Welcome to another Logistics News Update.

Besides the tariff fight, the headlines don’t inspire confidence: Transnet bailouts with another R94,8 billion in guarantees and Sanral eyeing a R7 billion BRICS loan. This is why South Africa urgently needs to get logistics back on track with real public and private sector collaboration.

The deadline for the 30%+ US tariffs is fast approaching, yet there’s silence from the government on whether negotiations are even happening. For now, all we must go on is what we pick up in the news.

What does this mean for Trade and Logistics?

For exporters, uncertainty is the biggest risk. If the 30% tariffs come into effect on 1 August, products like wine and citrus could lose competitiveness overnight. Importers aren’t immune; either supply chains will feel the pressure from higher costs and slower turnaround times if congestion persists. At the same time, Transnet’s reliance on bailouts raises questions about long-term sustainability. Without immediate reforms and meaningful private sector participation, inefficiencies will continue to drag down trade competitiveness. Businesses that plan to secure alternative markets, review pricing strategies, and lock in shipping capacity will have the edge in what could be a very volatile second half of 2025. That is easier said than done, you know that you can’t just walk into a market and start trading, this takes time, months, if not years.

Trump tariffs: more evidence of grim consequences -adapted from FreightNews

South African exporters are on edge as the United States moves closer to implementing 30% reciprocal tariffs from 1 August. Wine, one of South Africa’s key export products, is particularly exposed, with 2024 shipments valued at around US$562 million now under threat. Industry players warn that such duties would erode competitiveness in a vital market and inflict severe financial strain across the value chain.

What adds to the concern is the silence from the Government of National Unity and the Department of Trade, with no clear updates on negotiations with Washington. As the deadline approaches, businesses are left in limbo, forced to weigh contingency plans and brace for potential losses should the tariffs come into effect. Read the full article in FreightNews

Transnet bailouts? Government bends with R94.8bn more in guarantees

South Africa’s government has approved a fresh R94.8 billion guarantee facility for Transnet, the struggling state-owned logistics firm overseeing ports, rail, and pipelines. This new support builds on a R51 billion guarantee announced in May 2025, which covered Transnet’s funding needs through 2026/27 and included funds for debt servicing and capital investments. The latest guarantee is split between R48.6 billion to cover upcoming debt redemptions over the next five years and R46.2 billion to prevent further credit rating downgrades.

Transnet continues to grapple with deep-seated operational challenges stemming from chronic under‑investment, maintenance backlogs, and losses due to cable theft and vandalism. Its debt has climbed to around R145 billion, and freight rail volumes dropped from 226 million metric tonnes in 2017/18 to just 152 million tonnes in 2023/24. Rating agencies have warned that Transnet is now entirely dependent on state support, with negative free operating cash flow highlighting its ongoing financial crisis. Adapted from Reuters & MoneyWeb

GOOD NEWS: Durban and Cape Town shine as Africa’s top logistics hubs

Durban and Cape Town have solidified their positions as two of Africa’s most investable logistics and industrial markets, driven by resilience, adaptability, and strong investor appeal, according to a recent report by Cushman & Wakefield/BROLL.

These cities are capitalising on global trends like urbanisation, e-commerce, and supply chain reconfiguration, while navigating local challenges such as land scarcity and climate risks, the report notes. Source: FreightNews

Let’s Learn: SARS Customs VAT and the 10% Uplift

When importing goods into South Africa, SARS charges Customs VAT at the standard VAT rate (currently 15%). This VAT is different from customs duties and is calculated on more than just the invoice price.

How Customs VAT Is Calculated

Customs VAT = 15% × (FOB + 10% uplift + Freight + Insurance + Duties)

Here’s what those terms mean:

- FOB (Free on Board): The invoice price of the goods, up to the point they are loaded for export.

- 10% uplift: A notional amount SARS adds to cover non-invoiced costs like packing, handling, or commissions.

- Freight & Insurance: Costs to bring goods to South Africa.

- Duties: Any customs duties payable on the goods.

Why Does SARS Add 10%?

The 10% uplift ensures SARS captures additional costs often left out of invoices. This is a standard adjustment and applies even if these extra costs were not incurred. It applies only for VAT purposes, not for duty calculations.

Can you claim VAT that includes the uplift?

The uplift does not affect duties or other charges—it’s only used for the VAT base.

If you are VAT registered, you can claim the full Customs VAT (including the portion calculated on the 10% uplift) as input VAT.

NEWS

Stone fruit exporters close in on Chinese markets

Source: FreightNews – 16 July 2025

South Africa is edging closer to finalising market access for stone fruit exports, including peaches, plums, prunes, nectarines and apricots to China. At the Exporters Western Cape event, Agriculture Minister John Steenhuisen announced that the export protocol is ready, and the formal agreement is expected to be signed during the Agri G20 in September. If all goes well, South African stone fruit could reach Chinese shelves before the year is out.

This development is part of a broader diversification drive in agricultural trade. Steenhuisen highlighted the strategic shift beyond traditional markets like the US and EU, aiming to deepen relationships in the East and within Africa. Recent successes in gaining approvals such as apple schemes in Thailand, grapes into the Philippines, and beef into the Gulf, demonstrate that establishing new trade ties is a multiyear endeavour.

The stone fruit sector is already enjoying a strong 2024/2025 season. Export volumes are up, with plums rising 22% to 13.8 million cartons, nectarines up 16% to 9.4 million, and apricots surging nearly 50%. Only peaches saw a slight decline. Industry sources note that improved logistics, especially at the Port of Cape Town, are helping to restore reliability.

Meanwhile, South Africa is building on past successes with apples and pears. China already imports South African apples and pears, and customs inspections from earlier this year pave the way for the imminent inclusion of stone fruit in the import list. With production volumes, supply chain sophistication, and off‑season timing all in place, the fruit industry is well-positioned to tap into China during its winter and spring seasons…

WEEKLY NEWS SNAPSHOT

- Trump tariff threat grinds on (25 Jul 2025): With the 1 August deadline looming, South Africa’s wine exports worth US $562 million remain at risk as trade negotiations with the U.S. stall. Industry leaders warn of a serious impact on jobs and competitiveness.

- Cape Town sees record throughput (27 Jul 2025): The Container Terminal exceeded targets in June—refrigerated container throughput jumped 64% year‑on‑year, signalling strong momentum.

- SA ports clear 100 000‑containers‑per‑week barrier (22 Jul 2025): Terminals consistently exceeded weekly TEU volume targets, though agent delays in the Eastern Cape still create occasional bottlenecks.

- Transpacific rate drop rattles market (22 Jul 2025): Shippers are pushing back on peak‑season surcharges, with freight rates falling as carriers face growing resistance.

- Flags-of‑convenience crisis deepens (25 Jul 2025): ITF reports a 30% spike in seafarer abandonment, with 2,280 crew left stranded without pay or support.

- Mining boom fuels project cargo demand (25 Jul 2025): A surge in critical‑mineral exports and energy infrastructure investment is driving heavy‑lift logistics expansion across southern Africa.

- Customs corruption crackdown at Beitbridge (24 Jul 2025): A truck with cleared cargo was impounded over smuggling concerns, prompting authorities to tighten enforcement at key border points.

- Steenhuisen raises disease control alarms (22 Jul 2025): The FMD outbreak continues to threaten meat export markets, prompting opposition calls for stronger regionalised biosecurity protocols. Source: FreightNews

Key Highlights from Last Week’s Discussions – 20th July 2025

Source: BUSA, SAAFF, and global logistics data

1. Record Container Throughput in SA Ports

South Africa’s ports handled an average of 14 470 TEUs per day, the highest since the 2017/18 peak. This reflects better equipment use and collaboration among stakeholders, though operations were still challenged by bad weather and equipment breakdowns. Rail performance, however, dropped sharply, with a 48% decline in containers moved out of Durban.

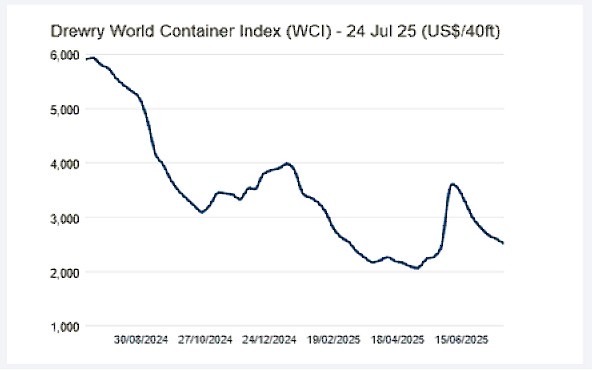

2. Global Shipping Trends

Global containership capacity increased by 8,1% y/y (2,43 m TEU) over the past year, with Africa absorbing 23% of this growth, supported by MSC’s mega-vessels on Far East–West Africa routes. Freight rates continued their slide, with Drewry’s World Container Index falling 2,6% to $2 602 per 40-ft. Despite this, charter markets remain tight due to scarce vessel availability.

3. US Trade Slowdown and Tariff Impact

US inbound container volumes dropped 7,9% y/y in June, one of the sharpest declines since the global financial crisis. New tariffs on goods from Japan, Indonesia, and the Philippines are dampening import demand, while front-loading earlier in the year means no traditional peak season is expected in H2.

4. Air Cargo Update

ORTIA handled an average of 607,000 kg inbound (+12% w/w) and 300,000 kg outbound (-4%), driven by US tariff concerns. Global air cargo tonnages dipped for a second week, though rates edged up by 1% to $2,65/kg. Africa bucked the trend with a 6% increase in tonnages over the past two weeks.

5. Regional and Border Flow

Truck volumes on the N4 corridor rose to 1,675 HGVs per day, with border queue and transit times improving slightly. Crossing delays at South African borders averaged 9,5 hours (-10%), while the broader SADC region averaged 4,6 hours (-2%).

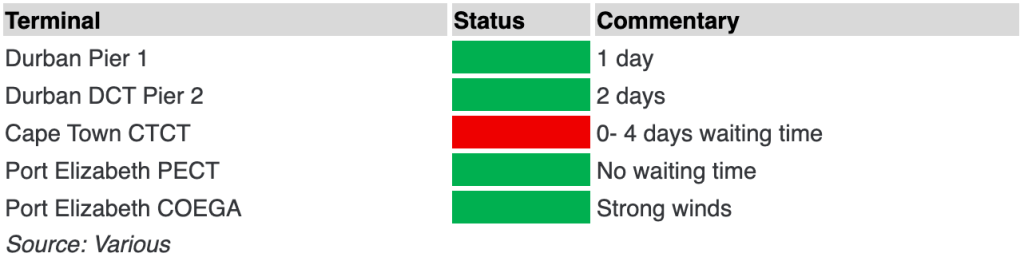

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

Global Freight Rates

Weekly Container Rate Update – 24th July 2025

Drewry’s World Container Index decreased 3% to $2,517 per 40ft container this week.

Freight Rates Continue to Fall

Drewry’s latest report shows its World Container Index fell 3.3% this week, marking the sixth straight weekly drop. After a short-lived spike in May and early June following tariff announcements, rates have been falling consistently since mid-June, erasing the earlier gains. Transpacific spot rates dropped further, with Shanghai–Los Angeles down 5% ($2,675/feu) and Shanghai–New York down 7% ($4,210/feu). With the pre-tariff shipping rush over and a temporary suspension of US tariff hikes ending mid-August, carriers are cutting services by cancelling sailings. Drewry expects rates to keep sliding and warns that 2H25 will see a weaker supply-demand balance, with volatility tied to potential new Trump tariffs and penalties on Chinese ships. Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”