Welcome to another Logistics News Update.

The talk is all about Transnet and the Port, the main artery in and out of our country, it is essential that this gets the attention it deserves. It seems that every news outlet has Transnet as a headline, there is also an offer to become a service provider for handling citrus out of Durban.

There is also a possible relief on the fuel price this is according to the Central Energy Fund, South Africa’s fuel prices are expected to drop in November according to the Central Energy Fund (CEF). The CEF points to a drop in petrol prices of around R1.90 per litre, while diesel is expected to drop by 75c a litre. The expected drops are 93 octane petrol, R1.89 per litre; 95 octane, R1.93 per litre; diesel (0,05%) down 75c per litre; diesel (0,005%) down 69c per litre.

Operationally, MSC is bypassing Cape Town, and the vessels are 44 deep outside the port of Durban, in the below report you will see that Cape Town Port has its challenges and some drastic attention needs to be paid to getting this back to some normality, we understand that weather plays a roll but operationally, it is adding to the supply chain woes of our country. A recent study shows that the country is losing around ten million Rand a month just in the port of Cape Town, I would hate to know the number for the entire country. (read the story “Transnet collapse threatens the entire South African economy” below.

I think BUSA summarised the Transnet saga best.

”In summary, the turbulent waters at Transnet are evident for all to see, with several high-profile resignations in the last few days6 – as widely predicted. The struggles of the rail sector have been laid bare in recent years, with much of the daily R1 billion that Transnet is costing the economy occurring in the failed railway space. Turning around Transnet and the rail sector requires significant operational and structural reforms, which will not happen simply due to changes in senior management; there must also be some outside involvement. Experienced personnel who opted for voluntary retrenchment must be brought back into the organisation. The private sector is involved in these efforts, including plans to publish a Freight Logistics Roadmap for stabilising operations, attracting private sector investment, and unbundling the transport sector, similar to the changes proposed for the energy sector.

It is evident that Transnet faces a host of challenges, including underinvestment in capital equipment and maintenance, redirecting funds to where they can most effectively be spent, and inviting private sector participation in infrastructure repair through concession arrangements. Structural reforms must continue and involve unbundling Transnet, creating a state-owned infrastructure company, and introducing a transport regulator, allowing third-party operators on the rail network. Despite obvious potential stumbling blocks, the changes initiated by Minister Gordhan are expected to bring substantial and lasting transformations to South Africa’s state sector, notably leveraging private sector skills and resources in both energy and logistics – decisively overturning the archaic ideal of mainly publicly-run models. These changes cannot happen quickly enough and must be prioritised by both the providers of spatial infrastructure and operations (i.e., mainly the state) and the users of the logistics network (i.e., mainly the private sector).

Source: BUSA

NEWS

How the Presidency aims to fix South Africa’s collapsing logistics sector

Amid a new sense of urgency over an R500bn loss to the economy, the Cabinet will soon be shown a plan to increase private sector involvement in SA’s railways and ports. The troubled logistics sector is headed for a fundamental shift if a plan by the Presidency is implemented. The plan would weaken Transnet’s monopoly and promote competition by increasing the private sector’s participation in the running of South Africa’s rail network and ports. The Presidency and organised business, with help from logistics experts, have drafted a plan that seeks to reverse the dysfunction of the railways and ports in the hands of Transnet. The dysfunction is estimated to have cost the economy at least R500 billion since 2010 and worsened SA’s fiscal crisis, which is pushing the government to consider raising taxes and cutting expenditures. Most of the reform proposals included in the 124-page Roadmap for the Freight Logistics System in South Africa are not new, as they complement policy initiatives already approved by the Cabinet. However, there is now a sense of urgency and greater support for the plan in government circles, including the Treasury, the Department of Transport and the Department of Public Enterprises. “There’s a broader recognition that South Africa’s logistics crisis is deep and there is no more time to waste,” said a source in organised business who worked on the plan.

Underscoring the logistics crisis are Transnet’s numbers. Volumes in rail operations have declined from a peak of more than 200 million tonnes a year in 2019 to an expected 143 million in 2023 because of mismanagement of the rail network, along with cable theft and vandalism. Transnet ports are among the world’s worst for efficiency and loading times, scoring in the bottom 10 of the 348 ranked in the World Bank’s latest Container Port Performance Index. Unlike others before it, the latest logistics plan sets out timelines for everything, including allowing private sector companies access to rail lines, setting up an independent manager of the rail network, rightsizing the network by closing down unprofitable lines and giving private operators concessions on ports and rail routes. The roadmap is set to be presented to the Cabinet for approval in early November. Transnet’s board is also working on a separate turnaround plan that will focus on the company’s operational and strategic affairs, and complement the Presidency’s roadmap. – Read the full story here where they cover “No privatisation” and “Reform proposals”

– Source: Daily Maverick

TNPA requests proposals for a citrus handling terminal at the Port of Durban

Transnet National Ports Authority (TNPA) has issued a Request for Proposals (RFP) for a terminal operator to design, develop, finance, construct, operate, maintain, and transfer a multi-purpose terminal at the Port of Durban’s Maydon Wharf Precinct for the handling of citrus and other fruit, including break bulk cargo.

Maydon Wharf is the main precinct for general cargo and has been developed in phases since the early twentieth century. The precinct extends over approximately 145 ha with 15 common-user berths and an annual cargo capacity of over 7 million tonnes. Responses to the RFP will assist TNPA in responding to potential investors in the agricultural industry. Bidders are required to submit bid responses for the exclusive right to complete the financing, refurbishment, procurement of terminal equipment, operation, maintenance, and transfer of the facility to TNPA after the concession period of 25 years.

Source: Bizcommunity

Transnet and the state’s new spin on privatisation

By Sarah Smit

Last week, the state’s plan for Transnet came to light through its draft Roadmap for the Freight Logistics System in South Africa — a 124-page document outlining the various reforms that will be undertaken to rehabilitate the beleaguered port and rail operator. The document, which is marked confidential but has reportedly been circulated among business and labour leaders, sets the scene for the private sector’s broader participation in the country’s rail network. In one particularly interesting section, the document’s authors consider the state’s developmental role, which the government has been accused of disregarding in light of its efforts to push through a reform agenda which seemingly has privatisation at its heart. The section borrows from economist Mariana Mazzucato’s idea of the entrepreneurial state, set out in her 2011 book of that name.

In quoting Mazzucato, the document’s authors offer a new spin on the privatisation narrative which is certainly more palatable than the alternative — an enfeebled state at the mercy of a profit-hungry private sector. The question is, will the government genuinely pursue the entrepreneurial state ideal or will it be derailed as it endeavours to protect narrow interests? This part of the roadmap contains an important admission — that the corporatisation of the country’s state-owned entities has failed. The push for corporatisation relied on the idea that it would lead to greater innovation and commercial agility, characteristics that are generally not ascribed to the state, which is all too often cast as inertial (as Mazzucato explains). “While the corporatisation of SOEs was intended to enable them to remain agile and responsive to changing business environments, they have largely failed to keep up with the evolving dynamics of the sectors in which they operate,” the document notes. “Rather than adapting and reforming to remain cutting-edge, they have stagnated and remained attached to business models that are increasingly unviable and abandoned by the rest of the world.” These problems have slowed growth, deterred investors and placed extraordinary burdens on the fiscus, the document adds, noting that this reality has necessitated difficult trade-offs. Elsewhere, the document focuses on dilemmas arising from Transnet’s corporatisation specifically — noting that, for much of its history, the entity has been governed under vague and often unfunded operational mandates. This pitfall of corporatisation has manifested in most of the other state-owned entities, including Eskom.

Source: Mail & Guardian

Transnet collapse threatens the entire South African economy

The continued deterioration of Transnet’s infrastructure and performance threatens the entire South African economy, which is reliant on the utility to facilitate 68% of its GDP. BDO partner Siyabonga Mthembu told 702 that the crisis at Transnet eclipses that of Eskom. “Similar to Eskom, what Transnet is going through is basically falling capacity, deferred maintenance, theft, and management issues,” Mthembu said. South Africa’s economy is heavily reliant on efficient logistics, as 68% of its GDP comes from imports and exports. The economy is peculiar in that it acts as a landlocked country with most of its GDP situated in the centre of the country in Gauteng. The production in Gauteng needs to be transported outwards to other provinces and the coast for export. “If the system is not working, then the current economy based on the movement of goods will basically die. No one will want to import or export goods,” Mthembu said. Mthembu said estimates that the country is losing R1 billion a day from Transnet’s collapse is conservative as they do not include lost potential investment from local and international companies, which is extremely difficult to quantify. “The reality is international companies will not want to come to South Africa and invest if they know there is a risk they will be unable to export their products or transport it to the end consumer,” Mthembu said. “The magnitude of this is significant. Some argue that it is significant as the impact that Eskom has and argue that actually, this is even worse than the impact that we see as a result of load-shedding.”

Some mining companies, such as Anglo American and its subsidiary Kumba Iron Ore, have delayed investment in South Africa due in part to Transnet’s inefficiencies. South Africa’s largest iron ore producer, Kumba, said in its interim results presentation that it had lost R6 billion from Transnet inefficiencies alone in the first six months of the year. This is in addition to a R10 billion loss in 2022. “An efficient logistics system is fundamental to global trade and South Africa’s weakening economic growth,” Kumba’s CEO Mpumi Zikalala said. “Given the uncertainty due to the logistics challenges, the company decided to defer non-critical capital expenditure of R2 billion.” Anglo-American CEO Duncan Wanblad said South Africa is missing out on billions in investments due to the challenging operating environment to which Transnet is a significant contributor. Wanblad said the country held “extraordinary untapped potential”, but challenges such as load-shedding and logistics bottlenecks affected “the profitability and sustainability of our business”. These issues also prevent investment in expanding output, particularly from mining companies, as there is uncertainty regarding the country’s economic future. Other impacts of Transnet’s collapse include the strain placed on South Africa’s Road infrastructure, with mining companies and fruit exporters turning to trucking to transport goods. This results in decreased road safety, increased spending on road infrastructure, and increased costs associated with trucking goods.

Source: https://secure-web.cisco.com/1ufHRJ7eKLN4gtT9D2cG-UaQ9VIy7f8Hg0KcIPzAZGNqNLHKCDNNIJur45VckBUEUoWG76JAbhYz3rjVOEeYBS7GARS29o6lDTSuZqjbwCRvZ5fdZkcYe02g9XvpFyR86zNdN1-_8l7S9AeV_dRl3HohUQ2do4BjTBp154-pmVAUBklcGj2uWxCV8bGl8-2lOHdVWdYNIx3zul_GT17iLpt0-tEdrKdfY7MaQrxAwTWbLrshTBvKyETpFCqizmtOihLLkTbkrTqx7z9HkIrrsxyyOm-YzveVmgvDp8fWoT9BhMwnuki4u4sXRzjaVlJfa/https%3A%2F%2Fdailyinvestor.com%2F

Key Notes

• An average of ~7 679 containers was handled per day, with ~6 672 containers projected for next week.

• Rail cargo handled out of Durban amounted to 2 335 containers for the week, ↓2% (w/w).

• SARS merchandise trade (August): exports (↑4,5%, m/m), imports (↑6,3%); YTD surplus: R32 billion.

• Cross-border queue times were ↓2,3 hours (w/w), with transit times ↑0,8 hours (w/w); SA borders increased by ~1,6 hours, averaging ~7,6 hours (↑27%); Other SADC borders averaged ~9,7 hours (↑10%).

• Global freight rates decreased by ↓1,1% (or $14) to $1 390 per 40-ft container this week. YTD: $1 738.

• Global cargo tonne-kilometres (CTKs) increased by ↑1,5% (y/y) in August, as rates moved up to $2,37/kg.

SUMMARY

Commercial ports handled an average of 7 679 containers per day – significantly up versus the 6 726 last week. However, several factors still impacted peak port performance this week, notably extensive network challenges, adverse weather conditions, frequent equipment breakdowns and shortages, and congestion. The Port of Cape Town was particularly affected on numerous fronts this week as its performance generally remained sub-par. At the same time, adverse weather conditions and network issues in Durban were the main culprits of operational delays there this week. After picking up an “EDU snag” issue late last week, the Durban helicopter remained out of commission for the entire week. The technical team hoped to return the aircraft to service over the weekend. According to reports received earlier this week regarding the Moor Master system at NCT, ten units are back online but are not enough to see the machine recommissioned. Additionally, The ConCor line was out of commission for most of Monday due to monthly maintenance.

In the global container shipping industry, carriers hesitate to cut capacity despite declining rates and no cargo roll pools ahead of China’s Golden Week. The standoff is expected to continue throughout the year, with capacity increasing despite flat global demand. MSC has extended its lead over Maersk, with its fleet reaching 5,36 million TEU, while Maersk’s operated fleet has shrunk to 4,12 million TEU. Port congestion remains low, affecting only about 6% of the industry. Freight rates have decreased, and the industry appears to be settling at low levels, with further declines expected as volumes remain lacklustre. Other developments include the FMC throwing out an ‘unjustified’ congestion charge complaint against MSC, Medlog winning the contract to operate a trimodal hub serving Paris, and ILWU filed bankruptcy to deal with ongoing litigation with ICTSI Oregon.

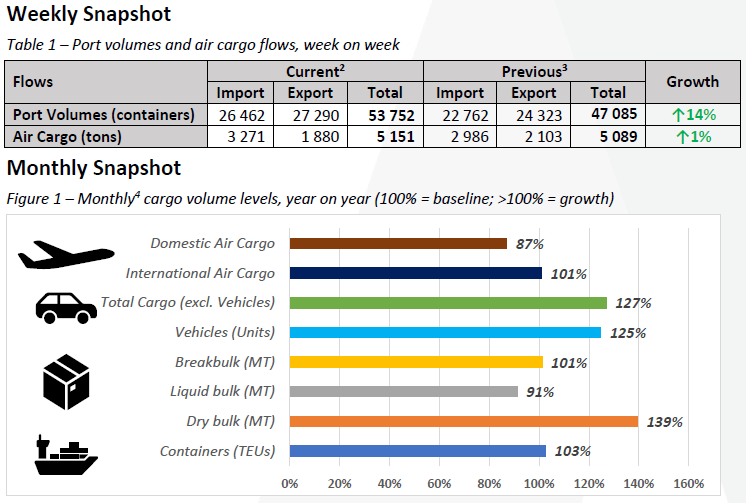

On the air freight front, international air cargo to and from South Africa increased marginally in the last week (↑1%) – led by imports (↑10%). On the domestic front, cargo remains significantly down from last year (~86%). Internationally, global air cargo tonne-kilometres increased by ↑1,5% (y/y), marking the first year-on-year growth in 19 months, but industry CTKs were still ↓1,3%% lower than their 2019 levels, according to IATA’s latest report. Air cargo capacity, measured in available cargo tonne-kilometres, grew by ↑12,2% (y/y), driven by increased belly capacity during the northern summer. Moreover, while air cargo demand has shown signs of realignment with industrial production and cross-border trade, the ongoing contraction in global trade remains a concern for air cargo demand.

In regional cross-border road freight trade, average queue times decreased by two and a quarter hour, while transit times increased by 48 minutes compared to last week. The median border crossing times at South African borders increased by an hour and a half, averaging ~7,6 hours (↑27%, w/w) for the week. In contrast, the greater SADC region (excluding South African controlled) increased by approximately an hour and averaged ~9,7 hours (↑10%, w/w). On average, several SADC border posts took more than a day to cross, notably Beitbridge, Kasumbalesa, Katima/Mulilo (the worst affected, taking around two days to cross), and Moyale OSBP. Further notable developments included (1) President Cyril Ramaphosa presiding over the BMA launch in Musina and (2) the DRC President becoming personally involved in addressing ongoing border and trade issues.

PORTS

i. Weather and other delays

• The Port of Cape Town was challenged on several fronts as port performance remained very poor, quite apart from any impact of the weather.

• Adverse weather conditions and network issues in Durban resulted in operational delays.

• Inclement weather and equipment breakdowns at Eastern Cape ports also impacted cargo flows.

• The main topic of discussion in Richards Bay this week was the fire that broke out in the woodchip plant.

ii. Cape Town

On Friday, CTCT recorded three vessels at berth and one at anchor. The terminal went windbound around 04:50 on Friday, expecting strong winds to persist through Sunday. Stack occupancy for GP containers was recorded at 43%, reefers at 52%, and empties at 43%. In the latest 24-hour period to Friday, the terminal handled 1 427 TEUs across the quay while 862 trucks were serviced on the landside, with 41 rail import containers on hand.

