Welcome to another Logistics News Update.

What a week last week was. The internet dropped, and everyone was checking their phone because they thought their phones were broken. Microsoft went down and no one has mail. It just goes to show you that no one would have ever thought the internet is our most valuable resource.

In the Red Sea, Houthi rebel attacks are causing major disruptions in the shipping industry. Delays, rerouted freight lines, and rising costs are forcing companies to turn to airfreight. The long-term impact remains uncertain. Additionally, Houthi rebels threaten vessel traffic around South Africa.

On The Ground Update: Port improvements are ongoing, but delays persist. Durban wait times remain high (22-28 days), while Cape Town’s container terminal is nearing target but the multipurpose terminal faces delays (4-5 days). Booking slots remain a challenge, but internal improvements are expected to ease this. See below summary from Maersk, MSC has started to tranship more and at time bypass to miss the port congestion.

| Cape Town CTCT | • Waiting time stable at 3-5 days – some wind impact • Productivity close to target. • Full recovery is estimated in a further 2 weeks (not withstanding possible Southeaster wind delays). • Transnet has released a Wind Recovery Plan to mitigate the effect of wind delays and speed up operations start-up. |

| Cape Town MPT | 4-5 days delayVery low productivity due to intermittent MHC (mobile harbour cranes) breakdowns.No improvement on week 11 |

| Port Elizabeth PECT | 1-2 days waiting time.2x STS (ship to shore) and 1x MHC operational are fully operational.Productivity just below the expected rates |

| Durban DCT Pier 2 | No improvement to wk. 11 update22-28 days waiting time.Productivity remains well below target.STS breakdown and straddle carriers’ reliability and availabilityMedium term equipment recommissioning – June/July STS on South Quay and straddle carriers from mid-year.Limited truck scheduled impacting imports collection and exports stackingRecovery estimated in 8-12 weeks |

| Durban Pier 1 | Deterioration from 2-3 days to 5 days waiting time.Poor STS and RTG reliability and availabilityProductivity below targetRecovery estimated in 3-4 weeks |

Disclaimer 1: Please note: All information presented in this post is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed.

RECAP OF NEWS: The news covers various topics in the freight industry, including port leasing opportunities, airline acquisitions, and challenges in manufacturing. The articles mentions that shippers are reliant on cargo visibility. Mozambique’s strict stance on its business language and the Western Cape’s aim to build a R1-trillion economy.

NEWS

Also read : Red Sea rebels threaten vessel traffic around South Africa

Imports surge as seaport volumes suffer

By Liesl Venter

Airfreight volumes, especially on the import side, are increasing.

According to Jacob Pretorius, general manager for airfreight at neutral cargo consolidator SACO CFR, there has been a significant improvement in volumes during the first months of this year compared to last year.

“We have had a very positive start in 2024 on the airfreight side,” he told Freight News. “There has been an increase in volumes, with imports leading the way in improvements. “This reflects our dedication to providing our customers with the best possible experiences and products.”

Pretorius cited the disruptions in ocean freight that were occurring due to attacks in the Red Sea, causing vessels to reroute and, in so doing, endure longer transit times.

He said the situation was continuing to impact the logistics sector. As a result, airfreight had become a practical choice for customers who needed their business operations to proceed.

Source: Freight News

Manufacturing confidence dips on back of energy, port challenges

By Staff reporter

Load-shedding has been cited as one of the main reasons for decreasing manufacturing confidence in South Africa. Source: Secret Cape Town

South Africa’s load-shedding crisis, efficiency challenges at the ports and political uncertainty weighed heavily on manufacturer confidence during the first few months of 2024.

This is according to the Absa Manufacturing Survey Quarter 1, 2024, which showed that business confidence dipped five points to 21 during the period, significantly lower than the long-term average of 37 points.

Seasonally, the first quarter is typically a quieter period for the manufacturing sector. According to the survey, this trend continued, with domestic and export sales falling nine and 17 points, respectively.

Source: Freight News

Industry resilience weathers trade lane disruption

By Staff reporter

In the face of adversity related to ongoing risk south of the Suez Canal, a trade lane ordinarily used for shipping about 15% of global ocean cargo between Europe and Asia, shippers and supply chain professionals remain resilient.

A series of interviews by Bloomberg with retail executives and at least one ocean operator has revealed that industry representatives are managing to absorb the impact of rebel attacks around the Horn of Africa that have disrupted as much as 60% of vessel traffic through Suez.

