Welcome to another Logistics News Update.

The month of love is upon us, and you have 29 days this leap year. Make the most of it.

Durban port operations are up and down, last week they were almost on track and come Monday they are back to delays, the split offloading was to help but is hampering the delivery and collection of containers out of the port. Both importers and exporters are frustrated, however are working around the inconstancy. Read the story on how a logistic expert states that “Trade is gonna be tricky in 2024” below the news.

REMEMBER: China is going into Chinees New Year; it starts the 10th of February, but some suppliers have already started to wind down.

NEWS

Transnet needs private sector ‘on steroids’

Image: Supplied

Michelle Phillips, acting group CEO of Transnet since November, says private sector participation in the dysfunctional state-owned logistics firm needs to be “put on steroids”.

“I’ve spent a lot of time with our customers and external parties talking about how we can better involve the private sector in collaborating with us to improve our operations. There are private sector transactions we would like to put on steroids because it’s an imperative for the country.”

Processes need to be speeded up.

“We’ve been working with the national logistics crisis committee to see how we can short-circuit these processes, but you’ll appreciate that in the state-owned enterprises sphere we are governed by a legislative universe that does not allow us to do the kinds of things that private businesses can do.”

Transnet has come a long way from where it was a few months ago, she says.

The National Treasury and the government have come to the party in terms of understanding the environment in which it operates, and its frustrations. “I think they’re beginning to get the picture and an understanding that things need to change. We need to crowd in the private sector so we can do things much faster and much better.

“Though we’ve been making a lot of changes to enable us to contract and transact with the private sector more optimally, there’s a lot more work that needs to be done.”

Ocean rates set to rise further in February

Shippers, freight forwarders and the liner trade can expect more pain in February as vessel traffic through the Suez Canal continues to suffer from Houthi rebels attacking commercial carriers in the Red Sea.

Western naval counter-attacks against Iranian-backed rebels in Yemen have added to widening tension in the area, turning the important waterway connecting the Mediterranean with the Arabian Sea into a no-go zone.

Based on the latest ocean freight data, industry analytics platform Xeneta said: “Early indications suggest shipping rates are set to increase further in early February amid the ongoing Red Sea crisis.

US oil and gas news resource Rigzone reports that the most up-to-date picture of the situation south of the Suez Canal and resultant liner trade disruption is based on 400 million crowdsourced data points.

“The latest projection is based on rates already received from customers for the first week of in February.”

Rigzone quotes Xeneta saying: “While the situation remains volatile and subject to change, the newly released data is the best indication of where the market is headed.”

According to Rigzone, market average short-term rates from Asia to Europe are set to increase 11% by February 2 to stand at $6507 per FEU – an increase of 243% since the Red Sea crisis escalated in mid-December, Xeneta has found.

“Rates from the Far East to North Europe are set to rise 8% by February 2, with a market average of $5106 per FEU – an increase of 235% since mid-December,” analysis shows.

“The biggest increase in rates is from the Far East to the US East Coast, Xeneta pointed out.

Global CEOs more positive about economic growth in 2024

Global business leaders are more positive about economic growth over the next 12 months compared to their outlook a year ago, the latest PwC Global CEO survey has found.

PwC South Africa’s Economic Outlook Report for 2024, released on Monday, shows that while CEO’s surveyed for the global research expressed a more positive outlook, many countries around the world are facing a worsening set of social challenges at the start of the year.

“Alongside country-specific structural challenges – which, in the case of South Africa, includes load-shedding, high levels of unemployment and a scourge of crime – the world is also facing short-term crises,” PwC said.

“These challenges are more transient in nature and less enduring than the long-term megatrends shaping society.”

These short-term challenges are not the same everywhere but can be grouped into five categories: economics, conflict, resources, health and institutions.

Based specifically on these categories, PwC identified crises across five areas of South African society, namely: macroeconomic volatility, conflict-hit international supply chains, access to scarce resources, access to healthcare and struggling public institutions.

PwC South Africa chief economist, Lullu Krugel, said these country-specific challenges are expected to dissipate somewhat over the medium to long-term.

It comes down to bureaucratic procedures that have to be followed, she says.

Good citrus crop faces export problems

CGA CEO Justin Chadwick said the citrus industry, which grows a water-intensive crop, was monitoring the possible effects of El Niño but had not yet seen any significant negative impacts.

South Africa’s citrus growers are concerned that port constraints and hostile trade policies in export markets will undermine their favourable yields this year.

Citrus Growers Association (CGA) CEO Justin Chadwick said they took exception to certain EU regulations and how they have been applied.

“We are deeply concerned about the EU’s phytosanitary regulations regarding citrus black spot and false codling moth. These regulations are unscientific and discriminatory — as was proved last year through a number of false interceptions by the EU,” he said.

The EU’s hard line against citrus black spot — an aesthetic problem that has no impact on a fruit’s health or taste — has been a thorn in the side of local exporters for years, often forcing farmers to take on millions in losses by suspending exports.

Chadwick said the CGA would continue to fight the regulations and called for speedy action by the South African government at the World Trade Organisation.

“Even though there will be a sufficient supply of high-quality citrus, and a strong demand for it from European consumers, these protectionist trade measures might limit the export of, especially, oranges,” he said.

A record 165 million cartons of citrus fruit were packed for export in 2023.

Read other interesting stories here

Labour – Transnet’s elephant in the room – Cape Town Port

Trade’s gonna to be tricky in 2024 – logistics executive

UN raises alarm over economic impact of shipping disruptions

PORTS UPDATE

Summary of port operations

The following sections provide a more detailed picture of the operational performance of our commercial ports over the last seven days.

Weather and other delays

- At the start of the week, the Port of Cape Town went windbound for a day and a half, with the resultant bypassing by some vessels

- Seven vessel movements deviated from their respective schedules in Durban earlier this week due to high swells and the late arrival of cargo.

- NCT went windbound for approximately 12 of the 24 hours between Wednesday and Thursday.

- The Port of Richards Bay experienced delays of up to three hours due to poor visibility.

Cape Town

On Thursday, CTCT recorded three vessels at berth and six at anchor, as continued strong winds prohibited operations for 36 consecutive hours during the earlier stages of the week. In the preceding 24 hours, stack occupancy for GP containers was recorded at 32%, reefers at 62%, and empties at 68%. In this period, the terminal handled 2 072 TEUs across the quay, which translated to 1 381 container moves while operating with nine STS cranes and 21 RTGs. This showcases the abysmal performance of the terminal as further calculations indicate that this constitutes between 6 and 10 container moves per hour. On the landside, 1,345 trucks were serviced, while 49 rail export units were handled. In addition to the 21 available RTGs, three of the second-hand RTGs from Los Angeles have also been introduced to the terminal, but the other four are still being utilised for training purposes.

The multi-purpose terminal recorded two vessels at anchor and three at berth on Wednesday. In the 24 hours leading to Thursday, the terminal managed to service 234 external trucks at an undisclosed truck turnaround time on the landside. During the same period, 225 container moves, and 3 465 tons were handled across the quay on the waterside. Stack occupancy was recorded at 45% for GP containers, 43% for reefers, and 33% for empties during the same period. The terminal also experienced extensive operational delays at the inception of the week due to strong winds.

Durban

Pier 1 on Thursday recorded two vessels at berth, operated by five gangs, and one vessel at anchor. Stack occupancy was 58% for GP containers and remained undisclosed for reefers. During the same period, the terminal recorded 1 428 gate moves on the landside, with an undisclosed number of cancelled slots and 177 wasted. The truck turnaround time was recorded at ~145 minutes, with an average staging time of ~116 minutes. At the beginning of this week, the terminal had 2,715 imports on hand, with 350 having road stops and 244 being unassigned. The terminal struggled with high traffic volumes throughout the week as minimal to no slots were allocated to blocks G3 and C1 on Wednesday. In contrast, block quotas for slot allocation were implemented at blocks C1 and F2 on Thursday.

Pier 2 had four vessels at berth and nine at anchorage on Thursday. In the preceding 24 hours, stack occupancy was 63% for GP containers and undisclosed for reefers. The terminal operated with ten gangs while moving 3 368 TEUs across the quay. During the same period, there were 2 046 gate moves on the landside with a truck turnaround time of ~102 minutes and a staging time of ~112 minutes. Of the landside gate moves, 1 630 (79%) were for imports and 460 (21%) for exports. Additionally, 339 rail import containers were on hand, with 282 moved by rail. The situation regarding the straddle carriers deteriorated again somewhat during this period, as the terminal had only about 49 straddles in operation. This brings the straddle carrier availability figure in the terminal to about 50% w. That is currently approximately ↓39% below the number of machines that would be the minimum to satisfy industry demand and deliver acceptable productivity. The entire straddle complement will be further reduced to 95 next week from the current 98 due to the machines reaching the end of their life cycles. According to TNPA, the usual life cycle of a straddle carrier is between 40,000 and 50,000 hours, which translates to approximately six years at maximum. The life cycle of a gantry crane, according to the same reports, is 20 years, while the life cycle of a haulier is 15 years.

Richards Bay

On Thursday, Richards Bay recorded 13 vessels at anchor, represented by four at DBT, four at MPT, four at RBCT, and one liquid vessel. Twelve vessels were recorded on the berth, translating to five at DBT, four at MPT, three at RBCT, and none at the liquid bulk terminal. Two tugs and one helicopter were in operation for marine resources in the 24 hours leading to Friday, while the pilot boat remained out of service. During the same period, the coal terminal had four vessels at anchor and three at berth while handling 191 341 tons on the waterside. On the landside, 15 trains were serviced which is indicative that the export coal line reopened after the collision of last week.

Eastern Cape ports

On Monday, NCT recorded two vessels on the berth and zero vessels at the outer anchorage, with three vessels drifting. Marine resources of two tugs, two pilots, and one berthing gang were in operation in the 24 hours leading up to Tuesday. Stack occupancy was 41% for GP containers and 48% for reefer ground slots, as a total of 2 222 TEUs were processed on the waterside. Additionally, 388 trucks were serviced on the landside at a truck turnaround time of ~33 minutes. No trains were serviced on the landside. On Wednesday, crane 7 experienced a breakdown, which left the terminal operating with five cranes. Vessel ranging and dense fog also proved to be an operational constraint during this period. Between Wednesday and Thursday, the terminal went windbound for 12 hours, which further constrained operations.

Global shipping industry

Global container summary

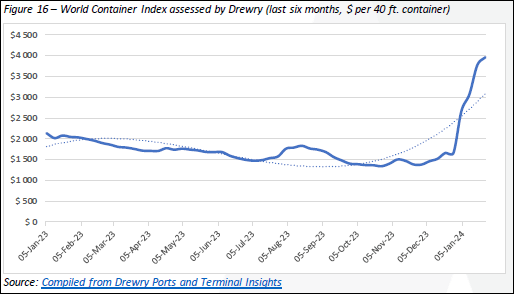

The composite index is now the highest it has been since October 2022 and is up by ↑94% higher compared to the same week last year and ↑179% higher than the average 2019 pre-pandemic rates of $1 420. Charter rates have also rapidly caught up, as the Harper Petersen Index (Harpex) is currently trending at 1004 points, up by ↑6,2% (w/w) but still significantly down on this time last year (↓10%)17. Elsewhere in the charter market, brokers are reporting more “heightened activity” in the containership charter market as ocean carriers fight to secure cargo to mitigate the impact of Red Sea diversions. According to some analysis by MSI, carriers could need to deploy up to 200 extra ships on their east-west networks in order to maintain weekly sailings18.

In Summary

In concluding this week’s report, there are many challenges and opportunities in South Africa’s cross-border trade, focusing on public-private partnerships (PSP) and private-sector involvement. We can only criticise governmental delays in infrastructure projects and emphasise the need for coordinated action to address inefficiencies. The benefits of partnership can clearly be seen in the Mozambique example referred to earlier in this report.

While physical upgrades are essential, the report underscores the importance of non-infrastructure measures like coordination and collaboration between government agencies and the private sector. Transnet’s handling figures highlight the extreme urgency for collaborative efforts to improve trade facilitation. The potential of PSP frameworks and joint ventures in modernising infrastructure is apparent, stressing the significance of accelerating such partnerships. With South Africa’s GDP heavily reliant on imports and exports, there’s concern over the economic outlook, but optimism exists for growth through innovative logistics solutions. Soft issues like customs-to-business risk migration programs and technology adoption are deemed crucial, along with involving logistics professionals in policy drafting.

The symbiotic relationship between the public and private sectors is highlighted as pivotal for fostering flourishing trade and regional integration. The report concludes by calling for urgent action to address trade inefficiencies and foster growth in the logistics industry. Overall, the report emphasises the need for collaborative efforts and innovative solutions to improve South Africa’s cross-border trade landscape, ensuring a conducive environment for economic growth and development.

Source: From Port Update to Summary BUSA – SAAFF

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform an Exporters Western Cape.

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”