Welcome to another Logistics News Update.

South Africa’s ports are in a state of crisis.

Persistent equipment failures, operational inefficiencies, and the recent impact of severe weather have created a perfect storm that’s disrupting supply chains. To make matters worse, the lack of reliable container tracking information is adding to the chaos as the port is moving container and not updating their systems, so operators are having to spend most of their time trying to find containers.

Importers and exporters are grappling with escalating costs and delays, forcing many to seek alternative solutions. Eastern Cape Port (COEGA) is experiencing severe congestion, resulting in delays of nearly a week for container collection. This situation is creating a significant burden on transporters who are unable to collect containers on time, despite facing penalties from shipping lines and port authorities.

South Africa is facing a significant decline in orange exports this season. Extreme weather conditions have damaged crops, forcing a second reduction in export forecasts for both navel and Valencia oranges. This is a major setback for the country’s citrus industry. A second estimate reduction now projects exports to be about 21m 15kg cartons.

Container Freight Rates Spike Out of India – Container freight rates on routes out of India have surged in July due to increased demand and ongoing capacity shortages. This is especially evident on trades to the US East and West Coasts, where rates have skyrocketed. Conversely, rates on intra-Asia routes have remained low. Despite these challenges, India’s overall merchandise exports have grown, with the potential for further increases in the coming months. However, the export sector is facing hurdles such as liquidity issues and a need for increased support from the government. Overall, the Indian shipping industry is experiencing a complex landscape with significant opportunities and challenges.

Tip of the week – General Average – Marine Insurance

General Average – GAA general average loss in marine insurance is a partial loss that occurs when a voluntary sacrifice is made to save a ship or its crew, or when extraordinary expenses are incurred for the benefit of everyone. The sacrifice must be reasonable and can include jettisoning cargo, towing a disabled vessel, or other property damage.

What does that mean?The basis behind this principle is that a party who has suffered extreme financial loss (shipping line) in order to save property belonging to others (your cargo) has the right to be compensated for such loss. (you pay in to salvage a vessel for example) The origins of General Average date back to the York-Antwerp Rules of 1890, but have obviously been modified numerous times since to adapt to modern supply chain conditions, most recently in 2004. The rule states “There is a general average act when, and only when, any extraordinary sacrifice or expenditure is intentionally and reasonably made or incurred for the common safety for the purpose of preserving from peril the property involved in a common maritime adventure.” (York-Antwerp Rules, 2016 update) From this, General Average is calculated, and each party who suffered a loss will be credited for the value of said loss and will be charged a percentage of their own interests’ value to pay for shared costs and others’ loss of interests.

On The Ground Report

Shipping Industry Challenges

The shipping industry is experiencing significant disruptions. Key issues include:

- Container congestion: Carriers are bypassing container terminals and storing containers in private depots due to terminal overload.

- Split berthing: This practice is causing operational difficulties.

- Equipment shortages: A critical challenge for importers and exporters.

- Booking system issues: Ongoing problems with booking systems are impacting transportation.

Richard Rattray was kind enough to supply the following on the USA Trade.

- In anticipation of possible port labor disruptions, US imports are at near-record highs. For exports from US, it is suggested to advance any orders pending for late Q3 / early Q4 to avoid possible delays.

- JOC.com reported that US imports from Asia are hitting levels not seen for years. While laden imports from May were slightly below those in January, volumes last month were, nonetheless, the second highest since August 2022. With labour contract stalled talks for US East and Gulf ports, importers have extra incentive to ship early before the existing longshore agreement expires at the end of September. This could have another huge impact on sea freight as the crisis will undoubtable increase rates and service worldwide. “US ports union suspends labour talks with strike risk looming”

- Catch up from last week’s bad weather with more bad weather forecast

- Split berthing still playing havoc for importers.

- Air freight worldwide in a “tizz” after the Microsoft update

Disclaimer: Please note: All information presented in this newsletter is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed – all news is adapted or specifically quoted.

NEWS

Blank sailing modesty confirms carrier confidence

26 July 2024 – by Staff Reporter

Shipping lines are maintaining a cautiously optimistic outlook for the upcoming peak season, according to new data from Sea-Intelligence. The consultancy found that carriers have planned to cancel just 3.9% of sailings on the crucial Asia-North America West Coast route. This figure is in line with pre-pandemic levels, indicating a stable market and a measured approach to capacity management.

While blank sailings are a common strategy to balance supply and demand, the relatively low percentage suggests that carriers anticipate a robust peak season. This is encouraging news for the industry as it continues to recover from the disruptions of the Covid-19 pandemic.

Overall, the data points to a shipping market that is finding its footing. Carriers are balancing their operations effectively while demonstrating confidence in consumer demand for the remainder of the year.

Adapted from Source: Freight News

Container ship capacity records fastest growth in 15 years

25 July 2024 – by Eugene Goddard

The global container ship fleet is experiencing unprecedented growth. In the first half of 2024, it expanded by a staggering 11%, the fastest rate in 15 years. This surge is driven by increased cargo volumes and longer shipping routes due to the Suez Canal crisis.

Despite this rapid expansion, ship recycling remains low, suggesting that shipping companies anticipate strong demand for container shipping services in the near future. This trend is likely to shape the industry’s landscape for years to come.

As the fleet continues to grow, industry experts will be watching closely to see how capacity will impact freight rates and overall market conditions.

Adapted from Source: Freight News

PORTS

South African Port Delays Summary (as of July 29, 2024)

Cape Town

- CTCT: Operational challenges due to management meetings. Improved landside performance but crane issues persist.

- CTMPT: Rain delays impacted operations.

- FPT: Vessel congestion and weather-related disruptions.

Durban

- Pier 1: Improved performance despite equipment constraints.

- Pier 2: Severe weather hindered operations. High stack occupancy.

