Welcome to another Logistics News Update.

Happy Workers’ Day Tomorrow!

Tomorrow, May 1st, is a day to celebrate working people and the achievements of labour movements around the world. Did you know? This day has roots in the European spring festival of May Day, but in 1889 it took on a new meaning. International Workers’ Day, also known as Labour Day, was established to fight for an eight-hour workday! While times have changed (looking at you, MS Teams!), this day reminds us of the importance of worker rights and fair treatment.

Enjoy the mid-week break!

Fuel Update:

Heads up, drivers! Petrol prices are going up at midnight tonight (May 1st). Expect a 37c increase per litre. But there’s some good news for diesel users: prices are actually dropping by 30c to 36c per litre! This brings diesel prices to their lowest point since February 2024.

Industry Insider:

This week, we’re featuring Iain McIntosh, Head of Marketing South Africa for Ocean Network Express (ONE LINE). Stay tuned for his insights on the ground after the “On The Ground” report.

On The Ground Update:

Durban port seems to have bettered its waiting time, the average time now is between 5 and 10 days from anchorage, they are still behind, but any improvement is a good one, I know that it is different to the below, but this was from a meeting this morning, where I was given “on the ground” reporting.

Port Update: Delays and Schedule Changes

Heads up for shippers! We’re seeing delays at South African ports, particularly at Durban Pier 2 where berthing times are running 22-26 days behind schedule. This means shipping lines are likely to experience schedule disruptions, including blank sailings (cancelled voyages) and port omissions. Expect short notice changes as shipping companies work to restore normal operations.

Here’s a quick breakdown by port:

- Durban:

- No significant weather delays expected in the next 3 days.

- Pier 1: Delays of 4-5 days.

- Pier 2: Significant delays of 22-26 days.(last week’s report)

- Point: Delays of 3 days.

- Cape Town: No weather delays anticipated in the next 72 hours.

- Coega: Strong winds expected on Tuesday afternoon, potentially causing delays at the terminal.

Source: Adapted from JAS

REPORT BY IAIN

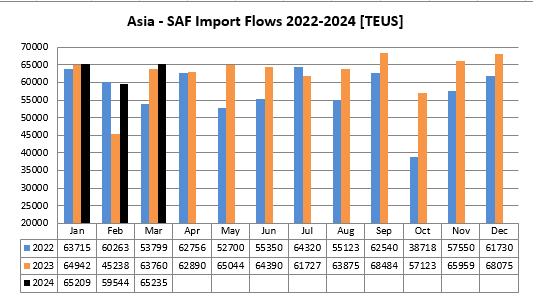

Just updated ASI-SAF import flows from TPT stats. Big factors post CNY dip was not as great as last year and YTD Q1/2024 over Q1/2023 volumes up 9% whilst this trend in Nov/Dec was also around 12% growth [measurement for Oct difficult due to Transnet strike in Oct 2022]. So definitely Westbound trade is trending upwards whilst EUR-SAF is trending down. What is keeping WB trade stronger is for me still a mystery given the state of the economy. In the past [2023] given we imported the equivalent of 2 x large power stations worth of solar panels and inverters/batteries etc would have had a positive effect and possibly also market buying down i.e. cheaper base imports from China rather than expensive equivalents from Europe. Meanwhile April-June stats will be interesting to see if what is happening now is demand or supply [sounds to me like supply ?? but…….]

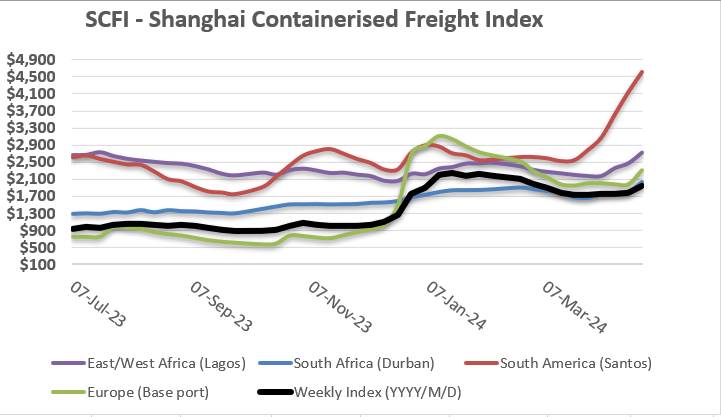

Today’s SCFI [26/4] gave some interesting trends and whilst Shanghai – Durban climbed up over 13.2% to US$ 2047 per TEU based on void sailings and perceived demand all other trade lanes increased by varying amounts pulling up the overall exchange by 10%. Notably Asia – ECSA really surged but Asia – Europe and USEC and USWC increased which highlights this is something beyond just isolated to Asia-RSA trade and comments about equipment shortages etc and delays in Asia ports are also relevant. Whilst the SCFI has been correcting itself since the initial surge caused by the Red Sea and Panama delays this has changed again and suggests a tighter market going forward for some time into Q2/2024. I hope this helps in your discussions with import market

Source: Iain McIntosh – Head of Marketing South Africa – Ocean Network Express (South Africa) (PTY) LTD

Disclaimer 1: Please note: All information presented in this newsletter is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed.

NEWS

Also read: SA CEOs ‘cautiously optimistic’ about growth

Port of Cape Town private partnership ‘monumental’ shift 26 Apr 2024 – by Staff reporter

Source: IMQS Software

The City of Cape Town has welcomed as “long overdue” the announcement this week that Transnet is seeking a private partner for development at the port.

Mayoral committee member for economic growth James Vos said the notice signalled a shift to improve productivity at the port.

“The port’s well-documented inefficiencies have long been a burden on many South Africans, from exporters struggling to reach offshore clients to ordinary citizens ultimately paying the surcharges on delayed imported products,” Vos said.

“Transnet’s notice this week is monumental, signalling a significant shift towards boosting outputs at the Port of Cape Town.”

This comes after Transnet National Ports Authority issued a call for interested parties to submit bids to acquire, operate, maintain, refurbish, or construct and transfer a liquid bulk terminal at the port for a 25-year concession period.

“The potential for private sector participation in the port is immense, with the capability to contribute an additional R6 billion in exports, generate roughly 20 000 jobs, and yield over R1.6bn in additional taxes over five years, as per research from the Western Cape’s Department of Economic Development and Tourism,” Vos said..

Source: Freight News

Good, bad – cargo data see-saws between highs and lows

25 Apr 2024 – by Staff reporter

South Africa’s ports handled an average of 8 281 containers per day last week, significantly up from the 6 180 that had been recorded by the previous Cargo Movement Update compiled by the Southern African Association of Freight Forwarders (Saaff) and Business Unity South Africa (Busa).

As was the case with data gathered for the previous Update, reflecting the impact of inclement conditions on the country’s coast, “port operations this week were again widely disrupted by adverse weather and increasing equipment breakdowns and shortages,” Saaff and Busa found.

“However, performance was much better compared with last week.

“This week’s primary operational constraint in Cape Town stemmed from the dense fog, while adverse weather coupled with equipment breakdowns and shortages caused extensive delays in Durban.

Strong winds and dense fog also hampered operational performance at ports in the Eastern Cape, notably the Port of Ngqura where shipping line representatives raised concerns regarding equipment challenges.

“Additionally, the latest reports suggest that Transnet Freight Rail experienced network issues for about six hours in the Durban complex between Tuesday and Wednesday.”

Source: Freight News

At the time of sending, BUSA did not send a weekly report.

This week’s news was brought to you by: FNB First Trade 360 – a digital logistics platform and Exporters Western Cape