Welcome to another Logistics News Update.

This week we look at the container terminals, how a big brand gets hit by the chaos in the port and how Transnet try to claw back some reputation.

Cape Town has been windbound since Friday and started to operate Tuesday morning, the winds have been up to 60km/. In other news, shipping rates are climbing due to the global problem and shipping from Europe becomes a challenge as they can’t go through the “short-cut” (Red Sea) due to attacks on shipping containers. The good news is that the backlog is becoming a much smaller problem and there appears to be a lot of confidence in the industry, against not great news stories. Not in this week’s news is that Unions demand no job cuts in the billionaire’s take-over of Durban port, let’s hope that we find a happy medium and there are no job losses.

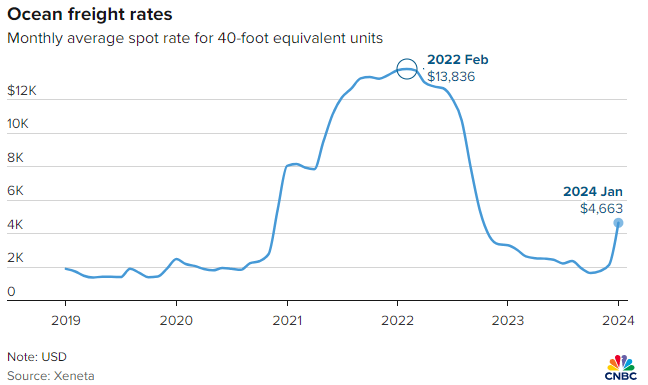

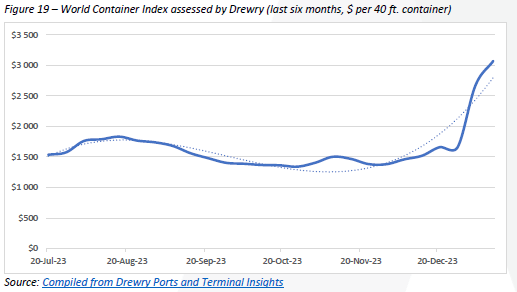

BUSA reported in their summary that in the global shipping industry, the Red Sea crisis remained very much in focus this week, leading to continued re-routing of traffic away from the troubled area. The affected shipping lane supports over 11% of global maritime trade volume, impacting economies in the Middle East, Europe, Asia, and Africa. Rerouting around the Cape of Good Hope adds significant nautical mileage, potentially leading to longer transit times and increased costs (which is clearly reflected in the massive increase in freight rates) – but even then, carriers are unlikely to be able to recoup all expenses incurred because of faster steaming, among other issues). In international news, “Air freight volumes soar as Red Sea delays, risks make more big retailers, auto companies nervous” CNBC reports that shipping rates are spiking, see the graph under Global Shipping Industry.

NEWS

Port chaos and bird flu hit Woolworth’s sales

Retailer Woolworths slipped on Monday after it warned of volume declines in its SA food and fashion businesses.

Port chaos, bird flu, and a constrained consumer are weighing on the group, which is also contending with near-record low consumer confidence in Australia. But it says its performance picked up over the festive season.

Shares in Woolworths fell nearly 2% on Tuesday morning after it warned that SA’s sputtering economic growth, a bird flu epidemic, and port chaos contributed to volume declines in its local food and fashion businesses.

The company also said in an update it was fighting for market share, with turnover and concession sales in its food business growing by 8.4% in the 26 weeks to 24 December, when underlying product inflation averaged 9.1%. Comparable stores grew their turnover 7.2%, with the company describing its growth as “solid” given the conditions.

The group said it faced tougher conditions in both Australia and SA, given the sustained effect of interest rate increases and higher living costs, which has weighed on discretionary spending.

Transnet to be called to account for CT port’s poor performance

Transnet will be invited to appear before the Standing Committee on Finance, Economic Opportunities and Tourism to provide feedback on the struggles the Port of Cape Town has faced during the table grape and stone fruit export season.