Reza Taleghani, CEO of luxury luggage manufacturer Samsonite, said: “If you think about things, you read about in the news, shipping delays, Red Sea, et cetera, we are just fine.

“We have inventory exactly where we need it to be. All of our facilities, even if there is a week or two delay, (it’s ) not that big a deal.”

Not everyone, though, is unconcerned.

Source: Freight News

Suez shipping disruption here to stay for the time being

By Staff reporter

Vessel traffic through the Suez Canal remain disrupted because of Houthi rebel attacks off the coast of Yemen. Source: The Times

Red Sea shipping diversions may last a few more months, and some freight industry experts think they could go on even longer.

That’s one of the takeaways from the CEO of Hapag-Lloyd, the world’s No. 5 container line, in an interview Thursday on Bloomberg TV.

Rolf Habben Jansen was speaking as the Hamburg-based company announced its 2023 earnings, which showed a steep drop in revenue and profits from a year earlier.

Attacks by Yemen’s Islamic Houthi militia on ships in the Red Sea have disrupted supply chains since mid-December, forcing carriers to change routes and redo schedules — adjustments that have helped absorb excess capacity.

. Source: Freight News

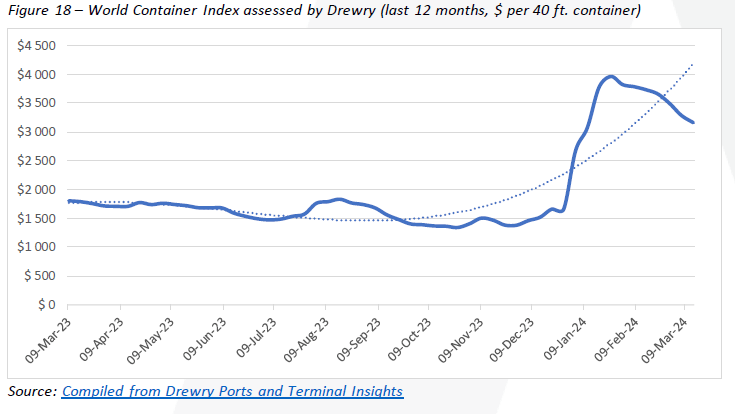

PORTS

Weather and other delays:

