Welcome to another Logistics News Update.

The past week has been a tumultuous one for South African logistics, as extreme weather conditions have wreaked havoc on ports across the country. From the howling winds of Durban to the record-breaking winter in Cape Town, the elements have conspired to disrupt operations and delay shipments. This disruption has cascading effects on the entire supply chain, with importers and exporters facing significant delays and increased costs. What once took weeks to transport goods now takes months, as vessels languish at anchor and ports struggle to cope with the backlog.

While the ports have made strides in recent years, the weather-related challenges have highlighted the need for further improvements. However, there have been some positive developments, as port authorities have taken steps to address the concerns of trucking companies and improve the booking system.

In this newsletter, we’ll delve into the stories and facts of what is happening in the world of logistics, explore the challenges faced by logistics providers, and discuss potential solutions to mitigate these disruptions but first let’s learn, this week, we’ll be exploring the distinctions between the CIF and CFR Incoterms.

Let’s Learn:

What is the Incoterm CFR?

CFR (Cost and Freight) is an Incoterm used for ocean freight. The seller is responsible for delivering the goods to a named destination port and paying the transportation costs. However, the buyer is responsible for insurance.Key Points:Insurance: Unlike CIF, insurance is optional with CFR.Risk Transfer: Risk transfers to the buyer when the goods are loaded onto the ship.Best Used: Suitable for sellers with direct vessel access and buyers who want to manage their own insurance.Remember: For other modes of transport, CPT (Carriage Paid To) is more appropriate.

On The Ground Report

The transport booking system at the port is currently been addressed, however, vessels are still waiting to come in but as I said above, the weather hasn’t played it part which has cause some delays. Roadworks in KZN is hampering on time collection, so Transnet has assisted hauliers with a collection area, this had made things a lot better. The Cape is still having a winter for the records, this is making things worse for the operation and with equipment problems, it does not help. East London and Port Elziabeth ports are also battling against the weather.

USA NEWS

Canada’s Major Freight Railroads Shut Down

Canada’s two largest freight railroads, Canadian National (CN) and Canadian Pacific Kansas City Southern (CPKC), have ceased operations due to a lockout of 9,000 Teamsters union members. This shutdown is expected to disrupt supply chains in both Canada and the United States, impacting industries such as agriculture, autos, home building, and energy. The railroads handle a significant amount of freight that crosses the US-Canadian border, and the disruption could lead to shortages of various goods in the United States. The shutdown is seen as a potential blow to the economies of both nations, highlighting their close economic interdependence. – Source: CNN Business – supplied by Richard Rattray Concordia

Disclaimer: The information presented in this newsletter is based on reputable sources and has been referenced accordingly. This Logistic News is provided obligation-free. If you wish to be removed from the mailing list, please reply to this email with a request for removal. Please note that all news content is either adapted or specifically quoted from its original sources.

This Weeks Key News Takeaways

Here are the main takeaways:

- Port of Cape Town addresses ship-to-shore crane issues.

- Dry freight container production hits a new record high.

- South African export market expansion is critical, especially amid delays at Durban Container Terminal.

- Minister Creecy emphasizes railways’ role in climate change efforts.

- President Ramaphosa visited China to strengthen trade relations.

- Houthi rebels implemented a new attack strategy against vessels in the Red Sea

Source: Freight news

NEWS

Port of Cape Town working hard to sort out STS breakdowns

23 August 2024 – by Eugene Goddard

Ship-to-shore crane capacity is not what it should be in Cape Town. Source: Liebherr

The Port of Cape Town is currently grappling with significant disruptions caused by broken-down ship-to-shore cranes (STS). This has resulted in longer vessel turnaround times and compromised customer satisfaction. Despite ongoing efforts by the port and its OEM, Liebherr, to address the issue, several cranes remain out of service.

The port’s managing executive, Oscar Borchards, has assured stakeholders that repairs are underway and that all eight cranes are expected to be operational by August 24. However, the ongoing disruptions have raised concerns about the port’s resilience and its ability to handle the demands of its operations.

To address these challenges, the Cape Town Container Terminal (CTCT) will launch a reliability program in September. This initiative will involve a phased approach to repair and maintain all nine cranes, with the aim of improving overall port efficiency and reducing disruptions. Adapted from Source: Freight News

Dry freight container production surpasses earlier all-time high

23 August 2024 – by Staff Reporter

Source: Redmond Magazine

Dry freight container manufacturing is experiencing a significant surge in 2024, driven by strong demand and record-breaking production levels. Despite this positive trend, the availability of containers, particularly 40ft high-cube units, has become increasingly tight due to various factors.

The strong exports from Asia, congestion at major transhipment hubs, and extended voyage times caused by the Red Sea crisis have strained container supply chains. This has led to a shortage of containers, especially the high-cube variety that is essential for transporting many types of cargo.

