Welcome to another Logistics News Update.

I hope everyone enjoyed a wonderful Heritage Day!

It’s been quite a week with snow, a holiday, and more all packed into just a few days. The arrival of snow at the start of spring caught many of us off guard, but after the challenging weather we’ve faced at the ports, nothing surprises us anymore. Additionally, over 700 trucks were stranded due to snow, and weather reports suggest there could be more snowfall this weekend, particularly in the mountainous regions of the Eastern Cape. These weather events are unpredictable, and unfortunately, we can only react as they come.

Looking ahead, a potential strike in the USA may impact shipping rates, so be sure to stay alert for any updates on that front.

Given the short week, here’s a quick snapshot of what’s happening and happened.

- Operational Delays: Harsh winter weather in KwaZulu-Natal, equipment breakdowns, and strong winds caused delays across several ports, including Durban, Cape Town, and Richards Bay. The N3 route between Durban and Johannesburg was closed due to snowfall, severely affecting trucking.

- Port Volumes and Air Cargo: There was a slight decrease in port volumes, while air cargo saw a 3% increase. Around 7,939 containers were handled daily. Rail cargo from Durban saw a notable 30% increase.

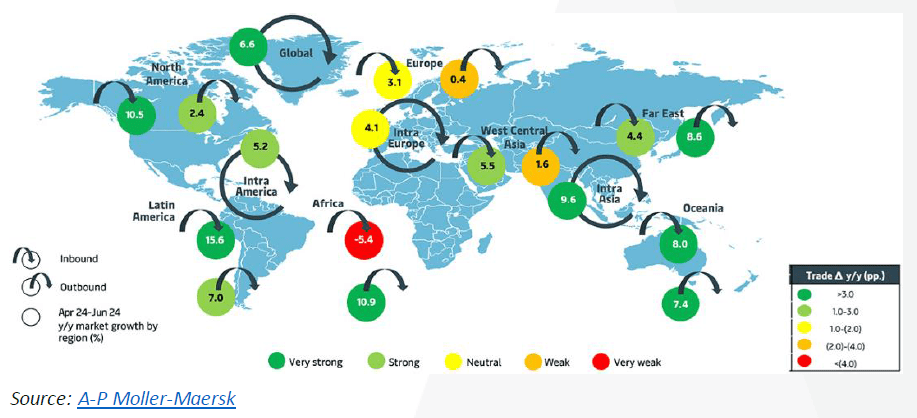

- Global Trade: Global container volumes grew by 6.6% in Q2 2024, driven by strong imports to North and Latin America, while African imports dropped by 5.4%. Freight rates declined by 4.8%, and a U.S. dockworkers’ strike looms, which could further disrupt global shipping.

- Cross-Border Trade: South African border crossings saw delays increase by 23%, while the SADC region experienced a 25% rise in border crossing times.

- Outlook: Despite challenges, the National Logistics Crisis Committee (NLCC) is driving reforms, and there is a focus on modernizing South Africa’s logistics infrastructure to support long-term economic growth.

Source: FreightNews

Here are the highlighted stories from the past week and what is happening now that I think are important to note.

Shift to Less-than-Container Load (LCL): Many exporters are turning to LCL shipping to save on freight costs.

Delays from Far East: Continued delays in shipping from the Far East are expected to persist due to congestion and other logistical challenges at major ports.

China’s Role in South Africa: China remains South Africa’s top export market, with Shanghai continuing to be the world’s most connected port.

Shipping Lines Preparing for US Strike: Major carriers have started to impose surcharges on imports and exports as a U.S. port strike looms.

Progress in Maritime Digitalisation: South Africa has made significant strides toward maritime digitalisation, with the mandatory use of a single digital platform since January 2024.

NEWS

Ocean rates on shaky ground because of US developments

23 September 2024 – by Staff reporter

Ocean freight rates may sharply increase by the end of the year due to two significant events: a looming U.S. port worker strike and the U.S. presidential election. Around 85,000 dockworkers, represented by the International Longshoremen’s Association (ILA), are threatening to strike after wage negotiations with the United States Maritime Alliance (USMX) broke down. If the impasse isn’t resolved through mediation, the strike could begin on October 1, affecting five of the ten busiest ports in North America and disrupting nearly half of all U.S. imports, potentially causing billions in trade losses.

The ILA is demanding a 77% wage increase, but USMX remains unwilling to meet these terms, prompting appeals to the Biden administration to intervene, which have so far been unsuccessful. If the strike proceeds, the ripple effects on supply chains would likely lead to significant delays and spikes in ocean freight rates, creating logistical challenges for shippers.

