Welcome to another Logistics News Update.

Brace yourselves! Delays and disruptions continue to plague South African ports, with skyrocketing shipping costs adding fuel to the fire. These challenges, unfortunately, show no signs of abating soon, impacting the entire South African economy, but wait, there’s more to the story.

Recent reports might highlight a trade surplus for South Africa. However, it’s crucial to understand the context. This “surplus” is largely inflated by soaring import prices, a consequence of disruptions in the global container industry. While import volumes have dropped, the cost of getting those goods here has skyrocketed.

So, what’s causing the global shipping chaos? Chokepoints like the Red Sea crisis have disrupted shipping routes, leading to a shortage of ships despite new deliveries. This imbalance has sent freight rates soaring, further squeezing margins. Ports, especially in South Africa, are overflowing, creating even more delays. Despite these difficulties, shipping lines are adapting by consolidating cargo and optimising vessel usage to maintain some level of normalcy.(there is a shortage of equipment)!

The bottom line? The South African trade landscape remains a highly competitive market, but the current situation presents significant challenges, the bittersweet news is that the Rand has bounced back after the announcement of the new government, and this helps importers but does not help our exporters.

Forex Tip of the week

| Incoterms® 101Incoterms are like a roadmap for international trade, but instead of navigating directions, they clarify who shoulders the responsibility (and cost) of getting your goods from point A to point B.The key difference between Incoterms lies in how they split transportation costs and tasks. This includes not just the main haul (trucking, ocean freight, airlift, etc.) but also the nitty-gritty like loading, unloading, and even packaging.Here’s why it matters:Incoterms can dramatically impact your bottom line. Imagine buying under Ex Works (EXW) terms where you, the buyer, handle everything. That’s vastly different from Delivered at Place Unloaded (DPU), where the seller takes care of most transportation aspects. This applies to sellers too! Choosing the right Incoterm® can save you a bundle or leave you with a surprise bill.But wait, there’s more! Incoterms go beyond just costs. They can also influence who’s best equipped to handle the logistics. By understanding Incoterms, you can ensure your goods arrive safely, efficiently, and without any unexpected financial surprises. |

On The Ground Report

We continue to have the same challengers daily at all the ports with Durban being the worst, we had a look at shipping time from China to South Africa and this is the result, currently it should take 32.3 days from China (Shanghai) to Durban, however it is taking 40,26 days and delays as you will see in the report is around 14 to 21 days at the port. Truckers are fighting a daily battle to get bookings; their frustration will flare at some point. Cape Town has some equipment that has come back (repaired), two weeks ago they were using a mobile crane to unload. Split vessels (mean they offload some) are still an everyday occurrence and importers are frustrated.

Disclaimer: Please note: All information presented in this newsletter is based on reputable sources and has been referenced accordingly, this Logistic News is obligation free and if you wish to be removed from the mailing list, please reply to this mail requesting to be removed – all news is adapted or specifically quoted.

NEWS

Transnet takes a hard line about concessionary involvement at DCT

28 June 2024 – by Eugene Goddard

There is a delay in awarding a concession tender for Durban Container Terminals (DCT) due to a court case between Transnet and APM Terminals (APMT). This is causing frustration in the logistics industry, which is also concerned about potential changes in government that could affect business continuity.

Transnet CEO Michelle Phillips says the company has done everything correctly and is waiting for the court decision in October. She emphasized that Transnet needs private sector investment to improve its business and will continue to hold a 51% stake in Pier 2.

Phillips also addressed concerns about citrus exports from the port, saying that Transnet is enforcing the Container Terminal Operating Contract (CTOC) to prevent shipping lines from exceeding their allocated volumes. She said this is necessary to maintain efficiency and avoid congestion.

Source: Freight News – read the full story here

Trade surplus more than doubled in first quarter of 2024

01 July 2024 – by Staff Reporter

South Africa has recorded a trade surplus of R183 billion in the first quarter of 2024, the first time in 15 years. This is mainly due to tighter control over spending by state-owned companies. The value of merchandise imports decreased while exports increased slightly. This is because South Africa is selling goods and services at a higher price than it is buying them.

The good news is that exports of mining and agricultural products increased. However, exports of manufactured goods decreased, particularly vehicles, chemicals, and machinery.

There is also some bad news. The decrease in imports is because of fewer mining and agricultural products being bought. However, imports of manufactured goods increased, excluding vehicles.

Source: Freight News – read the full story here

PORTS

Summary of Port Operations

This summary details delays experienced at various South African ports this week due to different factors:

- Cape Town: Vessel bunching (too many ships arriving at once) caused the most delays.

- Durban: Equipment issues (breakdowns, shortages, congestion) slowed down operations.

- Eastern Cape ports: Bad weather and lack of available marine equipment led to delays.

- Richards Bay: Some delays occurred due to rain towards the week’s end.

There are delays at South African ports, especially Durban which has an average waiting time of 5.3 days (126 hours) for container ships. Here’s a breakdown:

- Durban: Longest wait times, with Pier 2 experiencing the worst at 7.4 days (177 hours).

- Cape Town: Minimal delays, with an average wait of 1.4 days (33 hours).

- Ngqura: Moderate delays of 1.9 days (46 hours).

- Port Elizabeth: Short delays of less than a day (7 hours).

