Welcome to another Logistics News Update.

Cape Town has recorded the biggest jump globally in port performance, climbing 237.9 points in the latest CPPI rankings. You may remember that it was once cited as the worst-performing port in the world. After years of setbacks, this marks a real shift in the right direction. On the other hand, Durban has now been ranked the worst-performing port in the world. That said, the ports have shown great improvement overall and we need to acknowledge that. Their operations are visibly stronger, though attention is still needed on the truckers’ booking system. Small steps, but in the right direction.

That said, not everyone accepts Durban’s “worst port” title. Industry bodies are pushing back, arguing the World Bank ranking focuses only on vessel turnaround time, ignoring other operational metrics and context. We dive into the story in our news, on another positive story. After months of waiting, South Africa is closer than ever to securing a landmark trade deal with the United States. Washington has now formally replied to Pretoria’s offer. The U.S. counteroffer seems to shift into formal negotiations on text, meaning they’ve moved from broad ideas to concrete clauses and are now hashing out specifics. Let’s hope it turns out positive.

Super Typhoon Ragasa has passed through southern China and Hong Kong, leaving ports and freight networks scrambling to recover. Terminals such as Yantian, Shekou, and Nansha were shut or operated at reduced capacity during the storm, creating backlogs just as China heads into Golden Week (1–7 October 2025). If shipments were not planned, the window has now closed. China will effectively shut down for the holiday, even though ports will continue limited operations. The combination of storm disruption and the holiday slowdown means congestion and delays are inevitable. For South Africa, it’s essential to anticipate knock-on effects and keep contingency plans in place.

What is the news?

- Ocean carriers are aggressively cutting capacity to counter collapsing rates. They’re calling more blank sailings and cancelling seasonal services in response to a 30 %+ drop on key trade routes.

- Transnet has inked a 10-year deal with Liebherr for port equipment, including cranes and long-term maintenance, as part of a push to modernise SA’s ports.

- The SA government has granted long-term leases at Durban’s Island View terminal to major fuel companies, ending uncertainty over short-term leases and improving fuel import stability.

- The logistics sector opens to private investment: 11 train operators have been shortlisted to negotiate access to 41 routes and 6 corridors, which may unlock capacity for bulk exports like coal.

- Global air cargo volumes rose ~5 % in August but spot rates fell ~3 %, underscoring market pressure despite increased demand.

Let’s Learn: Demurrage vs Detention

These are two of the most common extra charges importers and exporters face and the difference matters. Know what the difference is important, so you understand if you are charged.

Demurrage

This is charged when a container stays inside the port or terminal longer than the free time allowed.(normally 3 days). It’s essentially “rent” for the space your cargo is occupying. The longer it sits, the higher the daily charge.

Detention

This applies outside the port. Once you’ve collected the container, you only have a certain number of free days to unpack and return it. If you keep it too long, detention fees apply almost like a late return penalty.

Key Point:

Demurrage = inside the port.

Detention = outside the port.

Both are avoidable with proper planning, quick documentation, and efficient unpacking. Managing them well keeps costs under control and cargo flowing smoothly..

NEWS

Durban Ranked Worst Port in the World: A Wake-Up Call for South African Trade

Source: Moneyweb.co.za

Trade Talks Signal a Turning Point for South Africa’s Cargo Industry

Durban has come in last place in the 2024 World Bank container port rankings, slipping further from its already poor position last year. This result highlights the severe challenges facing South Africa’s busiest port, which was once considered the gateway to the region. Instead of leading, Durban is now a warning sign of what happens when investment, efficiency, and management fail to keep pace with global shipping demands.

The ranking is more than a mark of embarrassment. It signals to shipping lines and global traders that Durban is slow, unreliable, and costly. Ports are measured by how long vessels wait outside harbour, how quickly containers move through terminals, and how efficiently cargo connects to road and rail. Durban has fallen short on every front, which makes it less attractive as a hub and drives up costs for importers, exporters, and consumers.

The problems are well known. Ships wait too long at anchorage before they can berth. Container yards are often congested, with land space poorly used and equipment breaking down. Customs processes and documentation delays keep cargo sitting in port longer than necessary. On top of this, the connection between the port and inland markets is weak, with road traffic jams and unreliable rail links slowing down the movement of goods.

For South Africa, the implications are serious. Durban handles a large share of the country’s imports and exports. If global carriers continue to lose faith in its efficiency, cargo could be diverted to competing ports in neighbouring countries. That would weaken South Africa’s role as a regional logistics hub, undermine local industries, and make goods more expensive for both businesses and households.

The ranking is therefore a wake-up call. Durban urgently needs investment in infrastructure, modern equipment, and better management. Processes must be streamlined, dwell times reduced, and hinterland links improved. If action is not taken, Durban risks becoming a permanent bottleneck rather than a facilitator of trade. With decisive reform, however, the port could recover its standing and once again serve as a gateway to opportunity for the region.

– Source: Adapted from MoneyWeb.co.za

WEEKLY NEWS SNAPSHOT

- Strong reaction expected from ocean carriers as rates tumble: SCFI spot rates plunged 31% to the US West Coast, 23% to East Coast.

- TPT strikes equipment deal with Swiss OEM; Transnet signed a 10-year contract with Liebherr to supply and service cranes at key SA ports.

- Creecy orders renewal of Island View leases: The CEF has secured access to Durban’s Island View terminal to strengthen B-BBEE and fuel logistics.

- Handled cargo at the Port of Beira shows 12.94% growth: August throughput rose significantly compared to last year.

- Transnet and police arrest 17 theft suspects: Suspects were arrested for theft and tampering with rail and port infrastructure.

- Cape Town’s new ‘red ladies’ transform container handling at port: RTG cranes deployed under Transnet’s R3.4 billion investment plan.

- Liner industry’s schedule reliability slides: Maersk emerges as the most reliable carrier at ~80.6% schedule reliability. Source: various

Key Highlights from Last Week’s Discussions – 14th September 2025

Source: BUSA, SAAFF, and global logistics data

Global Air Cargo – Volumes Stabilise, SAF in Focus

IATA spotlighted biomass feedstocks as critical to scaling sustainable aviation fuel (SAF).

Worldwide air cargo tonnages rose ↑2% (w/w) in mid-September. Africa recorded ↑9% y/y growth, with Africa–Europe flows up ↑10%.

Rates softened in line with global trends, while FedEx announced a pivot to add Asia–Europe capacity in response to US tariff pressures.

Port Operations – Weather and Equipment Disruptions

Container throughput fell to 81,417 TEUs (↓13% w/w), averaging 11,631 TEUs/day.

Cape Town improved ↑19% to 15,965 TEUs, while Durban Pier 2 rose ↑14% to 35,345 TEUs. Pier 1 dropped ↓29% and Ngqura fell sharply ↓53%.

Operations were constrained by adverse weather, dredging, and equipment breakdowns, especially in Durban and the Eastern Cape.

Richards Bay reported minimal delays, while rail out of Durban improved 3% to 3,579 containers.

Air Cargo – Stable but Above Pre-Pandemic Levels

OR Tambo handled ~604 000 kg inbound (↓6% w/w) and ~450 000 kg outbound (↑5% w/w), totalling 7,38m kg (↓2%).

Levels remain significantly above both 2024 (+12% y/y) and pre-2019 (+13%).

ACSA has pushed back the completion of Runway 03L works to 30 November 2025.

Updates to the iPAS Pre-Alert System highlight ongoing digitisation to streamline cargo egress.

Road and Cross-Border – Mixed Trends

Truck flows at Lebombo fell to ~1,425/day (↓7% w/w), with queues averaging 4,7 hrs and processing 4,4 hrs.

Cross-border times eased slightly: SA borders averaged 11,4 hrs (↓6%), while the wider SADC region averaged 6,3 hrs (↓2%).

Severe congestion at Groblersbrug persisted, with queues of three days or more, despite AEO pre-clearances moving swiftly.

Global Trade & Shipping – Uneven but Resilient

Drewry reported global terminal throughput up ↑7,2% y/y to 928m TEU, led by major operators and the rise of carrier-owned terminals.

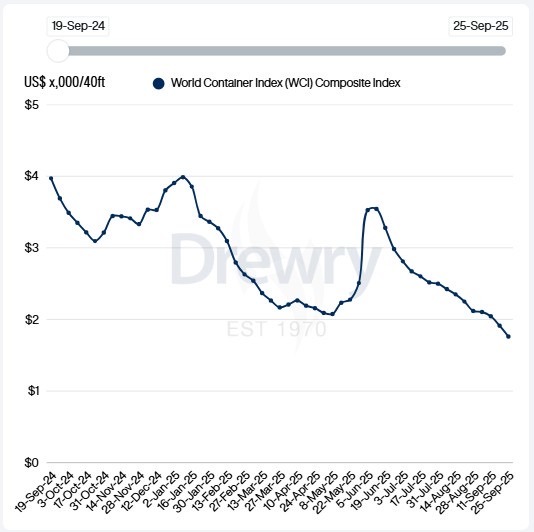

The World Container Index dropped ↓6,4% ($131) to $1 913/FEU, now ↓52% y/y.

Chinese ports continue to post record volumes, while South African outcomes in the World Bank CPPI showed Cape Town and Ngqura improving but Durban weaker.

Port Operations Summary: – Port Update:

SOUTH AFRICAN PORTS: – Summary

Cape Town remains vulnerable to wind stoppages, which periodically halt operations at CTCT. Durban seems to be adjusting and Port Elizabeth has picked up due to the weather.

DURBAN

- Pier 2.Pier 1 – 1 – 2 days waiting time

- Pier 2 (DCT) – 2. days waiting time

- Point 1 – 2 days waiting time

CAPE TOWN

Vessel berth delays may vary as per the service.

Moderate to strong winds are causing operational stoppages at the terminal.

- CTCT: 2 – 3 days waiting time.

PORT ELIZABETH

The weather is the main disruptor this week in that region. Operations are slower, but no severe equipment failures have been reported

- PECT: 1 – 2 days waiting time.

- NCT: 1 day waiting time Source: Various

Global Freight Rates

Weekly Container Rate Update – 25th September 2025

Global Freight Rates Continue to Slide

Drewry’s World Container Index dropped 8% this week to $1,761 per 40ft container, its 15th straight weekly decline. Spot rates on the Transpacific and Asia–Europe trades also fell, with Shanghai–Los Angeles down 10% to $2,311 and Shanghai–Rotterdam down 9% to $1,735. Despite earlier GRIs and blank sailings, momentum has faded, and carriers are cutting capacity ahead of China’s Golden Week. With demand softening, Drewry forecasts further rate pressure in the coming quarters. Source: Drewrey

Disclaimer: The information provided in this newsletter is based on reliable sources and has been carefully verified. This Logistics News is distributed free of charge. If you wish to unsubscribe from our mailing list, please reply to this email with “unsubscribe” in the subject line. Please note that all content is adapted or directly quoted from its original sources. We take no responsibility for any inaccurate reporting; we are only adapting the news for you.

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”