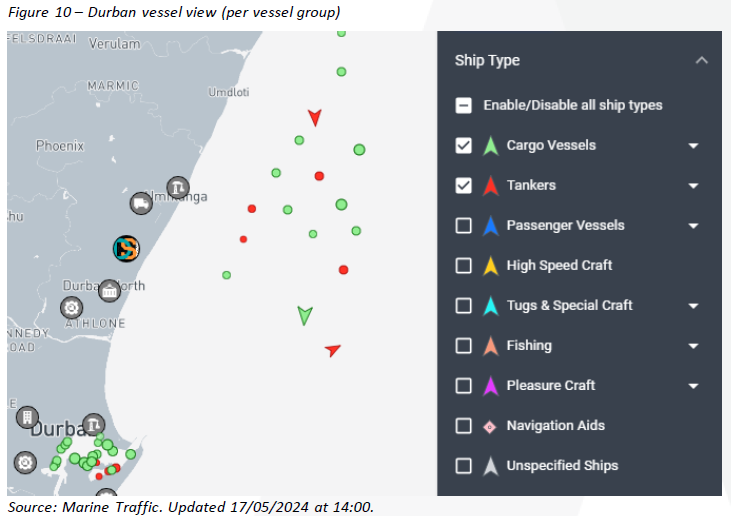

- Average time at anchorage for container vessels as of 06:00 this morning: Durban: 115 hours (Pier1: 86 hours, Pier 2: 174 hours), Ngqura: 11 hours, Port Elizabeth: 9 hours. The figure below shows the current situation at our ports from a container vessel perspective (please note that these figures where necessary have been estimated to the best of our knowledge and abilities). The line indicates the average number of days vessels have been waiting at anchorage (in days), and the bar graphs represent the total volume of containers to be loaded and discharged for the vessels at anchorage at 06:00 this morning).

- Operations at NCT were impacted by vessel ranging over the latest 24 hours. According to the latest reports, the shore tensioner is currently connected to berth D100.

- Landside targets at the Ro-Ro terminal in Durban were not met over the latest 24-hour period due to a low turnout of transporters as a result of the looming shutdown planned by the ATDF.

- Dredging will take place at DCT Pier 2, berth 204 until 22 May, which may delay operations at the terminal.

- The late arrival of transporters ensured operational delays at the Maydon Wharf terminal.

- More than 20 operational hours were lost in Cape Town this week due to strong winds and dense fog.

- Adverse weather conditions, dredging, and equipment breakdowns disrupted operations in Durban.

- Strong winds and equipment breakdowns caused delays at our Eastern Cape ports.

- At the start of the week, the Port of Richards Bay experienced some rainy weather.

Equipment Availability:

- At the time of reporting this morning, the Port of Durban had a full complement of five tugs in service, aided by a pilot boat, two launches, a helicopter, and a floating crane.

- Equipment availability at Durban MPT was reported as follows: three cranes, eight reach stackers, one empty handler, seven forklifts, and 20 ERFs.

- The dire equipment situation at DCT Pier 2 continues with only seven cranes being available at the time of reporting this morning. However, crane 525 is anticipated to return to service today, while crane 533 is expected back in service by 24 May. Additionally, the terminal had 58 straddles available at the time of reporting this morning.

- The latest reports suggest that DCT Pier 1 had 14 RTGs in service.

- One crane at NCT remains out of service and is anticipated to return by 24 May.

Ports Update

Summary of port operations

- Vessel ranging and adverse weather represented the main operational constraints in Cape Town.

- Equipment breakdowns and shortages prevented optimal performance in Durban.

- Strong winds, dense fog, and RTG breakdowns constrained our Eastern Cape Ports operations.

- No delays were reported at the Port of Richards Bay this week.

