Welcome to another Logistics News Update.

All statutory increases come into effect on 1 April 2025. This includes charges such as terminal handling (THC), cargo dues, and more — so be sure to factor these into your shipment costing. As if things weren’t complicated enough in trade and logistics, last week’s headline stirred the pot even more: “Freight industry prepared to fight state-owned cabotage.”

We’re keeping a close eye on the proposed Merchant Shipping Bill B12-2023. If passed, it could force international cargo to be moved between local ports using a government-run shipping line.

For exporters, this could mean higher costs, longer delays, and far less flexibility in moving goods through South African ports as exports will be taken to the main port and then shipped. We will keep you posted on any developments.

This week, we also turn to the bigger picture — global trade shifts — and ask: is South Africa’s participation in AGOA on the line? We unpack the implications in our lead story below.

Let’s Learn: Understanding Landed Cost – The True Price of Your Shipment

Landed cost is the total cost of getting goods to your door—including the price of the goods, freight, insurance, duties, VAT, and other handling fees. Many businesses focus only on the purchase price, but overlooking the full landed cost can eat into your margins. In this week’s segment, we’ll explain how to calculate landed cost and why it’s essential for setting profitable selling prices and managing cash flow.

Landed Cost = (Product Cost x Exchange Rate) + Forex Fee + Freight + Insurance + Duties + VAT + Handling & Clearing Fees + Local Delivery.

Why It Matters: Knowing your true landed cost means you can:

- Avoid underquoting customers

- Price your products correctly

- Improve your gross margins

- Make informed supplier comparisons

- Plan your cash flow accurately

NEWS

A sign of things to come for South African trade?

20th March 2025 – Fred Meintjes

With South Africa’s citrus industry now in the final stages of preparation ahead of the 2025 season, growers and exporters to the US are increasingly worried that the advantages they now enjoy under the AGOA agreement are under severe threat. The latest development in the relationships between the two countries is the expulsion of South Africa’s ambassador to the US, Ebrahim Rasool, from the country with immediate effect. This has caused much debate in South Africa, but weekend reports indicated that the country will seek a replacement as soon as possible and put the controversy behind it. There is not much appetite in South Africa to let the matter drag on – partly because it is generally accepted that the ambassador contributed to his own downfall. Although participation in AGOA has been extended to the end of the year, the country fears the Trump administration could at any time end South Africa’s involvement.

South Africa’s automotive and agriculture sectors are seen as areas of the economy that will be severely affected. Observers noted that US policies had become ”unpredictable” and were not helping stable trade development. The South African fresh produce sector has in recent times preferred to keep a low profile. However, during the past weeks industry leaders have become more outspoken. According to the Citrus Growers Association (CGA), at last week’s South African citrus industry meeting the view was that the EU’s politics were shifting to the right, while at the same time the bloc has been forced to become more unified in facing shared threats.

“All these factors have implications for market access, and in the case of South Africa, continued access to the USA market through AGOA is threatened,” the weekly CGA report to growers noted. “South Africa must diversify market access for its citrus and seek opportunities offered by BRICS+ countries, whilst also improving access through better tariff regimes,” it continued. ”EU market access remains challenging due to the maintenance of unnecessary measures against CBS (citrus black spot) and FCM (false codling moth). “We need to match a time of flux with different thinking about new markets and new opportunities,” CGA added.

Hortgro’s CEO Anton Rabe also recently told deciduous fruit growers that the world in which they operated had fundamentally changed, with a few clear lines that had been drawn in the sand. “Continued ideological rhetoric will however get us nowhere,” he said. ”As a country, we must adapt and find compromises and middle ground based on common sense and economic realities.” “!f South Africa is kicked out of AGOA, which I believe will happen, it will have serious economic implications in several sectors, including agriculture. “The short-term impact on our industry (deciduous fruit) will be small, although every cent counts,” Rabe outlined. “The ±R6mn we will pay more in additional duties is immaterial in the bigger scheme of things, but the diplomatic fall-out would be major. “Somehow, we will have to broker an alternative trade deal, to the benefit of both South Africa and the United States,” he added. ”The reality is that trade with the USA is not a one-way street. Both countries will be poorer without some or other win-win trade agreements in place.”….

– Source: Fruitnet – EuroFruit

WEEKLY SNAPSHOT

- Botswana Border Congestion: Inefficiencies at border crossings have led to significant backlogs affecting freight movement into Botswana. The existing infrastructure struggles to handle the volume, with reports indicating that the borders aren’t equipped to process 500 trucks daily.

- Border Management Authority’s Response: In reaction to mounting criticisms, the Border Management Authority has intensified efforts at the Kopfontein border post. Commissioner Dr Michael Masiapato stated that comprehensive measures are being implemented to address the congestion issues.

- Mozambique-Zimbabwe Rail Agreement: Mozambique and Zimbabwe have signed a memorandum of understanding to enhance rail freight efficiency between the two nations, aiming to streamline cargo flows and bolster regional trade.

- South Africa-Japan Trade Relations: South Africa is actively working to balance trade relations with Japan, underscoring a commitment to strengthening economic ties amidst global protectionist trends.

- Rand’s Stability: Despite global economic uncertainties, the South African rand has remained relatively stable. This resilience is attributed to investors adjusting their expectations regarding U.S. monetary policy and concerns about the U.S. economy’s strength.

- Consumer Price Index (CPI): The annual inflation rate stands steady at 3.2%, with housing, utilities, food, and non-alcoholic beverages being the primary contributors to this figure.

