Welcome to another Logistics News Update.

Durban Port in Turmoil: Delays, Privatisation, and Union Jubilation:

Durban’s port operations were brought to a standstill yesterday due to high winds (90 kms/h), further exacerbating existing delays for importers, exporters, and transporters. The recent court decision halting the Philippine company ICTSI’s takeover of the port has sparked a debate about the potential benefits and drawbacks of privatisation. While Transnet insists that the contract remains unaffected, the legal setback raises questions about the process and its implications for South Africans. The unions’ enthusiastic response to the court interdict is puzzling, particularly given their apparent absence from the negotiation process. This raises concerns about their motivations and the potential impact on workers. As we await a swift resolution to this matter, the industry remains grappling with the consequences of the ongoing disruptions.

Here is one reason we need privatisation – South Africa looks back on a difficult citrus export season:

South Africa’s citrus export season faced significant challenges due to shipping delays, equipment failures, and difficult climate conditions. The Citrus Growers’ Association highlighted issues at key ports, including the Durban and Eastern Cape terminals, which experienced equipment breakdowns and weather disruptions that delayed shipments. However, specialised reefer shipping to major markets like Japan, China, and the USA remained stable. Despite lower export volumes, the citrus industry adapted, and there were positive outcomes in certain regions like the Port of Maputo. These disruptions underscore the need for infrastructure improvements.

– Source FreightNews – 10 Oct 2024 – by Staff reporter

LET’S LEARn – Why DO I NEED A “LC” (Letter of Credit)

Reducing Risk in International Trade: The Letter of Credit

International trade often involves transactions between parties located in different countries, introducing unique risks for both exporters and importers. Exporters face the risk of non-payment, where buyers fail to fulfil their financial obligations after receiving the goods. Conversely, importers worry about non-delivery, where suppliers do not deliver the agreed-upon products or services despite receiving payment.

To mitigate these risks and establish a secure framework for international trade, a letter of credit (LC) can be employed. An LC is a document issued by a bank on behalf of an importer, guaranteeing payment to the exporter provided that specific conditions are met.

Here’s how an LC works:

- Application: The importer applies to their bank to open an LC in favour of the exporter.

- Issuance: The bank, after verifying the importer’s creditworthiness, issues the LC.

- Presentation: The exporter presents the LC to their bank, along with shipping documents and other required documentation.

- Verification: The exporter’s bank verifies that the shipping documents comply with the terms of the LC.

- Payment: If the documents are in order, the exporter’s bank pays them. The bank then seeks reimbursement from the importer’s bank.

By utilising a letter of credit, both exporters and importers can benefit from increased security and confidence in their international trade transactions. It provides a reliable mechanism for ensuring payment and delivery, reducing the risk of financial loss and disputes.

NEWS

No freight rate easing on the horizon – Drewry

18th October 2024 – by Staff Reporter

Source: Foresmart

According to industry experts, freight rates are expected to continue rising in the coming year, despite the introduction of new shipping capacity. The primary culprit for this surge is the ongoing disruption to global supply chains, exacerbated by factors such as the Suez Canal blockage and the threat of strikes at US east coast ports.

Drewry, a leading maritime consultancy, has analysed various scenarios and concluded that freight rates will likely increase regardless of whether a strike occurs. Even without disruptions, factors like rising carbon taxes and the ongoing reorganization of shipping alliances are expected to contribute to higher costs.

The consultancy has also extended its timeline for the full resumption of Suez Canal transits to 2026, citing rising tensions in the Middle East. This prolonged disruption will continue to strain global shipping capacity and drive-up rates.. – Adapted from Source: FreighNews Read the full Story Here

Harbour carriers react with anger following Transnet message

15th October 2024 – by Eugene Goddard

Durban Container Terminal Pier 2 is at the centre of a battle over Transnet’s plan to outsource its management and operations to a Philippines-based company. Picture: File Image: MARIANNE SCHWANKHART

Harbour carriers (represents the interests of transporters who operate in the port area) in Durban are up in arms over a new truck booking system introduced by Transnet. The carriers argue that the system is inefficient, time-consuming, and will only worsen the congestion at the ports.

Transnet, however, insists that the new system is necessary to improve the efficiency of the port operations. The company has defended the system, claiming that it will reduce delays and improve the overall experience for truckers.

The new system is currently in a pilot phase, and harbour carriers are expressing their concerns through various platforms. Despite Transnet’s assurances, the carriers remain sceptical about the system’s effectiveness.. Adapted from Source: FreighNews Read the full story here

On The Ground Report

Weather still played a big role at the port this week, there hasn’t been a lot of change in vessels coming in early and others moving out, as we said last week Cape Town appears to be on track, the obvious challenge is weather but this is expected in this region. Port Elizabeth has had some horrendous weather this week and this will always affect port operations.