Cape Town

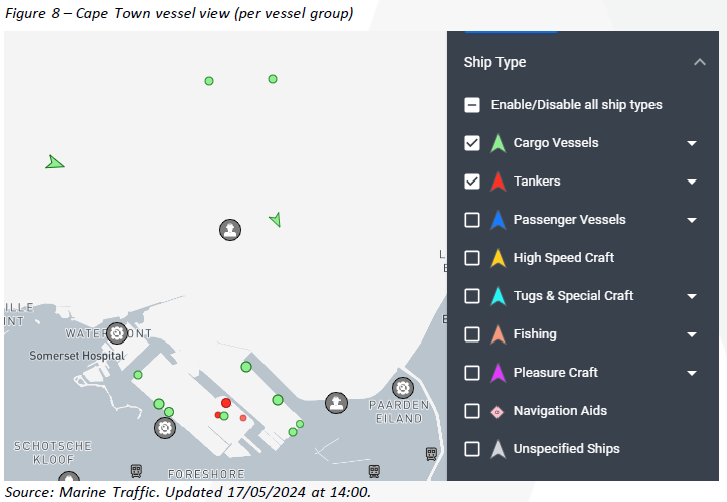

On Thursday, CTCT recorded three vessels at berth and zero at anchor as adverse weather conditions disrupted operations at the terminal once more. Between Monday and Thursday, the terminal handled 5 742 container moves on the waterside, translating to an average of 1 436 daily moves (↓12%, w/w). On the landside, during the same period, the terminal managed to service 3 278 trucks, translating to an average of 820 trucks per day (↓29%) while handling 68 rail units (↓55%). By the end of the week, stack occupancy for GP containers was recorded at 30%, reefers at 34%, and empties at 28%. Additionally, the terminal operated with seven STS cranes, 25 RTGs, and 42 hauliers. Due to strong winds and dense fog, the terminal lost at least 24 operational hours this week. Furthermore, 15 hauliers are set to arrive at the port by the end of the month to aid the existing fleet.

The multi-purpose terminal recorded zero vessels at anchor and two at berth on Thursday. In the preceding 24 hours, the terminal managed to service 256 external trucks at an undisclosed truck turnaround time on the landside. During the same period, CTMPT managed to move 298 TEUs and 5 116 tons of bulk across the quay on the waterside. Stack occupancy was recorded at 51% for GP containers, 62% for reefers, and 4% for empties. Towards the end of the week, the terminal operated with two cranes and three straddles, but at the same time, there was serious damage to productivity due to the presence of a cruise liner at E berth During the week of 06 to 12 May 2024, the FPT terminal serviced five vessels comprising three multi-purpose vessels, one dry bulk vessel, and one container vessel. Berth occupancy during this period was recorded at 54%. During the week, 461 TEUs were handled at ~seven container moves per hour, 17 182 tons of dry bulk was handled at ~142 tons per hour, and 3 555 pallets of fruit were handled at ~30 pallets an hour. FPT planned to handle ten vessels between 13 and 19 May, with another nine planned between 20 and 26 May. Adverse weather, loading challenges and the late arrival of cargo accounted for most of the delays at the terminal this week.

At midday on Friday, four vessels were waiting outside at anchorage in Cape Town, with the following snapshot of the port and vessels waiting to berth:

Durban

On Thursday, Pier 1 recorded two vessels at berth, operated by four gangs, and four vessels at anchor. Stack occupancy was 64% for GP containers and 26% for reefers. Between Monday and Thursday, the terminal executed 4 322 gate moves on the landside at an average truck turnaround time of ~134 minutes and an average staging time of ~116 minutes. Additionally, the terminal moved 5 486 TEUs across the quay on the waterside throughout the week. Towards the end of the week, all STS cranes were operational, aided by 12 RTGs.

Pier 2 had three vessels on berth and three at anchorage on Thursday as dredging operations commenced at berth 203. In the 24 hours before Thursday, stack occupancy was 63% for GP containers and 44% for reefer ground slots. The terminal operated with six low gangs on the waterside, moving 11 132 containers across the quay throughout the week. Between Monday and Thursday, there were 10 806 gate moves on the landside at an average truck turnaround time of ~97 minutes and an average staging time of ~94 minutes.

Additionally, 1 065 units were moved by rail in the same period. The number of available straddle carriers fluctuated between 49 and 56 this week. Additionally, reports this week suggested that the South Quay is still operating with only two cranes, while two cranes are out of service at East Quay and four are out of commission at North Quay.

Durban’s MPT terminal recorded two vessels at berth on Thursday and three at outer anchorage. On the waterside, 379 containers were moved across the quay, while 130 container road slots and ten breakbulk RMTs containing 368 tons were serviced on the landside. Stack occupancy for breakbulk at C-square was recorded at 10% and 39% for containers. During the same period, three cranes, eight reach stackers, one empty handler, seven forklifts, and 15 ERFs were in operation. The third crane was utilised for training for specific periods this week, while the fourth crane is anticipated to return to service by the end of the month.

On Thursday, the Maydon Wharf MPT had one vessel on berth and zero at outer anchorage, as 3 506 volumes were handled on the waterside. 24 trucks, containing 871 tons, were serviced on the landside. During the same period, the Agri bulk facility had no vessels on the berth, and as a result, no volumes were handled on either the waterside or the landside. The next vessel is scheduled to arrive on 19 May.

The following figure summarises the performance of Durban’s container terminals for the last two weeks, focusing on gate moves and time spent in the terminals.

Richards Bay

On Wednesday, Richards Bay recorded eight vessels at anchor, while ten vessels were berthed, consisting of three at DBT, four at MPT, three at RBCT, and none at the liquid-bulk terminal. Two tugs, one pilot boat, and one helicopter were in operation for marine resources. During the same period, the coal terminal had six vessels at anchor and one at berth while handling 145 041 tons on the waterside. On the landside, 24 trains were serviced, exceeding the target of 22.

Eastern Cape ports

On Wednesday, NCT recorded three vessels on the berth and one at the outer anchorage, with four drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading to Thursday. Stack occupancy was 36% for GP containers and 31% for reefers., as a total of 1 689 TEUs were processed on the waterside. Additionally, 563 trucks were serviced on the landside at a truck turnaround time of ~41 minutes.

On Wednesday, GCT recorded one vessel at berth and one at outer anchorage. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading to Thursday. On the waterside, 556 TEUs were handled across the quay, while 302 trucks were processed at a truck turnaround time of ~44 minutes. Stack occupancy figures were recorded at 42% for GP containers and 34% for reefers.

This week, no reports were received for the Ports of Port Elizabeth and East London.

Eastern Cape ports

On Wednesday, NCT recorded three vessels on the berth and zero at the outer anchorage, with one drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading to Thursday. Stack occupancy was 45% for GP containers and 49% for reefers, as a total of 2 257 TEUs were processed on the waterside. Additionally, 348 trucks were serviced on the landside at a truck turnaround time of ~36 minutes. Crane 3 returned to operations towards the end of the week but worked slowly due to other issues noticed on the crane. Crane 7 remains out of service with no ETR communicated yet.

On Wednesday, GCT recorded one vessel at berth and one at outer anchorage, with one vessel drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading to Thursday. On the waterside, 880 TEUs were handled across the quay, while 479 trucks were processed at a truck turnaround time of ~61 minutes. Stack occupancy figures were recorded at 49% for GP containers and 43% for reefers. During this period, GCT experienced some delays due to congestion due to harbour carriers entering the port well before booking appointments. The terminal also experienced some backlogs due to equipment breakdowns preventing optimal operational performance.

No vessels were serviced at the Ro-Ro terminal this week, with stack occupancy rising to 78%. And lastly, no reports were received for the Port of East London this week.

Global Container Freight Rates

Global container capacity and freight rates

Global reefer update

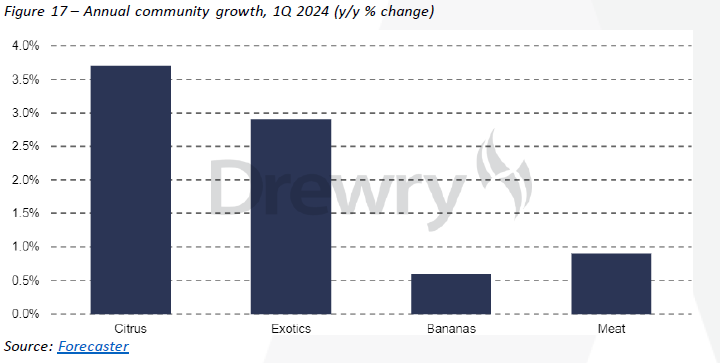

In 2024, the reefer shipping sector has shown signs of recovery after experiencing declines over the previous two years.14 According to Drewry’s “Reefer Shipping Forecaster”, this improvement is driven by robust crop yields in the Southern Hemisphere, including significant growth in South Africa’s citrus exports due to favourable growing conditions and new orchards. This has positively impacted exports of oranges, lemons, and grapefruits. Alongside, other key commodities like meat and bananas have also reported growth.

Source: BUSA-SAAFF

Reefer freight rates, which had surged during the pandemic, are now declining due to adjustments by shipping lines and excess capacity in the container segment, despite a brief rise in the first quarter of 2024 influenced by geopolitical tensions in the Middle East. Moreover, container shipping has remained robust against ongoing challenges like delays and backlogs at the Panama Canal, with major shipping lines securing long-term agreements ensuring shipment priority and schedule adherence. Drewry forecasts a more than ↑1% increase in global seaborne reefer volumes for 2024, marking a positive shift for the industry influenced by stronger exports and falling freight rates.

Global container capacity

Despite claims of significant capacity loss on Asia-Europe routes by carriers like Maersk, actual figures reveal a more nuanced situation. Maersk reported a 15-20% capacity reduction, especially on the Asia-Europe and Mediterranean routes. However, analysis shows that effective capacity, which accounts for actual vessel departures and route changes, has experienced varied adjustments. For example, the effective capacity to North Europe has decreased by ↑5,1% (y/y), mainly due to longer routing via the Cape of Good Hope, despite a ↑17,8% increase in deployed vessel capacity. Conversely, the Asia-Med route has seen a ↑10,5% increase in effective capacity, benefiting from a ↑49,1% surge in total deployed capacity. Overall, these routes’ combined capacity has increased by ↑28%, totalling nearly 7 million TEU—a net gain of 1,2 million TEU in the last five months, with a significant portion allocated to the Med, buoyed by higher freight rates.

Simultaneously, the Asia-Europe trade faces ongoing challenges. The three major shipping alliances are operating 10% below needed capacity, lacking 36 ships for their 25 loops, despite introducing 1,14 million TEU of new capacity this year:

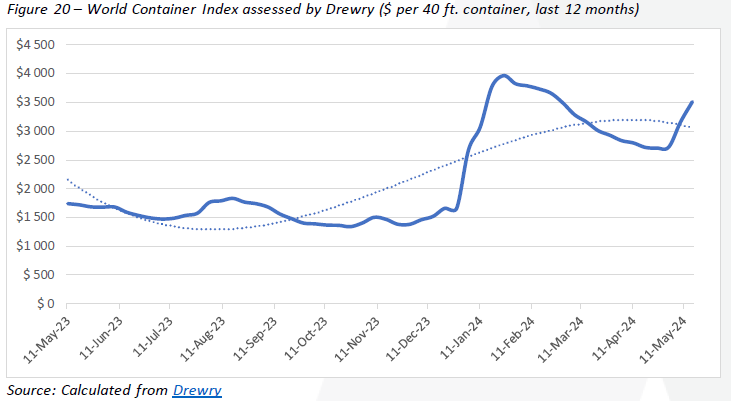

Global container freight rates

Market panic over tightening vessel space availability has sent freight rates to their highest level since September 2022, rising by nearly ↑20% after last week’s holiday break to hit a 20-month high.19 Unlike the surge in January this year when the rate hikes were primarily limited to the Red Sea-affected routes, the gains are more broad-based this time, with sharp rate hikes on all long-haul routes on the back of a strong rebound in demand ahead of the summer peak season. This week, the “World Container Index” increased by another significant amount, with the index up by ↑11,1% (or $352) to $3 511 per 40-ft container.20 The following figure shows the movement of the index across the last twelve months – with the recent spike very clear:

The most significant changes came on the ex-Shanghai-routes, with routes to Rotterdam, Genoa, LA, and NY up by around ↑12%. The composite index is more than double (↑104%) compared to last year’s week and ↑147% higher than the 2019 pre-pandemic rates of $1 420. In the charter market, the rate followed spot rates – albeit less dramatically – as the Harper Petersen Index (Harpex) is currently trending at 1 372 points, up by ↑4,0% (w/w) and up by ↑11% (y/y) versus this time last year

BUSA-SAAFF Summary

In concluding this edition, our focus was on coordinated border management being at the forefront of trade, transport, and logistics this week as the industry grapples with two crises in the form of medical goods and Port Health ITC constraints. At the weekend, SAHPRA communicated to stakeholders’ significant difficulties at OR Tambo International Airport, impacting the review and approval of essential medical shipments. SAHPRA is enhancing its on-site presence by increasing its inspector count to six and introducing a physical resubmission process for unprocessed documents, aligned with Border Management Agency hours. This adjustment aims to expedite the clearance of both backlogged and new shipments. Effective coordinated border management is essential, especially in crises, and hinges on (1) improved information system interoperability, (2) joint operational processes, (3) data exchange, (4) adequate resource allocation and (5), most crucially, co-operation between the various government agencies involved in these processes. This week has underscored the urgent need for robust collaborative efforts from all involved parties to navigate the crises effectively and maintain seamless trade operations vital for South Africa’s stability and health sector support, not to mention the on-time delivery of critically urgent medical supplies.

Source: BUSA

Glossary

BLANK SAILING – A blank sailing is a sailing that has been cancelled by the carrier, which may mean one port is being skipped, or the entire string is cancelled. Blank sailings happen for a couple of reasons.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape