Welcome to another Logistics News Update.

This week we will be looking at the Cape Town container terminal boost as well as how’s the how the deciduous season is coming to an end and the ports are getting ready for the citrus season. We however are not leaving out the uncertainty of Durban ports and how it is affecting the largest import and export markets. There is a huge focus on getting this right, the port stats supplied are a reflection on how far we have come but more importantly how much we still must do. Every importer or exporter wants to know what is happening at our ports as this affects their businesses, their stock levels, their ability to produce and mostly their profitability, so we keep our focus on this.

So, what is happening at the Durban port? On the ground the story is very different to what is being reported. Here are some examples, the vessels are doing what is a called a split discharge, meaning they offload some containers at one terminal and then offload the other at another terminal. All sounds good except, it can take up to a week to offload at Point as there is no equipment and the ship basically offloads the containers itself. Point can only take certain vessels, so a very slow process. Then we have vessels that come in (29th January) and today 27th of February, it hasn’t been touched. Then a vessel gets listed, clients get notified and the next day, it’s not on the list, this creates a lot of frustration with clients because it appears that you don’t know what you are doing. However, in this mess, there is some good news, they are now using the private port BPB to offload vessels. With regards to exports, this is just as bad as imports as when a big vessel arrives, they offload some of the imports, then backload (meaning they load exports to balance the vessel) then go and offload more imports and come back to load more exports, you understand why there is a backlog, and this coupled with little or poor equipment.

Disclaimer 1: Please note: All information presented in this post is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed.

NEWS

Cape Town Container Terminal boosts container volumes:

Source: TNPA

The Cape Town Container Terminal (CTCT) has improved efficiency by boosting its truck handling volumes over the past three weeks.

CTCT announced in a statement on Thursday that it had boosted volume throughput by 2 365, from an average of 5 500, to 7 865 containers in three weeks.

The terminal also reduced truck turnaround time from 75 minutes during January 15-21, to 51 minutes last week.

Transnet acting Western Cape Terminals managing executive, Oscar Borchards, said the terminal had boosted volumes by optimising its electronic container management system.

“We attribute all our improvements at CTCT mainly to our optimisation of the container management system Navis, which helps to streamline our processes and ensure efficiencies in our operations. In order to support our turnaround strategy, it was critical that we take advantage of an already existing system and reprioritise,” Borchards said.

He added that CTCT had used Navis to implement a yard strategy which translated to better planning of the container stack.

“So far, since the implementation of the yard strategy, we have seen encouraging results, which directly minimise potential clashes in the system and clear bottlenecks,” Borchards said..

Source: Freight News

South Africa is squandering its export opportunities:

Bertie Jacobs

- It is peak export season for the fruit industry and there is still a backlog of exports.

- The impact of the logistics crises caused by Transnet and the ports are having far-reaching negative consequences.

- Export industries are pleading for a chance to help, but government is unwilling to get out of the way.

Administrative chaos and shipping queues that last for days. These are just some of the hallmarks of South Africa’s major ports – from Cape Town through the Eastern Cape to Durban – all of which are experiencing backlogs and congestion that have seen tens of thousands of containers not reaching their destinations on time.

The Port of Durban is not only one of the busiest ports in Africa, but one of the busiest ports in the world. And it is isn’t coping with the workload. This has led to cargo being diverted to Maputo, Luanda and Walvis Bay, depriving South Africa of invaluable trade.

Although recent reports and comments by President Cyril Ramaphosa suggest that Transnet is on the mend, the irrefutable fact is that the state-owned enterprise, which is responsible for rail transport, port management and fuel pipelines, has experienced an operational implosion due to a litany of factors, including mismanagement and the Covid-19 pandemic.

According to economist Prof Waldo Krugell of the North-West University’s Faculty of Economic and Management Sciences, the scenario has escalated to the point where South Africa is currently squandering its export opportunities. Read more by clicking in source

Source: BIZCOMMUNITY

Transnet focuses on boosting efficiency at Eastern Cape ports:

22 Feb 2024 – 22 Feb 2024 – by Staff reporter

The Port of East London is one of the ports where significant improvements will be implemented. Source: Supplied

Transnet National Ports Authority (TNPA) is forging ahead with the implementation of its recovery plan, which focuses on enabling efficient use of port infrastructure and improving operational efficiencies at central region ports.

TNPA highlighted the latest developments being implemented as part of its recovery plan at the ports of East London, Ngqura and Port Elizabeth at a meeting with port users on Wednesday.

Managing Executive for central region ports, Siyabulela Mhlaluka said the plan aimed to ensure the competitiveness of the ports by improving efficiency through ensuring robust port operations oversight, delivery of critical infrastructure, and investment in a reliable marine fleet.

TNPA told port users that its strategic initiatives for East London include the deepening and strengthening of N-berth, the replacement of two graving dock jib cranes for the ship repair facility and the acquisition of two tugboats.

These initiatives are aimed at boosting the river port’s marine infrastructure and fleet availability to enable key sectors of the local economy.

The N-Berth construction project has commenced and will be completed in October this year, TNPA said.

Source: Freight News

Transnet focuses on boosting efficiency at Eastern Cape ports:

23 Feb 2024 – by Staff reporter

The Port of East London is one of the ports where significant improvements will be implemented. Source: Supplied

Transnet National Ports Authority (TNPA) is forging ahead with the implementation of its recovery plan, which focuses on enabling efficient use of port infrastructure and improving operational efficiencies at central region ports.

TNPA highlighted the latest developments being implemented as part of its recovery plan at the ports of East London, Ngqura and Port Elizabeth at a meeting with port users on Wednesday.

Managing Executive for central region ports, Siyabulela Mhlaluka said the plan aimed to ensure the competitiveness of the ports by improving efficiency through ensuring robust port operations oversight, delivery of critical infrastructure, and investment in a reliable marine fleet.

TNPA told port users that its strategic initiatives for East London include the deepening and strengthening of N-berth, the replacement of two graving dock jib cranes for the ship repair facility and the acquisition of two tugboats.

These initiatives are aimed at boosting the river port’s marine infrastructure and fleet availability to enable key sectors of the local economy.

The N-Berth construction project has commenced and will be completed in October this year, TNPA said.

As part of the plan, the Port of East London’s automotive terminal berth capacity will be expanded to allow for the berthing of modern automotive carriers, while the Port of Ngqura has taken delivery of two of six additional hydraulic tension mooring units that have been operationalised to curb shipping delays caused by inclement weather conditions.

In line with the central region’s focus on enabling the local fishing industry in Nelson Mandela Bay, the project pipeline for the Port of Port Elizabeth includes the completed upgrade of the 1200-tonne slipway and the refurbishment of the Dom Pedro Quay, which is scheduled to start at the end of February 2024.

Read More News here:

TNPA addresses Al Kuwait livestock carrier concerns at Cape Town Port

Interrupted supply chain infrastructure: Global supply risk or opportunity?

PORTS

Operational comments and general observations

Weather and other delays: 26th February 2024

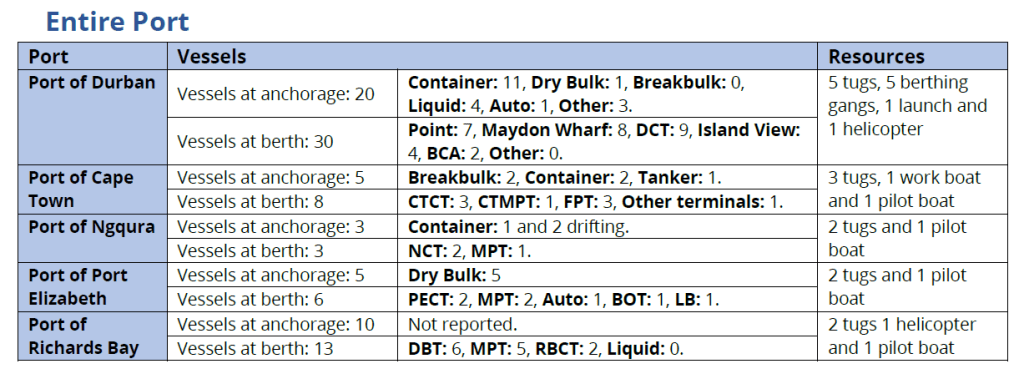

- Average time at anchorage for container vessels as of 06:00 this morning:

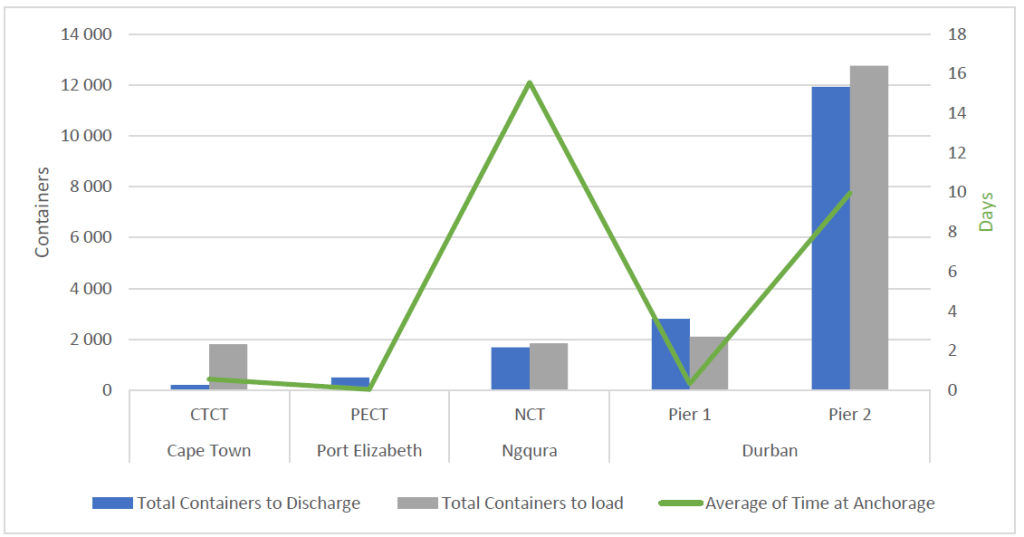

- Durban: 188 hours (Pier 1: 8 hours, Pier 2: 239 hours),

- Cape Town: 13 hours, Ngqura: 373 hours,

- Port Elizabeth: 1 hour.

The figure below shows the current situation at our ports from a container vessel perspective (please note that these figures where necessary have been estimated to the best of our knowledge and abilities). The line indicates the average number of days vessels have been waiting at anchorage (in days), and the bar graphs represent the total volume of containers to be loaded and discharged for the vessels at anchorage at 06:00 this morning).

- Both CTCT and CT MPTs operations were impacted by dense fog and strong winds over the latest 24-hour period.

- NCT went windbound for approximately 15 of the previous 24 hours while operations at GCT were also impacted by adverse weather.

- Five vessel movements were delayed in Durban on Saturday due to high swells and marine equipment challenges.

- Rain ensured operational delays at the Maydon Wharf terminal over the most recent 24 hours.

Equipment Availability:

- Three straddle carriers are still in service at the Port of East London despite minimal activity at the port.

- The ports of PE and Ngqura are still sharing pilot boats as the Tsitsikamma remains out of service.

- The Port of Durban experienced some challenges with the helicopter over the weekend and could only facilitate three sailings on Saturday. Additionally, the pilot boat is still out of service and is anticipated to return to operations early next week.

- At the time of reporting this morning, Durban MPT had three cranes, eight reach stackers, one empty handler, seven forklifts, and 16 ERFs in service.

- DCT Pier 2 had 57 straddle carriers in operation this morning.

Staging Areas Update:

Around midday, DCT Pier 2 had 73 trucks in overall staging and 98 in the respective terminal queues.

WHATS HAPPENING AT OUR PORTS:

Cape Town

On Thursday, CTCT recorded two vessels at berth and one at anchor as the terminal experienced a more challenging week with respect to operational delays. In the preceding 24 hours, stack occupancy for GP containers was recorded at 33%, reefers at 55%, and empties at 33%. In this period, the terminal moved 576 containers across the quay while operating with eight STS cranes and 24 RTGs. The low volumes can largely be attributed to the terminal being windbound for eight hours, accompanied by a union engagement, further delaying operations by two hours. LC7 remained out of service for the most significant part of the week and is only anticipated to return to service on 24 February. On the landside, 643 trucks were serviced, while six rail import units were handled.

The multi-purpose terminal recorded zero vessels at anchor and one at berth on Wednesday. In the 24 hours leading to Thursday, the terminal managed to service 123 external trucks at an undisclosed truck turnaround time on the landside. During the same period, 333 TEUs were handled across the quay on the waterside. Stack occupancy was only 11% for GP containers, 37% for reefers, and 15% for empties during the same period. The tender for a new supplier to supply new generators should be awarded by the end of the week. The lead time for delivery of these generators is between five and six weeks.

During the week of 12 to 18 February 2024, the FPT terminal serviced eight vessels comprising two container vessels, three multi-purpose vessels, two dry bulk vessels and a break bulk refrigerated vessel loading fruit. Berth occupancy during this week was recorded at 78%.

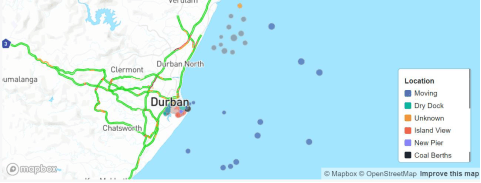

Durban

Pier 1 on Wednesday recorded two vessels at berth, operated by five gangs, and zero vessels at anchor. Stack occupancy was 59% for GP containers and remained undisclosed for reefers. During the same period, the terminal recorded 1 267 gate moves on the landside, with an undisclosed number of cancelled slots and 105 wasted. Truck turnaround time was recorded at ~121 minutes, with an average staging time of ~143 minutes. Additionally, the terminal had 2 392 imports on hand, with 244 of these units having road stops and 205 units being unassigned. In the 24 hours between Monday and Tuesday, the issuance of new appointment slots was suspended for at least two shifts.

Pier 2 had four vessels on berth and nine at anchorage on Thursday. In the preceding 24 hours, stack occupancy was 68% for GP containers and undisclosed for reefers. The terminal operated with 11 gangs while moving 3 093 TEUs across the quay. During the same period, there were 2 630 gate moves on the landside with a truck turnaround time of ~117 minutes and a staging time of ~114 minutes. Additionally, 260 rail import containers were on hand, with 343 moved by rail. Towards the end of the week, the terminal had a reported 46 straddles in operation. The current availability of straddle carriers in the terminal stands at approximately ~48%, which is around ↓40% below the minimum number required to meet industry demand and achieve acceptable terminal performance. It appears that improvements in procurement timing and maintenance practices could positively influence the consistency of straddle availability, which has been subject to significant fluctuations.

The Port of Durban returned to a complement of five tugs this week, with the pilot boat anticipated to return to service next week. The mechanical issues on the floating crane have been resolved; however, the technical team is currently finalising some steel work on deck. After that, SAMSA will come in to survey the crane before it can return to service. Additionally, crane 521 at DCT Pier 2 South Quay is anticipated to return to service by the end of June, while crane 520 is only expected to be back in service by the end of August.

Durban’s MPT terminal recorded two vessels at berth on Tuesday and none at outer anchorage while handling 419 TEUs on the waterside. Stack occupancy for breakbulk was recorded at 50% during that time and at 61% for containers. The terminal handled 305 container road slots, while 89 breakbulk road visits containing 2 722 tons were facilitated on the landside. During the same period, three cranes, five reach stackers, one empty handler, seven forklifts and 17 ERFs were in operation. Towards the end of the week, the third crane went out of service due to a burst pipe.

Richards Bay

On Thursday, Richards Bay recorded nine vessels at anchor, consisting of two vessels destined for DBT, two for MPT, four vessels for RBCT, and one for the liquid bulk terminal. A further 12 vessels were recorded on the berth, consisting of four at DBT, five at MPT, three at RBCT, and none at the liquid bulk terminal. Two tugs and one helicopter were in operation for marine resources, while the pilot boat remained out of service. During the same period, the coal terminal had three vessels at anchor and two at berth while handling 207 654 tons on the waterside. On the landside, 25 trains were serviced, which exceeded the target of 22. Additionally, on Wednesday, operations were delayed for around eight hours due to various marine craft being out of service.

Eastern Cape ports

On Tuesday, NCT recorded two vessels on the berth and three vessels at the outer anchorage, with two vessels drifting. Marine resources of two tugs, one pilot boat, two pilots, and one berthing gang were in operation in the 24 hours leading up to Wednesday. The Tsitsikamma pilot boat remains out of service; however, the port is utilising the outsourced pilot boat. Stack occupancy was 22% for GP containers, 24% for reefers, and 45% for reefer ground slots, as a total of 2 500 TEUs (1 532 containers) were processed on the waterside. Additionally, 317 trucks were serviced on the landside at a truck turnaround time of ~37 minutes. During this period, the terminal was windbound while expecting strong winds to return over the weekend.

No reports were received for GCT this week.

On Wednesday, the Port of East London recorded three vessels at berth and one at anchor. In the 24 hours leading to Thursday, the terminal handled 146 TEUs at a GCH of ~13 on the waterside. On the landside, the terminal discharged 66 entire rail skips and received 116 container trucks at a truck turnaround time of ~13 minutes, resulting in a stack occupancy figure of 37% on the container side. The Ro-Ro terminal handled 1 865 units at a UPH of 203 and further received 177 units, resulting in a stack occupancy figure of 79%. Stack occupancy on the grain elevator was recorded at 3%. The port operated with three straddles throughout the week.

Global shipping industry

Red Sea Crisis Update

In the four months of the Red Sea crisis, weekly merchant traffic through the Suez Canal dropped by approximately ↓55%. In total, nearly 300 fewer ships per week crossed the Canal in either direction since the start of Feb. By comparison, rerouting via the Cape of Good Hope has increased in count by ↑98%:

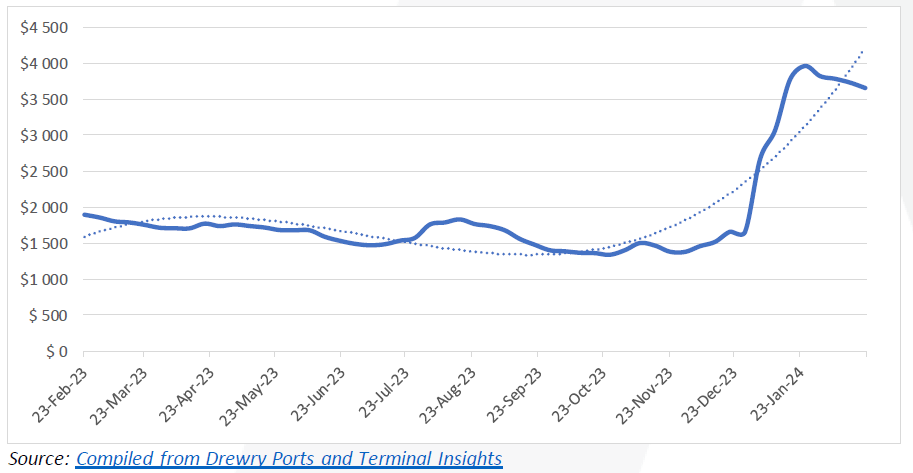

Global container freight rates and carrier profits

Continuing from the last couple of weeks’ decrease, global container rates dropped again, as the “World Container Index” is down by ↓2,0% (or $74) to $3 659 per 40-ft container18. The weekly changes mean that the composite index remains up by ↑93% higher compared to the same week last year and ↑158% higher than the average 2019 pre-pandemic rates of $1 420 – but getting closer to more stable long-term levels. The following figure shows the movement of the index in the last 12 months:

World Container Index assessed by Drewry (last 12 months, $ per 40 ft. container)

BUSA – SAAFF Summary

In conclusion, the national budget made significant reference to the current logistics crisis, with the Finance Minister mentioning the approval of the Freight Logistics Roadmap and steps needed to improve port equipment, locomotive availability, network security, enhancing efficiencies, and, importantly, facilitating the introduction of competition and leveraging the financial and technical support of the private sector6. However, the budget did not introduce anything new. Instead, it highlighted what the industry already knew and had desperately called to be fast-tracked, namely a workable third-party rail access and private sector partnerships in our ports. Indeed, as we have been advocating for a very long time, the government cannot go at it alone – it needs private sector involvement to get our logistics network functioning once again. Still, so far, hardly any concrete proposals have been received from the government. It is becoming even more evident that the involvement and effectiveness of other vital role players – including an expanded and enhanced role of the private sector – has become indispensable for South Africa’s economic success since fiscal policy alone cannot provide the solutions. Source: BUSA-SAAFF

This week’s news was brought to you by: FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

Enjoy the rest of your week.