Container Freight Rates on the Rise

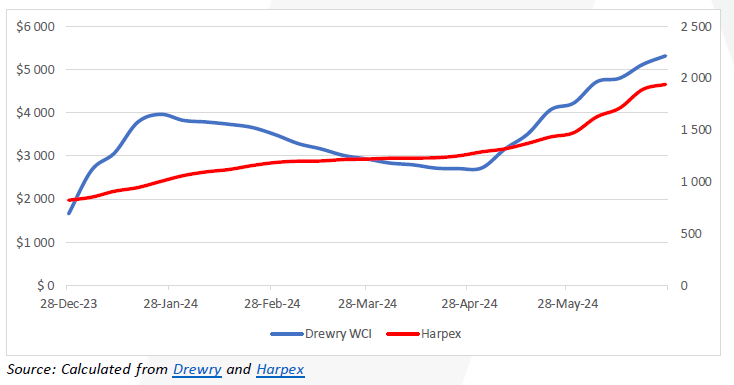

Container freight rates continue their upward trend, with a significant increase of 3.9% this week. Here’s a breakdown of the key points:

- Drewry’s World Container Index: Up by $315, currently at $5,117 per 40-ft container.

- Harper Petersen Index (Harpex): Increased by 2.6% this week and a substantial 73% year-over-year, reaching 1,914 points. This reflects minimal idle capacity available.

The high demand and limited capacity are driving these rising freight rates

Global Shipping Industry Summary: Chokepoints, Capacity, and Shortage

Key Points:

- Persistent Chokepoints: Issues like the Red Sea crisis continue to disrupt shipping routes.

- Overcapacity & Shortage Paradox: New ships (1.62 million TEU delivered this year) haven’t solved the issue due to:

- Longer Cape of Good Hope routes requiring more vessels.

- Vessel diversions removing capacity (1.6 million TEU from Red Sea, 0.5 million TEU from congestion).

- Shortage & High Rates: Despite new deliveries, a global shortage persists, driving up freight and charter rates.

- South Africa Feels the Pinch: Port congestion in Durban worsens, highlighting global challenges on a local level.

Additional Information:

- TEU (Twenty-foot Equivalent Unit): A standard unit for measuring container ship capacity.

- Linerlytica’s “Port Congestion Watch”: Tracks congestion levels at major ports around the world.

Overall: The global container industry faces a complex situation with chokepoints, overcapacity in some areas, and a shortage of ships in others. This imbalance leads to soaring freight rates and port congestion, impacting South Africa and other countries heavily reliant on maritime trade.

BUSA-SAAFF Summary

In summary, South Africa’s significant loss of liner shipping connectivity, as noted by UNCTAD, poses considerable challenges for the global trade dynamics outlined throughout this report, particularly under the strain of decreased container handling productivity and a stark decrease in port efficiency. This downturn in connectivity and operational capacity can be attributed mainly to a lack of capital and maintenance investment in the country’s commercial ports over the last decade, which has left infrastructure struggling to keep pace with global standards. Consequently, the reduced efficiency and capacity at critical ports like Durban exacerbate the issues of delays and increased costs for shippers, which can dampen the competitive edge of South African exports in the global market. The situation is likely to impact a broad spectrum of stakeholders, from local businesses relying on imports and exports to international trade partners who may seek more reliable trade routes. Moreover, diminished shipping connectivity directly affects the availability and cost of goods in the domestic market, potentially leading to higher inflation and reduced consumer choice. To mitigate these impacts and foster economic stability, strategic interventions are essential. These should include rejuvenating port infrastructure, enhancing operational efficiencies, and perhaps most critically, reestablishing stronger liner shipping connections to ensure South Africa remains a viable player in international trade.

Transnet Port Terminals’ recent engagement with shipping lines underscores a stringent reinforcement of Container Terminal Operating Contract clauses to enhance terminal efficiency and reduce delays, emphasising a commitment to contractual obligations amid rising deviations and volume adjustments which have disrupted terminal operations and supply chain flow. Consequently, prominent South African container terminals, including Durban, Cape Town, Port Elizabeth, and Ngqura, are mandated to adhere strictly to their contractual agreements, limiting handled volumes to those specified in contracts to restore operational norms and manage current backlogs effectively. The Eastern Cape ports are crucial for enhancing South Africa’s maritime connectivity, especially given the infrastructure issues at major ports like Durban and Cape Town. The lack of direct sailings from Cape Town to key trading partners increases logistical costs and complexity, weakening the competitive edge of South African trade routes and potentially raising domestic goods prices. Strategic investments in these ports and direct connections are vital to boost efficiency and maintain South Africa’s role in global trade.

Adapted from :BUSA

This week’s news was brought to you by:

FNB First Trade 360 – a digital logistics platform and Exporters Western Cape

“This information contained herein is being made available for indicative purposes only and does not purport to be comprehensive as the information may have been obtained from publicly available sources that have not been verified by FirstRand Bank Limited (“FRB”) or any other person. No representation or warranty, express, implied or by omission, is or will be given by FRB, its affiliates or their respective directors, officers, employees, agents, advisers, representatives or any other person as to the adequacy, reasonableness, accuracy or completeness of this information. No responsibility or liability is accepted for the accuracy or sufficiency thereof, or for any errors, omissions or misstatements, negligent or otherwise, relating thereto. In particular, but without limitation, no representation or warranty, express or implied, is given as to the achievement or reasonableness of, and no reliance should be placed on, any projections, targets, estimates or forecasts and nothing contained herein should be, relied on as a promise or representation as to the past or future. FRB does not undertake any obligation to provide any additional information or to update the information contained herein or to correct any inaccuracies that may become apparent. The receipt of this information by any person is not to be taken as constituting the giving of any advice by FRB to any such person, nor to constitute such person a client of FRB.”