Welcome to another Logistics News Update.

Sea freight rate hikes even steeper than anticipated!

Back on June 11th, we reported a significant rise in sea freight rates [see previous news 11/06]. However, the situation has become even more concerning.

In South Africa, we’ve witnessed a staggering 240% increase – far exceeding initial predictions of a 233% jump. This isn’t the only issue. Some shipping lines, like CMA-CGM, are adding peak season surcharges of $2,000 (around R40,000) on top of existing costs, even for already booked containers currently on their way to South Africa. This feels exploitative. To make matters worse, shipping lines have introduced a special “diamond tear rate” – and even with this supposedly premium option, there’s no guarantee your shipment gets loaded. One operator reported having seven containers booked under this rate that haven’t shipped yet. The shipping industry seems to have lost sight of its customers. We need action to address these excessive charges and ensure reliable service!

Other news is Richards Bay is going to have a container terminal in 2027, this will take pressure off the Durban container terminal for Cargo destined for the surrounding area and Richards Bay itself, lets watch this space.

Forex Tip of the week

What is CIF? – Incoterm 2020

Cost, Insurance, and Freight (CIF) is an international shipping agreement that defines the responsibilities of buyers and sellers when transporting goods by sea or inland waterway. It is one of 11 Incoterms rules set by the International Chamber of Commerce, which are regularly updated to reflect changes in the global business environment. The latest version of Incoterms is 2020, which came into effect on January 1, 2020.

Imagine you’re in South Africa and order some cool headphones from a store in the USA. With CIF, here’s the breakdown of responsibilities:

- The U.S. Seller:

- Covers the cost of the headphones themselves.

- Arranges and pays for insurance to protect the headphones during shipping.

- Pays for the freight to get the headphones to South Africa. This likely involves air or sea freight.

- You (the South African Buyer):

- Pay the purchase price for the headphones.

- Are responsible for any import taxes or duties that South Africa might charge upon arrival.

- Take on any risk of loss or damage once the headphones are loaded onto the airplane or ship in the USA.

In simpler terms, the seller gets the headphones to the port/airport in the USA and pays for everything up to that point. Once they’re shipped, you’re responsible for any fees and take the risk if something happens during transport.

Who should use CIF?

Importers new to international trade: For businesses that are new to importing, CIF can be a good option because it simplifies the process. The seller takes care of most of the legwork, allowing the importer to focus on customs clearance and other formalities once the goods arrive.

On The Ground Report

We have not seen an improvement at the ports, no matter what they come out and say, vessels are brought in to unload 60 container and go out again, these containers are regarded as urgent, so only special clients get their containers and the rest of us have to wait for the vessel to come back. I thought the report got them on their game and as we only see a slight improvement. There are significant delays for container ships waiting to dock at Durban port, with some vessels waiting over a week (174 hours) on average. Other ports in South Africa are experiencing shorter delays. The main causes of delays are bad weather, crane breakdowns, agent delays, changes in vessel schedules, and roadworks at the Maydon Wharf terminal.

There are significant delays for container ships waiting to dock at Durban port, with some vessels waiting over a week (174 hours) on average. Other ports in South Africa are experiencing shorter delays. The main causes of delays are bad weather, crane breakdowns, agent delays, changes in vessel schedules, and roadworks at the Maydon Wharf terminal.

The Port of Durban is experiencing some equipment issues. Here’s a quick rundown:

- Reduced tugboat availability (4 in service) due to a malfunction.

- Limited equipment at Durban MPT (3 cranes, 9 reach stackers, etc.).

- Straddle carrier shortage at DCT Pier 2 (53 operational).

- Crane outages at both DCT Pier 2 (2 cranes) and CTCT (1 crane).

- Mobile crane malfunction at CTMPT.

- Similar tugboat issue at Port of East London.

Disclaimer: Please note: All information presented in this post is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed.

NEWS

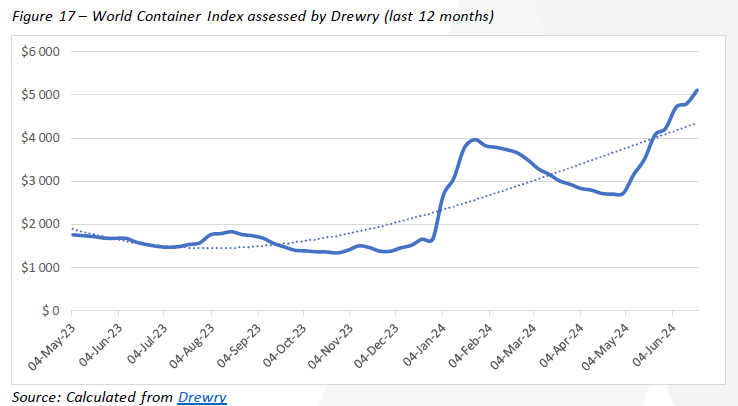

FEU rates spike by 233% year-on-year

24 June 2024 – by Staff reporter

The composite World Container Index (WCI) compiled by sea trade consultancy Drewry has found a 233% year-on-year (y-o-y) increase for forty-foot-equivalent units.

This is after FEU data for last week increased by 7% to $5 117.