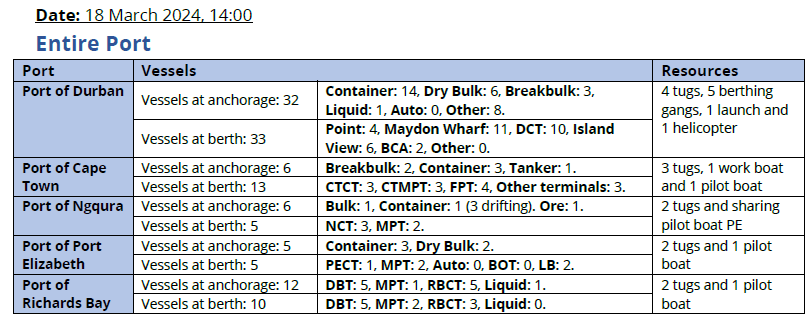

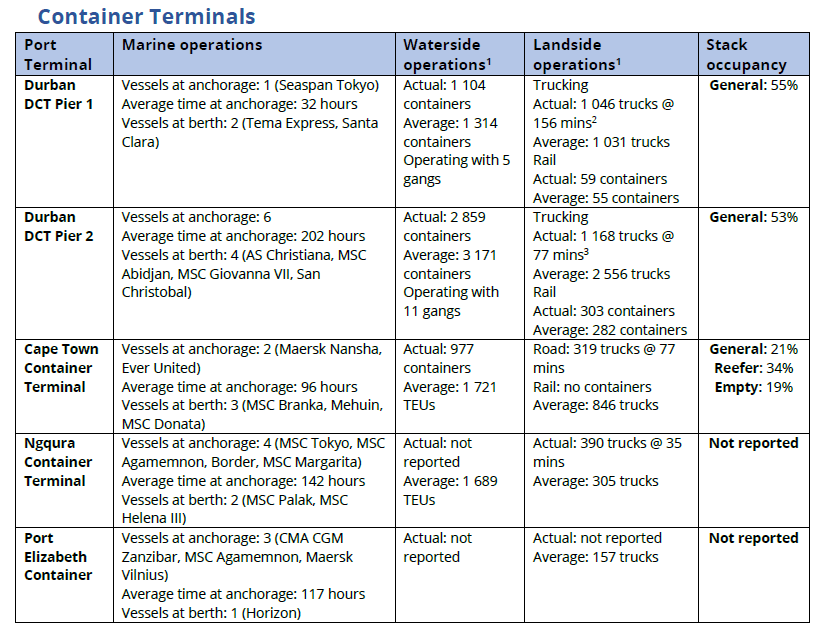

Average time at anchorage for container vessels as of 06:00 this morning: Durban: 155 hours (Point: 102 hours, Pier 1: 32 hours, Pier 2: 202 hours), Cape Town: 96 hours, Ngqura: 142 hours, Port Elizabeth: 117 hours. The figure below shows the current situation at our ports from a container vessel perspective (please note that these figures where necessary have been estimated to the best of our knowledge and abilities). The line indicates the average number of days vessels have been waiting at anchorage (in days), and the bar graphs represent the total volume of containers to be loaded and discharged for the vessels at anchorage at 06:00 this morning).

CTCT went windbound on multiple occasions yesterday, most notably between 06:00-10:00 and 19:20-01:00. CT MPT also went windbound for a few hours yesterday.

Strong winds and high swells delayed three vessel movements at the Port of Port Elizabeth over the most recent 24 hours. Adverse weather also disrupted operations at NCT during this period.

Two vessel movements were delayed in Durban due to strong winds and occupied tugs.

Equipment Availability:

This morning, four tugs were in service at the Port of Durban with the fifth tug anticipated to return by midday. The latest reports suggest that the port has a total of nine tugs of which four are out of commission. These tugs are currently in excess of 39 years old which could explain why they experience so many intermittent breakdowns. Additionally, the floating crane is fully operational and fully manned.

Over the weekend, the Island View terminal in Durban experienced some challenges with the launch boats as both crafts were out of service for a few hours yesterday.

Cranes 3 and 6 at NCT are currently out of service, with crane 6 set to be recommissioned on Wednesday.

At the time of reporting, Pier 2 had about 57 straddles in service.

At the time of reporting, CTCT was operating with seven STS cranes, 25 RTG’s, and 44 haulers. Cranes LC1 and LC2 are currently out of commission due to hoist motor issues.

Cape Town

On Wednesday, CTCT recorded two vessels at berth and two at anchor as sailing was delayed for approximately three hours due to the pilot boat being out of service. In the preceding 24 hours, stack occupancy for GP containers was recorded at 33%, reefers at 85%, and empties at 25%. In this period, the terminal was forced to stop its reefer intake for a large portion of the day due to the high stack occupancy figure. At the start of the week, the terminal went windbound for about four hours and towards the end of the week, the terminal operated with eight STS cranes, 25 RTGs, and 43 hauliers. It was pleasing to see that some consistency is being seen in terms of equipment deployment.

The multi-purpose terminal recorded zero vessels at anchor and one at berth on Tuesday. In the 24 hours leading to Wednesday, the terminal managed to service 209 external trucks at an undisclosed truck turnaround time on the landside. During the same period, CTMPT managed to move 526 TEUs across the quay on the waterside. Stack occupancy was very low at 10% for GP containers, a low 16% for reefers, and 4% for empties during the same period. The terminal is anticipating the citrus season to kick off in April. This gives rise do some nervousness, given that MPT had some difficulty in maintaining volumes in the deciduous season, mainly due to a shortage of plug points. At the start of the week, a CMA CGM vessel was seemingly delayed due to faulty cell guides, which resulted in slow loading.

During the week of 4 to 10 March 2024, the FPT terminal serviced five vessels comprising three multi-purpose vessels and two container vessels. Berth occupancy during this period was recorded at 43%. During the week, 2 983 TEUs were handled at ~nine containers per hour, 73 tons of breakbulk at ~40 tons per hour, and 5 805 pallets of fruit at ~28 pallets per hour. FPT planned to handle seven vessels between 11 and 17 March, with another six planned between 18 and 24 March. Slow loading due to faulty equipment constituted the majority of the delays encountered at the terminal this week.

