Good morning,

Welcome to another Logistics News Update.

It is no secret that our ports are in shambles. Just in KZN alone, there are 62 vessels at anchorage, there are more than 71’000 containers at sea and the importers and exporters are paying for the ports inefficiency to maintain and operate their equipment. The South African Freight Forwarding Association has reported below all the stats and facts. I hope this gives you a good view of what is happening at the ports. A member of the logistics team in KZN reported counting over 50 vessels that she could see. We know that there are at least 12 more, stretching from the port to Balito at a cost of around $40,000 (R725,400) per day, per vessel. That is why the importers and exporters are now paying the price by being charged around R8000.00 per container by the shipping line.

The port should be paying this and not the importer or exporter. They are the problem and not the other way around.

This week’s news only focuses on the ports. We know that many importers will not get their goods until after Christmas as it is reported that it will take over 15 to 17 weeks to clear. There was no way an importer could plan for this; our export market is under threat unless we have a Christmas miracle. Exporters are moving their cargo to Cape Town to try get their goods onto a vessel.

SAAFFA Reports

Source: SAAFFA

NEWS

How Transnet is killing the economy

As ports and roads collapse, experts sound a dire warning.

Failing ports, congested roads and the collapse of Transnet are dealing a death blow to the economy as vital exports are held up on blocked roads with further delays at dilapidated ports now rated among the worst in Africa.

And there seems no prospect of the situation improving any time soon, experts say, which is bad news for an economy that relies heavily on exports to generate foreign exchange and could potentially employ millions more people.

Rudi Dicks, joint head of President Cyril Ramaphosa’ s much-vaunted turnaround plan, Operation Vulindlela, admits the situation is “fast becoming unsustainable”.

“We recognise the problem and the scope of it. The congestion has been building up over time,” Dicks said.

The transport crisis, which is rapidly displacing load-shedding as the main stumbling block to reviving South Africa’s dormant economy, is being felt on major national roads.

In a massive blow, Maersk, one of the world’s biggest shipping lines, frustrated with delays at Cape Town harbour, has confirmed it will now bypass the Mother City and offload South Africa-bound container cargo in Mauritius, from where it will be moved to South Africa in smaller vessels.

The situation is little better in Durban. On Friday, the average vessel waiting time at Container Terminal Pier 2 was 457 hours, or 19 days, according to a Transnet Port Terminals (TPT) national recovery update.

Average delays at the Durban Multipurpose Terminal were 365 hours (15 days).

By Friday, according to Transnet’s website, at Container Terminal Pier 1 four ships were berthed with a further 16 anchored and awaiting to be serviced.

Importers are now opting to fly goods into South Africa, at higher cost, due to the port delays.

Source: The Sunday Times

It will take months to clear Durban port backlog

Even non-ship watchers will have noticed the huge number of vessels anchored offshore on Friday – there were more than 60.

Transnet says it will take seven to 15 weeks to clear the 63 vessels at anchor off the Port of Durban, with some importers saying delays in offloading containers mean they will miss the Christmas rush.

Of these 63 vessels, 20 are destined for the Durban Container Terminals (DCT) Pier 1 and Pier 2, managed by Transnet Port Terminals (TPT).

In a statement on Friday, Transnet said several initiatives had been implemented to clear the backlog. “With all initiatives employed, it would take Pier 1 seven weeks to clear the backlog and 15 weeks for Pier 2 – or less,” the statement said.

Plans are in place to ramp up Pier 2’s container handling from 2 500 to 4 000 containers a day over three months. There are also plans to increase Pier 1’s container handling from 1 200 to 1 500 containers a day.

Last week, Moneyweb reported on the ever-lengthening queue of ships at anchor outside Durban, with ships taking three to four times the average time to offload cargo.

The world’s largest container shipping company, MSC, recently advised clients that it would impose a “congestion surcharge” due to the backlog and difficult operating conditions at SA ports.