Adding to the uncertainty is the U.S. presidential election on November 5, where a Trump victory could result in increased tariffs, especially on Chinese imports. This could drive U.S. importers to accelerate shipping before the tariffs take effect, causing a spike in demand for freight services. Combined with a potential strike, the situation could severely disrupt global trade, leading to a dramatic increase in shipping costs towards the end of the year. – Adapted from Source: Freight News: Read the full story here

Line launches new surcharge to mitigate supply chain disruption

19 September 2024 – by Staff reporter

Lars Jensen, founder and CEO of Vespucci Maritime. Source: Shipping Watch

Hapag-Lloyd has announced a “work disruption surcharge” (WDS) of $1,000 for routes to America’s Atlantic and Gulf Coast ports, as potential strike action looms. This surcharge will apply to imports from North Europe, the Mediterranean, Africa, the Middle East, Oceania, and Latin America, effective from October 18 until further notice. Notably, the surcharge does not apply to imports from the Far East.

In addition to the WDS, Hapag-Lloyd has also announced a general rate increase of $1,000 per container for shipments from the Indian subcontinent and the Middle East to the U.S. East and Gulf Coasts, starting October 17. This comes as the possibility of a strike by dockworkers represented by the International Longshoremen’s Association (ILA) and the United States Maritime Alliance (USMX) looms, with a deadline of October 1.

Lars Jensen, CEO of Vespucci Maritime, advised shippers to prepare contingency plans for cargo currently in transit, as a strike could leave goods stuck at sea or in impacted ports. He also highlighted the urgency for exporters on the U.S. East Coast to ensure containers are loaded and gated into terminals before the potential disruptions…

Adapted from Source: Freight News – Read more here

PORTS

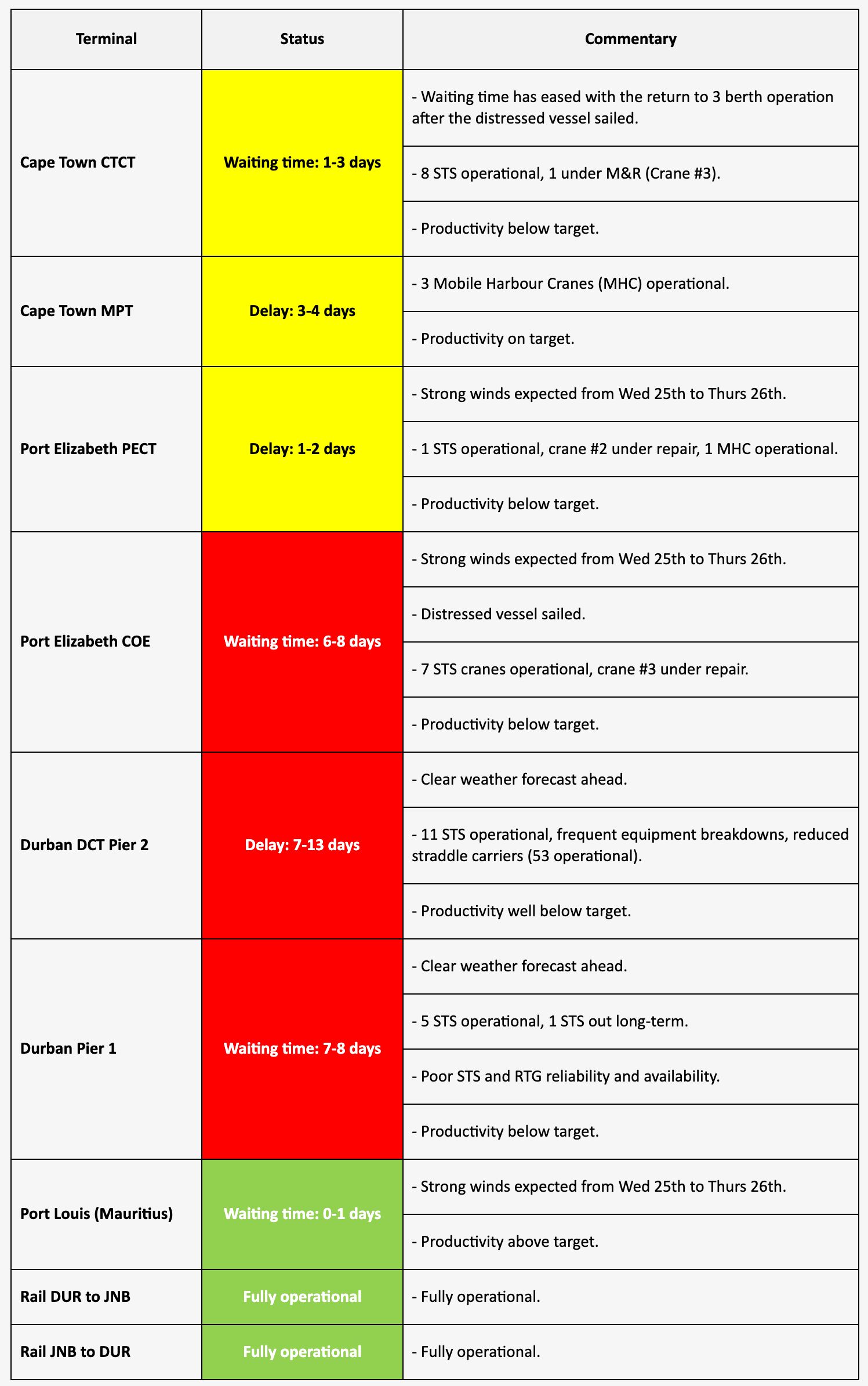

Source: MAERSK

Summary of Global Shipping Industry

As 2024 enters its final quarter, uncertainty surrounds the global container industry. Manufacturing export orders remained below the 50 thresholds in July, raising concerns about industrial recovery. Full-year demand growth is projected at 4-6%, despite a 6.6% year-on-year (y/y) increase in container volumes during Q2, driven by strong imports to North and Latin America and exports from Far East Asia. Intra-Asia trade has gained momentum, while U.S. and European exports continue to lag. Only African imports saw a decline, dropping by 5.4%, as global demand remains robust.

Supply-side pressures continue, with high deliveries and low recycling rates keeping capacity utilization full. Rising bunker prices and geopolitical tensions have kept Brent oil prices high, peaking at $84 per barrel by August-end. Freight rates have dropped by over a third since July, as carriers expand their roll pools instead of cutting capacity. The impending U.S. dockworkers’ strike in October could further disrupt container markets, affecting up to 15% of global capacity and potentially influencing freight rates well into 2025.

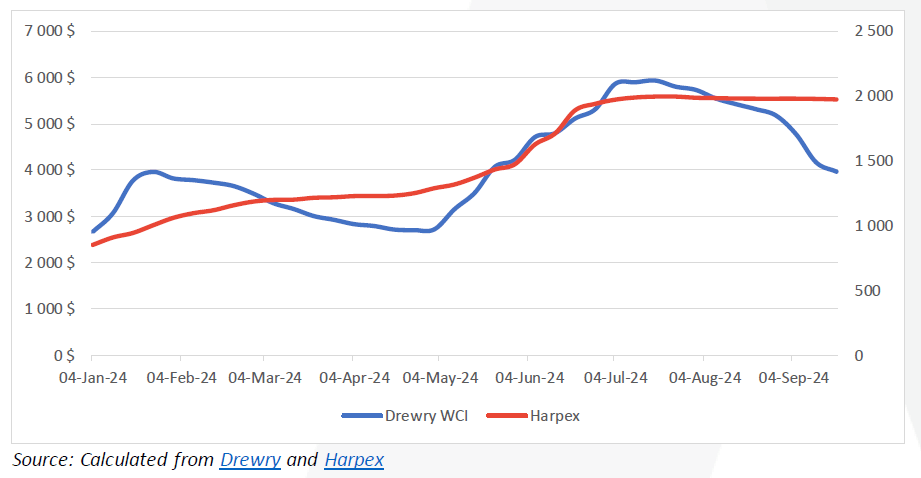

Global Container Freight Rates and US Strike Surcharges

Drewry’s “World Container Index” has dropped below $4,000 per 40-foot container for the first time since mid-May, falling by 4.8% (or $198) to $3,970. Despite this decline in spot freight rates, charter rates have remained stable, with the Harper Petersen Index (Harpex) holding at around 1,975 points. The stability in charter rates contrasts with the continuing downward trend in freight rates as shipping volumes and capacity utilization remain low ahead of the Golden Week holidays. The ongoing potential for a U.S. dockworkers’ strike could add further pressure to freight markets. The latest spot-rate composite index is now 62% below the pandemic peak of $10,377 but remains 193% higher than September 2023 rates. This downward trend is expected to persist, especially as U.S. East Coast cargo faces disruption surcharges ahead of potential labour strikes on the U.S. East and Gulf coasts. From October 1, MSC will impose a $1,000 surcharge for 20-foot containers and $1,500 for 40-foot containers on shipments to the U.S., Caribbean, Mexico, and Canada. Other carriers have also introduced similar surcharges, adhering to the 30-day advance notice required under U.S. Federal Maritime Regulations. Despite the looming strike, the White House has confirmed it will not intervene, increasing the likelihood of disruptions. This combination of new surcharges and unresolved labor issues may lead to further complications for global shipping networks in the coming months.

BUSA-SAAFF Summary – Summary

This week, South African ports managed an average of 7,939 containers per day, with operations facing delays due to adverse weather and equipment failures. Harsh winter conditions in KwaZulu-Natal caused the closure of the N3 route, severely disrupting road logistics. Other key ports, such as Cape Town and Durban, also experienced operational setbacks due to strong winds and equipment breakdowns, while Eastern Cape ports struggled with similar issues. Globally, container shipping saw a 6.6% increase in Q2 volumes, though looming threats like a U.S. dockworkers’ strike could disrupt global supply chains and impact freight rates significantly.

In air freight, ORTIA handled nearly 1 million kg of cargo last week, showing a 26% increase compared to September 2023. Global air cargo demand remains strong, supported by increased passenger flights and growth in key regions like Asia and the Americas. However, potential regulatory changes in the U.S. related to e-commerce could pose challenges for shippers during the peak shopping season. Meanwhile, South Africa’s logistics sector continues to face critical infrastructure challenges, with outdated systems and poor rail performance. The National Logistics Crisis Committee (NLCC) is working on reforms to modernize the sector and promote long-term economic growth. Source::BUSA

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”