Durban

Earlier this week, the Hoegh Shanghai was delayed due to a communication mishap regarding marine equipment availability. According to TNPA, the extent of the delay could have been mitigated if

communication between themselves and port control had been a bit better. TNPA apologised for this miscommunication and assured the industry that they would improve. Conversely, the pilot boat made its long-awaited return this week, while the port returned to a complement of six tugs towards the end of the week. Additionally, the latest reports suggest that a seventh tug will be brought into service soon, with the eighth tug set to join the fleet sometime next week.

Pier 1 on Thursday recorded two vessels at berth, operated by five gangs, but no vessels at anchor. Stack occupancy was 53% for GP containers and remained undisclosed for reefers. During the same period, the terminal recorded 1 293 gate moves on the landside, with an undisclosed number of cancelled slots and 196 wasted. The average truck turnaround time for the week was recorded at approximately ~151 minutes, with an average staging time of ~98 minutes. Additionally, the terminal had 2 220 imports on hand, with 120 of these units having road stops and 84 units being unassigned. Between Tuesday and Wednesday, the terminal experienced intermittent system challenges with customer links.

Pier 2 had four vessels on berth and nine at anchorage on Thursday. In the preceding 24 hours, stack occupancy was 60% for GP containers and undisclosed for reefers. The terminal operated with ten gangs while moving 2 883 containers across the quay. During the same period, there were 2 707 gate moves on the landside, of which 1 529 were for imports and 1 178 were for exports. The average truck turnaround time for the week was recorded at ~105 minutes, with an average staging time of ~140 minutes. Additionally, 433 rail containers were on hand, with 308 moved by rail. The terminal had a reported 54 straddles (↑5, w/w) in operation, translating to an availability figure of approximately ~55%, which is around ↓32% below the minimum number required to meet industry demand and achieve acceptable terminal performance.

Durban’s MPT terminal recorded three vessels at berth on Wednesday and three vessels at outer anchorage. No waterside or landside volumes were reported this week. However, stack occupancy for breakbulk was recorded at 32% and 63% for containers. During the same period, three cranes, nine reach stackers, one empty handler, six forklifts, and 20 ERFs were in operation. The latest reports suggest that the fourth crane’s repairs were delayed due to an outstanding certificate, which has since been received. The technical team is aiming to have the machine back in operation by 30 March; however, with the current condition of the machine, further delays can be anticipated. The terminal went windbound for the entire night shift on Tuesday, which subsequently impacted operations.

No reports were received for the Maydon Wharf or Agri-

Richards Bay

On Friday, Richards Bay recorded eight vessels at anchor, while eight vessels were also recorded on the berth, consisting of six at DBT and two at RBCT. Two tugs, one pilot boat, and one helicopter were in operation for marine resources. On Thursday, the coal terminal had five vessels at anchor and two at berth while handling 173 513 tons on the waterside. On the landside, only ten trains were serviced. This week, TNPA announced the opening up of approximately 100 leasing opportunities for port land and commercial developments at South Africa’s seven commercial seaports. Of these leasing opportunities, about 24 sites within the Port of Richards Bay will be up for grabs. The other leasing opportunities include 26 sites in Cape Town, 26 in Durban, two in East London, four for Mossel Bay, 11 in Gqeberha, and six in Ngqura.

Eastern Cape ports

On Thursday, NCT recorded two vessels on the berth and one vessel at the outer anchorage, with two vessels drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading to Friday. Stack occupancy was 40% for GP containers, 21% for reefers, and 40% for reefer ground slots, as a total of 2 398 TEUs were processed on the waterside. Additionally, 466 trucks were serviced on the landside at a truck turnaround time of ~42 minutes. Cranes 6, 7, and 8 at the terminal all remained out of commission this week. The revised ETR for Crane 6 is scheduled for 20 March; Crane 7 is still scheduled for 22 March, while Crane 8 is scheduled for 18 March. Strong winds and dense fog hindered operations at the port this week.