In response to Moneyweb questions, Transnet said it had deployed industrial engineers to maximise berth performance at the container terminals while engaging with original equipment manufacturers (OEMs) and second-hand cargo equipment suppliers to address the short-term challenges at the terminals. Source: MoneyWeb

Crippling costs to police truck gridlock in Richards Bay

The global demand for coal is extracting a heavy price from the community of Richards Bay. Source: The Maritime Executive

The escalating expenses associated with managing the trucking logjam at the Port of Richards Bay have compelled the uMhlathuze Local Municipality to seek intervention from the Presidency to address the issue.

In a breakdown of its costs, the Richards Bay Council revealed that its yearly allocation of R4 million for overtime payments to traffic officers has already been depleted for this financial year.

An application for an additional R14 million has been submitted to the city manager by the Community Services department to fund truck management duties.

This funding will need to be drawn from the budgets of other municipal departments.

Authorities stated earlier this week that reservist traffic police have been pulled in on fixed-term contracts to assist with traffic management, and this measure will be implemented by next week.

The council highlighted that the city’s traffic officers have been working to control the persistent disruptions caused by up to 1 800 tipper trucks arriving at the port daily to offload coal.

“On average, traffic police officers have been receiving overtime pay that exceeds even their basic salary,” the council said.

“Authorities have been compelled to extensively deploy traffic department personnel to regulate truck traffic, ensuring the smooth flow of traffic and safety on the roads.”

Source: FTW

Cape Town dropped from major shipping route

Ports paralysis threatens Christmas

Transnet failings mean container backlogs are worsening — and shipping giant Maersk is bypassing Cape Town because of delays

About 70,000 shipping containers are stranded on ships off Durban in a congestion crisis that threatens festive season shopping and the economy as a whole.

Delays of 14 days to offload cargo this week prompted one of the world’s biggest shipping lines, Maersk, to dump Cape Town as a port of call on a major Far East route to avoid disruption and spiralling operating costs.

The move sent shock waves through the business sector, which says the economy is being held hostage by Transnet’s inability to fix or replace basic equipment at its ports.

Maersk Shipping, which carries a large proportion of South Africa’s imports and exports, will from next month tranship all Cape Town cargo in Port Louis, Mauritius. Containers will be loaded onto a smaller “feeder service” to the Cape. Outgoing cargo from the Cape to the Far East will similarly have to be transhipped.

Maersk and other shipping lines — including the world’s biggest, MSC — will from next month impose a “congestion surcharge” of about R8,000 per incoming container due to the delays. “We’ve been saying for years it will come to a crunch, and it has,” said Mike Walwyn, vice-chair of the South African Association of Freight Forwarders (Saaff). Source: Business Live

‘Chaos’ at Durban port with an estimated 71 000 containers stuck at sea

Source: News24

Transnet crisis:

Retailers fly stock into SA as Durban port delays worsen.

Clothing and shoes are flown in at great cost ahead of the peak season from the end of November.

Worsening delays at the Durban port are forcing a handful of retailers to fly clothing and shoes into SA at a high cost, damaging SA’s reputation as a reliable trading partner and potentially jeopardising its competitiveness in the global economy.

Broken equipment has caused a crisis at the Durban port, which handles about 60% of the country’s container traffic and suffers from long waiting times and penalty fees imposed by carriers. Other ports in SA face similar issues, affecting the country’s trade and economy.

Source: Business Live

DURBAN HARBOUR | WAVES OF CONTAINERS CHOKE PORT

DURBAN – A storm is brewing at the Durban Harbour as a container crunch grips the port.

About 70,000 containers are stranded on ships.

Business says the economy is being held hostage by Transnet’s inability to fix or replace basic equipment.

The situation is being worsened by a lack of working equipment at the port.

Chris Hattingh, Executive Director at the Centre for Risk Analysis, says container handling output is sitting at 19 percent down compared to what it was the same period last year.

