Welcome to another Logistics News Update.

Last week may have been a short week, but it certainly wasn’t quiet. Easter brought welcome news with a drop in road accidents, and despite the public holidays, port operations remained active — a positive sign that our terminals are recovering well.

However, the threat of a strike by UNTU remains a serious concern, with wage talks deadlocked and the potential for major disruption still looming. Against this backdrop, the international tariff saga continues to evolve. With the 90-day reprieve ticking down, South African businesses must keep alternative markets front of mind and act now to minimise future exposure.

In the news, we see that Beijing warns countries against colluding with US to restrict trade with China. Beijing has warned its trading partners against succumbing to US pressure to isolate China in President Donald Trump’s tariff war, as part of its carrot-and-stick approach to win over countries caught between the world’s two largest economies. Source: CNN

Remember that next week, Monday and Thursday are holidays.

On the ground

- Cape Town: Transporters continue to struggle with bookings at the terminals; with slot allocations being delayed and gate openings tightly controlled.

Let’s Learn: What Are Rules of Origin — and Why Do They Matter?

Last week, we unpacked how trade agreements open doors for South African exporters. But did you know that your goods might not qualify for duty-free access, even under a valid trade agreement? That’s where rules of origin come in.

So, what are they?

Rules of origin are the criteria used to define where a product was made. They determine whether your goods qualify for preferential treatment under a trade agreement.

Why should you care? • Misunderstanding them could lead to delays or unexpected duties

• Customs may reject your claim for duty-free access if your documents aren’t in order

• It affects how you structure your supply chain — especially if components come from multiple countries

For South African exporters:

- Each trade agreement has its own rules — AGOA, SADC, EU… they’re not all the same.

- Even minor changes in processing or packaging might not be enough to meet the required origin standard.

- You often need a Certificate of Origin — issued by an authorised body — to prove compliance.

💡 Tip: Work with a reputable clearing agent or trade consultant to ensure your product origin is correctly documented — especially if you source components internationally.

Understanding rules of origin ensures you get the full benefit of trade agreements — and avoid costly surprises.edge your business needs.

NEWS

TRADE TENSION: Is the US going to be great again?

16 Apr 2025 – by Eugene Goddard

As trade tensions between the US and China intensify, economist Azza Al Habsi of Ominvest has weighed in on the broader implications of President Donald Trump’s latest round of so-called “Liberation Day” tariffs. According to Al Habsi, it’s increasingly clear that tariffs form part of Trump’s long-term economic strategy. While appearing erratic at times, his approach seems closely tied to the US bond market — easing tariff pressure when yields rise and doubling down when yields drop. This balancing act reflects a desire to reassert control without destabilising US financial markets.

China remains the primary target. Despite the temporary 90-day exemption granted to many countries, which has delayed broader retaliation, China’s position has weakened. Al Habsi noted that although China had a strategy ready to counter US pressure — including forming stronger regional ties — the exemption made it harder to rally allies, effectively isolating Beijing during a period of economic fragility. In response, China is expected to increase economic stimulus to buffer the blow, which may have broader implications for global markets, especially as China accounts for nearly 30% of global manufacturing output.

Meanwhile, the US is pushing hard for near-shoring — relocating production closer to home — but this strategy comes with significant costs. Although Trump’s message is clear (“relocate to the US”), the reality is more complex. Despite the rise of automation and government incentives, manufacturing abroad remains far more cost-effective. Regulatory burdens and high labour costs continue to deter full-scale re-shoring, with companies like Apple remaining heavily reliant on Chinese supply chains. Following the latest tariff announcement, Apple’s stock plummeted by nearly 23% over four trading days, wiping out around $700 billion in value. Ultimately, while near-shoring might create some benefits for North America — including improved supply chain resilience and reduced shipping costs — it doesn’t necessarily translate into widespread job creation within the US. Most of the gains may instead be felt by neighbouring economies like Mexico. For now, global manufacturers will likely continue weighing cost structures and geopolitical risk as they decide whether to stay, shift, or split their production footprints….

– Source: – FreightNews

WEEKLY NEWS SNAPSHOT

- Trump’s 90-Day Tariff Suspension: President Donald Trump announced a 90-day suspension of reciprocal tariffs for over 75 countries, excluding China. This move aims to ease global trade tensions and has led to a temporary rally in U.S. stock markets.

- Asian Manufacturers Accelerate Shipments: In response to the impending end of the 90-day tariff reprieve, Asian manufacturers, particularly in Taiwan, are expediting production and shipments to the U.S. to avoid potential tariff hikes.

- Market Volatility Amid Tariff Announcements: The recent tariff announcements have caused significant market fluctuations, with the S&P 500 experiencing a notable decline. Analysts warn of potential long-term economic impacts if trade tensions persist.

- Potential Impact on AGOA Benefits: South African industries express concern over the potential loss of benefits under the African Growth and Opportunity Act (AGOA) due to new U.S. tariffs. The citrus and automotive sectors, in particular, could face significant challenges.

- Criticism of Government Policies: AfriForum attributes the imposition of U.S. tariffs on South African imports to the country’s domestic policies, urging a re-evaluation to maintain favourable trade relations.

- Cape Town Port Enhancements: The Port of Cape Town has acquired new cranes equipped with anti-sway technology, aiming to improve operational efficiency even in challenging weather conditions.

- Easter Border Operations: The Border Management Authority (BMA) has implemented 24-hour operations at key land borders, including Groblersbrug and Kopfontein, to accommodate increased traffic during the Easter period.

- Road Safety Initiatives: Authorities have intensified road safety campaigns, focusing on driver wellness and vehicle compliance, in anticipation of heightened travel during the holiday season. Source: – FreightNews

Key Highlights from Last Week’s Discussions: Source: BUSA

- Terminal Throughput Surges Again:

All major ports experienced a 33% increase in container throughput, handling over 86 000 TEUs.

Standouts: Pier 1 (↑72%), Cape Town (↑67%), Port Elizabeth (↑125%).

Rail cargo out of Durban rose slightly to 2 701 containers (↑1%). - Global Trade Risks Persist Amid Tariff Turmoil:

Despite a 90-day tariff pause by the US (excluding China), the average US tariff rate now sits at 24%.

Risks for SA include:

Volatile global demand, especially from tariff-hit markets like China and the US.

Trade marginalisation, as supply chains realign. - Air Cargo Weakens:

Air cargo volumes dropped (inbound ↓11%, outbound ↓33%) at OR Tambo.

Still slightly better year-on-year (↑4%) but remains 13% below pre-COVID levels.

Regulatory pressure increasing, with stricter de-grouping and bond store enforcement. - Border Flows and Regional Corridors:

Lebombo border truck volumes fell by 2%, now averaging 1 486 HGVs/day.

SA border crossing times improved, now averaging ~10,9 hrs (↓20%).

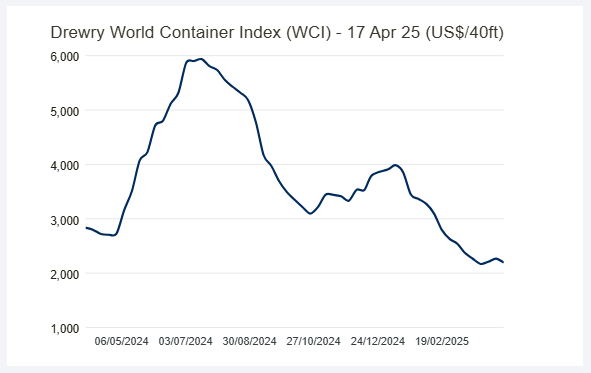

High delays remain at Beitbridge, where transit times can exceed 2.5 days from the Zambia side. - International Shipping & Rates:

Global container demand declined ↓13.6% (m/m) and ↓0.7% (y/y) in February.

Drewry WCI now sits at $2 265 per 40ft, still 59% above 2019 pre-pandemic levels.

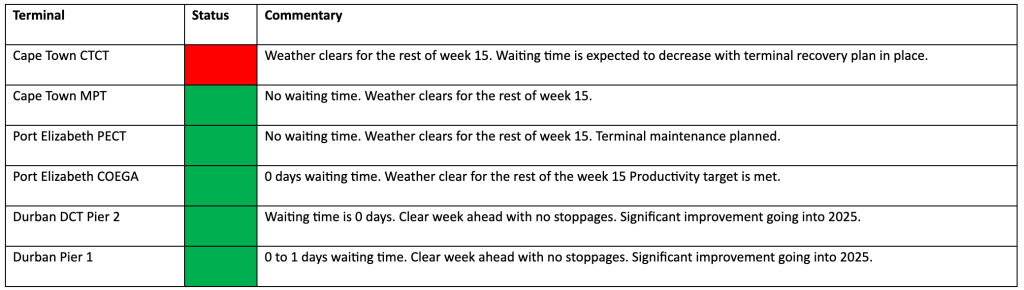

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS

Durban

Significant improvement in terminal operations

- Pier 1: No delays

- Pier 2: No delay

- Durban Point: 2 days delay

Cape Town

Transporters continue to struggle with bookings at the terminals; with slot allocations being delayed and gate openings tightly controlled.

- CTCT: 0–5 days delay

- MPT: No delay

Port Elizabeth

The port experienced windy conditions during the week.

- PECT: no delays

- NCT: 0-2 days

Source: SACO * as reported 17/4/2025

Global Freight Rates

World Container Index – 17 April 2025

Drewry’s WCI composite index decreased by 3% this week, settling at $2,192 per 40-foot container. This figure is 79% below the pandemic peak of $10,377 in September 2021 but remains 54% higher than the pre-pandemic average of $1,420 in 2019. The year-to-date average stands at $2,897, slightly above the 10-year average of $2,890.

Freight rate changes on major routes:

- Shanghai to New York: Decreased by 7% to $3,706 per 40ft container.

- Shanghai to Los Angeles: Dropped 5% to $2,683.

- Shanghai to Rotterdam: Fell 2% to $2,344.

- Shanghai to Genoa: Down 2% to $3,018.

- New York to Rotterdam: Decreased by 1% to $817.

- Rotterdam to New York: Reduced by 1% to $2,129.

- Rotterdam to Shanghai: Increased by 4% to $493.

- Los Angeles to Shanghai: Remained stable.

Drewry anticipates that rates may continue to decline in the coming week due to reduced capacity and ongoing uncertainty stemming from tariffs.

Source: Drewreyates may continue to rise in the coming weeks due to tariffs and reduced capacity. – Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”