Welcome to another Logistics News Update.

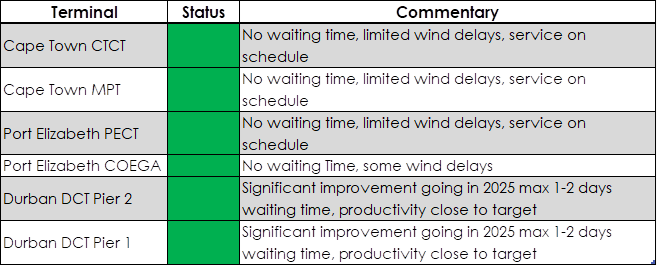

At the end of last week, Maersk shared an update regarding the port. We believe it’s important to give credit where credit is due for the efforts made by the ports towards the end of last year and the beginning of this year.

Transnet Port Authority has made a strong start, and we hope they continue to build on this momentum. Please see below for the information shared by Maersk at the end of last week. That said, there are still significant challenges with booking trucks into the ports. While the Harbour Carriers Association’s intervention has helped ease some of the pressure, it has not eliminated the waiting times faced by transporters. We are hopeful that these issues will be addressed early this year to ensure efficient truck turnaround times. Please see the below reported by the transporters below.

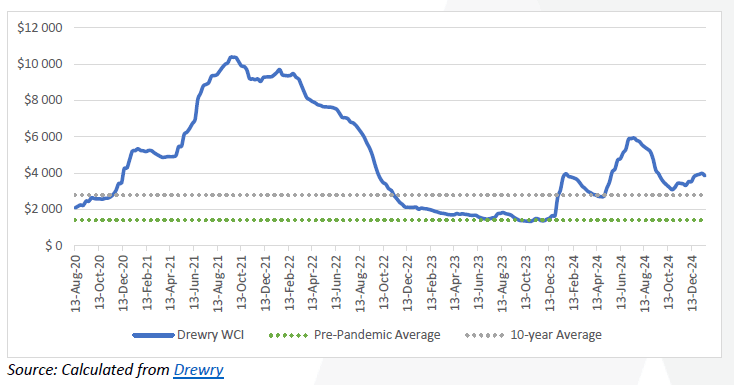

We have an excellent story below on the port tariffs, offering an insightful perspective from Shipping and Freight Resource. Additionally, we’ve examined ocean freight rates, which are expected to decrease following an announcement by Yemen’s Houthi rebels to cease attacks on merchant shipping in the Red Sea after a ceasefire between Israel and Hamas. Despite this development, major shipping companies such as Maersk and Hapag-Lloyd remain cautious, with no immediate plans to resume Red Sea routes due to ongoing security concerns. It remains to be seen how this situation will evolve. FreightNews also reports it.

NEWS

Strategic reductions in port tariffs will be a game-changer for South African maritime

16th January 2025 – Hariesh Manaadiar

Source: Shipping & Freight Resource

South Africa’s maritime industry is set to gain a competitive edge with the announcement of a 60% reduction in port tariffs for vessels making short-duration calls (under 48 hours) for bunkers, stores, or water. This initiative, effective April 2025, aims to make the country’s ports more attractive to global shipowners and operators. With more ships rerouting around the Cape of Good Hope due to changes in international shipping routes, the timing of this tariff reduction is particularly opportune.

This move is expected to boost port activity, creating new economic opportunities, especially in bunkering and marine supply sectors. Increased maritime traffic will likely lead to job creation and economic growth, further strengthening South Africa’s position as a key hub for international shipping. By reducing costs for vessel operators, South African ports are poised to become a more competitive alternative to other regional ports.

However, this initiative is not without challenges. Reduced tariffs may initially impact port revenues, requiring a significant increase in traffic and activity to balance the potential shortfall. Investments in infrastructure, including advanced bunkering facilities and logistics support, will be critical to handling the expected surge in demand. Furthermore, operational efficiency will need to improve to ensure that short-duration vessel calls can be processed without delays, reinforcing the attractiveness of South African ports.

This strategic reduction highlights South Africa’s commitment to enhancing its maritime sector’s efficiency and competitiveness. With the right infrastructure and operational improvements, this initiative could solidify the country’s status as a vital player in global trade and logistics, delivering long-term economic benefits to the region…

– Adapted from Source: Shipping and Freight Resource

Cape Town port improvements sweeten table grape export season

20th January 2025 – Jeanne van der Merwe

The South African table grape industry is experiencing a promising export season, with a 39% increase in exports by mid-January compared to the same period last year. This positive trend is attributed to notable improvements at the Cape Town Container Terminal (CTCT), which has enhanced its operational efficiency. The terminal reported an average of 23 windbound hours per week in early January, a significant reduction from the 56 hours per week experienced in January 2024.

As of January 14, approximately 24.5 million 4.5 kg cartons of table grapes have been exported, with 81% destined for the European Union and the UK, and 10% to North America. The discrepancy between inspected and exported volumes, an indicator of port delays, has decreased to 7.8 million cartons, down from 16.36 million cartons at the same time last year. This reduction suggests that ports are performing more effectively, allowing fruit to reach international markets more swiftly.

This season marks the inaugural use of a predictive logistics model by the industry, aiding in more efficient planning and operations. The model’s effectiveness is reflected in the CTCT’s actual utilisation surpassing planned volumes, indicating limited delays and improved throughput. Additionally, a decrease in windbound hours and the implementation of 72 extra operational hours over the festive period have significantly boosted productivity at the terminal.

Despite these advancements, the industry remains vigilant as export volumes peak. There is a possibility of bottlenecks arising, particularly with certain grape varieties ripening faster than usual. Continuous monitoring and proactive management are essential to maintain the current positive trajectory and ensure the timely delivery of high-quality produce to global markets….

– Adapted from Source: FreighNews

On The Ground Report

Jet Fuel Shortage at O.R. Tambo Impacts Operations

The Airports Company South Africa (ACSA) is tackling a jet fuel shortage at O.R. Tambo International Airport (ORTIA) following a fire at the NATREF refinery on 4 January 2025. With the refinery’s Crude Distillation Unit expected to remain offline until 21 February 2025, ACSA has coordinated with industry partners to secure alternative fuel supplies via rail, pipeline, and other airports. Airlines, including British Airways (BA), have implemented mitigation measures such as tankering fuel, affecting payload capacity. To manage the situation, BA/IAG Cargo has suspended new cargo bookings until 12 February 2025 and is routing cargo through Cape Town where possible. Source: IAG Cargo

Weekly News Snapshot

- Positive Start for South African Port Activities in the New Year: South African ports have commenced the year on a positive note. However, shipping lines are closely monitoring the political situation in Mozambique, particularly in Beira and Maputo, where high waiting times are reported.

- Cape Town Port Enhancements Boost Table Grape Exports: The Cape Town port has implemented a predictive logistics model for the first time this season, enhancing the efficiency of table grape exports.

- Ocean Alliance Maintains Stability Amid Rising Marine Insurance Costs: Marine insurance premiums for Suez sailings have surged, now costing approximately 20 times more than before the Houthi attacks. In response, the Ocean Alliance is implementing strategies to maintain stability in shipping operations.

- Global Economy Settles at Modest Growth Rates: Analyses indicate that without significant policy changes, many low-income countries may not achieve middle-income status by mid-century, as the global economy adjusts to a period of low growth.

- Trade Sector Anticipates Potential Shifts with U.S. Presidential Inauguration: The inauguration of the U.S. President brings uncertainty to global trade, with concerns that new tariffs could provoke retaliatory measures, potentially escalating into broader trade conflicts.

- Houthi Rebels Announce Lifting of Red Sea Shipping Ban: Following a ceasefire agreement, Houthi forces have declared an end to attacks on merchant shipping in the Red Sea. However, vessels owned by Israeli companies may remain at risk until the ceasefire is fully implemented.

- South African Table Grapes Gain International Popularity: South African table grape producers are experiencing increased demand overseas. Industry experts advise producers to remain proactive and prepared to address potential challenges as the export season progresses.

- Red Sea Shipping Lanes Remain Volatile Despite Ceasefire: Despite a declared ceasefire, the Red Sea region continues to experience volatility. The peace process is expected to be gradual, with political uncertainties potentially leading to further Houthi attacks on vessels.

- World Economic Forum in Davos Presents ‘Golden Opportunity’ for South Africa: Finance Minister Enoch Godongwana highlights the World Economic Forum in Davos as a prime opportunity for South Africa to align key messages and showcase its economic strengths on the global stage.

- Air Freight and Carrier Updates :Emirates has announced a 15% increase in main deck cargo capacity compared to January 2024, anticipating another airfreight boom. This expansion aims to accommodate growing demand and strengthen trade links.. Source: FreightNews

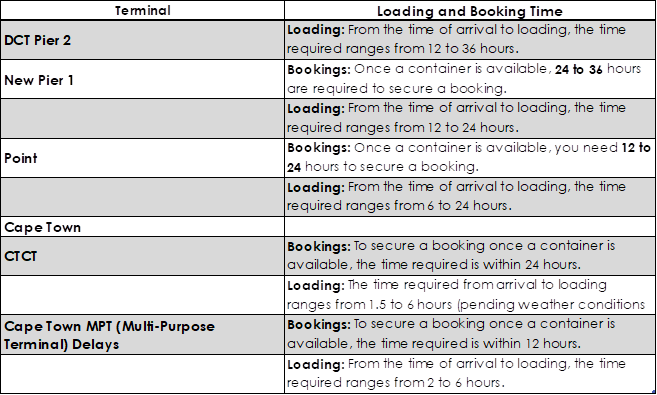

Port Operations Summary: – Port Update:

- Durban Port:

- Pier 1: No delay reported, only bookings are an issue.