- MPT: Limited breakbulk activity due to lack of vessels. Equipment challenges.

- Maydon Wharf and Agri-bulk: Minimal activity.

Richards Bay

- DBT, MPT, RBCT: High vessel congestion. Coal terminal underperforming on rail targets. Pilot boat issues caused delays.

Eastern Cape

- NCT: Weather-related challenges and vessel delays.

- GCT: Vessel congestion and spill-related disruptions.

Overall, South African ports continue to face significant challenges due to weather conditions, equipment breakdowns, and operational inefficiencies.

NOTE: We recommend factoring these potential delays into your shipment planning to avoid disruptions.

Weather and Other Delays

- Cape Town: Union meetings and rainy weather caused operational delays.

- Durban: Equipment breakdowns and sounding operations led to disruptions.

- Eastern Cape: Agent delays and adverse weather impacted operations.

- Richards Bay: Pilot boat out of commission resulted in operational delays.

Port Delays:

DURBAN Weather: Windy

- Pier 1: 11 days delay

- Pier 2: 15 – 16 – 17 – 18 days delay

- Durban Point: 3 days delay

CAPE TOWN Weather: Severely strong winds

- CTCT: 6 – 7 days delay

- MPT: 0 – 1 – 2 days delay

PORT ELIZABETH Weather: Windy

- PECT: 1 – 2 – 3 days delay

- NCT: 2 – 3 – 4 days delay

Global Freight Rates

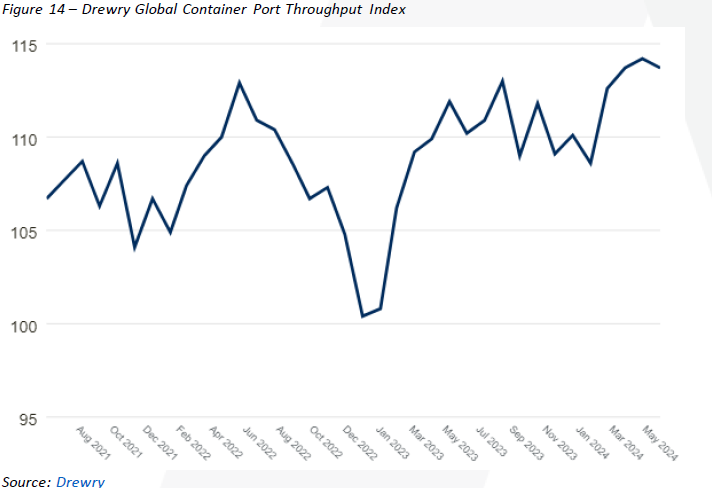

Drewry’s Global “Container Port Throughput Index” saw a ↑0,4% increase in May 2024, reaching 114,2 points, marking a ↑3,9% year-on-year growth.12 The numbers are slightly lower than those quoted by Container Trade Statistics in the report of 12 July, which showed that container volume has increased by a substantial ↑7,1% (m/m) and is up by ↑5,8% (y/y).13 For the first five months of 2024, all regions except the Middle East and South Asia reported growth, with North America, Latin America, Africa (up by ↑9,1% month-on-month), and Oceania achieving double-digit growth year-to-date. However, Drewry’s Nowcast model anticipates a ↓0,5% (m/m) decline in June to 113,7 points, driven by lower performance in Asia (excluding China), Europe, and North America. The Greater China Container Port Throughput Index increased by ↑1,5% (m/m) to 120,5 points in May 2024, reflecting a ↑6,3% (y/y) rise. The region’s 12-month average growth rate reached ↑5,6%, outpacing the global growth rate of ↑3,7%. Despite overall gains, Hong Kong and Xiamen experienced declines. In North America, the Container Port Throughput Index saw a marginal rise of ↑0,3% (m/m) to 107,8 points, with a ↑5,5% (y/y) increase. Nevertheless, US West Coast ports reported month-on-month volume declines in May, with Long Beach down ↓7,3%, Los Angeles down ↓2,3%, and Oakland down ↓0,3%. The European Container Port Throughput Index fell by ↓1% in May 2024 to 104,9 points, just ↑0,2% above the May 2023 level. Spanish ports, particularly Valencia and Barcelona, saw significant year-to-date volume increases of ↑13% and ↑24%, respectively, due to changes in call patterns. Northern European ports are also experiencing some volume recovery.

Container Industry Summary

The container shipping industry is currently facing a capacity crunch. This is due to:

- Longer shipping times: Caused by the Red Sea crisis.

- Port congestion: Particularly severe in Shanghai, Ningbo, Singapore, and Durban.

- Increased demand for goods: Driving up consumption.

As a result, major shipping lines are rerouting their vessels to the Cape of Good Hope to avoid congestion, with only a few continuing to use the Suez Canal.

BUSA-SAAFF Summary

In summarising this edition, the recent increase in throughput volume has been welcomed by all economic actors, as the recovery plans are indeed paying off. Besides operational matters, the industry requires concerted efforts on all fronts to allow the logistics network to increase cargo movement and be a better conduit for trade flows to increase. Aggressive investment drives are desperately needed, especially to ports and railways. These drives include equipment and hard infrastructure. Consequently, the industry has widely welcomed the approval of the Environmental Impact Assessment (EIA) study to construct a second access road to the Port of Durban. This project, a crucial development the private sector has long advocated for, must now be fast-tracked. Connecting access roads and major provincial and national roads is essential for smooth and efficient cargo transport operations. It’s crucial to remember that national logistics systems play a pivotal role as the providers of infrastructures and spatial connectivity, while business logistics systems are the users of these systems. Without the proper connection, economic actors cannot use the infrastructure and drive trade – a significant driver of economic growth and development, something South Africa desperately needs.

Source::BUSAThis week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape.

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”