Drewry’s latest y-o-y data for FEUs is also 260% higher than the pre-coronavirus average measured in 2019.

Since then, FEU rates have consistently risen from $1 420 before Covid-19 disruption rippled out across the sector, leading to extreme rate volatility and current FEU costs.

Drewry has reported that “freight rates from Shanghai to Rotterdam increased 11% or $690 to $6 867 per FEU.

“Similarly, rates from Shanghai to Los Angeles grew 7% or $416 to $6 441 per 40ft box.

“Likewise, rates from Shanghai to New York rose 3% or $253 to $7 552 per 40ft container.

“Also, rates from Rotterdam to Shanghai and Shanghai to Genoa increased 2% to $672 and $7 029 per FEU respectively.

“Conversely, rates from New York to Rotterdam and Rotterdam to New York decreased 1% to $633 and $2 093 per 40ft box respectively.

“Meanwhile, rates from Los Angeles to Shanghai remain stable. Drewry expects that freight rates from China will continue to rise next week due to congestion issues at Asian ports.”

Source: Freight News

Congestion at key transhipment hubs

24 June 2024 – by Staff reporter

The Red Sea crisis is hitting transhipment hubs as carriers have made major changes to individual exchanges handled at these hubs.

That’s according to the latest research by maritime consultancy Drewry, which reveals that key transhipment ports, such as Singapore, have witnessed a sharp rise in congestion due to the impact of Red Sea carrier service diversions.

This has led to fewer vessel calls but larger average exchanges – resulting in additional yard congestion.

The report reveals that port productivity has also taken a hit in recent months. “The time spent by ships waiting before berthing at high-volume ports tracked by Drewry increased 43% between 3Q23 and 2Q24 – to over 400 000 hours.

“Singapore is in a microcosm of transhipment ports around the world, where changes to carrier service patterns in response to the Red Sea crisis have wrought havoc on container terminal operations. It is experiencing a density of shipping containers in its terminals, close to the records of the pandemic period.”

The research has found that in the five months to May, throughput at the port grew 8% year-on-year, representing a strong start to the year but not enough on its own to challenge existing handling capacity.

However, the rerouting of container vessel services away from the Red Sea in response to the Houthi attacks on shipping resulted in a 22% increase in average parcel sizes in the period between January and May, according to Drewry’s Ports and Terminals Insight, with a significant knock-on impact for port productivity.

Drewry expects congestion at major transhipment ports to remain high, but some easing is anticipated as carriers add more capacity and restore some of their disrupted schedules.

Source: Sunday Times – Business

PORTS

Summary of Port Operations

South African ports saw mixed performance this week:

- Cape Town: Improved operations with minimal delays.

- Durban: Equipment shortages and power outages caused disruptions.

- Eastern Cape: Adverse weather and network issues led to delays.

- Richards Bay: Minimal delays reported.

Cape Town: Improved performance with some crane outages.

Durban: Stack congestion at Piers 1 and 2 due to equipment issues and dredging. Delays experienced at MPT. Waiting vessel queue remains.

Richards Bay: Grindrod selected to develop a new container terminal. Coal terminal functioning well despite some train servicing issues.

Eastern Cape: NCT faced tidal challenges but handled a good volume of TEUs. GCT also performed well. No reports from East London. TNPA is looking for renewable energy solutions at Eastern Cape ports.

Overall: Mixed bag of performance across ports with some improvements in Cape Town offset by congestion and delays in Durban. Richards Bay saw positive developments and the Eastern Cape is looking towards renewable energy solutions.

Container Market Summary

- Demand remains strong: Fears of a market downturn due to peace talks were unfounded as freight futures rebounded and rates rose for three weeks straight.

- Rates to increase further: New Asia-North Europe routes haven’t lowered rates due to schedule disruptions and blank sailings. A German port strike is expected to worsen delays.

- Transpacific demand surges: New services and increased capacity are fully booked, with further rate hikes expected.

- Congestion disrupts supply chains: Global port congestion is at an 18-month high, with Durban (South Africa) experiencing significant deterioration.

- Limited spare capacity: Only 0.3% of the global container fleet is idle.

Global Container Freight Rates

- Rates are up an average of 9.5% in the last seven weeks.

- Drewry’s World Container Index increased by 6.6% to $5,117 per 40-ft container this week.

BUSA-SAAFF Summary

South Africa’s supply chain is experiencing mixed results. Throughput volumes recovered to average levels after bad weather and equipment issues impacted ports. Grindrod was chosen to develop a new terminal at Richards Bay. Globally, container shipping is booming with record highs projected for 2024. This surge has caused congestion at major Asian ports and driven freight rates up despite new routes. Congestion also disrupts efficiency with the Port of Durban being particularly affected. Air cargo in South Africa is down slightly compared to last week but still up year-over-year. Internationally, air cargo rates remain strong.

The recent positive figures from TNPA suggest the port and rail industry is on the road to recovery thanks to strategic plans. While these short-term gains are encouraging, significant challenges remain, including equipment shortages and infrastructure investment needs. There’s a lot to be done, but these early signs of improvement are a reason for cautious optimism.

Adapted from :BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”