Source: ENCA

We are losing our ‘gateway to Africa’ status. Losing this tag happens slowly … however, what is clear is that we are seeing ever more businesses looking into alternative ports

Saaff research head Jacob van Rensburg

The South African Association of Freight Forwarders (Saaff) said the Cape Town port needed 28 cranes. On one day this week, it started with 18 cranes, but five broke during the day.

“We are losing our ‘gateway to Africa’ status. Losing this tag happens slowly … however, what is clear is that we are seeing ever more businesses looking into alternative ports,” said Saaff research head Jacob van Rensburg.

Dicks said they were aware of the ripple effects of the problem.

“We are working on a number of short-term interventions and on the longer term, some structural changes. We are co-ordinating work with Transnet. There are maintenance and equipment issues required to be fixed,” he said.

“There are many unintended consequences because of the congestion at our ports. You will find that congestion at a harbour will force people to find another way to get their products to the international markets, like what is happening now with companies trucking their goods through Komatipoort to reach a foreign harbour.”

He agrees the situation is untenable.

Source: The Sunday Times

REPORT BACK

Key Notes

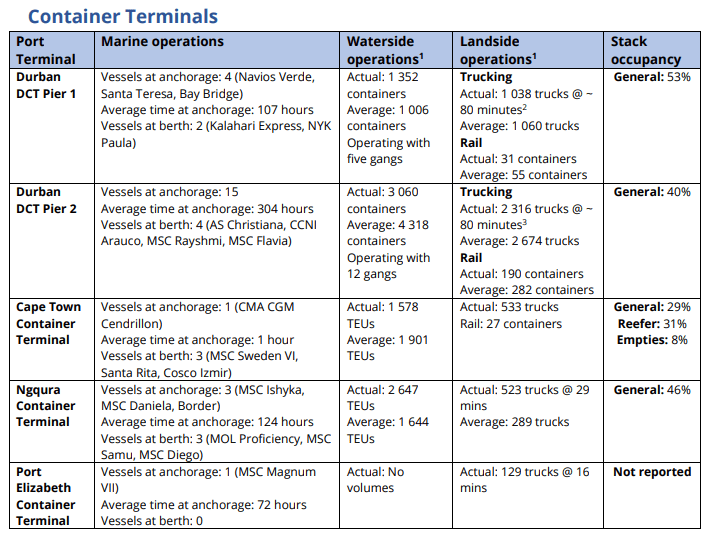

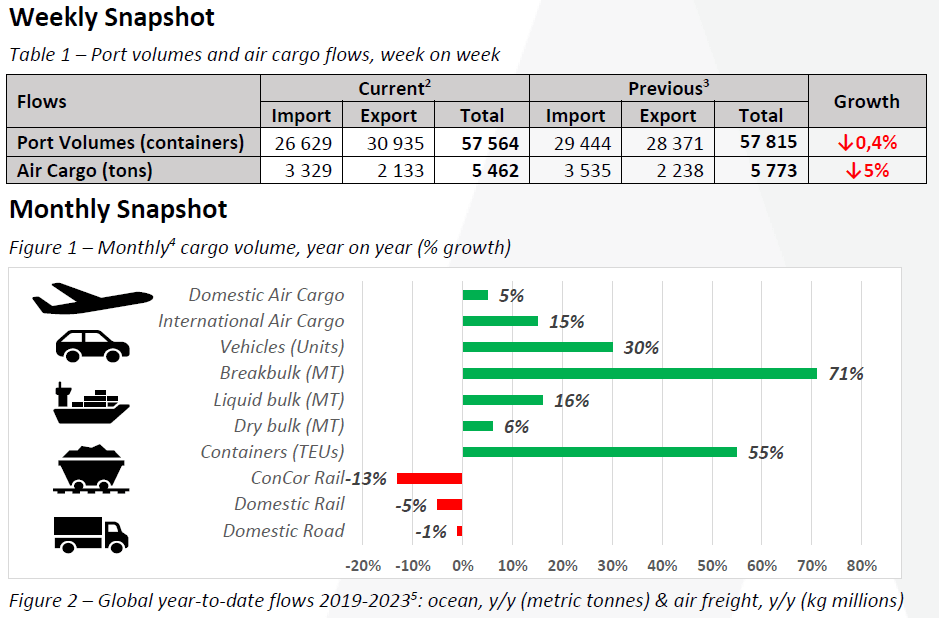

• An average of ~8 329 containers was handled per day, with ~8 120 containers projected for next week.

• TNPA stats for October: containers: down by ↓20% (m/m), up by ↑55% (y/y), but down by (YTD). Total

bulk: down by ↓1% (m/m) but up by ↑10% (y/y). Vehicles: down by ↓13% (m/m) and up by ↑30% (y/y).

• Rail cargo handled out of Durban amounted to 2 834 containers, up by ↑8% from last week.

• Cross-border queue times were unchanged (w/w), with transit times ↑1,7 hours (w/w); SA borders increased

by ~3,3 hours, averaging ~13,0 hours (↑34%); Other SADC borders averaged ~7,7 hours (↑33%).

• Global freight rates have subsided again and are down by ↓2% (or $35) to $1 469 per 40-ft container.

• Global air cargo is stable compared to the previous week, with a ↑2% increase in average rates.

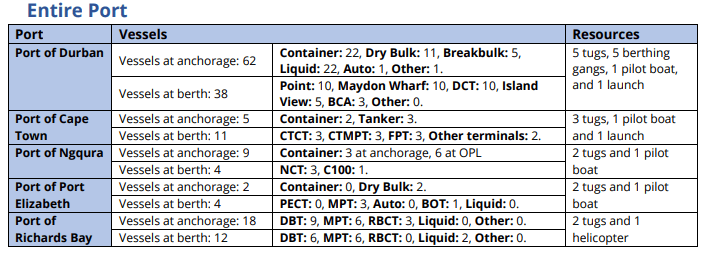

Summary

Commercial ports handled an average of 8 223 containers per day, slightly down from the 8 329 reported last week. Port operations in the last week were once again bedevilled by poor weather conditions as well as equipment breakdowns and shortages. Adverse weather returned to the Port of Cape Town this week as several operational hours were lost while the estimated time of arrival for the new shore tensioning units has been shifted to the second week of December. The backlogs and congestion persisted in Durban, as there were 63 vessels at anchor by the end of the week, while equipment challenges at Pier 2 persisted, as the terminal had only 55 straddle carriers in operation towards the end of the week. Furthermore, minimal reports were received from TFR this week, and therefore, no accurate reports can be provided on the cable theft and vandalism situation on our rail network. In the container industry, carriers slashed mid-November rates after recent hikes, anticipating further weakening before a December rate increase. Despite a decrease in the idle fleet, Alphaliner warns of a possible resumption of the upward trend as vessels exit maintenance. Container scrapping is anticipated to remain low in 2024, mainly due to weak prices. Port congestion stands at around 1,6 million TEU, with selected ports experiencing high volumes at anchorage, including Durban.

In the air freight market, international air cargo to and from South Africa has recently dipped, as inbound cargo (↓6%) and outbound cargo (↓5%) both decreased this week. Nevertheless, the longer-term trend remains positive, especially with our other two international airports. For October, Cape Town cargo increased by ↑40% (m/m) and ↑62% (y/y), and Durban cargo increased by ↑68% (m/m) and ↑106% (y/y). Domestically, air cargo decreased last month (↓23%, m/m) but was up versus October last year (↑5%, y/y). Internationally, despite a gradual increase in worldwide average air cargo prices after the summer, global airfreight demand has not exhibited a robust peak in the fourth quarter, according to high-frequency data from World ACD. Preliminary figures for week 45 (6 to 12 November) indicate stable tonnages compared to the previous week, with a 2% increase in global average rates, reflecting a trend closely mirroring last year’s patterns but with slight improvements compared to 2022’s trends.

