Welcome to another Logistics News Update.

Tariffs Bite, China Opens the Door: Smaller exporters to the USA have seen a 46% drop in volumes, with tariffs playing a major role in the decline. Shifting trade to other regions may sound like a solution but in practice, it’s far more complex. Exporting fruit from South Africa to China, for example, faces stringent phytosanitary rules, long shipping routes, South African port congestion, and strong competitive pressure that limits our advantage. To make matters worse, Chinese authorities can reject shipments at the last minute, which is a costly risk because cargo cannot simply be rerouted.

There is some good news. South Africa’s stone fruit industry has secured a new trade protocol with China, covering apricots, peaches, nectarines, plums, and prunes. The deal could unlock up to R400 million in export value over the next five years, providing a timely boost to the sector.

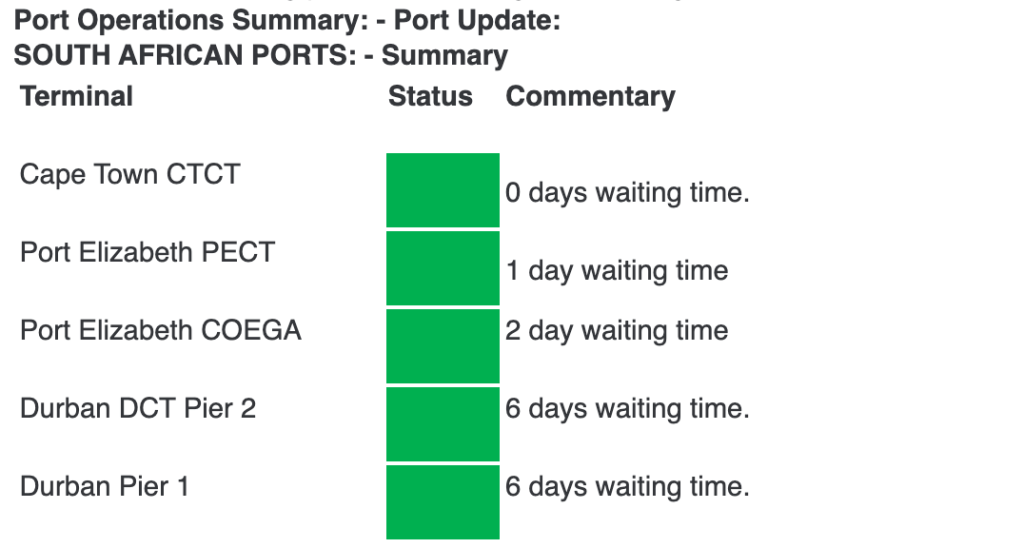

As we move deeper into the peak season, our ports are under serious strain and terminals across the country are battling to stay on schedule due to peak season. You’ll find details in our Port Report below.

Trade

- Zuko Godlimpi (Deputy Minister of Trade, Industry & Competition) said that because of the 30 % US export tariffs, South Africa must shift focus from over-reliance on the US market and accelerate diversification to Asia, Africa and trade zones such as AfCFTA.

- According to the new SME Export Index, South African small and medium exporters’ direct-to-consumer exports to the US have dropped 46% since April 2025, largely due to tariff changes and the removal of the de-minimis waiver.

- Global trade patterns are shifting: A study highlighted that emerging markets (including South Africa) will record some of the fastest trade growth between 2025-29, as companies diversify supply chains amid tariff and policy turbulence.

- The South African Association of Freight Forwarders (SAAFF) has called for rapid progress on the 49 % concession PPP at Port of Durban’s Pier 2 terminal, following the recent High Court ruling in favour of ICTSI. The statement underscores urgency in delivering capacity and reform outcomes.

What is the news

- South Africa Urged to Preserve Strong Trade Ties with the US: The Exporters Western Cape says diverting trade away from the US would be difficult and counterproductive, as the long-standing partnership continues to deliver clear export benefits for South Africa.

- Ports record ‘defining moment of excellence’: All nine segments of data measured across South Africa’s freight industry have tracked “in the green” of the Cargo Movement Update (CMU) a historic first for the weekly report by the South African Association of Freight Forwarders (Saaff) and Business Unity SA.

- Cape Winelands Airport secures R8bn investment: Growthpoint Properties has made an initial R8 billion investment in the new Cape Winelands Airport precinct with the right to co-invest and develop the precinct, marking the start of a partnership to deliver the aviation, hospitality and industrial hub.