The port’s performance has been well below par over the last month, with delays of up to three weeks reported in getting produce to ships.

This means that fruit spends too much time in cold chambers, potentially affecting the quality and making it unfit for foreign markets.

According to Hortgro, which represents various organisations in the fruit industry, the total volume of apricots, cherries, peaches, plums, apples and pears shipped through the port in November and December was down about 35% compared with the same time last year.

Important stakeholders affected by the port will also be invited to brief the committee, including:

– South African Table Grape Industry Association

– South African Association of Freight Forwarders

– Western Cape Department of Economic Development and Tourism

– Port of Cape Town Container Logistics Chain

The goal of the meeting will be to compile a report that can be submitted to Transnet and assist them in fixing the port.

Durban Container Terminal prepares for citrus season

Durban Container Terminal (DCT) Pier 2 is prioritising terminal fluidity with a rail link solution to reduce truck congestion on roads around the port ahead of the upcoming citrus season.

Transnet’s DCT management said in a statement that the terminal was providing a rail link solution for customers’ import containers to a back-of-port facility seven kilometres from the terminal, as a means of reducing the number of trucks calling at the terminal.

Durban Terminals managing executive Earle Peters said it was important to focus on how the port handled both its waterside and landside traffic, which had led to its “fruitful collaboration with both shipping lines and truckers”.

Peters added that customers had been collecting their containers at the back-of-port facility with minimal waiting times and flowing roads in the vicinity since the beginning of January. The back-of-port initiative aims to clear terminal stacks more quickly to improve vessel turnaround time due to the improved capacity on the landside..

Durban port plans to tackle backlog

The Durban Container Terminal Pier 2 decided to make use of these empty trains by loading them with import containers.

Transnet Port Terminals (TPT) says it’s optimising and leveraging existing infrastructure and resources for a more efficient system at the Durban port which will also see truck congestion being reduced.

TPT said that one of the initiatives, which forms part of the overall plan to deal with the ongoing vessel backlog at the harbour, was to make use of an existing rail link between back of port facilities to the terminal for the loading of import containers.

It said the railing of containers to back-of-port facilities from places like Johannesburg or Mpumalanga and then to the port terminal was a daily occurrence.

However, once these trains dropped off their export containers at the port terminals, the trains returned to the back-of-port facilities empty.

The Durban Container Terminal Pier 2 decided to make use of these empty trains by loading them with import containers.

“The benefit is that these containers can be picked up by trucks away from the port terminal to ensure the terminal creates capacity to enable its core function of loading and offloading vessels.”

While TPT could not give an update on the vessel backlog on Monday, managing executive at the Durban Terminals Earle Peters had said in early January that they’d exceeded the set targets of clearing the vessel backlog.

Gavin Kelly, CEO of the Road Freight Association (RFA), said that there were “good moves” being made by Transnet.

PORTS

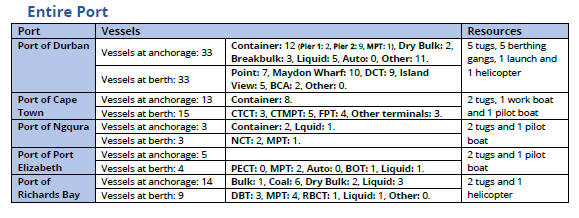

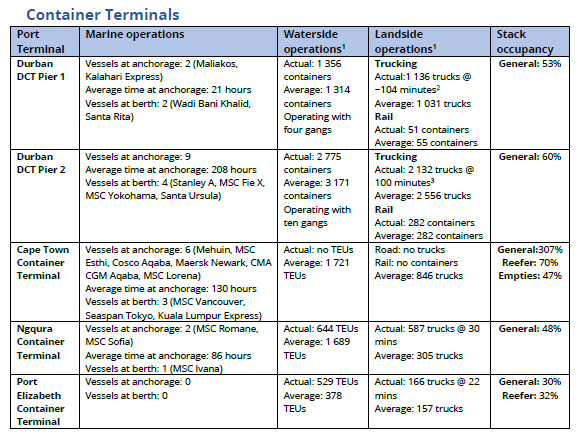

Summary of port operations

The following sections provide a more detailed picture of the operational performance of our commercial ports over the last seven days.