While the production of reefer containers has also increased, the overall reefer cargo market has remained relatively weak. The tonnage of reefer cargo on routes involving the Red Sea experienced a notable decline in 2023, further highlighting the challenges faced by this sector. Adapted from Source: Freight News

PORTS

South African Port Container Terminal Operations & Delays Summary (as of August 26, 2024)

Overall, South African container terminals are experiencing increased congestion, particularly at Durban.

This is evidenced by the high number of vessels waiting at anchor and the extended average time spent at anchorage. Despite this, the terminals are generally operating at capacity, with high container throughput.

Key findings:

- Durban: The most congested port, with high vessel waiting times and container throughput.

- Cape Town: Moderate congestion, with a lower average container throughput compared to Durban.

- Ngqura: Moderate congestion, with a relatively high reefer container throughput.

- Port Elizabeth: Low congestion, with a lower overall container throughput.

Specific challenges and trends:

- Trucking: All terminals are experiencing high truck volumes, leading to delays and congestion.

- Rail: Rail operations are generally underutilized, particularly at Durban and Cape Town.

- Reefer containers: Reefer container throughput is high at most terminals, indicating a strong demand for perishable goods.

South African ports faced significant operational delays this week due to adverse weather conditions, specifically strong winds and vessel ranging. Cape Town experienced vessel movement alongside berths, leading to operational halts. Both Durban and Eastern Cape ports were impacted by inclement weather, with equipment breakdowns also contributing to delays in Durban.

Port Delays Due to Windy Weather

- Durban:

- Pier 1: 7–9-day delay

- Pier 2: 10–16-day delay

- Durban Point: 3-day delay

- Cape Town:

- CTCT: 2–4-day delay

- MPT: 1–2-day delay

- Port Elizabeth:

- PECT: 2–4-day delay

- NCT: 1–5-day delay

All South African ports have experienced delays due to windy weather this week.

NOTE: We recommend factoring these potential delays into your shipment planning to avoid disruptions.

Global Container Shipping Update

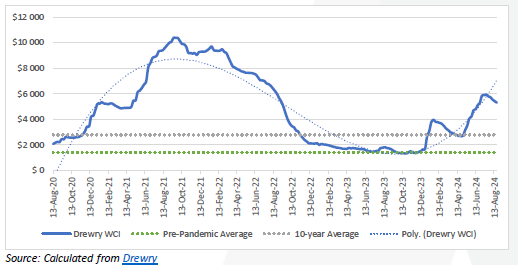

Freight rates are unlikely to hold and are expected to reduce further, as rates on Asia-Europe and Transpacific routes face pressure. Planned transpacific rate hikes for 15 August failed, causing US West Coast rates to drop.21 Nevertheless, carriers are attempting a September rate hike, but with low confidence as capacity utilisation declines on major routes. Despite rate corrections, carrier earnings will rebound in Q3, though 2Q results show Asian carriers outperforming European peers, with Maersk lagging. Maersk recorded the lowest EBIT margin of ↑5,6% in Q2 2024, marking its third consecutive quarter at the bottom, signalling a likely strategic shift for the Danish carrier. Lastly, charter rates were stable this week, as the Harper Petersen Index (Harpex) traded around 1 981 points on Friday, down by ↓0,1% (w/w) but still up by ↑82% compared to this time last year

BUSA-SAAFF Summary – Summary

South African Logistics & International Trade Summary

Container port operations in South Africa faced challenges due to adverse weather conditions, equipment breakdowns, and vessel ranging. Globally, container port throughput grew, driven by increased demand and stockpiling. South Africa’s Durban port experienced growth, while global port congestion and declining freight rates persisted. Air cargo volumes to and from South Africa declined but remained healthy.

Despite challenges, the industry is optimistic about future prospects. Transnet’s recovery plans and reforms in key sectors are crucial for South Africa’s economic progress.

Transnet’s Challenges:

- Reduced throughput: Many sub-sectors of Transnet have seen a significant decline in throughput, as illustrated in Figure 1.

- Financial struggles: Despite optimism, Transnet’s current financial performance is not promising.

- Infrastructure vulnerabilities: Theft, vandalism, and other issues are impacting rail volumes and causing disruptions.

Recommendations for Improvement:

- Enhance rail volumes: Increase rail traffic to boost profitability.

- Address infrastructure issues: Resolve problems like theft and vandalism to minimize disruptions.

- Implement recovery plan: Expedite the implementation of Transnet’s rail and port recovery plan, including opening network access to private operators and establishing a leasing company.

- Invest in equipment: Sustained investment in critical equipment and signalling is essential.

- Secure long-term funding: Seek long-term funding commitments from stakeholders to reduce reliance on borrowing.

- Restructure debt: Reduce the monthly interest burden to stabilize the financial outlook.

Source:BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”