- Transnet seeks break-bulk operator for Port of Cape Town: Transnet National Ports Authority (TNPA) has issued a Request for Proposals (RFP) for a terminal operator to construct and manage a break-bulk terminal at the Port of Cape Town.

Let’s Learn: What Is Transit Time?

When shipping lines or airlines quote a “transit time”, it can be misleading if you do not understand what it includes. Transit time only refers to the movement between the port of loading and the port of discharge. It does not include the time before or after the voyage.

What Transit Time Covers

Transit time is the period the cargo spends in transit on the vessel or aircraft. For example, a 35-day sea freight transit from Shanghai to Durban means the container is at sea for 35 days, not that it will be delivered to your warehouse in 35 days.

What Delivery Time Really Includes

Delivery time includes everything from the factory gate to the destination.

• Export clearance and container staging

• Waiting time before vessel departure

• Sailing or flight time

• Port offload and stack time

• Customs clearance and inland transport

Why the Difference Matters

• Delivery often takes 30-40% longer than transit time

• Port congestion, strikes, or customs inspections can add days

• Incorrect planning can cause stock shortages or penalties

What You Can Do

• Plan based on total lead time, not just the carrier’s quoted transit time

• Add a buffer when planning sales or production schedules

• Track shipments from origin to destination using a visibility platform

• Communicate clearly with suppliers about delivery expectations

Key Point:

Transit time is only one piece of the puzzle. Delivery time is what your business feels. Plan on reality, not just what is written on the schedule.

NEWS

Port Fees in China and the US Disrupt Global Cargo Flows

Source: FreightNews – Lyse Comins

South Africa’s Port Performance Is Finally Improving

Creecy: TEU Targets Met, Queues Cleared, and Rail Volumes Rising

A new round of port-call fees between the United States and China is disrupting global trade routes and pushing freight rates higher. The reciprocal charges, introduced on 14 October 2025, target vessels linked to each other’s countries. As a result, many carriers are rerouting ships to avoid the additional costs. The move has already reduced available capacity on key trans-Pacific and connecting routes, with the Shanghai Containerised Freight Index climbing nearly 13 percent in a week.

Shipping lines such as Maersk and Hapag-Lloyd have begun adjusting their schedules, skipping certain ports and consolidating sailings to manage the cost impact. This has caused service gaps, longer lead times, and increased congestion at alternative ports. The tanker market has also been affected, with freight rates for large crude carriers to China rising sharply as fewer vessels qualify for exemptions.

For South African importers and exporters, the effects may be indirect but significant. Cargo moving between Asia, the United States, and Africa often relies on trans-Pacific hubs for transhipment. Any slowdown or rerouting in those corridors can tighten container supply, extend delivery times, and increase overall shipping costs. Forwarders and traders are already warning clients to review their supply-chain schedules and build extra time into delivery planning.

The development highlights how geopolitical decisions now have immediate effects on global logistics. With freight costs rising and schedules becoming less predictable, companies need to plan around volatility rather than hope for quick stability. For businesses like TSI Central Station, the priority is clear: stay informed, stay agile, and communicate early with clients to keep trade moving despite shifting global tides. Source: Adapted from Reuters

Key Highlights from Last Week’s Discussions – 12th October 2025

Source: BUSA, SAAFF, and global logistics data

1. Port Operations

South African ports handled 81 088 TEUs this week, a decline of 14 percent week on week, averaging 11 584 TEUs per day.

- Cape Town increased throughput by 49 percent to 16 436 TEUs despite wind and equipment downtime

- Durban Pier 2 fell 5 percent to 31 830 TEUs, while Pier 1 dropped 8 percent to 13 293 TEUs

- Ngqura volumes declined sharply by 46 percent to 12 071 TEUs

- Port Elizabeth throughput fell by 72 percent

- Richards Bay moved an average of 157 000 tons of coal per day, but weather continued to affect performance

- Rail volumes out of Durban dropped 58 percent to 2 856 containers

Summary:

Ports are under visible pressure as peak volume approaches. Weather and ageing equipment continue to expose operational weaknesses. Capacity is available but reliability remains at risk.

2. Air Cargo

Total international air cargo at OR Tambo reached 6,98 million kilograms, down 4 percent week on week.