Weather and other delays

- Cape Town suffered from lengthy periods of being windbound this week, with one extensive stint of 36 hours of ceased operations.

- The main operational challenges in Durban could be seen in the familiar form of adverse weather and equipment breakdowns.

- Strong winds in the Eastern Cape ensured operational delays at the start of the week.

- Approximately 48 operational hours were disrupted in Richards Bay this week due to bad weather and the unavailability of marine resources.

Global shipping industry

i. Red Sea crisis: consequences, outlook, and overview of incidents

Attacks on commercial ships prompting shipping companies to re-route traffic away from the Red Sea continue, as President Biden has pledged to continue strikes against Yemen’s Houthis even as he admitted that military action against the rebel group has failed to halt attacks on commercial shipping14. The shipping lane facilitates about 11% of global maritime trade volume and over 19 000 transit calls annually, which has been drastically reduced since the first attacks took place: Sailing via the Cape of Good Hope means unavoidable extra nautical mileage – the distance from Singapore to Rotterdam via the Cape with no other ports in between, for example, is nearly 3 600nm longer than going via the Suez Canal at 8 300nm. However, longer distance doesn’t have to mean longer transit times. If carriers want to keep sailing days close to normal when routing via the Cape of Good Hope, they can steam at faster speeds, but that will incur significant extra costs (fuel and vessel primarily), which might not be recoverable from higher freight rates15.

For the longer term, the disruption is expected to alter the narrative of an oversupplied market with anticipated decreases in freight rates. Disruptions drive up shipping costs, leading to potential freight rate inflation. There’s a risk of port congestion and equipment shortages due to ship diversions in Europe. While affected markets may tighten temporarily, spare capacity in the system should mitigate severe impacts. In a worst-case scenario of prolonged Suez avoidance, the adequate capacity may reduce by ↓9%, indicating a heavily oversupplied market. The impact on the global economy, if any, is more likely from higher energy costs than freight rates, contingent on potential oil price increases. Overall, the situation may affect specific trades but is unlikely to alter the global supply and demand dynamics completely.

SUMMARY

To end, here is the summary by BUSA

In summary, the improved port throughput numbers are encouraging – as are the increased air cargo handled in the last week. These developments give us some cause for optimism and also indicate that Transnet’s recovery plans may be bearing some fruit. Only hard evidence in the form of regular improving numbers will convince the market that recovery is on track. Unfortunately, as has been previously pointed out, the rail modality remains the most significant cause for concern and must improve by an order of magnitude if South Africa’s extended logistics network is to have any hope of functioning at the levels we have seen in the not-too-distant past. Throughput volumes from both our iron ore and coal export lines indicate that volume remains down by some 20% when compared to only a few years back. And this is not due to any downturn in international markets; our producers would be moving the cargo if they could! The continued high truck volumes through the Lebombo border post towards Maputo is further evidence of that – with the situation even receiving some satirical commentary in the news this week6. With the current influx of cargo vessels passing our shores because of the Red Sea crisis and consequent diversion from the Suez Canal, it is a necessary realisation to ponder why these vessels are passing in transit (apart from the minor business in bunkering) and not calling at our ports because of increased supply and demand, as, ultimately, the evidence is clear. South Africa has unfortunately become a second (or even third) tier port. And we only have a small window of opportunity to turn matters around, or else the likes of Maputo, Beira, Walvis Bay, Lobito, Luanda, and others will continue to mop up trade previously handled by South Africa.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.