ON THE GROUND BUSA REPORT

South African Ports Under Pressure:

- Container volumes dropped 22% week-on-week.

- Cape Town faced 35+ hours of delays from strong winds.

- Durban and Eastern Cape ports struggled with equipment failures and berth issues.

Global Shipping Trends:

- MSC acquired Hutchison Ports, raising its terminal market share to 15%.

- Despite a 5.8% rise in global container demand, capacity use dropped below 90%, pushing spot rates down.

Air Cargo Sees Modest Growth:

- Global air cargo up 2% YoY; Asia-Pacific leads with 8% growth.

- South Africa’s aviation sector faces challenges from skills shortages and outdated systems, triggering government action.

Cape Town port was delayed by four days last week, they have also started to do split berths in Cape Town. Durban has only two split berths but is operating normally.

The South Africa – Europe Container Service (SAECS) has faced multiple disruptions in recent weeks, leading to schedule delays. These have been caused by: Extreme weather conditions in South Africa, Terminal inefficiencies, Rotterdam strike/go-slow action, Heavy congestion, and bad weather in European hubs. To mitigate delays, the Santa Rita/250N will omit Cape Town, sailing directly to Europe from Durban. Cape Town imports will be transhipped via Mehuin, which will take Santa Rita’s position in Cape Town, ensuring continuous export coverage. Despite these challenges, SAECS has successfully maintained service continuity throughout the Deciduous Fruit Export Season, and measures are in place to stabilise schedules for the upcoming Citrus Export Season. Source: Maersk

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS

Durban: Windy weather caused delays.

- Pier 1: 0–2 days

- Pier 2: 0–1 day

- Durban Point: 3 days

Cape Town: Intermittent wind throughout the week.

- CTCT: 5–8 days delay

- MPT: 3 days delay

Port Elizabeth: Windy weather noted.

- PECT: 0–1 day delay

- NCT: No current delay, expected to increase to 0–2 days in week 12. Source: SACO

BUSA Summary

Port Operations

- Volume Increase: Container volumes rose by 25% week-on-week, with an average of 11,547 TEUs handled per day.

- Cape Town: Over 30 operational hours were lost due to adverse weather. Delays at CTCT are currently between 5 to 8 days.

- Durban: Operations were affected by bad weather and ongoing equipment failures.

- Pier 1: Delays of up to 2 days

- Pier 2: Delays of up to 1 day

- Point Terminal: Delay of 3 days

- Eastern Cape Ports: Operations at Ngqura and Port Elizabeth were impacted by equipment issues and berth availability. The Maersk Cubango is expected to omit Coega due to delays.

- Richards Bay: Experienced minimal disruption, with a 9% week-on-week increase in volumes.

Air Cargo

- At OR Tambo International Airport:

- Inbound volumes averaged 584,936 kg/day (down 7% week-on-week).

- Outbound volumes averaged 392,466 kg/day (up 2% week-on-week).

- Current air cargo volumes are 9% higher year-on-year and 25% above pre-pandemic levels (2020).

- Globally, air cargo volumes rose by 3% year-on-year, with average spot rates steady at $2.37/kg.

Global Trade and Shipping

- Global Trade: Reached a record $33 trillion in 2024, a year-on-year increase of 3.7%, driven by developing markets and services trade.

- Container Throughput: Up 8.3% year-on-year in January 2025.

- Red Sea Diversions: Approximately 10% of TEU capacity has been rerouted, increasing TEU-miles by 12%.

- Freight Rates:

- World Container Index: $2,264 per 40-ft container (down 4.4%).

- Shanghai to Durban (SCFI): $4,400 per 40-ft container.

- Shipping Line Financials: Combined industry earnings for 2024 are estimated at $60 billion. Although significantly below pandemic highs, this remains well above pre-pandemic levels.

Key Developments

- In Cape Town, a container fell overboard from the MSC Resilient at Berth 601, causing delays.

- A crane (LC1) at CTCT is out of operation following an incident. Fog over the weekend is expected to cause further delays.

- Maersk has announced that certain vessels, including the Santa Rita and Maersk Cubango, will bypass Cape Town and Coega respectively to avoid extended wait times. Source: BUSA

Global Freight Rates

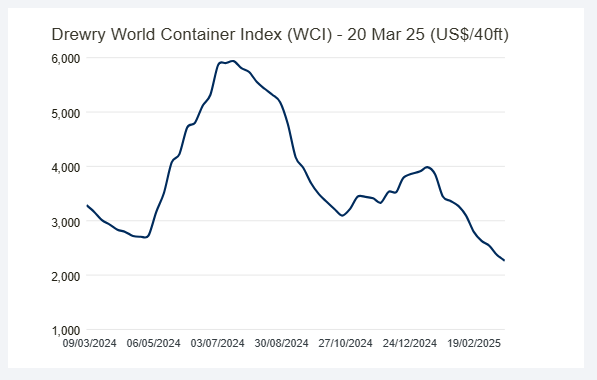

World Container Index – 20 March

For many years, World Container Index has been the go-to, independent, global reference for index-linked contracts. Drewry’s World Container Index decreased 4% to $2,264 per 40ft container this week. The Drewry WCI composite index fell 4% to $2,264 per 40ft container, 78% below the previous pandemic peak of $10,377 in September 2021 and the lowest since January 2024. However, the index was 59% higher than the average $1,420 in 2019 (pre-pandemic).

The average YTD composite index closed at $3,127 per 40ft container, $242 higher than the 10-year average of $2,885 (inflated by the exceptional 2020-22 Covid period).Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”