In summary, South Africa’s commercial ports are presently operating significantly below the threshold performance levels across various key metrics. The current state of these ports indicates a substantial gap between their current operational performance and the desired benchmarks in multiple critical aspects of maritime logistics, often referred to as demonstrated capacity. Transnet must improve its performance, or the South African economy will continue to bleed unnecessarily. Nevertheless, as we have often mentioned – logistics take place on a shared infrastructure with shared responsibility by all parties – it is not only Transnet that must improve its performance, but indeed, all role players operating within the extended logistics network.

PORTS

Summary of port operations

The following sections provide a more detailed picture of the operational performance of our commercial ports over the last seven days.

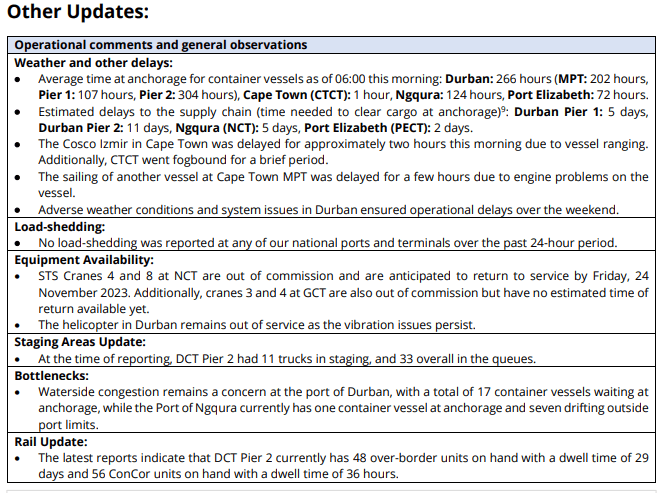

Weather and other delays

Adverse weather (wind and fog) returned to Cape Town this week as several operational hours were lost. Backlogs and congestion persisted in Durban as there were 63 vessels at anchor by week’s end. Our Eastern Cape Ports lost the most significant part of Tuesday due to strong winds. Richards Bay had minimal weather disruptions, but the struggles on the landside against staging truckers with the influx of coal-carrying trucks continued.

Cape Town

On Thursday, CTCT recorded three vessels at berth and four at anchor as the terminal continues to try and recover. In the 24 hours leading to Friday, stack occupancy for GP containers was recorded at 24%, reefers at 24%, and empties at 20%. In this period, despite being fogbound for two hours and experiencing a system failure lasting for eight hours, the terminal handled 1 563 TEUs across the quay while 1 106 trucks were serviced on the landside. Additionally, equipment challenges at the terminal continued this week as Cranes LC1 and LC4 remained out of commission. The spares for these cranes arrived earlier this week after the estimated time of return for LC1 was communicated as 17 November and for LC4 as 15 November. Furthermore, the estimated time of arrival for the new shore tensioning units has been shifted to the second week of December, with the seven second-hand RTGs due in the first week. The multi-purpose terminal recorded zero vessels at anchor and two at berth on Wednesday. In the 24 hours leading to Thursday, the terminal managed to service 272 external trucks at an undisclosed truck turnaround time on the landside. During the same period, 134 TEUs and 3 708 tons of general cargo were handled across the quay on the waterside. Additionally, 237 tons of agri-bulk cargo was also handled on the waterside. Stack occupancy was recorded at 23% for GP containers, 8% for reefers, and 28% for empties during the same period. The FPT private terminal reported zero vessels at anchorage while having no working vessels at berth on Thursday. During the 24 hours leading to Friday, the terminal handled no volumes on the waterside but managed to service 74 trucks and 12 trains on the landside. At the same time, reefer stack occupancy was recorded at 65%. As a general comment, it will be noted that congestion at Cape Town has eased considerably. Unfortunately, this is not due to any improvements in performance or productivity but rather to a drop in cargo volume and the bypassing of Cape Town, which is clearly visible in the Ngqura statistics, with some overflow into Durban as well.