On Thursday, GCT had one vessel on berth and none at anchor. In the 24 hours to Friday, the terminal had two tugs, one pilot boat, two pilots, and one berthing gang in operation. On the landside, 257 trucks were processed at a high truck turnaround time of ~44 minutes, while 276 TEUs were handled across the quay on the waterside. The high truck turnaround time experienced can largely be attributed to the extensive challenges experienced with the straddle carriers. For the most significant part of the week, no vessel was on berth at the Ro-Ro terminal. Stack occupancy towards

Global container summary & Update

The Red Sea shipping diversions may last a few more months, and some think they could last even longer. That’s among the takeaways from the CEO of Hapag-Lloyd, the world’s No. 5 container line, in an interview on Thursday15. Rolf Habben Jansen was speaking as the Hamburg, Germany-based company announced 2023 earnings that showed a steep drop in revenue and profits from a year earlier. Houthi attacks on ships in the Red Sea have disrupted supply chains since mid-December, forcing carriers to change routes and redo schedules — adjustments that have helped absorb excess capacity. As a result, they’re burning more fuel and taking longer to deliver, with some needing to purchase more containers given the extended routes. The added costs are getting passed along to customers. The longer routes around southern Africa initially boosted spot container rates, but those are coming down, Jansen said. “The services are stabilising, which also means that the market is getting calmer.” Nevertheless, the traffic through the Suez Canal remains significantly depressed – diverting to traffic flowing around the Cape of Good Hope:

Global port congestion is stable and currently affecting ~4,5% of the total fleet; however, things at Durban are seemingly worsening again, as Durban remains the only South African port featured on the first page of the “Port Congestion Watch”. This week, the queue-to-berth ratio at Durban increased to 0,7616, which does not bode well after we continually saw this figure dropping in recent weeks. The idle capacity stands at ~0,3% of the total fleet, as the “Cancelled Sailings Tracker” is down and is currently trending at around 6%17. Nearly 200 000 TEU of newbuild containership capacity was delivered in February, following a record 300 000 TEU received the month before – the new tonnage being comfortably soaked up by Red Sea diversions around Africa. However, if and when a safe passage can be guaranteed and ships can again transit the Red Sea to the Suez Canal without fear of attack, ocean carriers will need to manage a chronic oversupply situation, as at least another 2,5 million TEU is slated still to be delivered this year18. Consequently, the increased demand for tonnage has fully absorbed all the new capacity delivered in the last five months, with additional requirements for another 400 000 TEU of incremental capacity still to be fulfilled to maintain services in the current market dynamics.

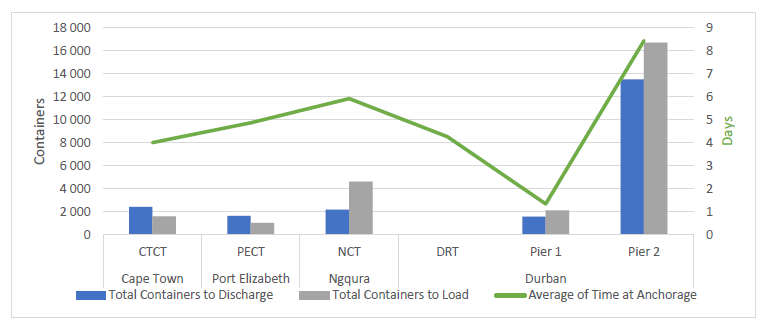

Global container freight rates and carrier profits

Global container rates continued their fall, as the “World Container Index” is down by another ↓3,8% (or $125) to $3 162 per 40-ft container19. All major routes continue to fall this week by between↓1-5%, except for the New York – Rotterdam and mirror routes, which are up by ↑2-3%. The composite index remains up by ↑77% compared to the same week last year and ↑123% higher than the average 2019 pre-pandemic rates of $1 420. We are unlikely to see these rates again; however, the industry is pricing another few rounds of rate decreases in the next couple of weeks, as the composite index is likely to settle in the mid-$2 500s. There are concerns about the commercial viability of carriers at those freight levels. The following figure shows the movement of the index in the last year:

BUSA-SAAFF Summary

In summary, the increasing quantities of cargo handled – in conjunction with the monthly reported volumes from TNPA – for our container industry are starting to indicate that we may have turned a corner as far as port operations go, but it is probably too early to take this as a firm trend. Furthermore, effective collaborative efforts between business and government will certainly assist Transnet in reporting higher volumes than initially forecast6. However, some caution must be expressed, as several indicators have again turned for the worse, notably the vessels at anchorage in Durban, the queue-to-berth ratio of containers, and the ongoing reporting of equipment shortages and breakdowns. Overall, industry challenges persist amidst evolving market dynamics, both locally and internationally. These will be closely monitored as the collective industry takes every step possible to bring our sports economy back to a position of which we can be proud once more, as, similar to other emerging markets such as Brazil, our current performance is significantly behind the times.

Source: BUSA – SAAFF

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape.