Welcome to another Logistics News Update.

This week’s weather continues to pose challenges for South African ports, with potential delays. Be sure to factor these into your shipping plans and book cargo from the East at least 3 weeks in advance to navigate these disruptions.

Speaking of disruptions, our lead story dives into the Chaos at Cape Town Port! Recent bad weather has created a backlog, but that’s not all. A broken booking system, lax security, and frustration among truck drivers are causing major friction. Let’s see how a green lane for reefer containers might ease the pain.

Good news for South Africa’s ports and logistics! Transnet, the state-owned company responsible for railways, ports, and pipelines, secured a 25-year loan of ZAR18.85 billion ($1 billion) from the African Development Bank. This government-guaranteed loan will jumpstart the first phase of Transnet’s ZAR152.8 billion investment plan to improve existing infrastructure and relaunch operations. (let’s hope that they buy new equipment)

Forex Tip of the week – Incoterm CFR – Cost and Freight

CFR

What Is Cost and Freight (CFR) in Foreign Trade Contracts?

Cost and freight (CFR) is a legal term used in foreign trade contracts. In a contract specifying that a sale is cost and freight, the seller is required to arrange for the carriage of goods by sea to a port of destination and provide the buyer with the documents necessary to obtain them from the carrier.

Understanding Cost and Freight (CFR)

With a cost and freight sale, the seller is not responsible for procuring marine insurance against the risk of loss or damage to the cargo during transit. Cost and freight is a term used strictly for cargo transported by sea.

On The Ground Report

- Catch up from last week’s bad weather with more bad weather forecast.

- Split berthing still playing havoc for importers.

- Air freight worldwide in a “tizz” after the Microsoft update.

Disclaimer: Please note: All information presented in this newsletter is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed – all news is adapted or specifically quoted

NEWS

On-time reliability continues to suffer under Red Sea situation

17 July 2024 – by Staff Reporter

On-time performance of container ships continues to decline, dropping to 49.9% in June from 50.2% in May. This is significantly lower than 2023 levels due to several factors.

The situation in the Red Sea, where attacks on shipping have forced carriers to take longer routes, has reduced capacity and extended transit times. Additionally, congested ports and high demand are further straining the system and preventing a return to normalcy.

Unless the Red Sea conflict is resolved or there’s a significant improvement in port efficiency and a decrease in demand, this trend of unreliable shipping is likely to continue. Shipping companies will need to adapt their operations to minimize disruptions to global trade..

Adapted from Source: Freight News – here

Saaff CEO spells out what is expected of the GNU

18 July 2024 – by Eugene Goddard

The South African Freight forwarding Association (SAAFF) South Africa’s freight community was at one with the hope that President Cyril Ramaphosa would emphasise the need for nationwide logistical progress ahead of his Opening of Parliament Address on July 18, particularly to restore faith in the government’s economic renewal ability.

Speaking to Freight News ahead of the Opening Address, Dr Juanita Maree, chief executive of the South African Association of Freight Forwarders (Saaff), said: “As the key enabler of the national economy, and generator of growth and employment, the logistics and freight forwarding sectors stand this evening before the seventh parliament of our beloved country to renew our collective commitment to work together, to collaborate to secure the full recovery and stabilisation of South Africa’s supply chain logistics’ network.”

Read the full story

Adapted from Source: Freight News – read the full here

PORTS

South African Port Delays Summary (as of July 23, 2024)

This is a friendly reminder about potential delays at some South African ports due to upcoming wind forecasts:

- Durban: Strong winds are expected on Wednesday, leading to delays of up to 10 days at Pier 1 and up to 25 days at Pier 2.

- Cape Town: Winds are forecast for Thursday, causing potential delays of up to 3 days at the CTCT (Cape Town Container Terminal).

- Port Elizabeth & Ngqura: Winds are predicted for Tuesday and Wednesday, resulting in potential delays of up to 2 days at the NCoega Container Terminal (NCT) and Port Elizabeth Container Terminal (PECT).

We recommend factoring these potential delays into your shipment planning to avoid disruptions.

Weather and Other Delays

- Bad weather in Cape Town (though it improved)

- Equipment issues at Durban

- Strong winds and ship manoeuvring problems in the Eastern Cape

- Only Richards Bay had minimal delays

Port Delays:

- Durban:

- Pier 1: 11-13 days delay

- Pier 2: 10-18 days delay

- Durban Point: 3 days delay

- Booking appointments are difficult due to high container volume.

- Cape Town:

- CTCT Terminal: 0-2 days delay (expect delays to increase)

- MPT Terminal: 0-2 days delay (expect delays to increase)

- Port Elizabeth:

- PECT Terminal: 1-2 days delay

- NCT Terminal: 0-3 days delay

Overall: Significant delays are happening in Durban and expected to worsen in Cape Town due to recent bad weather. Port Elizabeth has some delays, but less severe. Booking appointments are difficult in Durban.

Container freight rates seem to have peaked out of the East; however, it is important to book any cargo from the East at least 3 weeks before you need the booking, this will secure your booking. One report read “The first cracks in the incredible container boom of 2024 are emerging with shippers ready to bargain hard.” We should only see rates coming down after October 2024.

Global Freight Rates

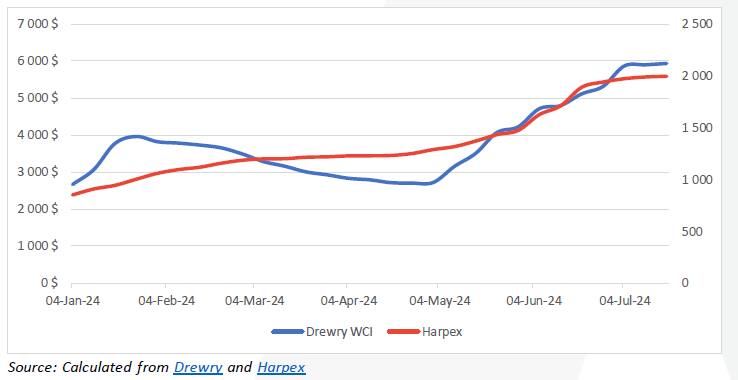

Container freight rates have further stabilised this week, as Drewry’s “World Container Index” increased by ↑0,7%. It is up by $36 – a level similar to last week after an average weekly increase of ↑9% for the previous two months – and is trading at $5 937 per 40-ft container.23 For charter rates, the Harper Petersen Index (Harpex) has also stabilised and increased this week by almost the same magnitude as spot rates, with the index trading at 1 997 points on Friday, up by another ↑0,4% (w/w) and ↑78% (y/y) compared to this time last year.24 The following figure shows the movement of both of these indices since the start of the year:

The average price for shipping a 40ft container is now ↓43% lower than the pandemic peak in September 2021 but still ↑286% higher than the pre-pandemic average in 2019. Fortunately, recent trends in container spot freight rates suggest they may be nearing a peak, as evidenced by minimal increases and some declines in key indices this week.25 Specifically, the Shanghai-Los Angeles and Asia-North America west coast rates showed declines, while the Shanghai-New York leg still saw a slight increase. Market analysts and shipping indexes are observing a potential shift in bargaining power back to shippers. However, some routes like Shanghai-Rotterdam and Shanghai-Genoa continue to rise, indicating that the rate decrease is not uniform across all trade lanes. Furthermore, Linerlytica notes that recent capacity additions have also contributed to putting a cap on freight rate increases.26

In the last month, the shipping routes from the Far East to the Indian Subcontinent, Latin America, and the US West Coast have experienced notable increases in capacity by ↑9,0%, ↑6,0%, and ↑4,7%, respectively. This surge is due to the introduction of new services and the addition of extra loaders since June. This trend of capacity expansion is expected to persist through August, maintaining a tight charter market as carriers face a shortage of tonnage needed for these routes. Despite this, the additional capacity has limited the rise in freight rates, leading to carriers reducing some of their previously increased rates. Ultimately, as the Nobel-winning economist Joseph Stiglitz said this week, every company depends on others to build capacity.

BUSA-SAAFF Summary

In concluding this edition, we turn our focus to the latest TNPA figures released for June, which showed that most port sub-sectors showed an increase in throughput for the second consecutive month. Unfortunately, yearly comparisons are mixed, with containers up ↑4% from last year, but bulk and vehicle handling showing varied trends against pre-pandemic levels. In reading these TNPA numbers with the recently updated Liner Shipping Connectivity Index, we can realise significant developments of late. Global connectivity for South African ports has declined since the early 2010s, with Durban and Cape Town experiencing significant drops. Conversely, Coega has shown remarkable growth, increasing by ↑129% since its operational start in 2009. UNCTAD’s LSCI for Q2 2024 shows a marginal quarter-on-quarter improvement in connectivity but a substantial annual decline, highlighting ongoing challenges in maintaining global port competitiveness. As Nobel-winning economist Joseph Stiglitz emphasised this week, every company relies on others to build capacity. The ongoing “free-riding” that leaves no one with reserve capacity in crises continues to affect global supply chains since COVID-19. This situation underscores the critical need for South Africa to enhance its port connectivity. As connectivity is a pivotal driver of global trade, improving it will help mitigate current supply chain vulnerabilities and bolster South Africa’s strategic role in the global shipping industry.

Source::BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape.

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”