- Inbound volumes increased by 8 percent to 4,21 million kilograms

- Outbound volumes fell 18 percent to 2,78 million kilograms

- September cargo rose 1 percent month on month, but remains 1 percent below last year

Summary:

Air imports remain firm with retailers building stock. Export softness is a concern for local manufacturers. The sector is stable but lacks strong South African outbound demand.

3. Road and Border Crossings

- Lebombo handled 1 422 trucks per day, but queue times increased to 7,1 hours

- Processing time climbed 34 percent, affecting time-sensitive cargo

- Rail to Maputo dropped to 9 trains per day

- South African borders saw transit times increase to 11,1 hours on average

- SADC borders outside South Africa improved to 5,0 hours

- Beitbridge, Groblersbrug and Kasumbalesa remained high risk, often exceeding 24 hours

Summary:

South African border performance is slipping again. Inland systems and customs delays are creating bottlenecks, even as neighbouring corridors improve. Exporters are facing renewed uncertainty.

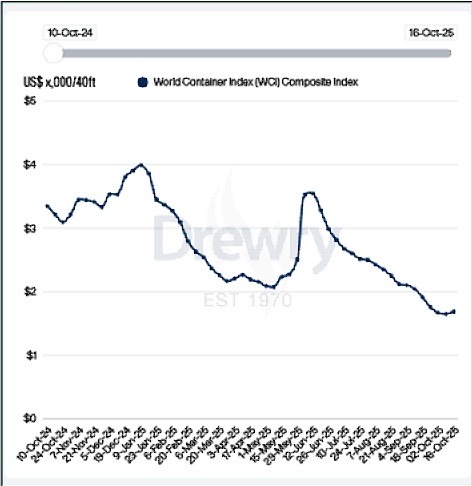

4. Ocean Freight and Global Shipping

- Drewry World Container Index fell 5,2 percent to 1 669 dollars per FEU

- Rates are now 52 percent lower than a year ago

- Carrier margins dropped below 10 percent

- Structural overcapacity is expected to peak by 2027

- New US port fees on China-built vessels will take effect on 14 October, placing pressure on Asian carriers such as COSCO

Summary:

The global container market has moved firmly into a buyer’s market. Carriers are under rate pressure and may introduce more blank sailings to defend pricing. Shippers should expect volatility rather than stability.

5. Global Air Cargo

Freighter capacity increased 2,6 percent and belly capacity by 7,8 percent

Global air cargo demand grew 4,1 percent year on year in August

Africa recorded 11 percent growth, its second consecutive double-digit month

Jet fuel prices declined 6,4 percent year on year to 87,60 dollars per barrel

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

Global Freight Rates

Weekly Container Rate Update – 16th October 2025

Freight Rates Edge Up After Seventeen Weeks of Decline

Global container freight rates have posted their first increase in more than four months, offering a brief pause in what has been a steady downward trend since June. Drewry’s World Container Index (WCI) rose 2% this week to $1,687 per 40ft container, marking the first uptick after seventeen consecutive weeks of decline. While the rise is modest, it reflects carriers’ recent attempts to stabilise the market through General Rate Increases (GRIs) and new Freight All Kinds (FAK) rate adjustments.

Spot rates from Shanghai to Los Angeles climbed 1% to $2,195 per 40ft container, while the Shanghai–New York route increased 1% to $3,236. Drewry expects this momentum to continue into next week, driven by the GRIs that came into effect on 15 October. However, analysts believe the improvement will be short-lived, with rates likely to soften again before carriers attempt further GRIs on 1 and 15 November to counter the drop.

Asia–Europe lanes also showed small but encouraging gains. The Shanghai–Rotterdam rate rose 6% to $1,669 per 40ft container, and the Shanghai–Genoa rate moved up 2% to $1,821. These changes follow the introduction of new FAK levels by major carriers who are trying to slow the post-Golden Week rate slump and prevent another prolonged decline heading into the quieter winter season.

While the short-term rate increase offers carriers a brief reprieve, market fundamentals remain weak. Global demand has not recovered fully, and vessel overcapacity continues to weigh heavily on pricing. For shippers, this means temporary cost pressure but also ongoing uncertainty. Rate volatility is expected to remain through year-end as carriers adjust capacity and test the market with repeated GRI cycles. Source: Drewreyrewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”