- Pier 2: No delay reported, only bookings are an issue.

- Durban Point (MPT): No Delay reported, only bookings are an issue.

- Cape Town Port:

- CTCT: No Delays reported this week – weather is hot and only bookings are an issue.

- MPT: No delays reported.

- Port Elizabeth/Ngqura:

- PECT: Operations are stable, no delay reported.

- NCT: No delays reported.

BUSA / SAAFF Summary

Port Operations:

- Container terminals handled an average of 12,304 TEUs daily, a significant increase from 8,814 TEUs the previous week.

- Weather disruptions and equipment breakdowns caused delays in Cape Town, Durban, and Eastern Cape ports.

- At Durban’s Pier 2, over 500 trucks were staged due to limited straddle carriers, leading to extensive delays.

- Container dwell times were 48 hours (local) and 50 days (over-border) at DCT Pier 2.

Global Logistics Context:

- South Africa’s shipping connectivity index dropped to 99.27 in Q4 2024, highlighting declining port efficiency compared to global hubs.

- The global container industry experienced record capacity expansion with 1.5 million TEU ordered in Q4 2024.

- Durban port reduced congestion with a queue-to-berth ratio of 0.22.

Air Cargo:

- Significant weekly growth in air cargo at OR Tambo: inbound volumes increased by 30% and outbound by 50%.

- Volumes remain below pre-pandemic levels but are expected to improve, despite risks like limited fuel supply and geopolitical tensions.

Cross-Border Road Freight:

- Queue times increased by ~30 minutes; transit times were also slightly higher.

- Median border crossing times at South African borders dropped by 23% to ~6.1 hours.

- Key problem areas included Kasumbalesa, where crossing times exceeded two days due to congestion.

Strategic Recommendations:

- South Africa’s logistics network is critical for economic growth, requiring accelerated reforms to meet global competitiveness.

- Investments like new straddle carriers in Durban are positive but need to be part of broader, sustained efforts to modernize infrastructure.

- Collaboration, innovation, and increased competition in logistics are essential to reducing costs and enhancing efficiency.

– Source: BUSA

Summary of Global Shipping Industry

The global container industry experienced significant supply and demand changes in Q4 2024. A total of 1.5 million TEU of new container ship capacity was ordered, with 107 new vessels added, making it the third-highest quarter in history for ship orders. By January 2025, the global orderbook reached a record 780 vessels (8.5 million TEU), marking a 10.7% increase in capacity and 5.1% growth in vessel numbers compared to the previous quarter.

In 2024, vessel demolitions were unusually low, with only 56 ships (80,950 TEU) scrapped half of 2023 of 2023’s total. This decline was due to strong freight and charter markets, which incentivised shipowners to retain older vessels despite favourable demolition prices and regulatory pressures. Increased TEU-mile demand, spurred by vessels rerouting around the Cape of Good Hope to avoid the Suez Canal, absorbed much of the new capacity, while charter rates nearly doubled from 2023 levels, reaching their highest since the 2021-2022 post-COVID boom.

Global congestion remained steady at 2.65 million TEU, representing 8.5% of the global fleet. Locally, Durban port has made strides in reducing congestion, with 13,450 TEU waiting outside anchorage and a queue-to-berth ratio of 0.22. These improvements earned Durban a spot on Linerlytica’s “Port Congestion Watch” in 2024. However, challenges remain, particularly in recovering lost connectivity and capacity. Lastly, Drewry’s “Cancelled Sailings Tracker” reported a relatively high cancellation rate of 15%, reflecting ongoing adjustments in global shipping. Source: BUSA

Global Container Freight Rates

Global container spot rates dropped by 3.3% this week, returning to last month’s level of $3,855 per 40-ft container, according to Drewry’s World Container Index. Despite this decrease, rates are still 171% higher than the pre-pandemic average of $1,420 in 2019. Five of the eight major trade routes recorded declines this week, with factors such as increased capacity, reduced congestion, fewer strikes, and shorter transit times due to the Red Sea ceasefire contributing to the downward trend. However, spot rates remain volatile and subject to ongoing adjustments. Charter rates, on the other hand, continue to be elevated. The Harper Petersen Index (Harpex) traded at 2,058 points, reflecting a 118% year-on-year increase, indicating sustained strength in the charter market.

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”