Special Report – By Iain Macintosh

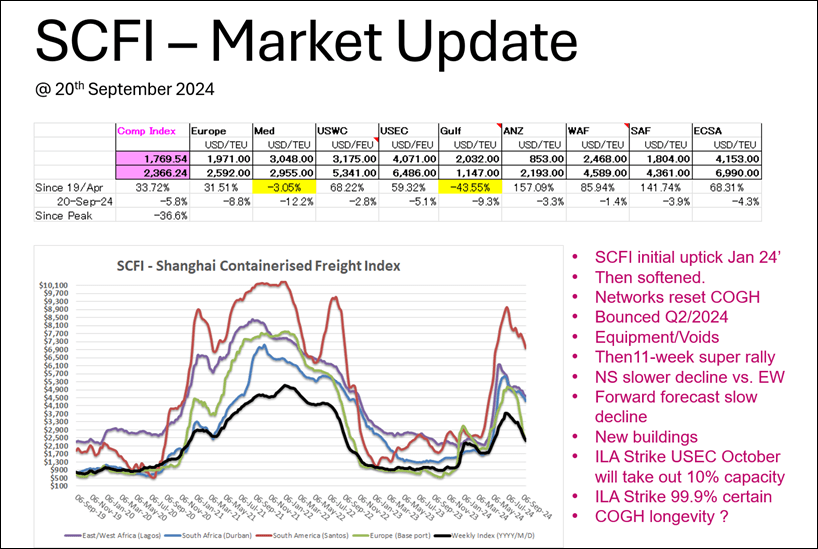

“..Please see the index today which overall declined 5.8% on the back of strong reductions Asia – EUR and MED although slower reductions USEC and USWC reports of still demand into US west coast fuelling some strength in the market. Still ECSA/WAF/SAF and ANZ move downwards at a slower trajectory and in the case of RSA much of the movement will have been caused by quite a number of small extra loaders [2000 teu’s] deployed in recent weeks. These were opportunist and won’t last. COSCO deployed the seatrade peru, a newbuild for Seatrade which is a specialised reefer vessel for the ECSA-EUR trade in bananas. This paints a slight false flag on supply/demand as it’s not structural. The trajectory is down but still lower glide path.

Significantly Shanghai – Gulf is now lower than the 19/Apr peak but my view on this is that with the Red Sea crisis this has diverted a lot more activity in markets from Asia to Gulf and vv. so the supply side here would be the influence. I cannot however explain the Shanghai-Med decline other than being a faster trajectory due to more activity for cargo hubbing over Algeciras/Tangier to shorten voyage times on the Asi-MED main leg.

Finally, and this will likely influence the index 27/Sep and that is the ILA strike on the USEC is about 99.9% certain to go ahead. 1 day = 6 days to unjam and if its a 1 week strike = 1.5 to 2 months to recover whilst 2 weeks = 5-6 months. The length will determine the supply/demand impact and therefore price trajectory of the big East West trade lane and therefore the overall index. For Asia-South Africa the market does seem to be stable to flat with some slight spot decreases however watch this space. – Source: Iain Macintosh

Summary

The logistics network showed improvement, with port volumes rising despite ongoing operational challenges. However, weather and equipment issues at key South African ports, along with global disruptions like the US port strike, continue to strain logistics flows.. – Source: BUSA

Weekly Roundup: Key Developments and Insights from the Industry Local & International

- Port Development in Africa: There’s ongoing discussion about port development in Africa, which is crucial for handling growing trade volumes. This is particularly relevant considering the low availability of equipment that has been an ongoing problem for African ports.

- Safety Concerns in Shipping: There have been recent incidents of accidents and safety concerns in the shipping industry, including a container ship capsizing. This highlights the need for stricter regulations and improved safety measures.

- Positive Developments: Despite the challenges, there has also been positive news. The Port of Beira has seen an increase in container volumes, indicating positive growth. Additionally, Maersk has launched a new Ukraine service, which could improve trade connectivity in the region.

Overall, the freight news landscape this week is mixed. While there are challenges and safety concerns, there are also positive developments that point towards a growing and dynamic freight industry in Africa.

Global Container Freight Rates

Our detailed assessment for Thursday, 17 October 2024

The latest Drewry WCI composite index of $3,216 per 40ft container is 69% below the previous pandemic peak of $10,377 in September 2021, but it is 126% more than the average 2019 (pre-pandemic) rate of $1,420. The average composite index for the year-to-date is $4,058 per 40ft container, which is $1,225 higher than the 10-year average rate of $2,834 (inflated by the exceptional 2020-22 Covid period).

Global Freight Rates

Freight rates from Shanghai to Genoa decreased 9% or $346 to $3,438 per 40ft container, while rates from Shanghai to Rotterdam dropped 6% or $218 to $3,373 per 40ft container. Likewise, rates from Shanghai to New York fell 3% or $152 to $5,609 per 40ft container and those from Shanghai to Los Angeles declined 2% or $78 to $4,941 per 40ft container. Conversely, rates from Rotterdam to Shanghai increased 1% or $4 to $547 per 40ft container. Meanwhile, rates from Los Angeles to Shanghai, New York to Rotterdam and Rotterdam to New York remained stable. Drewry expects rates (ex-China) to continue with their marginal decline in the coming weeks.

Source: Drewery

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”