Durban

Pier 1 on Wednesday recorded two vessels at berth, operated by five gangs, and four vessels at anchor. Stack occupancy was 56% for GP containers and remained undisclosed for reefers. During the same period, 2 500 imports were on hand, with 81 units having road stops and 50 unassigned. The terminal recorded 863 gate moves on the landside, with an undisclosed number of cancelled slots and 127 wasted. The truck turnaround time was recorded at ~100 minutes, with an average staging time of ~126 minutes. During the same period, the terminal had 13 RTGs in operation. Pier 2 had four vessels at berth and 16 at anchorage on Friday. In the preceding 24 hours, stack occupancy was 47% for GP containers and undisclosed for reefers. The terminal operated with ten gangs while moving 2 896 TEUs across the quay. During the same period, there were 2 390 gate moves on the landside with a truck turnaround time of ~114 minutes and a staging time of ~174 minutes. Of the landside gate moves, 1 120 (46%) were for imports and 1 270 (54%) for exports. Additionally, 360 rail import containers were on hand, with 359 moved by rail. The terminal experienced a much more challenging week on the weather front, as adverse weather conditions were reported on numerous occasions. However, equipment challenges persisted, as the terminal had 55 straddle carriers in operation towards the end of the week. The terminal currently sits on an availability figure of approximately 48% when it comes to straddles and is currently approximately 32% below the number of machines that would satisfy industry demand. Durban’s MPT terminal recorded three vessels at berth on Thursday and two at outer anchorage while handling 411 TEUs and 1 659 breakbulk tons on the waterside. Stack occupancy for breakbulk was recorded at 50% during that time and at 36% for containers. The terminal handled 105 container road slots and 69 breakbulk RMTs containing 2 100 tons on the landside. During the same period, three cranes, seven reach stackers, one empty handler, seven forklifts and 18 ERFs were in operation. According to the latest reports, the third crane at the terminal made a welcome return to service on Thursday night around 22:00 after a lengthy outage.

Richards Bay

On Thursday, Richards Bay recorded 19 vessels at anchor, with ten vessels destined for DBT, eight destined for MPT, and one destined for RBCT. Additionally, ten vessels were recorded on the berth, translating to four at DBT, five at MPT, one at RBCT, and none at the liquid bulk terminal. Two tugs and one helicopter were in operation for marine resources in the 24 hours leading to Friday while the pilot boat remained out of commission. During the same period, the coal terminal had one vessel at anchor and one at berth while handling 90 885 tons on the waterside and 23 trains on the landside.

Eastern Cape ports

NCT on Wednesday recorded three vessels on the berth and one vessel at the outer anchorage, with seven vessels drifting. Marine resources of two tugs, a pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading up to Thursday. In the same period, stack occupancy was 40% for GP containers and undisclosed for reefers, as a total of 2 793 TEUs were processed. Additionally, 745 trucks were serviced on the landside at a truck turnaround time of ~36 minutes. The latest reports suggest that Crane 6 went out of commission this week, with no estimated time of return as yet. Furthermore, TNPA noted that the MoorMaster will be out for service towards the end of November into early December; however, final dates will be communicated to the industry once available. GCT on Wednesday recorded zero vessels at outer anchorage with one on berth. Available waterside resources were two tugs, a pilot boat, two pilots, and one berthing gang in the prior 24 hours. Stack occupancy was recorded at 78% for GP containers and remained undisclosed for reefer ground slots. On the waterside, 462 volumes were handled across the quay. Additionally, 225 trucks were serviced on the landside at a truck turnaround time of ~21 minutes.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

Enjoy the rest of your week