The port was extensively challenged during the early stages of the week, contributing to its poor operational performance. An accident on the N2 delayed the start-up of the afternoon shift on Monday by approximately two hours. During the same period, at block D8, a private truck hit a container, further delaying operations, while a system failure between 20:00 and 21:30 also created some operational challenges. Additionally, crane QC4 remained out of commission for most of the week. The crane was anticipated to return to service by Thursday; however, strong winds prevented final testing to be completed on time. Not that an extra crane will help much, given the alarming shortage of RTGs in the terminal!

iii. Durban

Pier 1 on Tuesday recorded two vessels at berth, operated by five gangs, and four vessels at anchor. Stack occupancy was 56% for GP containers and remained undisclosed for reefers. During the same period, 1 465 imports were on hand, with 26 units having road stops and 21 unassigned. Despite losing a few hours to strong winds, the terminal recorded 614 landside gate moves, with 211 cancelled slots and 56 wasted. The truck turnaround time was recorded at ~154 minutes, with an average staging time of ~131 minutes. Additionally, at the start of the morning shift on Wednesday, the terminal started with 13 RTGs but retracted to 12 after one breakdown.

Pier 2 had four vessels at berth and nine at anchorage on Friday. In the prior 24 hours, stack occupancy was 48% for GP containers and 16% for reefers, with 72% of reefer ground slots utilised. The terminal operated with nine gangs while moving 2 680 TEUs across the quay despite losing a few hours to adverse weather and network challenges. During the same period, there were 2 147 gate moves on the landside with a truck turnaround time of ~130 minutes and a staging time of ~162 minutes. Of the landside gate moves, 1 080 (51%) were for imports and 1 063 (49%) for exports. Additionally, 437 rail import containers were on hand, with 320 moved by rail. During the same period, the terminal had 15 out-of-gauge import containers on hand, of which five were for rail and had elevated dwell times. Additionally, at the start of the morning shift on Wednesday, the terminal started the morning with between 60 and 65 straddles; however, due to several breakdowns, this number came down to 58 by the end of the shift.

iv. Richards Bay

On Friday, Richards Bay recorded 21 vessels at anchor, with 11 destined for DBT, nine destined for MPT, and one for RBCT. Additionally, 14 vessels were recorded on the berth, translating to six at DBT, six at MPT, one at RBCT, and two at the liquid bulk terminal. Two tugs and one helicopter were in operation for marine resources in the 24 hours leading to Saturday. The pilot boat remains in Durban for repairs, with no estimated time of return available yet.

v. Eastern Cape ports

NCT on Tuesday recorded three vessels on the berth and one vessel at the outer anchorage, with three drifting. Marine resources of two tugs, a pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading up to Wednesday. In the same period, stack occupancy was 36% for GP containers, 31% for reefers, and 53% for reefer ground slots. In that period, 2 430 TEUs were processed at a GCH of ~17 and SWH of ~39. These metrics must be improved as a matter of urgency, just as they must at all our ports.

Additionally, 241 trucks were serviced on the landside at a truck turnaround time of ~36 minutes. According to reports earlier this week regarding the Moor Master, ten units are back online but are not enough to see the machine recommissioned. Additionally, crane QC3 went out of commission earlier this week for energy chain repairs and has not returned to service yet.

GCT on Wednesday recorded one vessel at outer anchorage and one at berth. Available waterside resources were two tugs, a pilot boat, two pilots, and one berthing gang in the 24 hours to Wednesday. In the same period, stack occupancy was recorded at 48% for GP containers, 22% for reefers, and 54% for reefer ground slots. On the waterside, 299 volumes were handled across the quay at a GCH of ~15 and SWH of ~14. Additionally, 241 trucks were serviced on the landside at a truck turnaround time of ~36 minutes.

ii. Global container freight rates

This week, the “World Container Index” decreased by another ↓1,1% (or $14) to $1 390 per 40-ft container19, despite the attempted rate hikes by carriers (several announcements were made this week, notably by Hapag Lloyd and CMA CGM20; whilst Maersk continues to give discounts on spot prices21). These current rates were last seen in February 2020 before the pandemic turned the shipping industry upside down. The following figure shows the last three years, with the massive see-saw illustrated:

Figure 15 – World Container Index assessed by Drewry (last 12 months, $ per 40 ft. container)

This week’s news was brought to you by:

FNB First Rade 360 – a digital logistics platform & Exporters Western Cape.